ipopba/iStock via Getty Images

Elevator Pitch

I continue to rate Devon Energy Corporation’s (NYSE:DVN) stock as a Hold.

I touched on DVN’s short-term outlook in view of its share price weakness between the beginning of June 2022 and mid-July 2022 as part of my prior article published on July 19, 2022. After experiencing a strong share price recovery in August 2022, Devon Energy’s stock price pulled back in the last month.

The focus of the current article is determining if DVN’s stock is a Buy on the dip; my analysis suggests that DVN doesn’t warrant a Buy rating. There is still downside for Devon Energy’s shares if the decline in energy prices continues and investors revise their expectations of DVN’s future variable dividends lower.

On the other hand, a Sell rating for Devon Energy is unjustified as well. The stock is still expected to boast a reasonably decent high-single digit dividend yield for FY 2024. More significantly, the company has continued to invest in future growth opportunities rather than divert all of its free cash flow into capital return initiatives. In other words, Devon Energy’s approach of having a good balance between capital return and capital investment should be supportive of its share price to some degree, notwithstanding the inevitable drop in variable dividends in the future.

In a nutshell, Devon Energy isn’t a Buy on the dip and deserves a Hold rating in my view.

DVN Stock Key Metrics

It is relevant to first review Devon Energy’s most recent quarterly metrics to understand what drove DVN’s good stock price performance in August 2022 prior to the dip in its shares in the past month.

Devon Energy announced the company’s financial results for the second quarter of this year on August 1, 2022, and this coincided with the +15% rise in DVN’s share price from $61.57 as of August 1 to $70.62 as of August 31.

Revenue for DVN expanded by +133% YoY from $2,417 million for Q2 2021 to $5,626 million in Q2 2022, while Devon Energy’s non-GAAP earnings per share or EPS jumped by +38% YoY to $2.59 in the most recent quarter. The company’s actual top line and bottom line for the second quarter of 2022 beat Wall Street analysts’ expectations by +18% and +9%, respectively.

Apart from the impressive headline financial numbers, Devon Energy’s operating profit and cash flow also came in above the market’s expectations. DVN’s EBITDAX (Earnings Before Interest, Taxes, Depreciation, Amortization, and Exploration Expenses) grew by +33% YoY to $2,833 million in Q2 2022, and this turned out to be +6% higher than the sell-side’s consensus estimate of $2,668 million according to S&P Capital IQ data. Separately, free cash flow for Devon Energy increased by +62% YoY to $2,105 million in the recent quarter, and this translated into a cash flow per share of $3.73 that came in +3% better than the market’s consensus forecast of $3.62.

In terms of key operating metrics, Devon Energy’s Q2 2022 production of 616 thousand barrels of oil equivalent per day or MBoe/d represented a +7% QoQ growth. DVN’s actual second-quarter production exceeded Wall Street’s consensus production projection by +3% as per S&P Capital IQ.

With respect to shareholder capital return metrics, DVN continued to pay out dividends and buy back its own shares. Devon Energy’s Q2 2022 dividend per share (including both fixed and variable payouts) grew by +22% QoQ and +216% YoY to $1.55 in Q2 2022. DVN also disclosed in its Q2 2022 earnings presentation that the company had spent $1.2 billion buying back approximately 6% of its shares outstanding since the initiation of its $2 billion share repurchase program in the final quarter of 2021.

It is easy to appreciate why Devon Energy’s shares performed well in August 2022 based on a review of the company’s Q2 2022 metrics. But DVN’s positive share price momentum wasn’t sustainable as discussed in the subsequent section.

Why Is DVN Stock Dipping?

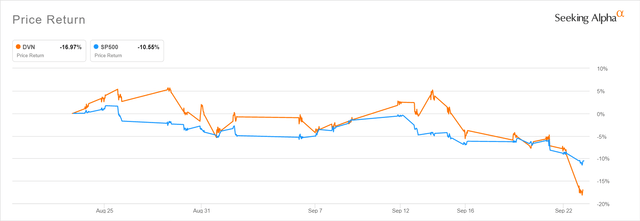

DVN’s stock has been dipping in the past month. In fact, shares decreased by -17.0% as compared to a -10.6% decline for the S&P 500 as highlighted in the chart presented below.

Devon Energy’s One-Month Stock Price Chart

In my opinion, the recent dip in Devon Energy’s stock price is attributable to worries about the sustainability of DVN’s high dividend yield in the future which are triggered by the weakness in oil prices. All eyes are on Devon Energy’s ability to strike a balance between income and growth going forward.

A September 23, 2022 Seeking Alpha News article noted that “energy stocks are the worst performers” as “WTI crude oil slides below $80/bbl for the first time since January.” Notably, Devon Energy’s shares dropped by -8.6% on the same day to close at $57.69.

In February last year, DVN became the first listed company in the oil & gas industry to implement a “‘fixed plus variable’ dividend framework” as indicated in its press release dated February 16, 2021. Devon Energy currently offers an enticing annualized dividend yield of 10.7% (based on Q2 2022 dividend payout of $1.55 per share), and this is only made possible by its policy of paying out 50% of excess cash flow as variable dividends. For the most recent quarter, DVN’s $1.55 dividend per share comprised of a $1.37 per share variable dividend and a $0.18 per share fixed dividend.

Notwithstanding the recent share price dip, DVN’s stock price has gone up by +82.4% in the last year which outperformed the S&P 500’s -17.0% drop by a very wide margin. The market has given Devon Energy a lot of credit for its “‘fixed plus variable’ dividend framework” and its attractive yield supported by variable dividends in the past, which drove DVN’s share price rise and positive valuation re-rating over the last year.

But when energy prices return to mid-cycle levels eventually, it is inevitable that DVN’s future free cash flow and variable dividends will shrink, resulting in a much less appealing forward dividend yield. The pullback in WTI crude oil prices mentioned above has been the catalyst for a valuation derating for Devon Energy, as it reminded investors that the valuation multiple expansion driven by high variable dividends isn’t sustainable. According to valuation data sourced from S&P Capital IQ, DVN’s consensus forward next twelve months’ free cash flow yield has already gone from above 20% at the peak to the mid-to-high teens percentage level in the past one month.

On the other hand, I have a positive view of Devon Energy’s approach of attempting to achieve a good balance between income (capital return) and growth (capital investment).

DVN announced on August 9, 2022 that it “entered into a definitive purchase agreement to acquire Validus Energy, an Eagle Ford operator” which will cost the company an estimated $1.8 billion. Earlier, Devon Energy had spent $865 million to buy “the leasehold interest and related assets of RimRock Oil and Gas, LP in the Williston Basin” as indicated in a July 21, 2022 announcement.

Separately, Devon Energy also raised the mid-point of its upstream capital expenditures guidance for full-year fiscal 2022 by +10% from $2.1 billion previously to $2.3 billion now. This is in line with the +3% (as compared to prior budget) increase in DVN’s FY 2022 production guidance to between 600 MBoe/d and 610 MBoe/d.

It is noteworthy that DVN stressed at its recent Q2 2022 earnings call that “we’ll always be looking for opportunities to strengthen our company’s asset base and continue to build Devon for the long haul.” It is clear from Devon Energy’s management comments that the company will continue to seek out organic and inorganic growth initiatives.

In conclusion, it is unavoidable that Devon Energy’s valuations will derate in line with lower energy prices and the resulting reduction in variable dividends going forward. As energy prices revert to mid-cycle levels, investors will start to rate oil & energy stocks on both income and growth metrics. Further downside for DVN’s shares is limited to some extent by the fact that the company strikes a healthy balance between income and growth.

What Is DVN Stock’s Forecast?

The key metric to pay attention to as part of DVN stock’s financial forecasts is free cash flow.

As per consensus data taken from S&P Capital IQ, Devon Energy’s free cash flow is projected to decrease by -11% and -23% to $5,970 million and $4,573 million for FY 2023 and FY 2024, respectively.

According to my calculations, DVN’s forward FY 2024 dividend yield is still expected to be a decent 6.6%. This is derived using the sell-side’s consensus free cash flow estimate, and assuming that Devon Energy maintains its quarterly fixed dividend per share of $0.18, and a variable dividend payout pegged to 50% of excess cash flow. Nevertheless, Devon Energy’s estimated forward fiscal 2024 dividend yield of 6.6% will be much lower than its current annualized dividend yield of 10.7% as highlighted above.

How Does Devon Energy Compare To Competitors?

Devon Energy’s current valuations appear to be reasonably fair as compared to its upstream oil & gas peers focused on the North American region.

Peer Valuation Comparison For Devon Energy

| Stock | Consensus Forward Next Twelve Months’ Free Cash Flow Yield |

| Ovintiv Inc. (OVV) | 29.7% |

| Devon Energy | 16.8% |

| EOG Resources, Inc. (EOG) | 12.4% |

Source: S&P Capital IQ

As indicated in the peer valuation comparison table presented above, DVN isn’t as cheap as OVV based on the forward free cash flow yield metric, but it isn’t as expensive as another one of its peers, EOG.

Is DVN Stock A Buy, Sell, or Hold?

DVN is a Hold rather than a Buy, despite its recent share price dip. As energy prices trend downwards, expectations of Devon Energy’s future variable dividends will be lower which will drive a further derating of DVN’s valuations. On the positive side of things, Devon Energy isn’t solely focusing on capital return and income at the expense of capital investment and growth. The company has recently announced two acquisitions, and it also revised its production and capex guidance for full-year FY 2022. As such, DVN’s stock will fare relatively better when the market’s focus for oil & gas stocks shifts from income to growth in the future.

Be the first to comment