Maja Hitij/Getty Images News

I’ve been an active Twitter (NYSE:TWTR) user for years (my account is here https://twitter.com/AdamB1438), but I was never a shareholder. Notable users such as Donald Trump (currently banned from the platform) and Elon Musk (https://twitter.com/elonmusk) have made extremely productive use of the platform and used it to expand their reach and influence. In this article, I’ll explain why there are two big questions that matter for the decision to own stock in Twitter:

– Can it be made profitable?

– Will being profitable ruin the company?

Elon Musk’s offer to buy Twitter for $54.20 per share confirms that the answer to the first question is “yes,” and the answer to the second question is “no.” So now that the stock is effectively “de-risked,” shareholders should hold on and not be willing to sell at this price or anything less than say $100 per share.

Twitter’s History in a Nutshell

Twitter started as a “micro-blogging” site in 2006 by Evan Williams, Jack Dorsey and others. The site became more and more well-known over time, and reached 100 million users per day in 2012. Although growing, it was something of a corporate curiosity: the company was not profitable, and unusual for these situations, founder Jack Dorsey basically left to start another company “Square”, now known as “Block” (SQ).

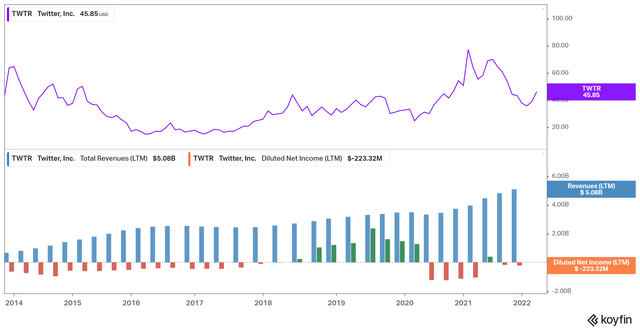

After some internal intrigues, Dorsey returned as CEO in 2015 but without giving up his role at Square/Block. Twitter went public in 2013 at an “IPO price” of $25 but traded that day up to $44 per share. Investors have suffered poor returns ever since as the company struggled to obtain profitability:

Share Price and Profits (Koyfin, Author)

So over the last nine years, Twitter became one of the most influential companies and mediums of communication on Earth. But no one could be sure what it meant to own stock in the company. In November, Dorsey stepped away from his role as CEO and Twitter executive Parag Agrawal took over.

Can Twitter Make Money? Yes.

As you can see in the chart above, around halfway through the Trump administration Twitter found a way to produce net income on flat revenue. The last year’s lack of net income is actually marred by the one-time event of an $800 million lawsuit settlement, so it’s actually more profitable than it appears.

The incredible strength of software and tech business models lies in their ability to not only grow earnings without additional capital but also in the increasing returns to scale of additional revenues. The cost of running Twitter for say 110 million users isn’t much greater than the cost to run it for 100 million users, so any additional revenue “drops straight to the bottom line.” (This is an oversimplification, but it’s still useful.)

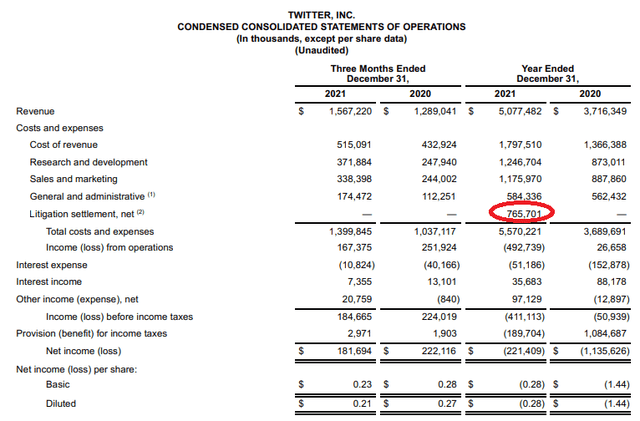

To see what I mean, look at the Income Statement from Twitter’s Shareholder Letter:

Twitter Income Statement (Twitter)

We clearly see the $765 million line item for Twitter’s share of the settlement mentioned above. So without that settlement, “Total Costs and Expenses” were $4,805 million in 2021 compared to $3,690 million in 2021 – so costs increased of 30%. At the same time, revenue increased year over from $3,716 million to $5,077 million for a gain in revenues of 36%. To the extent that this trend can keep growing, future profitability is far greater than the $272 million income from operations (without the lawsuit) we see in last year’s numbers.

Even if Twitter had reported net income of $250 million instead of a loss of $221 million, it would still seem expensive at a market cap of $37 billion times earnings (148x earnings). Buying at those prices indicates expectations of much higher profitability in the future, and I think that’s very reasonable.

But will Twitter Stay Fun? Yes.

Now that we know Twitter can begin earning net income, the next question is whether or not “the magic” of Twitter will remain and keep it such an essential part of the marketplace. After all, others have talked about starting alternative social networks geared to conservative voices such as the “Truth Social” offering of Digital World Acquisition (DWAC) and the growing reach of TikTok (owned by ByteDance).

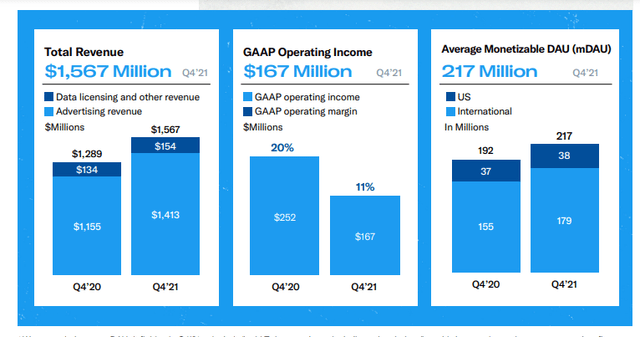

Despite a number of challenges, it seems like Twitter is staying relevant and vital. Twitter suspended Donald Trump (its most influential!) user on January 8, 2021, but as you can see from this chart in the company’s Shareholder Letter, both revenue and the number of users have increased from the fourth quarter of 2020 (when Trump was still on the platform) to the fourth quarter of 2022 (when he’d been off for almost a year). So Twitter’s business is clearly bigger and more durable than just the effect Trump had on its growth.

Twitter Year-over-Year results (Twitter Shareholder Letter)

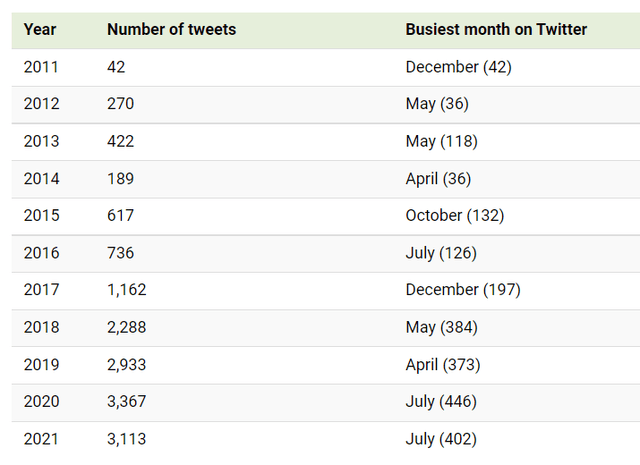

Musk has also become an increasingly active user of the platform, as you can see in this article from Visual Capitalist, which also reviews some of his best-known Tweets:

Elon Musk’s Tweets by Year (VisualCapitalist.com, Carmen Ang)

While looking at Musk’s activity alone doesn’t prove anything, it seems like there are plenty of reasons to think Twitter remains vital. This article explains what Twitter means to marketing customers, so you can see that even though WhatsApp (owned by Facebook/Meta (FB)) or other social media apps may be gaining, Twitter’s level of engagement and value to customers remains high.

Armchair strategists have had ideas for how to make Twitter bigger, more successful and more relevant for years (see for example this article from 2016). Many have been critical, but throughout it all – the company keeps growing. So I don’t know of any other way to answer the question than to say, “Yes, Twitter keeps being fun and that’s why people use it.”

What Does Musk’s Offer Mean for Shareholders

Musk, of course, has a pretty storied history with Twitter, including offering to buyout Tesla for $420 per share (pre-split) and another tweet which got him sued for libel. Last month, he bought 9% of the company’s stock, planned to take a seat on the board of directors, and then withdrew from consideration.

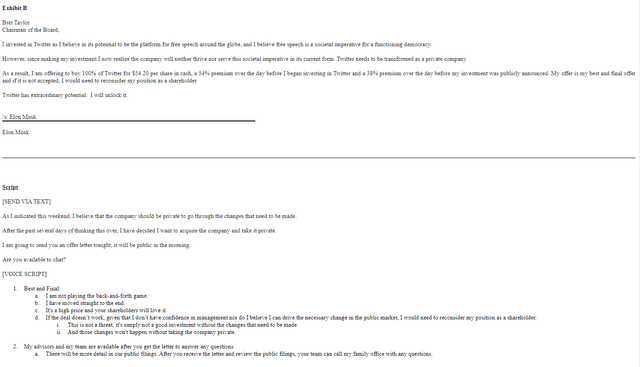

Now Musk has made an offer to buy the whole company, and it’s worth reading the whole test of his filing with the SEC:

Musk’s Offer to buy Twitter (SEC)

Musk has been selling stock in Tesla (TSLA) recently, but his 17% stake is still worth approximately $175 billion – so he should be “good for” the $40 billion or so required to buy the rest of Twitter. (Recall that he already owns 9% of the company).

There are a few ways to think about his offer:

1. He wants to take over the company and run it

2. He wants to draw attention to his ideas about how to run Twitter

3. He’s bluffing about buying Twitter and just wants attention

I’ll skip over analyzing number 3 because it requires an assumption of bad faith I’m not willing to make, and focus on 1 and 2. If 1 is true and Musk thinks the company is valuable, then maybe someone else can unlock that value and shareholders’ gains don’t have to “top out” at the offer price of $54.20?

If 2 is true and Musk wants to draw attention to the way he would run Twitter, this is something of the “best of all possible” worlds for Twitter shareholders. They’ll get the benefit of Musk’s ideas, but they won’t give up any upside. This is also a great strategy for Musk himself. He can bring the focus of executives, directors and shareholders to his strategy, and possibly gain influence or place someone in the C-Suite or board of directors – but he doesn’t have to pay a buy-out premium. He gets the benefit of forcing the company’s hand to increase the value of his investment, but he doesn’t have to pay a premium for it!

Shareholders Can Sit Pretty – Don’t Sell!

For the reasons described above, I think it’s clear that the value of Twitter is starting to poke out from under the surface. It remains to be seen whether the current management team can deliver, or whether it will require Musk’s influence to make changes. In either case, there’s little reason for outside shareholders to give up future upside by selling their shares in the market, or by supporting Musk’s buyout offer.

If Musk’s offer is not accepted, I would expect shares to fall in price for the time being. But that doesn’t mean the value of the business has declined. I would consider that a good time to buy.

Thanks for reading. Good luck to all!

Be the first to comment