AlexRaths/iStock via Getty Images

I haven’t been doing a whole lot of buying when it comes to stocks to start 2022 for a couple of reasons. It has been hard to find attractive valued opportunities and I have had a couple other significant expenses to deal with as well. Looking forward over the next couple months, I plan to add to several of my favorite positions, including tobacco giant British American Tobacco (NYSE:BTI).

Investment Thesis

British American Tobacco is a European tobacco giant, with a market cap of $97B. The company is still working to add newer categories like vaping to their combustible lineup. I have mixed feelings on that myself, but I think it’s good for the business to focus on adding new segments. I’m more old school and prefer the occasional cigar, but that’s neither here nor there. The biggest piece of the bullish thesis is the valuation. Shares have had a solid start to 2022 and are up over 10% YTD, but the risk/reward is still skewed to the upside.

Shares still trade under 10x earnings, which is well below the average multiple. I think shares should be worth at least 15x earnings, especially when you consider the high margin profile of the business. The other driver of the bull case is the capital return program, which is going to be very generous to shareholders in the coming years. The dividend sits at a juicy 6.8%, which will draw investors looking for current income, but the company has a consistent track record of dividend raises as well. They have started to buy back shares in 2022 and the current authorization could just be the beginning. In my opinion, investors are in for double digit returns for the foreseeable future.

The Business and ESG

British American Tobacco is a business that provokes a mixed reaction from the investing community for several reasons. There are many investors who refuse to buy any tobacco stocks under any circumstances because tobacco is detrimental to our health. I understand where they are coming from and realize that people are free to make those decisions. I have a different opinion and I know that everyone has their vices.

There are many investors who see this as a contrarian opportunity. Many well-known investors have said that the best time to buy something is when it is out of favor. Major funds refuse to own it, but the other thing bullish investors see is the actual business. For investors willing to take the time to scan the financial statements, they will find a high margin business that throws off a ton of cash.

Altria (MO), another tobacco company I own, has many of the same characteristics. It is out of favor many of the same reasons, but it is another high margin business that is worth way more than the current share price in my opinion. I think people are starting to see it, as both businesses are up in 2022. This brings me to central piece of the bull case, which is the dirt-cheap valuation.

Valuation

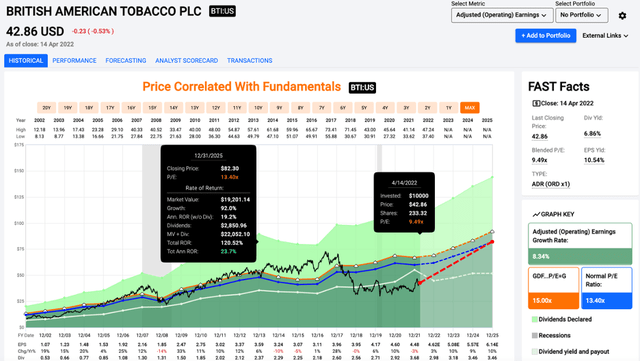

British American Tobacco isn’t going to light the world on fire with its revenue growth, but investors buying today are getting a high margin cash cow with a fat dividend well below fair value. Shares currently trade at 9.5x earnings, which is well below the average 13.5x multiple. While I don’t know if we will see a 15x multiple, a single digit multiple is just too good to pass up.

Price/Earnings (fastgraphs.com)

Altria is a little more expensive, with a 11.8x multiple. I don’t plan to add to my position there as it is already a full-sized position for me. I do plan to add to British American Tobacco in the next couple months because it is a smaller position and I do think it is more attractive today than Altria (or any of the other tobacco industry alternatives). One of the reasons I’m so bullish on the company is the capital return program that is poised to juice returns for shareholders.

Capital Return

One of the things I always check before writing articles is the SEC website. Usually it’s just the 10-K or 10-Q for the most recent quarterly updates, but the website is setup differently for the filings from international companies. After going through several filings showing that the company is repurchasing shares on a daily basis, I had seen enough. The buyback program was $2.7B when it was authorized, so I’m hoping they can use that up rather quickly, especially with shares in the low $40s.

The other piece that investors can look forward to is the huge dividend. Shares yield 6.8%, and long-term investors can expect dividend growth in the future. It won’t occur in a straight line like Altria due to currency conversion, but it is highly likely that the payout will be higher 5 years from now. Altria’s yield is slightly lower, at 6.5%. British American Tobacco’s buyback program should also give the company the ability to raise the dividend more aggressively in the future. I’m content with buybacks at these prices, but I would hope for higher dividends if the share price was materially higher.

Conclusion

British American Tobacco is materially undervalued today. Investors looking to put some cash to work might want to consider British American Tobacco. I think the downside is relatively limited, and you get paid to wait for the upside to materialize. The company has impressive margins, an improving balance sheet, and plans to continue to diversify their product line. The buyback program that was started in 2022 could be the beginning of an impressive capital return program, and I plan to add to my position in the coming weeks.

Be the first to comment