Sundry Photography/iStock Editorial via Getty Images

Introduction

After reporting yet another spectacular quarter, Snowflake’s (NYSE:SNOW) stock is melting down amidst a tough macroeconomic backdrop and management’s guidance for slowing revenue growth. While Snowflake is still one of the most expensive growth stocks out there (by virtue of its trading multiples), the violent valuation compression in this high-quality business could prove to be a great entry point for long-term investors. To read our original investment thesis for Snowflake (released at the time of its IPO), please refer to this note:

In today’s note, we shall dig through Snowflake’s Q4 2021 report and assess the company’s long-term prospects. Furthermore, we will review Snowflake’s valuation to formulate an investment decision.

Dissecting Snowflake’s Q4 Report

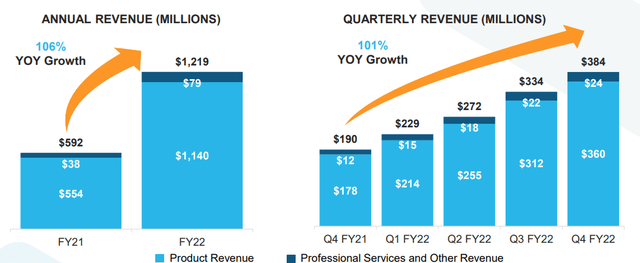

In Q4 2021, Snowflake’s revenues snowballed higher as more and more companies continued to shift their workloads to the cloud. With quarterly revenues growing ~101% y/y to $384M, Snowflake handily beat consensus analyst expectations and management’s guidance.

Snowflake Q4 2021 Earnings Presentation

The strength in Snowflake’s revenue growth is two-pronged –

- Expansion within existing customers, and

- Acquisition of new customers

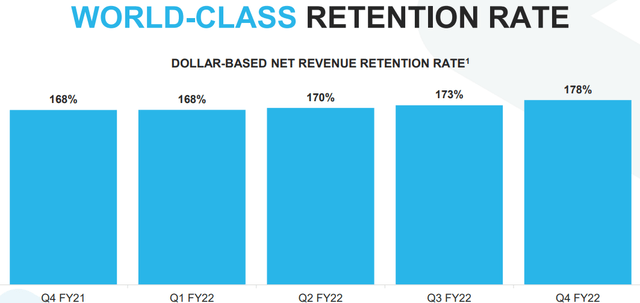

While many enterprise SaaS businesses boast robust net retention rates, I have never seen anything like Snowflake (NRR of 178%) before in my investing career. As customers continue to ramp their usage of Snowflake’s data cloud for storage and compute solutions, Snowflake’s revenues are growing like a wildfire.

Snowflake Q4 2021 Earnings Presentation

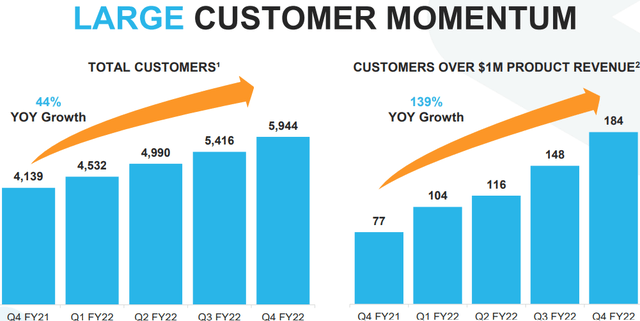

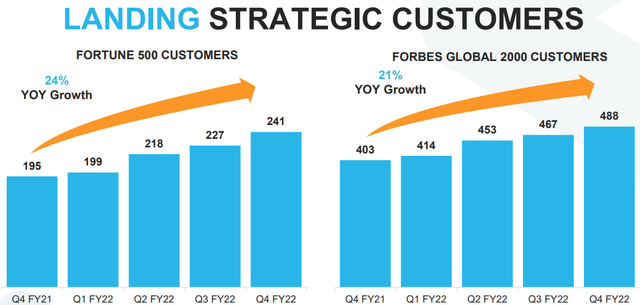

In Q4 2021, Snowflake’s customer count reached 5,944 (up 44% y/y), with 184 customers now contributing >$1M in annual product revenue. Snowflake is focused on the large enterprise market, and its customer base now includes 241 Fortune 500 and 488 Forbes Global 2000 organizations (including overlap).

Snowflake Q4 2021 Earnings Presentation

Snowflake Q4 2021 Earnings Presentation

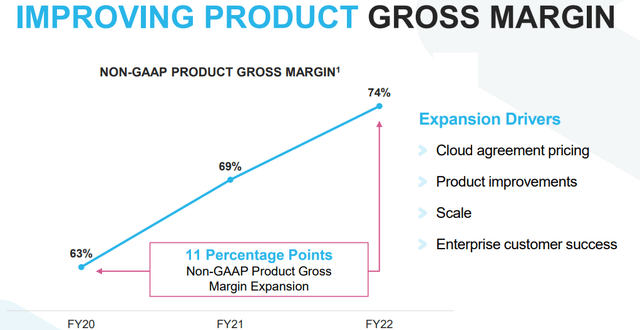

While Snowflake’s revenue base is expanding rapidly, this hypergrowth is certainly not coming at the cost of margins. Snowflake’s product revenues (93% of total revenues) now command GAAP gross margins of ~70% [non-GAAP: 74%], up from 65% [non-GAAP: 69%] from a year-ago period. An expansion in margins with such growth is reflective of the high demand for Snowflake’s platform in the market.

Snowflake Q4 2021 Earnings Presentation

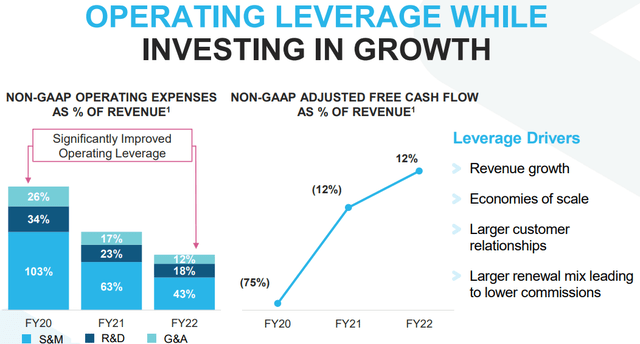

In addition to gross margin improvements, Snowflake’s business model is delivering significant operating leverage with scale. Now, Snowflake’s GAAP operating expenses are still greater than its revenues; however, the charts below show a very healthy trend for Snowflake’s profitability. As operating expenses as a %age of revenue decrease, Snowflake is turning FCF positive (at least on a non-GAAP basis, i.e., after removing non-cash SBC expense, Snowflake is making positive free cash flow already).

Snowflake Q4 2021 Earnings Presentation

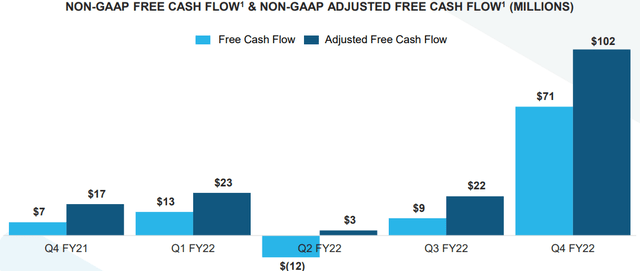

As we know, Snowflake’s Q1 and Q4 are likely to be stronger as compared to Q2 and Q3 due to billing cycles and renewals. Since Snowflake’s business model is consumption-based (and not a SaaS model), we are likely to see more volatility in its free cash flows than what we see in other enterprise SaaS companies. Hence, I do not see Q4 FCF numbers as an inflection point.

Snowflake Q4 2021 Earnings Presentation

Snowflake is still in hypergrowth phase, and its experienced management team is unlikely to compromise on growth for profitability in the near term. And so, I don’t expect to see tons of free cash flow or positive earnings from Snowflake anytime soon.

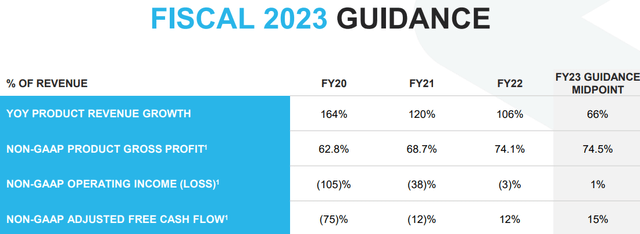

At the midpoint of management’s guidance for 2022, Snowflake’s revenue growth rate is expected to hit 66%, which would represent a sharp deceleration in growth. However, Frank Slootman clarified in a CNBC interview that the management is being conservative with guidance. My projection for Snowflake’s 2022 product revenue is ~$2.05B (y/y growth of 80%).

Snowflake Q4 2021 Earnings Presentation

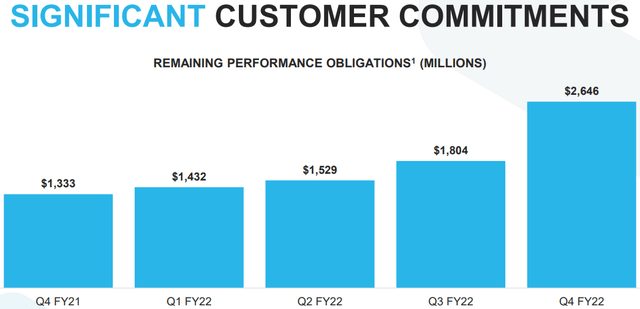

Why am I more optimistic than Snowflake’s management? Well, that’s because I don’t need to sandbag projections. With stronger-than-expected bookings on the platform from existing and new customers, Snowflake could easily beat this conservative guidance. In Q4, Snowflake’s RPO grew to ~$2.65B (up ~100% y/y, up 47% q/q).

Snowflake Q4 2021 Earnings Presentation

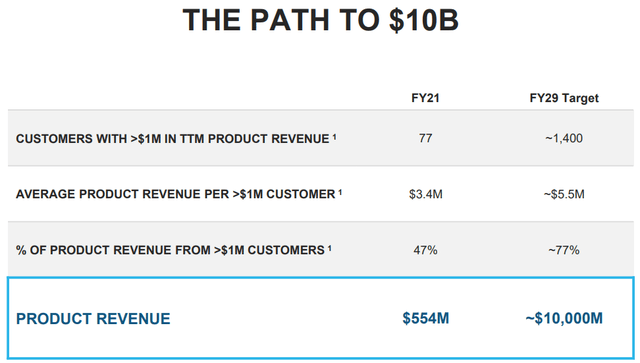

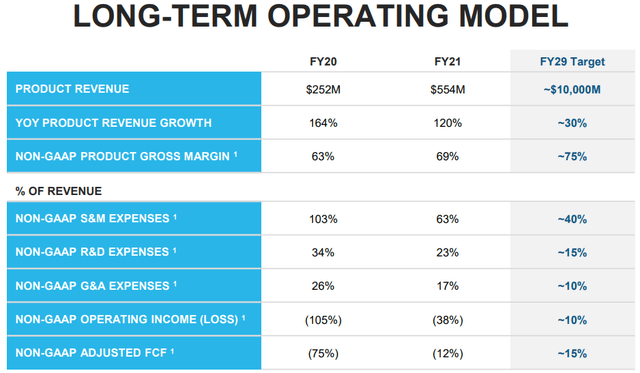

For the long-term, Snowflake’s management has guided for FY-29 sales to reach $10B, which would make Snowflake the fastest enterprise software company to achieve this milestone. While this forecast projects for ~30% CAGR growth for Snowflake post-2022, I think Snowflake could sustain ~50% CAGR sales growth over the next four years, and this $10B revenue target could be done in FY26 (3 years faster than management projections). My numbers are based on the secular tailwinds driving the transition in software spending towards the cloud, and the expectation of a more significant share for data management from the annual cloud spend.

Snowflake Investor Presentation

Snowflake Investor Presentation

While Snowflake’s management has guided for a non-GAAP FCF margin of just 15% in the long run, I think this figure will come in much higher because Snowflake’s business is already delivering at this level with a lot of operating leverage to be had with scale.

Snowflake’s management has clarified in the past that the company will not need to make any major acquisitions to achieve its long-term financial projections. However, the company has significant market currency at its disposal, and it has ample cash on its balance sheet to drive inorganic growth. Along with its Q4 report, Snowflake released a press note to announce the acquisition of Streamlit. While this acquisition is unlikely to have a material impact on Snowflake’s numbers in the near term, the addition of an open-source developer framework to its platform is a massive boost for Snowflake.

Since Snowflake is already FCF positive (on a non-GAAP basis), I am not worried about the lack of profitability, and I think Snowflake has minimal liquidity risk. Snowflake’s equity dilution (per year) is also <3%, so it has that going for itself too. Overall, Snowflake’s business appears to be in great shape, and this financial picture may get better and better with every passing quarter. Hence, I would be a buyer in Snowflake if the price is right.

Now, let’s determine Snowflake’s fair value and expected returns to see if it’s a buy right now.

Valuation And Conclusion

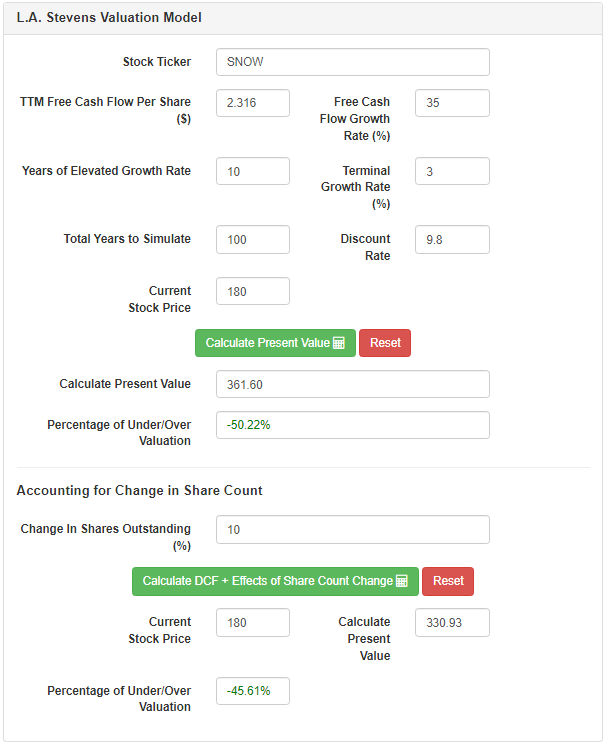

Assumptions:

|

Forward 12-month expected revenue [A] (our estimate) |

$2.05 billion |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average diluted shares outstanding [C] |

~310 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$2.316 |

|

Free cash flow per share growth rate (a reasonable estimate) |

35% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

Results:

L.A. Stevens Valuation Model

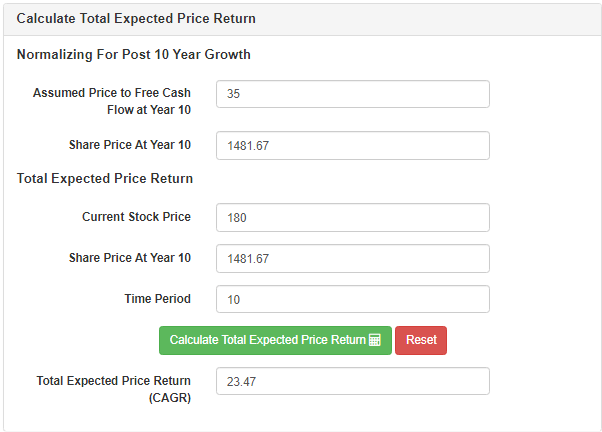

According to my estimates, Snowflake is worth $331 per share, i.e., it is currently undervalued by ~45%. Furthermore, with Snowflake, investors could generate a CAGR of 23.47% over the next ten years. At $180 per share, Snowflake looks like a great buy.

L.A. Stevens Valuation Model

However, Snowflake’s (relatively high: >30x P/S) valuation could yet compress further in the near term. And so, I think starting a small position here and following up that purchase with a six to twelve-month DCA plan would make sense. Snowflake is a high-quality growth company that could make up ~3-4% of growth-focused portfolios, and it is now trading at a reasonable valuation. I would always buy a great company at a fair price, then a fair company at a great price. Hence, I am happy to start accumulating Snowflake in the $180s.

Key Takeaway: I rate Snowflake a buy in the $180s.

Thank you for reading, and happy investing. Please feel free to share any questions, thoughts, or concerns in the comments section below.

Be the first to comment