patty_c/iStock Unreleased via Getty Images

Investment Thesis

The Home Depot, Inc. (NYSE:HD) stock has come under significant pressure over the last few months. The market has been concerned over a multitude of risks relating to the macro-environment that has thrown a curveball to investors. The worsening inflation, faster than expected rate hikes, and the Russia-Ukraine conflict took their toll as HD stock fell 28% from its December highs.

However, we think HD stock valuation has improved dramatically, as it reverted to its five-year mean across several metrics. In addition, it’s also markedly below the consensus price targets (PTs).

As a result, we think HD stock’s defensive FCF profile can withstand the risks highlighted above. Therefore HD investors can consider taking the opportunity to add exposure before the market realizes its overreaction.

A Drop Too Far In Home Depot stock’s Valuation?

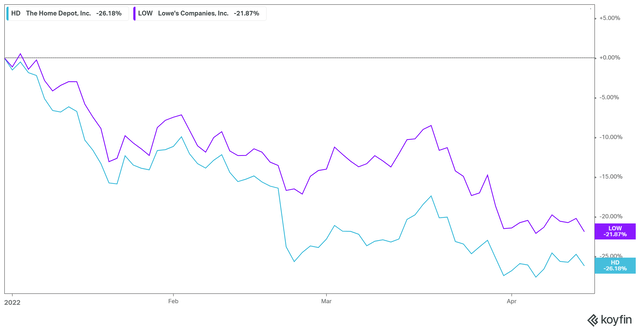

HD stock YTD performance % (koyfin)

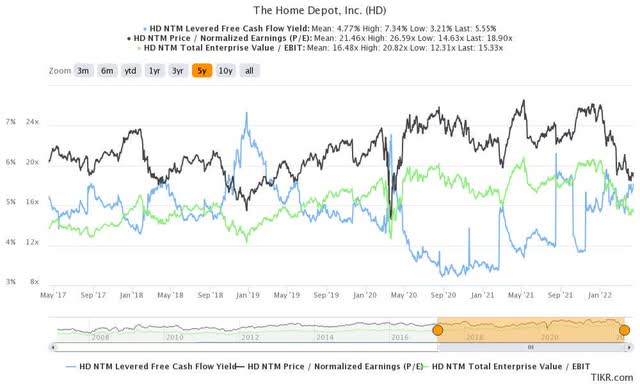

HD stock valuation metrics (TIKR)

HD stock has been buffeted since the start of 2022 as the macro and geopolitical headwinds intensified. As a result, HD stock has lost -26.2% YTD, more than Lowe’s (LOW), as its stock fell 21.9%. Notably, both stocks have fallen markedly ahead of the SPDR S&P 500 ETF’s (SPY) YTD loss of 7.5%. Home Depot also referred to these headwinds in its 10-K, as it added (edited):

Russia’s invasion of Ukraine and other geopolitical conflicts, as well as any related international response, may exacerbate inflationary pressures.

Rapid and significant changes in commodity and other prices, and our ability to pass them on to our customers or manage them through our portfolio strategy, may affect the demand for our products, our sales and our profit margins.

Our financial performance depends significantly on the stability of the housing and home improvement markets. Adverse conditions in or uncertainty about these markets could adversely impact our customers’ confidence or financial condition, causing them to decide against purchasing home improvement products and services. (Home Depot’s FY21 10-K)

Therefore, investors would be remiss in disregarding these headwinds, no matter their confidence in the resilience of Home Depot’s Pro and DIY market. However, the significant fall in its stock price has also lowered its valuation substantially. For instance, HD stock last traded at an NTM FCF yield of 5.6% (5Y mean: 4.8%). Moreover, its NTM normalized P/E and NTM EBIT multiples have reverted below their 5Y mean.

Furthermore, the median P/E (26.4x) of the home improvement retail industry has also dropped below its 10Y mean of 30x. Therefore, though justified, we believe that the recent valuation compression had already priced in the impact of these headwinds.

Cautious Guidance Is Prudent

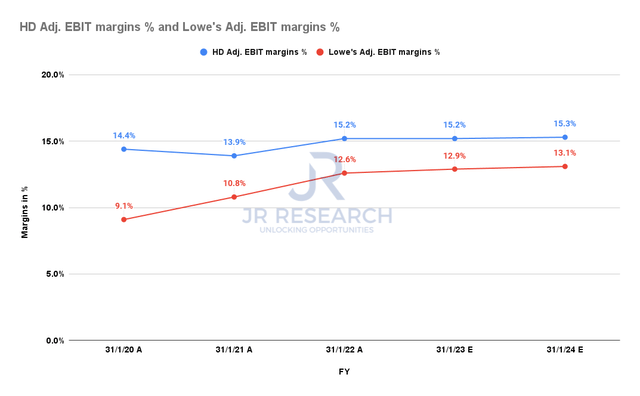

Home Depot Adj. EBIT margins % (S&P Capital IQ)

Some investors were disappointed with Home Depot’s guidance on its profitability for FY22. The company highlighted back in its FQ4 card (edited): “Operating margin approximately flat with FY21. Diluted EPS growth to be in the low single digits.”

The consensus estimates have also reflected the company’s cautious guidance. Investors can observe the “flattish” operating leverage gains from FY21, with an adjusted EBIT margin estimate of 15.2%. Compared to Lowe’s slight improvement of 12.6% to 12.9%, some investors called out Home Depot’s weaker guidance.

However, Home Depot emphasized that investors should not predicate their observations on the company’s near-term guidance, given the headwinds. Furthermore, the company has also been investing in the Pro segment. Such investments could potentially compress margins in the near term. However, Home Depot believes that it could reap substantial longer-term rewards. CFO Richard McPhail accentuated (edited):

We realized that there are customer wallets out there that are much deeper than we ever anticipated. For example, we had a customer who was a $50K customer a year. We thought we were getting our fair share of their business. We opened up our flatbed distribution center, and we are now doing $500K a year. We had no idea they were this big.

If our product mix were static, we wouldn’t see much fluctuation in our margins, most likely. But what we have in front of us is the opportunity to grow in this $900B+ market in ways that we’ve never been able to before.

It means that — take sales from our flatbed distribution centers. Well we know that customer that grew from $50K to $500K is still shopping across our assortment. We will have opportunities in categories that carry above company average gross margin. (J.P. Morgan’s 8th Annual Retail Round-Up Conference)

Is HD Stock A Buy, Sell, Or Hold?

HD stock consensus price targets Vs. stock performance (TIKR)

Investors can glean that the most conservative price targets (PTs) had consistently supported HD stock over the past five years. But, HD stock last traded at a level that was well ahead (19.2%) of the most conservative PTs of $255. Moreover, the average PTs have also been revised downwards, as the Street turned more cautious with the headwinds mentioned earlier.

Therefore, we think the stock looks well-balanced, with the negative sentiments priced in.

As such, we rate HD stock as a Buy.

Be the first to comment