Totojang/iStock via Getty Images

International Flavors & Fragrances (NYSE:IFF) made two major deals that greatly expanded their world-wide operations over the last few years, but these deals, however, also greatly increased their debt. Because of potential supply chain issues and concerns over margins with soaring inflation, investors have pushed the stock price down over 33% from its 12-month high. Their exposure to China, where there are still some lockdowns, also negatively impacted the stock. With a current dividend yield of 3.16% it is time to examine this major manufacturer of the ingredients used in almost all the food you eat/drink and many of the items applied to your body. IFF has a premier R&D department that has received over 1,346 patents (plus 608 pending) since 2000.

How IFF Fits into My Portfolio

Before looking at IFF, I think it would be appropriate to discuss my portfolio approach to investing. I have a number of sub-portfolios within the total portfolio. Some of these sub-accounts are bankrupt securities, short-term trades, limited partnerships, and other sub-portfolios. By far my largest sub-portfolio is what I call “preservation of capital” account. Some of the profits from the other sub-portfolios are transferred over to this account periodically. This account is based on the desire to preserve capital to be passed on to heirs. The goal of this account is to beat inflation by 2-3% on average per year over many decades, which increases the total inflation-adjusted value over time. It is intended to preserve a nest egg-not make a nest egg. In my opinion, too many investors are too aggressive trying to make a lot more money and too often risk too much of their assets on very speculative trades.

Currently, this preservation of capital account currently has mostly just short-term debt of less than 18 months and only a little equity because I have been fairly bearish over the last year as inflation worsened and the political situation became more intense. I purchased IFF on Friday as my limit orders were hit and again on Monday morning. I have “ladder” orders to buy additional shares at descending limit prices.

Relatively Low Stock Price

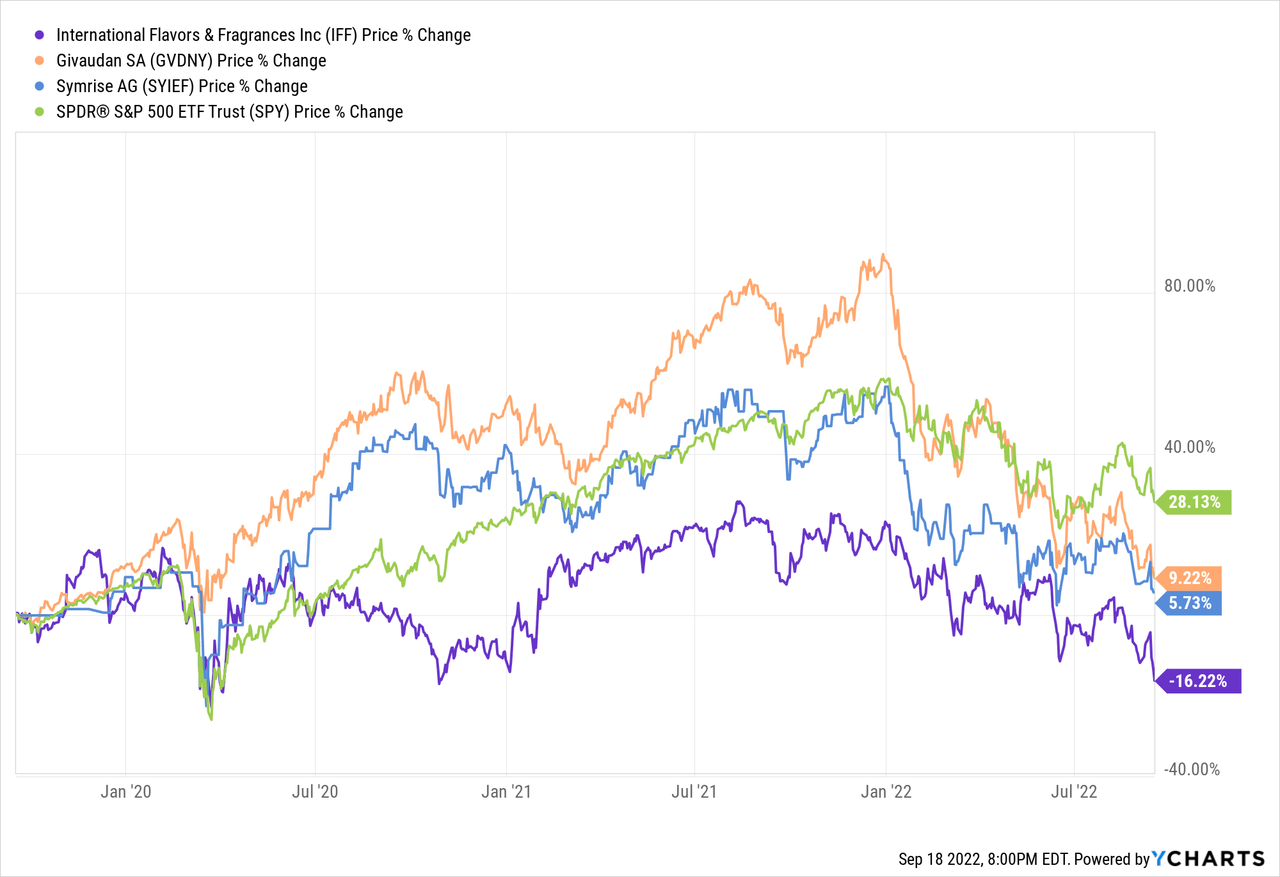

The primary reason why I bought IFF was the relatively low price. I did not buy the stock because I am expecting some major positive event or major improvement in operations. Directly related to that low stock price is their current yield of 3.16%, which is about 91% of the yield on 10-year U.S. treasury notes. IFF has underperformed lately compared to the market and compared to their competitors Givaudan SA (OTCPK:GVDNY) and Symrise AG (OTCPK:SYIEF), as seen by the chart below.

Stock Price Percent Changes for Last Three Years

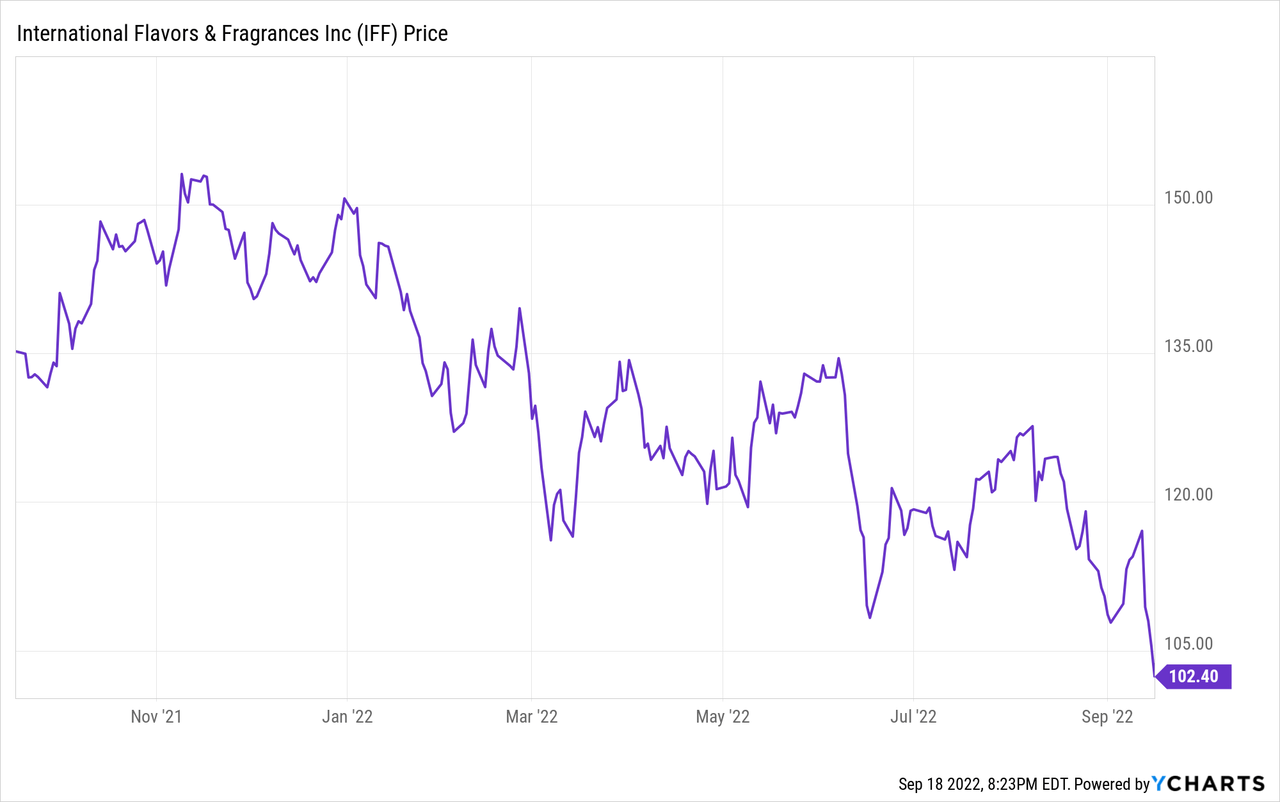

The last nine months have been especially difficult for IFF shareholders as the stock price has dropped about 33% from its high last November.

One Year IFF Stock Price

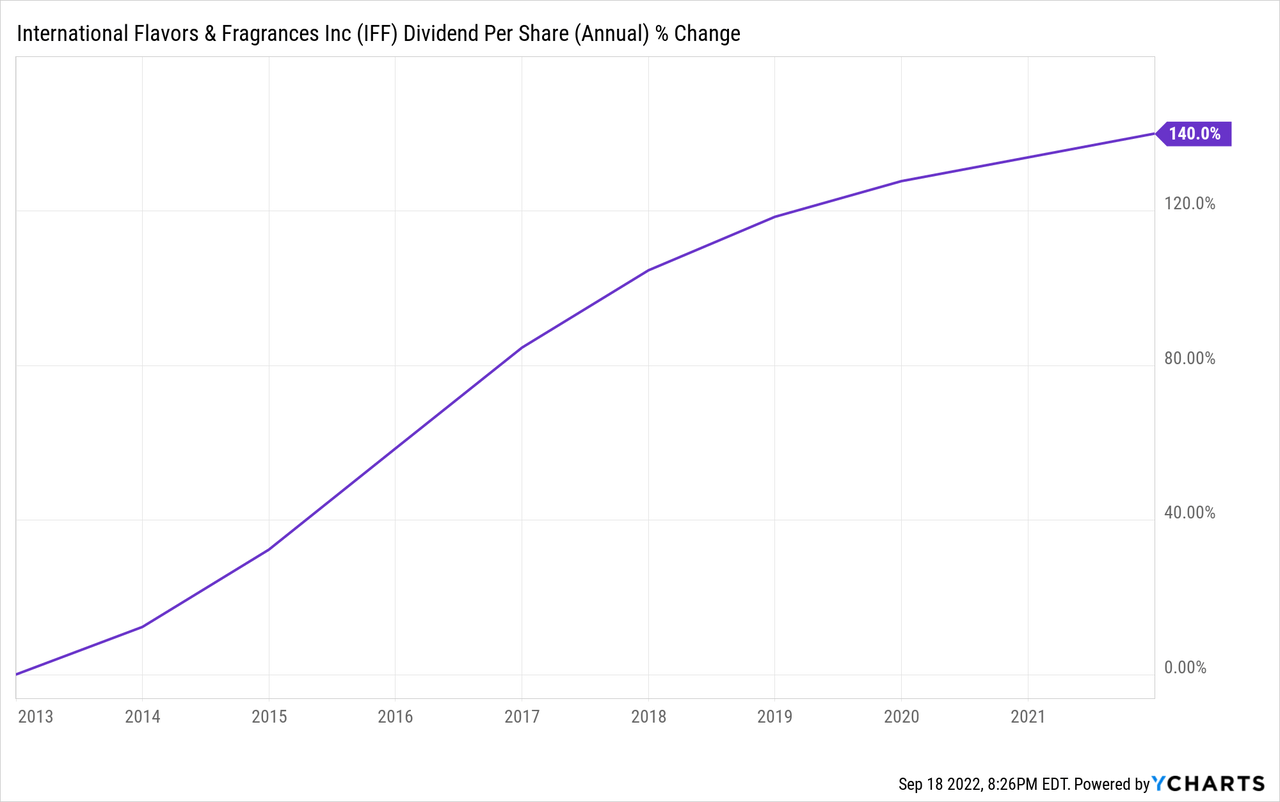

The increase in dividends over the last 10 years of 140% could be an indication that future dividends might be able to keep up with or even beat future inflation.

Annual Dividend Percent Increase Over 10 Years

Operating Business Model

IFF is the “middleman” for literally tens of thousands of different items that are used to make a very wide range of final products. If you look on the packaging of a product and read the list of ingredients most of them could have come from IFF. Before they bought Frutarom Industries in 2018 for $7.1 billion using cash and stock, IFF had about 3,000 customers. Now they have over 42,000. This was a dramatic change because Frutarom mostly had small to mid-sized customers. Because of the impact of the pandemic, it is difficult to make a fair determination if this was a successful deal.

Here are just a few of the raw materials that IFF uses: “essential oils, extracts and concentrates derived from fruits, vegetables, flowers, woods and other botanicals, animal products, raw fruits, organic chemicals and petroleum-based chemicals, as well as, gelatin, glycols, cellulose processed grains, guar, locust bean gum, organic vegetable oils, peels, saccharides, seaweed, soybeans, and sugars and yeasts”.

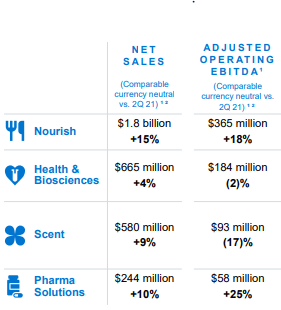

2Q 2022 Segment Results

2Q Segment Results (ir.iff.com)

Inventories increased to $2.993 billion at the end of 2Q from $2.516 billion at the end of 2021. Management stated that most of the increase is not because of increased volume, but because of sharply increased prices. This increase in inventories had a major negative impact on cash flow. Revenue increased 7% to $3.307 billion in 2Q from $3.089 billion during the same period in 2021, but all that increase was just price increases and not an increase in actual volume. Adjusted operating EBITDA increased 3% to $700 million from $679 million. Adjusted operating EBITDA margin dropped 80 basis points in 2Q to 21.2% from 22.0%. Given the rapidly changing prices during the period, I am actually somewhat impressed they were almost able to maintain their margins during the current very challenging economy.

An interesting new part of their business model is trying to get IFF to be the sole supplier to a customer instead of their customers managing a number of suppliers. It would be a way for both IFF and their customers to have more efficient operations, which should have a positive impact on margins. In addition, it should also increase revenue/profits. This, of course, would be more for smaller customers that IFF got via the Frutarom purchase. It would be unrealistic to expect a very large multi-national company to use just IFF.

I almost did not buy IFF because of China, which is their second largest market. Not only do the current lockdown issues concern me, but long-term I try to avoid investments that have too much exposure to China as I think we are headed to very serious problems with China within the next few years.

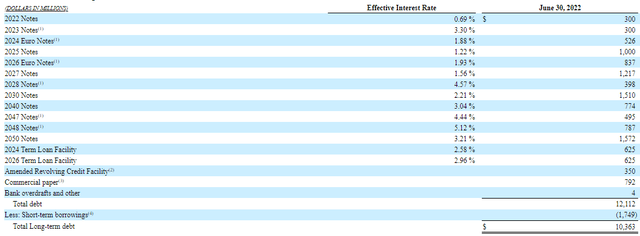

Too Much Debt

One of the major negatives facing IFF is their debt has soared because of the recent two mega deals. For example, $6.25 billion in various tranches of unsecured notes were issued in 2020 as part of the Nutrition & Biosciences deal. Debt at the end of 2017, including long-term and short-term borrowings, was a relatively low $1.639 billion. At the end of 2Q 2022, total debt had soared to $12.112 billion.

Management understands that they need to deleverage by selling assets and using the cash to pay down debt. At the beginning of 3Q 2022, IFF completed the sale of Microbial Control and received $1.277 billion. They used that cash to pay down $350 million of their revolving credit facility and $900 million of their commercial paper. Management has also recently stated they are looking at 3-4 deals that are expected to bring in $1.5 billion-$1.7 billion. Assuming that they do sell additional assets at the mid-point of $1.6 billion, plus their already closed deal, total debt would be reduced from $12.112 billion to $9.235 billion. That is, in my opinion, still way too high. At least the coupon rates on the debt are relatively low and maturities are spread out over a long time period — there is no “wall of debt” maturing in the future.

Debt as of June 30, 2022

Debt as of June 30, 2022 (sec.gov)

Their debt is currently rated BBB by S&P. At the end of 2Q, IFF had 4.4x net debt credit adjusted EBITDA ratio with a trailing 12-month credit adjusted EBITDA of $2.644 billion. Management reconfirmed their earlier guidance for 2022 of EBITDA of $2.5 billion-$2.6 billion and sales of $12.6 billion-$13 billion. (Because of technical issues on how they are determined, there could be a slight difference between these guidance numbers and credit adjusted EBITDA.)

They recently amended their credit agreement and “delayed certain step-downs from maximum permitted leverage ratio of 4.5:1, stepping down to 3.5:1 over time, with the first step down now occurring at the end of the third quarter 2023 versus the end of the fourth quarter 2022 previously”.

Conclusion

Management keeps referencing their Capital Markets Day set for December 7. I am not sure if I am reading too much into this, but the tone of their voices when they mention this day seems to indicate something positive might be disclosed.

IFF sells mostly to industries that are not severely impacted by recessions. You still eat and brush your teeth during a recession. Their excellent R&D record should make them competitive going forward. The current dividend yield of 3.16% may also help keep the stock price from dropping significantly. I bought IFF because of its yield and with the expectation that the dividends will continue to increase, which makes IFF more attractive than just buying a fixed income security.

While their debt level is way too high, they are trying to deleverage by selling some assets. The China issue remains and may get worse in the future, but at this time I rate IFF a buy for investors seeking long-term total returns. This is not a “trade” buy recommendation.

Be the first to comment