fotokostic/iStock via Getty Images

BrasilAgro – Companhia Brasileira de Propriedades Agrícolas (NYSE:LND) is a Brazilian land developer with operations in Brazil, Paraguay and Bolivia. The company specializes in soybean, corn, sugarcane, bean, cotton, and cattle.

Last December, I wrote an article on LND, with a hold recommendation. There, I commented that the company was doing significant improvements in terms of cost management, which allowed it to operate profitably in different contexts. However, I considered that the company’s recent earnings were significantly affected by fair value, non-cash changes in assets (particularly payables in production from land sales). In my opinion, those earnings could revert in the event of a downturn in global agricultural commodity prices. Also, that the company was having trouble finding new cheap land to purchase, which shaded doubts on the returns on capital generated by previous land acquisitions being projectable into the future.

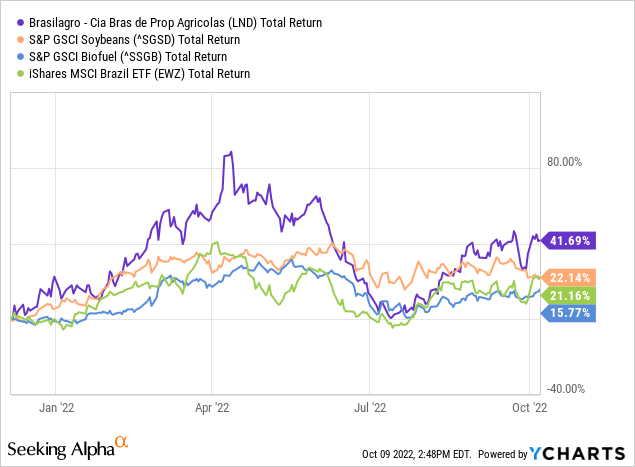

Since the article was published, LND’s ADR has done very well, both appreciating in value and paying dividends. The stock has consistently outperformed soybean, biofuel prices and Brazil’s flagship iShares MSCI Brazil Capped ETF (EWZ). This is not surprising, considering that commodities have continued growing in price. But my article and Hold recommendation was based on a cycle agnostic valuation, that is, one that did not depend on commodities’ prices either increasing more or remaining elevated.

In this article, I revisit the situation with data from the last three quarters, including the company’s fiscal year ended in June 2022. My conclusions have not changed significantly. In my opinion, the most important problem is that LND has not shown that it can continue purchasing cheap land, therefore reducing expected returns on capital, which calls for a discount on capital employed. Second, current earnings are somehow dependent on future commodity prices remaining elevated, a situation that may or may not reverse in the future.

Note: Unless otherwise stated, all information has been obtained from LND’s filings with the SEC.

Previous thesis

My latest article on LND explained several positive and some negative aspects of the company. Particularly, the article questioned price in contrast to recurring earnings, rather than criticizing the company’s operations, which I believe are commendable. For a complete description, along with accompanying charts, please revisit the initiation coverage article on LND.

Starting with the positives

LND competes in ultra-commoditized markets of agricultural products. In a competitive market, no single supplier has pricing power, and, therefore, profitability is determined by costs. In the case of agriculture, costs are influenced by land quality, weather, region infrastructure, scale of operations, and managerial ability.

Positively for LND, the company has shown both that its main products (soybean, sugarcane, and corn) can be profitably exploited across the commodities cycle, and also that the company can consistently reduce its operating costs. This is an important margin of safety for any company operating in commodities, because it means the company will not suffer in a prolonged downturn cycle.

Also on the positive, LND acquired lands in Brazil when these were cheaper than they are today. During the 2000s, the agribusiness boom was already in full fledge in Brazil but had not developed to today’s prices. This provides LND with great original returns on capital (most of which have not been realized yet), and also with a substantial land pool currently standing at 145 thousand hectares valued at $620 million.

On the negatives, current land prices, and the return they promise, stand out. Even considering LND’s efficient operations, land prices promise yields of 7% during the peaks and 3% or less during the valleys. This means that although LND has a costly resource, it cannot produce so much value with it.

I also considered that LND has not been able to find cheap land anymore. Even the purchases made during commodities bottoms like the period between 2016 and 2019 have not appreciated in this upward portion of the cycle. If LND cannot find cheap land, we cannot consider the previous appreciation as a recurring portion of the business model, but rather as a one time event.

This last point made me believe that LND can be considered as two different businesses.

First, it is a land holding company that made great acquisitions in the past and can now liquidate those lands and distribute the proceeds among shareholders. That would represent past returns on capital investments. I calculated that depending on the price at which lands are sold, that model could generate between $16 and $42 million in net income for 10 years.

Second, LND could continue using its lands, albeit at low average returns on capital. This means that the company should trade at a discount from its average capital value (not the same as book value, because land is stated at cost) in order to provide a sufficient return. Today, the company does not trade at that discount but rather at a premium. In my opinion, LND could generate between $11 and $25 million across the cycle from exploiting its own lands plus additional leased lands. This is a low figure compared with a market cap of $650 million.

These two models are predicated on the assumption that LND cannot find cheap land anymore. It could very well be that the company sells land during the upward portion of the cycle (as it has done during 2021 and 2022) and then acquires those lands back at the lower portion. As of FY22 (closed in June), I have not found evidence of this, but the cycle is still in the upward portion. Fortunately, the company has not been buying. If this assumption changed, LND’s previous capital returns on land acquisitions could be extrapolated to a more distant future than 10 years.

Finally, I added the risk arising from LND’s important exposition to fair value accounting. The company’s earnings are not only affected by its year-to-year operations, but also by the changes in value of the proceeds from previous operations. For example, if the company holds on to inventories (ex. grains), then those inventories can significantly change in value, and that will affect both a fair value account in the income statement and sale period CoGS. When the company sells land, it is usually paid a portion in cash and another portion in produce installments. Those receivables are also valued at fair value and change the company’s earnings without affecting actual cash flows.

For those reasons, considering that the company was trading at a market cap of $440 million, I commented that LND was not a promising investment. My analysis was based purely on a cycle agnostic evaluation of the company, that is, independently of whether commodity prices continued increasing or moved downwards. Some readers commented their own interpretations of the cycle, and I believe that if any reader is convinced that agricultural commodities are going to keep increasing in price, then LND is an interesting vehicle for that speculation.

Latest quarters and developments

Data from the latest three quarters (2Q, 3Q and 4Q FY22 corresponding to December 2021, March 2022 and June 2022), does not show a significant change in the situation.

In my opinion, there are only two conditions that would render LND a desirable investment. First, that the company was trading at a discount, probably only during the bottom portion of a commodities cycle, which is not the current case. Second, that it showed that either their most recently purchased lands (from the cycle between 2016 to 2019) grow in value or that it can purchase lands in relatively highly regarded zones at discount prices, something that could probably only happen in a downward cycle as well.

Starting with price, LND’s stock has appreciated substantially, which is understandable, again, given that commodities have continued rising and that fundamental developments point towards further price increases (war in Ukraine, effects of gas prices on fertilizers, droughts).

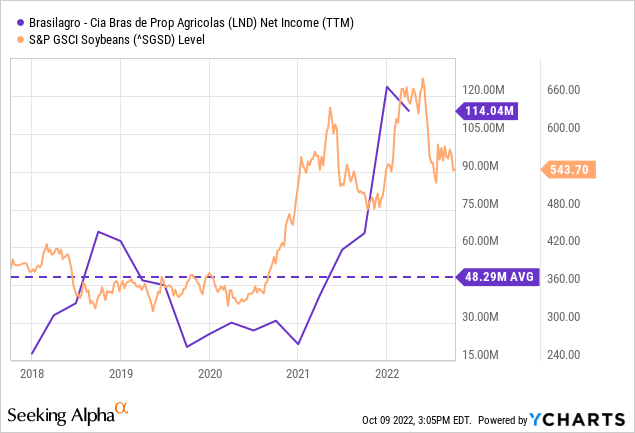

The chart below shows that even with LND trading at a current price of $650 million, it does not seem excessively priced, not even against the latest two cycle portions’ average of $50 million in net income.

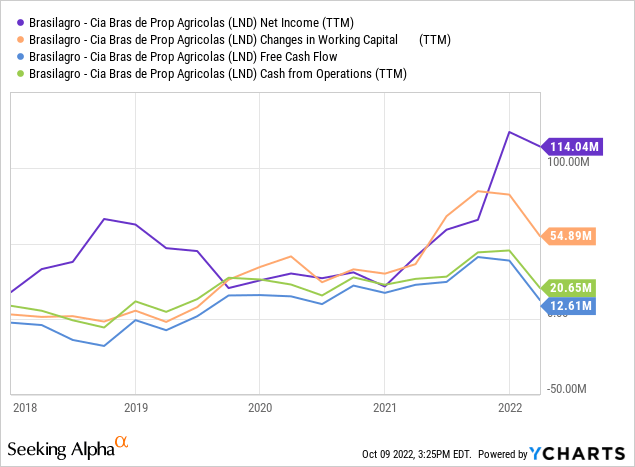

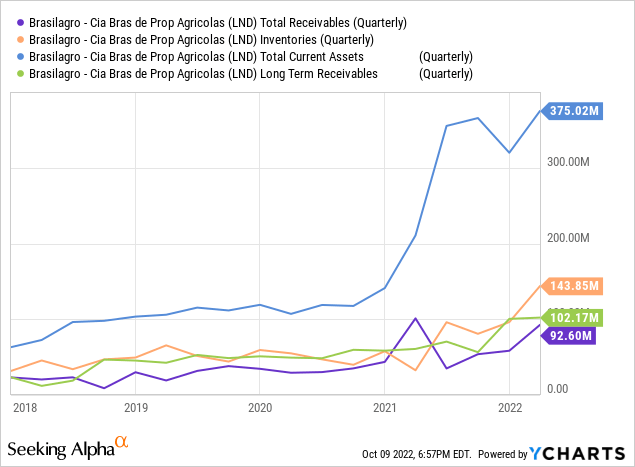

However, here I call for investors to be wary. A significant portion of those net earnings have not been realized yet. They are embedded in fair value accounting of inventories (products already harvested or received that have not been sold), biological assets (products growing in the ground) or receivables (promises of future products to be delivered in exchange for land). These are repriced each quarter, adding to net income. With prices either increasing or remaining elevated for the past harvest cycle, profits have not reverted to the mean. However, as the chart below shows, the company has not yet converted those profits to cash.

Conversion will be contingent on all that working capital (inventories, biological assets and receivables) being sold at current or higher prices. Otherwise, the company will have to revert those fair value profits and record fair value losses.

Second, on the land development portion, the company has not shown advances. This is the most important factor for long term profitability and return on capital. Of course, it would be difficult for the company to find cheap land during an upward portion of the commodities cycle, and therefore the above is not a criticism to management. Actually, quite the contrary, LND sold lands for the past few years, which is a good sign. In FY22, LND sold more than R$300 million of lands on some of its most productive areas that were purchased in the 2000s decade and therefore carried a lot of previously unrecognized appreciation. Part of the company’s record profits come from these sales.

Conclusion

The main conclusions about LND have not changed in recent months, even though the company’s shares have appreciated.

I still believe that the company has to be valued differently depending on its ability to continue finding cheap land. Until it proves that it can do so, I err for the conservative side of considering that it cannot.

Valued as a company that cannot find new cheap land, LND’s average earnings across the commodities cycle do not justify a current market cap of $650 million. In my previous article, I showed that earnings range between $11 and $25 million across the cycle. In this upward portion of the cycle, a lot of accounting earnings have been generated, but these have not yet been turned into cash.

Therefore, until the land question is resolved, I ask for a commodity bottom cycle price for LND. Otherwise, it becomes a bet on the commodities markets.

Be the first to comment