agrobacter/E+ via Getty Images

Introduction

UnitedHealth Group Incorporated (NYSE:UNH) provides healthcare benefits worldwide, serving individuals and employers, and Medicare and Medicaid beneficiaries. It is the largest healthcare company in the United States and has seen its share price rise sharply in recent years. The smaller competitor is Elevance Health (ELV), which I wrote about earlier.

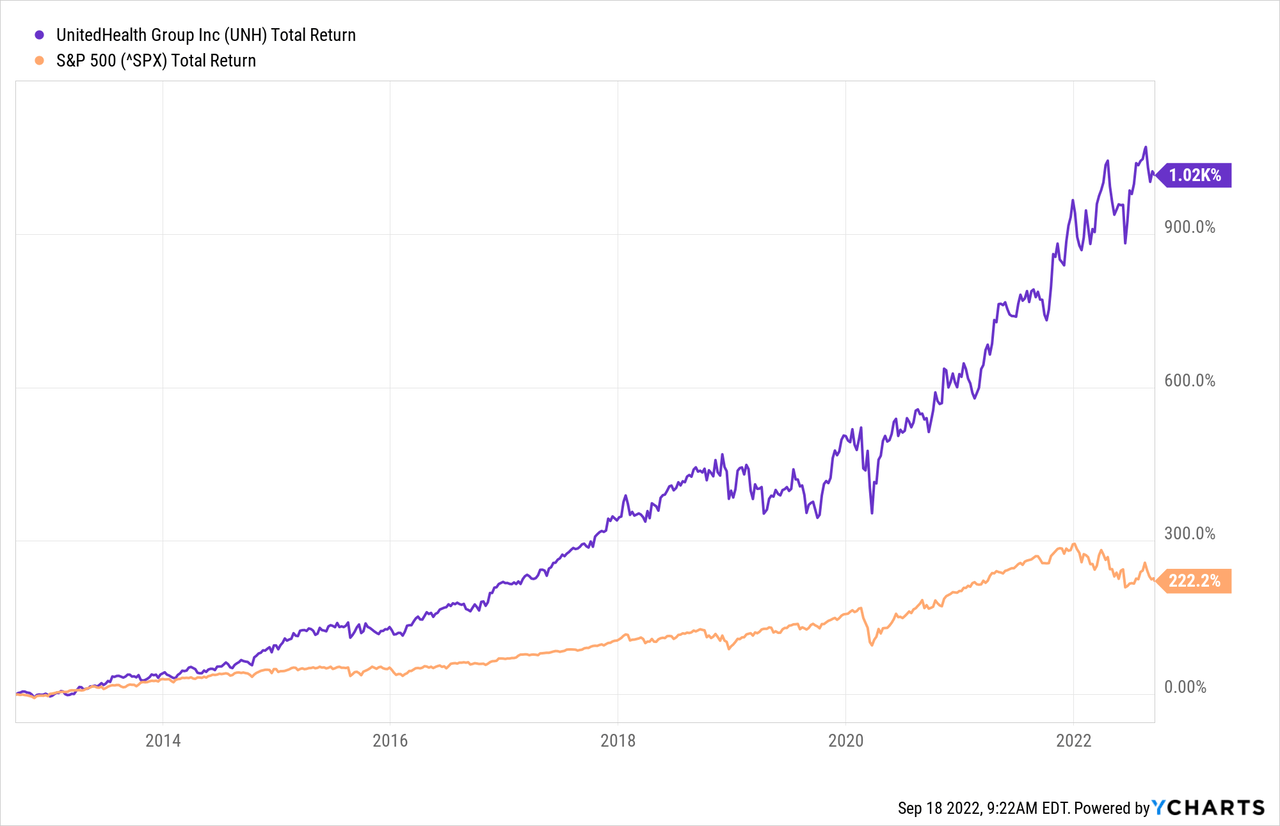

UnitedHealth’s stock price has seen strong growth over the past 10 years, easily beating the total return of the S&P 500 Index. While the S&P 500’s return averaged 12% per year, UnitedHealth’s total return was a whopping 27% per year.

Strong growth in membership numbers, revenue and earnings have been growth drivers in recent years. Growth doesn’t seem to be slowing down; strong growth is expected in the near future. The share price is a bit expensive compared to its historical valuation. That is why the shares are a hold.

UnitedHealth Has Grown Strongly In Recent Years

Recent quarterly results have been strong. Revenues were up 13% year-over-year, with double-digit growth at both Optum and United Healthcare. Earnings from operations grew 19% year-over-year, and the medical cost ratio improved from 82.8% last year to 81.5% this year.

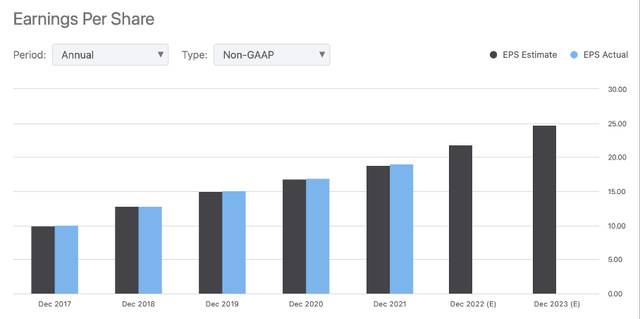

Earnings per share grew by an average of 17% annually from 2017 to 2021. Earnings per share are growing steadily. On the SA ticker page, 19 analysts have revised earnings upwards and only 2 analysts have revised earnings downwards.

UnitedHealth’s Outlook Is Bright

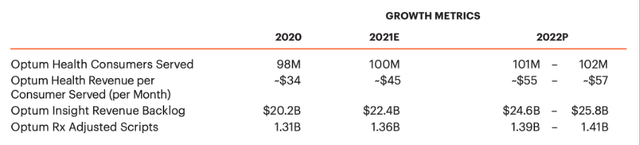

Adjusted EPS is expected to grow 14% from 2021 to 2022. Strong growth is expected due to their growing consumer base in both business segments (Optum and United Healthcare), higher revenue per consumer served, and lower operating expenses.

Optum Health customers served are expected to grow 1% to 2%, and revenue per consumer is expected to grow significantly to 22% to 27%.

Optum growth metrics (2022 outlook)

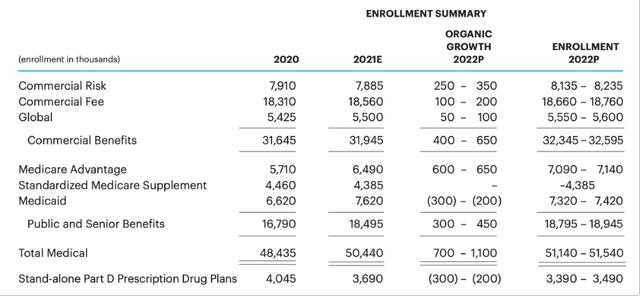

The United Healthcare business segment is also experiencing strong growth. On average, commercial risk enrollment is expected to grow strongly at 3.8% year-on-year. Medicare Advantage enrollment is also expected to grow strongly (9.6% YoY), while Medicaid enrollment is expected to decline.

United Healthcare enrollment summary (2022 outlook)

21 analysts from the SA UNH ticker page expect revenue to grow 12% year-over-year in 2022 and non-GAAP EPS to grow 14% over the same period.

As interest rates rise, their investment income from debt securities increases, resulting in higher income. A negative effect arises from the changes in the fair value of debt securities when interest rates rise. This shouldn’t be a problem, as they are kept until the expiration date.

Strong membership growth, revenue per customer, and rising interest rates are contributing to the upward earnings revisions for the company.

Dividend And Share Repurchase Program

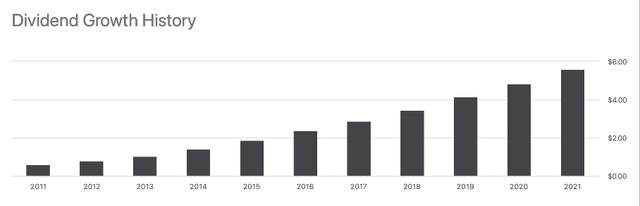

UnitedHealth’s dividend has been growing steadily for years; the dividend per share grew by an average of 24.8% per share from 2011 to 2021. The forward dividend is $6.60, which is easily covered by their non-GAAP EPS of $21.83, and their TTM free cash flow (“FCF”) per share is $21.45.

Dividend per share (SA UNH ticker page)

UnitedHealth not only pays out stock dividends but also buys back its own shares. Their 2022 target is to pay ~$5.45 billion in dividends and to repurchase shares worth $5 billion to $6 billion. The buyback yield is approximately 1% and the forward dividend yield is 1.3%.

Net earnings target is $19.15M to $19.73M, and the FCF target is $20.50M to $21.50M, so their shareholder return program is well covered by their earnings and free cash flow.

Valuation Metrics

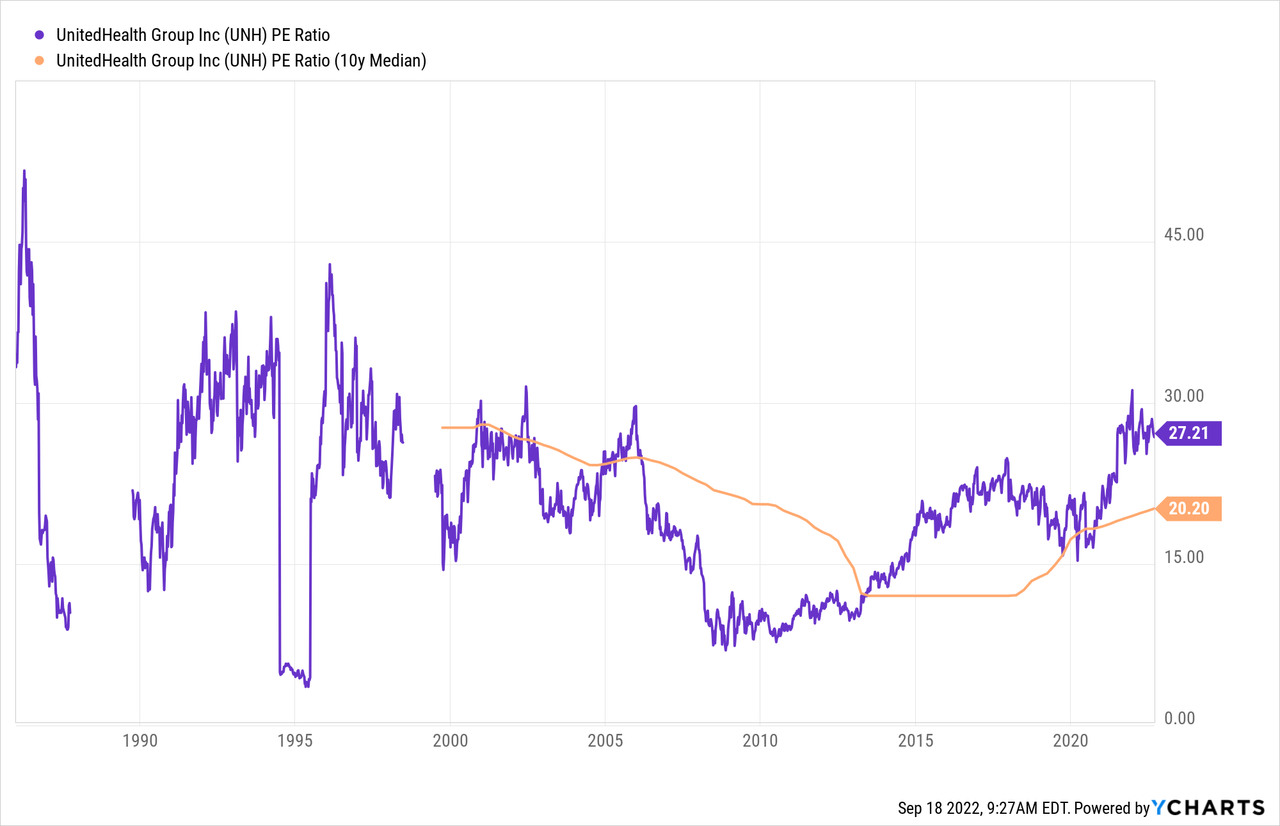

To map the valuation metrics for UnitedHealth, the P/E ratio is a commonly used choice. Currently, UnitedHealth is trading at a premium compared to the 10-year median P/E ratio. This was also the case in the years 1996 to 2006, when the share price rose sharply.

A high valuation measure is not a problem if the outlook is still rosy. With revenue growth expected to be 8% in 2023 and earnings growth expected to be 13% over the same period, UnitedHealth’s share price is still on an upward trend.

Forward P/E ratio for 2023 is 21, and for the year 2024, the forward P/E ratio is 18. The stock price is priced in for 2024 profit, so the stock price is only slightly overvalued.

I’d rather wait for some event to cause the stock price to fall. Depending on the event, I buy the shares. But for now, the share price seems a bit expensive. UnitedHealth is a great company to own, but the valuation seems expensive. The stock is a hold.

Conclusion

UnitedHealth is the largest health care benefits company in the United States. It serves individuals and employers, and Medicare and Medicaid beneficiaries. The company has grown steadily in revenue and earnings in recent years. Recent quarterly results were strong thanks to member growth, strong revenue per customer growth and higher investment income. As interest rates rise, so does investment income. The fair value of their debt securities decreases as interest rates rises, but if they are held to maturity, this is not a problem for UNH.

The dividend per share has grown by 25% annually for the past 10 years, and the dividend yield is currently 1.3%. The dividend is easily covered by their earnings and free cash flow. In addition to the dividend payment, management also repurchases shares. Their goal is to repurchase up to $6 billion worth of shares, representing a 1% buyback yield.

The valuation figures show that the company is currently valued somewhat expensively. I, therefore, wait for the share price to fall and then will consider a position in this high-growth company.

Be the first to comment