5./15 WEST/iStock Unreleased via Getty Images

Investment Thesis

Pinterest, Inc. (NYSE:PINS) is due to report its FQ1’22 earnings on April 27. It would be a highly anticipated earnings call, given the “horror” show in FY21 for Pinterest and its social media peers. While Pinterest had an early bump post-FQ4 earnings, it has continued to slide further.

Since our FQ4 update (Hold rating, down 15%), we have observed more cracks within management. Insider stories have also emerged questioning CEO Ben Silbermann’s capability, relating to his “indecision.” Furthermore, the current Russia-Ukraine conflict has also further stretched supply chain disruptions that could impact the recovery of ad spending.

In addition, a recent update by Business Insider suggested that Meta’s (FB) revenue impact from Apple’s ATT framework could exceed the $10B highlighted in its previous earnings call. If that wasn’t enough, Insider Intelligence accentuated in an update that TikTok (BDNCE) is embarking on an aggressive global push as ByteDance’s Chinese market growth has slowed down.

And then, a new risk factor was added to Pinterest’s 10-K, suggesting that management has grown concerned over the potential loss of users and engagement to other platforms. Such a development is significant because Pinterest has consistently emphasized that it’s a unique platform. So maybe, even management isn’t so confident about its edge anymore, even though they may not say it in a conference.

We discuss these revelations as we head into Pinterest’s FQ1 card. We also discuss why we retain our Hold rating, despite its more attractive valuation.

Lost Its Edge With More Cracks Within

In one of our articles last year, we discussed that Pinterest believes strongly in its “differentiated” platform. That has consistently been the “story” Pinterest investors have bought into. Management even highlighted last year that Pinterest users “come with a planning mindset where they’re looking for new ideas to bring into their life, not to follow other people or to communicate or read the news.”

Silbermann also reiterated its message at a recent conference in March. He accentuated (edited):

From the beginning, we’ve always thought of ourselves as a tool that’s meant to take people from inspiration, so getting that feeling, that idea of what you want to do in the future, all the way to realization. (Morgan Stanley TMT Conference 2022)

However, a new risk factor added in its recent 10-K provided more insights into management’s “frustration” with its social media peers. It seems like Pinterest has lost the competitive edge that it thinks sets it apart, driving “shopability.” Pinterest elaborated (edited):

We may not be able to effectively compete for creators who create content on our platform and on social media and other platforms or may get creators who create content that is not relevant, useful or inspiring to our users.

If creators prefer to create content on competing platforms over ours, or prefer the incentives or financial rewards offered by competing platforms over ours, we may not develop or may lose potentially engaging and relevant content.

Even if we attract and retain creators who create engaging content, we may not be able to distribute that content effectively due to lower relevancy and search signals. Further, we plan to make increased investments in attracting creators, including increasing workforce resources, which may reduce our short or medium term financial and operating results. (Pinterest’s FY21 10-K)

It’s significant because we think it communicated management’s tacit acknowledgment of intense competitive pressure. So, is Pinterest that different from Meta or Snap (SNAP) that it can attract attention better? Likely not.

Furthermore, Silbermann’s management capability was also questioned by some of its former executives. The Information reported in late March about the frustration experienced by its executives. They were particularly concerned with Silbermann’s indecision on critical matters, as he deferred to consensus views. However, his indecision was said to have cost Pinterest dearly, missing out on at least two acquisitions. The Information highlighted (edited):

At least 10 Pinterest executives have left the company over the past few months, some of whom were unhappy about delays in decision-making at the company.

One of those executives-Celestine Maddy, Pinterest’s former global head of consumer and brand marketing-wrote a letter to Silbermann late last year about the issue, telling him “it’s hard to get work out the door at Pinterest due to an org-wide default toward consensus and an absence of decision making from leaders.” – The Information

Pinterest previous head of corporate development Kamran Ansari also quipped in as he shared insights into Silbermann’s thinking. He added (edited): “Maybe Pinterest hasn’t been as aggressive as Instagram and others to get there. The company has always had an ethos of focusing on core competencies.”

However, it seems that Pinterest has already acknowledged that it’s losing its competitive edge. Even though it claimed it didn’t need to feed to eyeballs from other social media platforms, Pinterest seemed to have tweaked its approach in March. The company launched its Idea Pins sharing with other apps such as Instagram. Therefore, the company may have recognized the need to broaden its appeal to more users from other platforms as its MAU has declined over the past few quarters.

Investments Could Further Impact Profitability

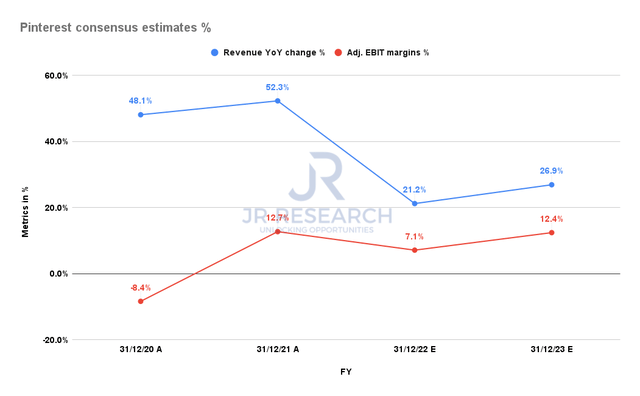

Pinterest consensus estimates % (S&P Capital IQ)

The updated consensus estimates also expect headwinds from the company’s focus to increase its investments in FY22, even as revenue growth is expected to decelerate significantly. As a result, Pinterest’s FY22 revenue growth is estimated to fall to 21.2%, and its adjusted EBIT margin is estimated to decline to 7.1%.

However, we think there could be some uncertainty over the guidance presented in its FQ4 card. CFO/COO Todd Morgenfeld updated in March (edited):

So we wanted to update people. There are a number of factors going on. There’s the COVID situation. We’re all also seemingly back to something that’s approximating normal here, but we’re still watching that unfold. And it’s still a very competitive environment for people’s time and our users’ time and attention. So we’re monitoring that as well. (Morgan Stanley Conference)

Notably, Business Insider recently reported that Meta’s revenue impact from Apple’s ATT could worsen to $12.81B in 2022, up from Meta’s $10B guidance in its FQ4 earnings call. Therefore, we think that the worst may not be over yet for the social media platforms. Coupled with potentially weaker ad spending disruption from worsening supply chain disruptions, these challenges could stretch well into 2023.

Therefore, we believe investors need to discount the consensus estimates accordingly to reflect these uncertainties. Notably, the most conservative estimates (based on S&P Cap IQ data) suggest that Pinterest’s revenue could increase by just 10.9% in FY22. In addition, its adjusted EBIT margin could fall to -2%. In addition, Morgan Stanley also weighed in recently, as it observed a steep fall in engagement on Pinterest. It added (edited):

Both user and time spent trends are lower than they had been previously, with time spent at 2017 levels.

In addition, Pinterest is shifting users towards lower monetizing creator videos. We have been wrong about PINS’ ability to continue to rapidly innovate and improve its user offerings (to drive retention, growth, and engagement) and ad offerings (to capitalize on its social shopping opportunity). – Seeking Alpha

Is PINS Stock A Buy, Sell, Or Hold?

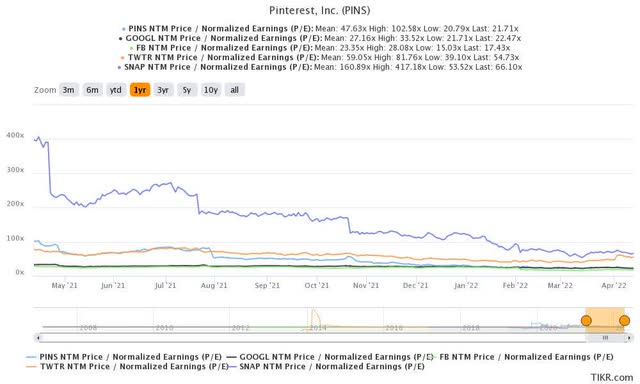

PINS stock NTM P/E Vs. peers (TIKR)

PINS stock remains a Hold. We concur that its valuation has declined markedly, and more so after its FQ4 slump. Consequently, its NTM P/E of 21.7x last traded in line with Google (GOOGL) (GOOG) stock’s 22.5x. However, it remains markedly above FB stock’s 17.4x. Still, PINS stock last traded below the communications industry median P/E of 26.6x.

Hence, we believe the recent pessimism over PINS stock seems to have been priced in. However, we believe that Pinterest’s fundamental story may have altered. The platform is no longer thought to be as unique as it highlighted. We also think the competitiveness edge of its platform has weakened dramatically with the emergence of TikTok and the continued Apple’s ATT headwinds.

Be the first to comment