Justin Sullivan/Getty Images News

Introduction

Originally PayPal (NASDAQ:PYPL) was supposed to be a tool for beaming funds from one PalmPilot to another. My thesis is that the payments landscape will continue to evolve and PayPal will have to remain open-minded.

At the September 2015 Deutsche Bank Technology Conference, CEO Dan Schulman said the only digital payment companies at scale were PayPal, Tencent’s (OTCPK:TCEHY) WeChat Pay, and Alipay which is partially owned by Alibaba (BABA). China has been ahead of the rest of the world with payment processing for many years. This was acknowledged by CEO Schulman at the December 2018 Goldman Sachs US Financial Services Conference:

Yes. So first of all, China is not a developing market when it comes to digital payments. They are the developed market. It amuses me if somebody says to me like, “Oh, are you worried if you go into China that they may take your trade secrets,” like I want to take their trade secrets. So they’re quite developed.

CEO Schulman has noted that Alipay and WeChat pay don’t make money in payments. Instead, payments are a way of keeping users engaged such that money can be made in areas like credit, insurance, and wealth management. I believe Alipay and WeChat Pay will continue to influence the rest of the world such that we’ll keep seeing a decline in transaction take rates globally.

PayPal – Managing The Business

At the 2018 Deutsche Bank Technology Conference, CFO John Rainey uses a hot dog example to explain that they manage the business for free cash flow (“FCF”) as opposed to the take rate. They want to increase peer-to-peer (“P2P”) total payment volume (“TPV”) because it increases engagement even though it has a low take rate:

Like if you think about, say, you and I have a hamburger store. We sell hamburgers at a 30% margin. That’s good for us. But we realize that with no incremental overhead, we can start selling hot dogs because hot dogs come in at 20% margin. They generate additional free cash flow. It’s absolutely what we want to do for our business. That’s the mix element of it. On P2P, if you think about what take rate is, it’s the revenue divided by volume. P2P doesn’t have necessarily the revenue associated with it, but we have the volume. If you take our hamburger store example, it’s akin to offering a freebie to someone to come into the store. We recognize that a P2P customer has 2x the lifetime value of someone that doesn’t use P2P, so we’d absolutely want to do that to grow our profits in the future.

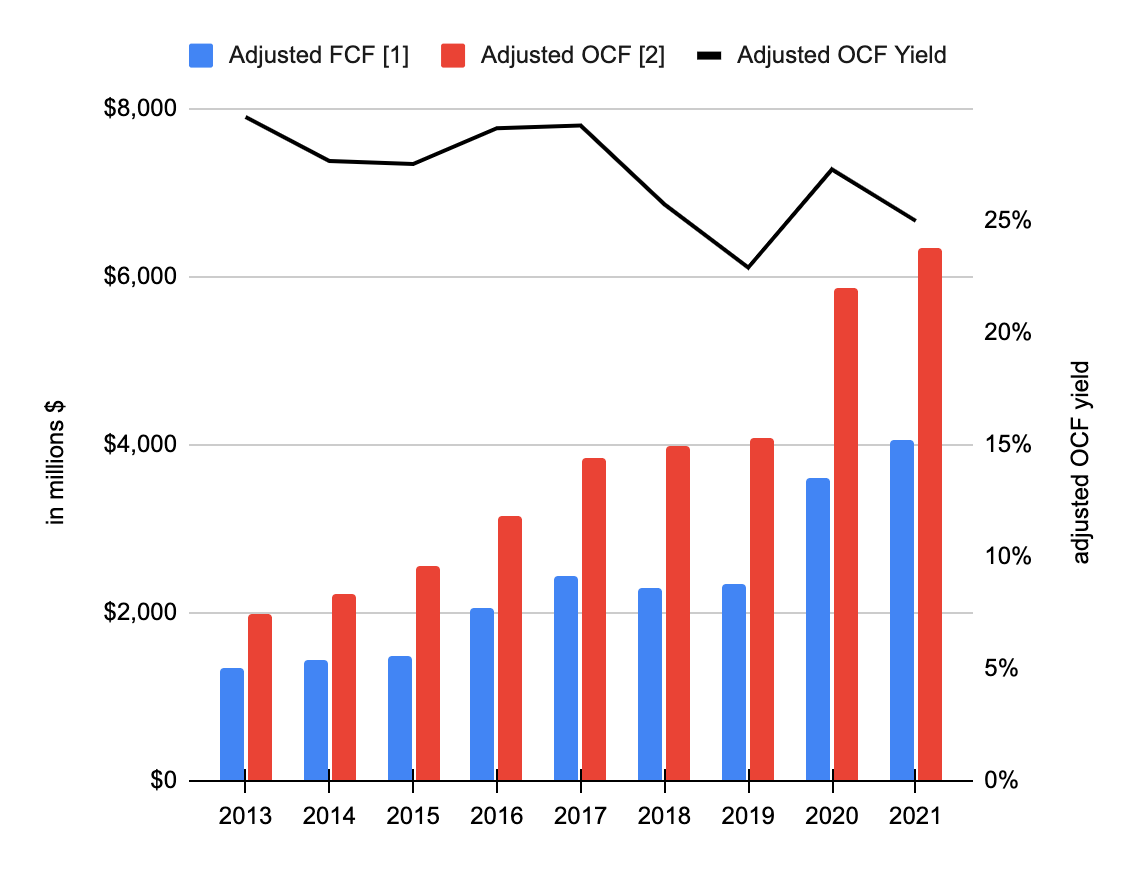

For every dollar of revenue, about one quarter makes its way down to operating cash flow (“OCF”). Management has done a nice job increasing adjusted FCF over the years:

OCF Growth (Author’s spreadsheet)

[1] Stock-based compensation is treated like a cash expense.

[2] Impact of held for sale accounting presentation related to US consumer credit receivables portfolio on cash flow from operating activities. 2017 is adjusted up by $1,299 million and 2018 is adjusted down by $1,508 million.

The above would be especially impressive if PayPal returned much of the FCF to shareholders in the form of dividends or buybacks but that is not the case. There have been significant acquisitions during this time that were largely paid for with cash from FCF. 10-K filings show that the cash component of the Paidy acquisition in October 2021 was $2.6 billion. The January 2020 cash component of the Honey Science acquisition was $3.6 billion. The cash portion of the September 2018 iZettle acquisition was $2.1 billion. The 2021 10-K shows 1,165,004,913 shares outstanding while the 2015 10-K shows 1,222,675,902, so buybacks over the years have only reduced the shares outstanding by about 5%. At the November 2017 Synchrony call, CFO John Rainey revealed that at the time, they were using 40% to 50% of FCF to fund their U.S. consumer credit business which only represented 2% of TPV and $1 billion of revenue.

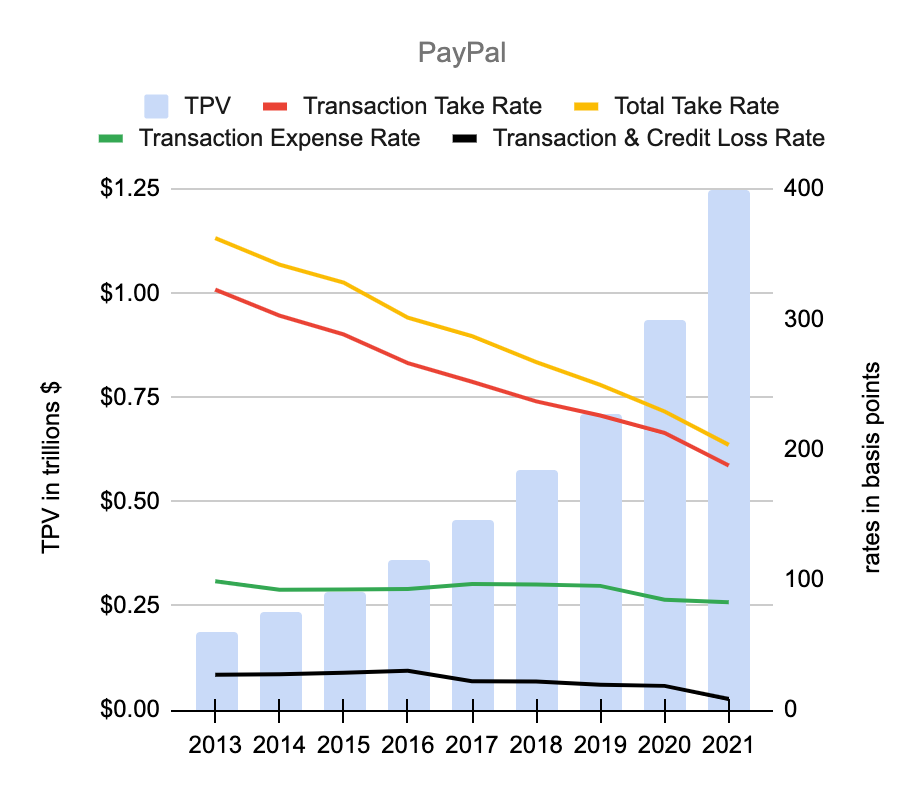

Take Rates

In 4Q21, PayPal’s $6,377 million transaction revenues made up 92% of the $6,918 million total revenue. The 4Q21 TPV was $339.5 billion such that the transaction take rate was 1.88% and the total take rate was 2.04%. One of the reasons the transaction take rate has declined is that P2P transaction volume has helped increase the overall transaction volume substantially and Venmo is a big part of P2P. We know Venmo did about $900 million in revenue in 2021 from about $230 billion in TPV for a take rate of less than 40 basis points. Another factor in the transaction take rate decline has been the reduction of eBay-related transaction revenue relative to overall payment revenue. An August 2021 blog post by @noyesclt notes that increased bill payment volume is an additional factor in declining take rates. Understanding the individual weight of the above considerations can be abstruse but the cumulative impact over the years has been undeniable as take rates have fallen:

PayPal Take Rate (Author’s spreadsheet)

It is concerning that the spread between the transaction take rate and the sum of the transaction expense rate and the transaction & credit loss rate has declined over the years. This spread was 197 basis points back in 2013 and it narrowed to just 97 basis points by 2021.

At the December 2018 Goldman Sachs US Financial Services Conference, CEO Schulman explained that Alipay and Tencent don’t make money in payments so we know their transaction take rates are apples and oranges relative to PayPal:

Regulation was quite different when Ali and Tencent began. There’s no real commonality of standards. Ali and Tencent are at each other’s throats to get the next merchant and – because their QR codes are proprietary. They make no money in payments. They make no money in payments. They make their money on – or want to make their money on other things that they’re doing.

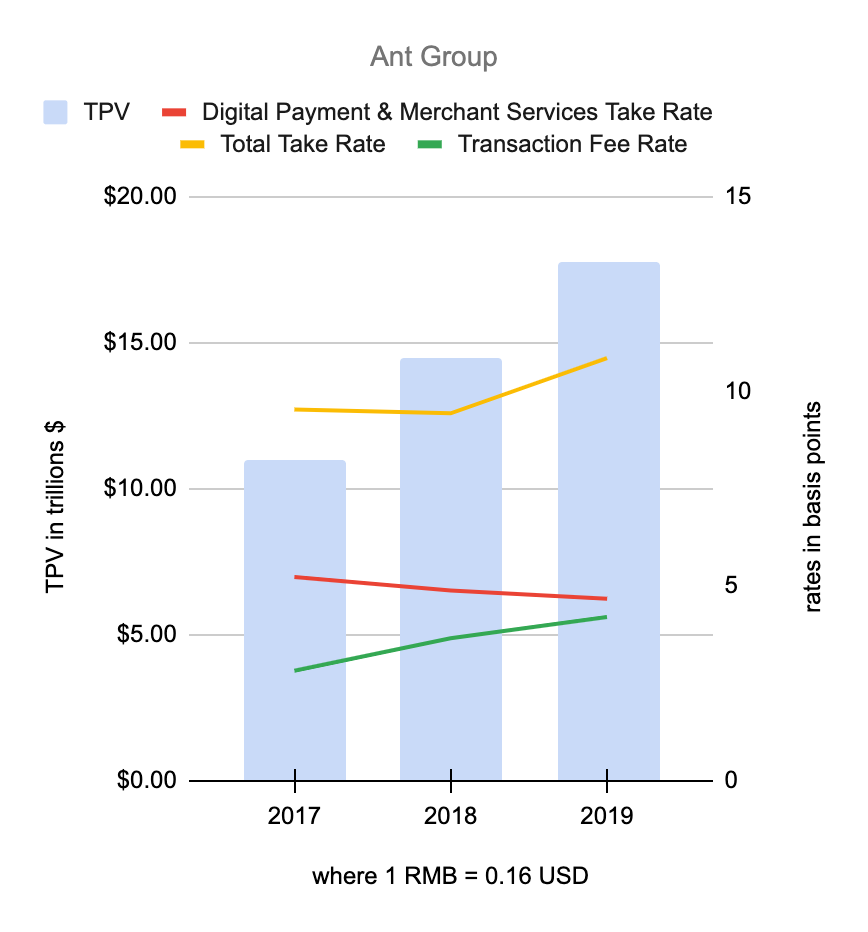

2019 was the last year where it was easy for me to gather relevant data for Ant Group. That year, PayPal’s TPV was a little over $0.7 trillion while Ant Group’s was about 25 times larger at nearly $18 trillion. PayPal’s 2019 transaction take rate was 226 basis points while Ant Group’s 2019 digital payment and merchant services take rate was about 45 times smaller at 5 basis points. PayPal’s 2019 total transaction take rate was 250 basis points while Ant Group’s was more than 20 times smaller at 11 basis points:

Ant Group Take Rate (Author’s spreadsheet)

These take rate differences are staggering. PayPal gets about $2 in transaction revenue for every $100 of processing volume while Ant Group only gets about a nickel! We can see from the above graph that PayPal CEO Schulman is right about Alipay not making money from payments. Honing in on Alipay’s 2019 numbers, their digital payment & merchant services take rate is 5 basis points and their transaction fee rate is 4 basis points for a spread of just 1 basis point.

I believe PayPal’s transaction take rate will continue to fall in the decades ahead and they will have to be flexible as the landscape shifts.

eBay

eBay acquired PayPal in 2002 but then they spun them off in 2015. PayPal’s contract with eBay (EBAY) has expired and Adyen (OTCPK:ADYEY) has taken over. This is a notable loss for PayPal and one has to wonder if they should be more flexible about increasing in-house development like Adyen as opposed to being overly reliant on acquisitions. The WSJ explains that Adyen rarely loses customers given their in-house customer development approach:

The company eschews acquisitions to avoid system integration challenges. Instead, Adyen invests in its platform to meet ready demand, for example by solving specific customer pain points or adding new regions that can service existing clients. The company recently expanded its capabilities to Japan and the United Arab Emirates. This “land-and-expand” approach to customer development appears to be working: More than 80% of growth comes from existing clients and volume churn is under 1%. A case in point is McDonald’s, which started using Adyen for mobile transactions in the U.K. in 2019 and has now expanded it into Canada, the U.A.E. and further into Europe.

More Than Payment Transactions

92% of PayPal’s 2021 revenue was from payment transactions [$23,402 million/$25,371 million] but the company has a long history of considering other revenue streams. They will have to be flexible and re-think these other streams in the future if the transaction take rate keeps falling. In order to understand the possibilities for these streams in the future, it is helpful to look at PayPal’s history. Confinity was founded in 1998 by Max Levchin, Peter Thiel, and Luke Nosek and they made a service called “PayPal.” X.com was founded by Elon Musk, Harris Fricker, Chris Payne, and Ed Ho. X.com did a 50-50 merger with Confinity in March 2000. PayPal’s IPO was 2 years after this merger. Just as the Alibaba platform formed the Alipay network, the eBay platform formed the PayPal network. The Founders by Jimmy Soni explains that Elon Musk wanted X.com to provide financial services. Interning at Scotiabank, Musk came to the conclusion that new fintech companies like X.com could innovate in ways that circumspect legacy banks could not. He also questioned why companies like X.com couldn’t allow people to trade stocks without going through exchanges. The Founders reveals that X.com originally had goals far beyond payment processing based on early statements:

Already, thousands of people enjoy the benefits of low-cost online trading, thousands more save money through online insurance rate research and financial planning – but millions of people still pay brick-and-mortar banks for expensive branches and tellers, when they are more intimate with the corner ATM. X.com’s mission, as a purely Internet-based company with no branches and no old, expensive-to-maintain computer infrastructure, is to put those banking fees and hidden charges back into the pockets of our customers, while also providing low-cost solutions for personal investing, insurance, and financial planning. X.com will be the seamless solution for personal finance management.

[The Founders – Kindle Location: 1,869]

Musk said X.com would not be undercut by anyone including Vanguard. It is said that Musk wanted X.com’s color scheme to be blue because he used Schwab and they have a blue color scheme. Schwab makes money as a bank and they essentially use free trading as a customer acquisition tool. They are lucky that X.com and PayPal didn’t execute on their original plans and compete with them.

In the future, PayPal will have to be open-minded about these revenue streams outside of payments as the transaction take rate continues to decline.

Focusing On Engagement Over New Accounts

Recently PayPal has been flexible with their goals as they have shifted focus from the number of accounts to the level of engagement at each account. At the November 2019 MoffettNathanson Payments, Processors, and IT Services Summit, CEO Schulman explained that engagement is on the rise:

I think if you think about 4 years ago, the average PayPal consumer used us about 14 or so times a year, maybe a little bit more. We have a good option for Checkout on desktop. And that switched completely right now. Now it’s almost 40 times a year. Mobile is rapidly going to become the dominant way that we do Checkout. That’s obviously the trend everywhere. Our mobile is growing 40%-plus. It’s over 41%, 42% of our overall volume right now.

The February 2021 Investor Day has a graphic showing the road to 750 million accounts in 2025. In October 2021, there were talks of PayPal acquiring Pinterest (PINS) and this would have added hundreds of millions of new users. Nothing came of the Pinterest talks and in the 4Q21 call, it was revealed that PayPal is no longer trying to get to 750 million accounts in the medium-term as they are shifting focus to engagement instead.

PayPal continues increasing the number of annual transactions per user but they are not in the same ballpark as Alipay. In 2021, PayPal had 19,348 million transactions from 426 million active accounts including 34 million merchant accounts. In the month ended June 2020, Alipay had 711 million monthly active users and over 80 million monthly active merchants.

PYPL Stock Valuation

Funding with Visa (V) and Mastercard (MA) has always been more expensive than using Automated Clearing House (“ACH”). The Founders describes how PayPal increased ACH funding years ago by authenticating with two random deposits like 35 cents and 11 cents and then having the owner of the account verify with a code of 3511. Deals have been made with Visa and Mastercard such that the funding gap has narrowed and these days PayPal encourages folks to fund with credit cards as it increases engagement. PayPal’s transaction expense rate has gone down a little bit from 99 basis points in 2013 to 83 basis points in 2021. We’ve also seen the transaction and credit loss rate fall from 27 basis points in 2013 to 9 in 2021. I expect pressure on the transaction take rate to continue being a bigger factor than slight improvements with the transaction rates. In other words, I expect the spread to continue declining. This means substantial TPV growth is crucial unless other revenue streams can become more significant.

TPV has grown much faster than revenue and OCF from 2013 to 2021 and I think that will continue. Climbing from $185 billion in 2013 to $1.25 trillion in 2021, the 8-year CAGR for TPV has been almost 27%. Meanwhile, revenue has gone from $6.7 billion in 2013 to $25.4 billion in 2021 for an 8-year CAGR of 18%. OCF has climbed from $2 billion in 2013 to $6.3 billion in 2021 for an 8-year CAGR of nearly 16%. All these numbers are fantastic but it is somewhat concerning that OCF growth lags TPV growth. A PayPal: Deep Value Fintech article shows that YoY TPV growth has declined every quarter since 1Q21 such that it is now between 22% and 23% for 4Q21. If TPV growth keeps declining and OCF growth keeps lagging TPV growth by 9% or so, then management will have to make some adjustments. As I said earlier, consideration will have to be given to other revenue streams.

It isn’t a good sign that CFO Rainey is leaving in May.

Despite the concerns above, I believe that the impact of the world shifting from cash to digital is prodigious and PayPal will continue to be a meaningful part of this transition. Given this consideration and the way in which PayPal has increased FCF over the years, I think it is reasonable to value them at 30 times their $4.2 billion earnings or a little over $125 billion. Note that my adjusted FCF number is $4.1 billion which is close to the $4.2 billion earnings number and my adjusted FCF number is even higher if we don’t subtract growth capex.

The market cap is fairly close to the enterprise value as the $8 billion in long-term debt is essentially a wash with the $5.2 billion cash and the $4.3 billion short-term investments. The market cap is $119 billion based on the 1,165,004,913 shares outstanding on January 28th and the $102.31 share price on April 15th.

The market cap is close to my valuation range so I think the stock is reasonably valued.

Be the first to comment