ezypix/E+ via Getty Images

The transport and logistics industry sees massive challenges amidst rising prices and disruptions. But Marten Transport, Ltd. (NASDAQ:MRTN) does not disappoint. Its performance remains better than expected, with steady revenue growth and margins. It remains a solid company with an impressive liquidity position. This attribute is essential for capital-intensive companies like MRTN. Indeed, it withstands headwinds and navigates the rugged market with ease.

It is no wonder dividend payouts remain well-covered. Returns are stable, and cash levels are adequate to cover borrowings and dividends. However, yields are not attractive due to low payments. Meanwhile, the stock price adheres to impressive fundamentals. But it is already near its maximum.

Company Performance

The transport and logistics industry is susceptible to more risks these days. Fuel prices remain elevated, while pandemic and recession fears have yet to subside. Even more challenging is when a company must transform its business model and enhance efficiency amidst skyrocketing prices. So stabilizing revenues and margins while implementing changes is proof of resiliency. Marten Transport is a perfect example. From being a long-haul carrier of refrigerated goods, it now also caters to dry-truck services.

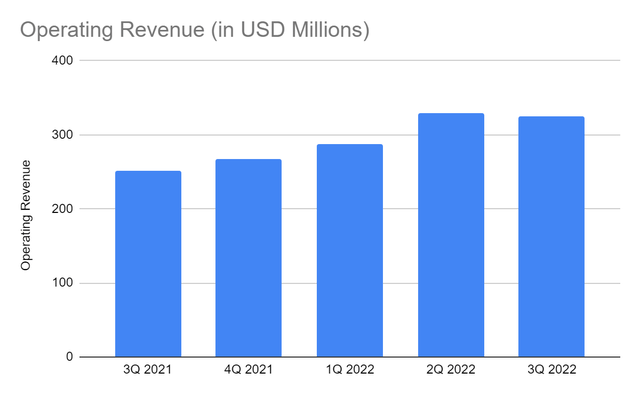

Marten Transport remains on solid footing as it drives strong fleet growth amidst inflation. Its operating revenue amounts to $324.45 million, a 28% year-over-year growth. It is a testament to the company’s sustained growth as it deals with the rampant driver shortage. Even better, it is the tenth consecutive quarter with impressive year-over-year growth. Hence, it can indicate that MRTN may continue maneuvering its operations with ease and prudence.

Operating Revenue (MarketWatch)

Currently, it operates in four segments, namely truckload, dedicated, intermodal, and brokerage. All of these show massive revenue growth. The primary growth drivers are the largest revenue components, truckload and dedicated. Thanks to the impact of fuel surcharges, allowing MRTN to offset the impact of rising fuel costs. Also, pandemic fears and restrictions ease, so the domestic movement of goods speeds up. It helps as the rise of online businesses and border reopenings raise the demand for carriers. It also increased the distance in miles transported, which conveys improved productivity. Indeed, it is still dependent on economic cycles and government regulations. So it continues to strike as the economy stabilizes. The expansion in recent years continues to pay off.

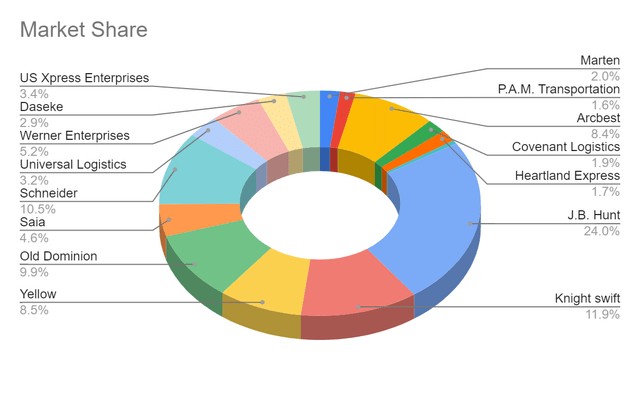

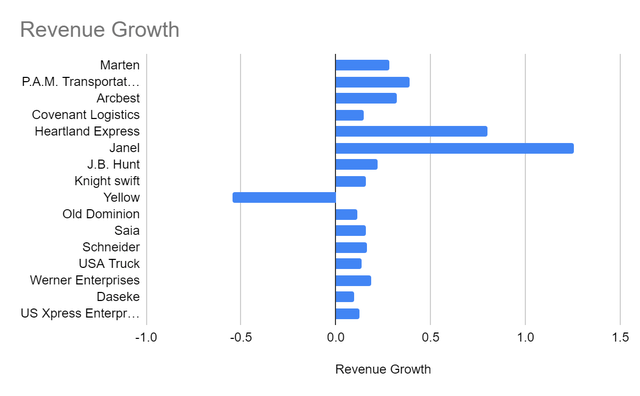

Moreover, MRTN outperforms most of its peers. Although the market share remains small at 2%, it is an improvement from 1.5% in 3Q 2021. Its revenue growth is even more impressive as it exceeds the market average of 25%. As such, Marten thrives more than many of its close competitors.

Market Share (MarketWatch) Revenue Growth (MarketWatch)

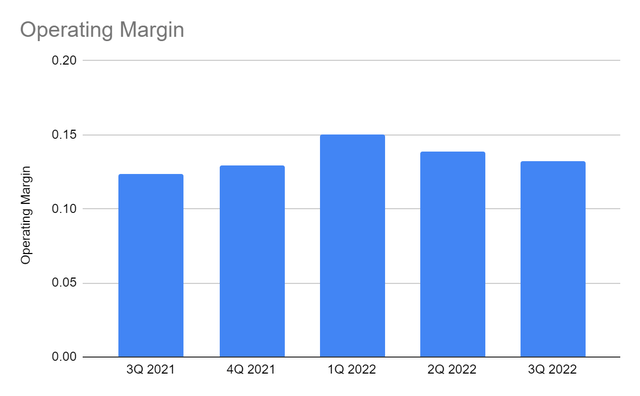

It only has to deal with the rising prices, affecting fuel, purchased transport, and labor expenses. And since goods movement remains slower than pre-pandemic levels, it must be cautious of refrigerated goods. Supplies and maintenance costs keep increasing, too. Nevertheless, the increase in expenses remains proportionate with revenues. Marten maintains efficiency as its operating capacity increases. It also shows that the increased demand and prudent fuel surcharging offset expenses. Hence, the operating margin of Marten remains stable at 13.2% versus 12.3% in 3Q 2021. It is even higher than the market average of 11%. Indeed, Marten remains ahead of the market.

Operating Margin (MarketWatch)

Market Risks, Opportunities, And Core Competencies

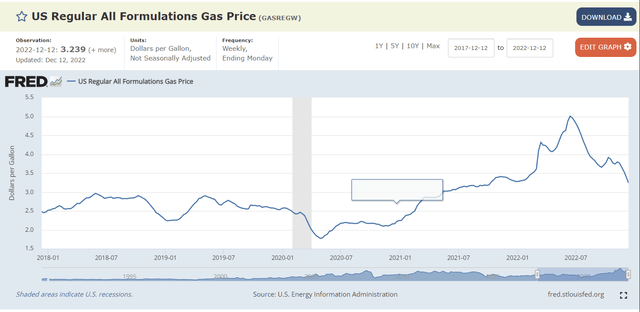

Marten sees intense market challenges. The market outlook remains bleak as driver shortages remain high. Fuel prices remain skyrocketing as the impact of inflation and war in Europe persists. Although the US has abundant oil and fuel reserves, it still needs to import. It is more essential today as domestic and international goods movement increases. Thankfully, inflation has stabilized in recent months, dropping to 7.1%. Businesses hope that inflation has already reached its highest point. Likewise, fuel prices have been in a downtrend after reaching the peak during Spring. However, they stay elevated than pre-pandemic levels.

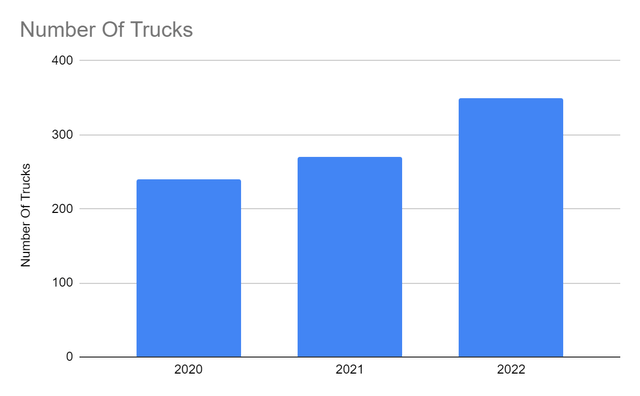

Marten handles these risks accordingly. Thanks to its larger and more diverse operating capacity. Its move pays off as the demand for carriers increases. Also, there are more businesses without brick-and-mortar stores, which makes carriers vital. These are businesses with limited network capacity to adjust or change order plans. As of now, it has 350 carriers, 30% higher than its capacity in 2021. Even better, it has 621 drivers, about 20% higher than in 2Q 2021. So the current ratio of 1:1.79 is an improvement from 1:1.56 in the comparative period.

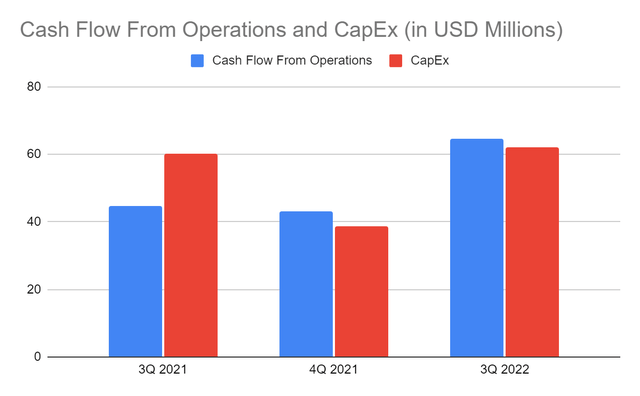

Number Of Trucks (3Q Investor Presentation)

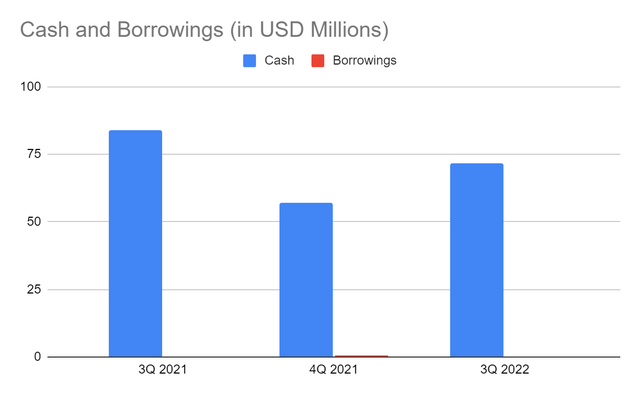

Moreover, it maintains a stellar Balance Sheet with an excellent liquidity position. Cash levels are stable with lower borrowings. Net Debt/EBITDA is a negative value, showing adequate cash. It can pay all its borrowings and accounts payable in a single payment. Also, cash and receivables comprise 21% of the total assets, proving its liquidity. A substantial portion of assets is in the form of revenue. Meanwhile, FCF is low but has a positive value. It shows that the cash from operations is more than enough to cover CapEx. Indeed, the company can continue increasing its capacity while covering borrowings and dividends.

Cash And Equivalents And Borrowings (MarketWatch) Cash And Equivalents And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of Marten Transport, Ltd. adheres to fundamentals. It has been moving sideways in the last month, but the uptrend remains evident. At $20.66, it is already 22% higher than the starting price. But, it appears to be approaching its limit. Its price-earnings multiple of 15x shows that the stock price is still reasonable. Yet, the relative value is more expensive than many of its peers. These include ArcBest (ARCB), Heartland (HTLD), Werner (WERN), P.A.M. Transportation (PTSI), and Universal Logistics (ULH). If we multiply the price-earnings multiple by the EPS estimates of NASDAQ, the target price will be $21.04. Indeed, the stock price is still reasonable, but near its maximum. My EPS estimation is more optimistic at $1.42, so my target price is $21.51, a 4% upside.

Meanwhile, dividend payments are impressive and consistent. Marten sustains its dividend growth with occasional special dividends. Yet, yields are not attractive at only 1.15%. It is way lower than the S&P 600 and NASDAQ components average of 1.91% and 1.29%, respectively. To assess the stock price better, we can use the DCF Model.

FCFF $84,379,000

Cash $71,490,000

Borrowings $214,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 81,096,632

Stock Price $20.66

Derived Value $21.24

The derived value adheres to the supposition of the reasonability of the stock price. There may only be a potential upside of 3% in the next 12-18 months. Investors must watch out for the stock price before buying stocks.

Bottom Line

Marten Transport, Ltd. remains a durable company despite market headwinds. It maintains impressive fundamentals and liquidity to sustain its operating capacity. It can cover and increase dividends, but yields are still low. Meanwhile, the stock price appears reasonable, but approaches the maximum. While I am optimistic about its performance, there may be no substantial increase in investor value. Investors may wait for a better entry point before making a position. The recommendation, for now, is that Marten Transport, Ltd. is a hold.

Be the first to comment