JHVEPhoto/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I am always looking for the next opportunity for my portfolio. Sometimes these are companies I already own, while other times I start new positions to supplement the current 70+ positions in my portfolio. The goal is to invest monthly to build a reliable stream of dividend income to reinvest in more income-producing assets.

One of the first stocks I analyzed was Lockheed Martin (NYSE:LMT). I analyzed it back in 2015 and found it to be a decent addition to dividend growth portfolios. Since then the stock has returned 196% compared to the S&P’S 107%. The war in Ukraine has emphasized the need for defense capabilities, and I decided to take another look at the company.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, Lockheed Martin a security and aerospace company engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. It operates through four segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space.

Wikipedia

Fundamentals

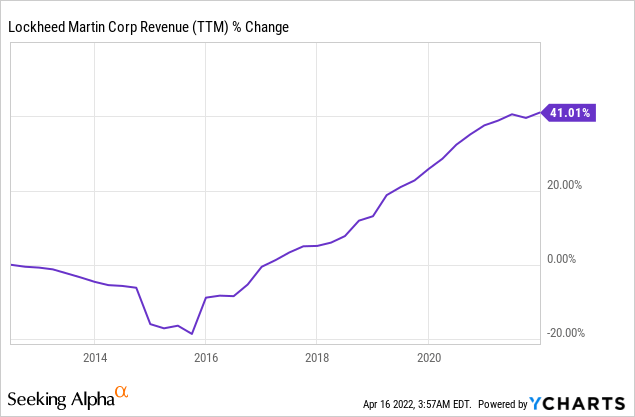

The company is slowly growing its sales over the last decade. A 41% growth rate equates to ~3% annual sales growth. The company’s sales growing steadily with the growth of defense spending. Growth is mainly organic, as even when the company tries to acquire competitors, it finds itself fighting with the FTC which forced it to forfeit. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Lockheed Martin to keep growing sales at an annual rate of ~2% in the medium term.

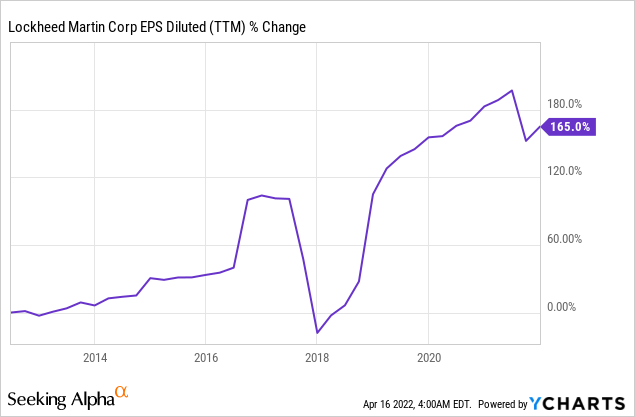

The EPS (earnings per share) has been growing at a much faster pace over the past decade. EPS growth was fueled by top-line growth together with buybacks and improved margins. Over the past decade, operating margins have increased by 33%. The company is reworking its business plan for the next five years and is working on improving EPS growth. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Lockheed Martin to keep growing EPS at an annual rate of ~2% in the medium term.

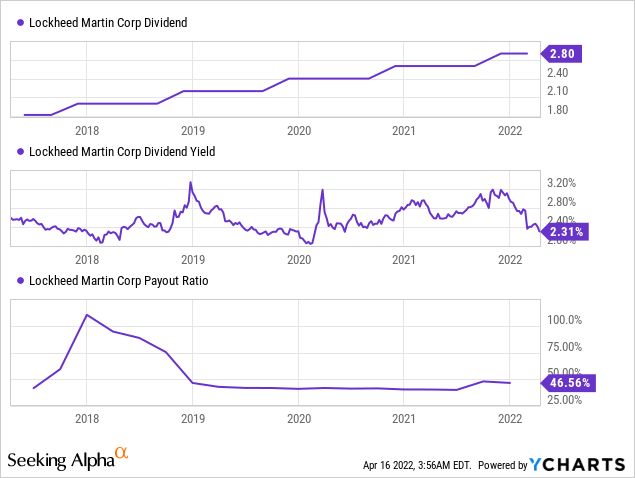

Lockheed Martin is on its path to becoming a dividend aristocrat. The company’s next dividend increase in December will be the 20th increase in a row. Lockheed Martin is paying a 2.3% yield with the payout being safe below 50%. Investors should take into account that due to the slower forecasted growth rate, the dividend increases in the medium term may be below the 10% average over the last decade.

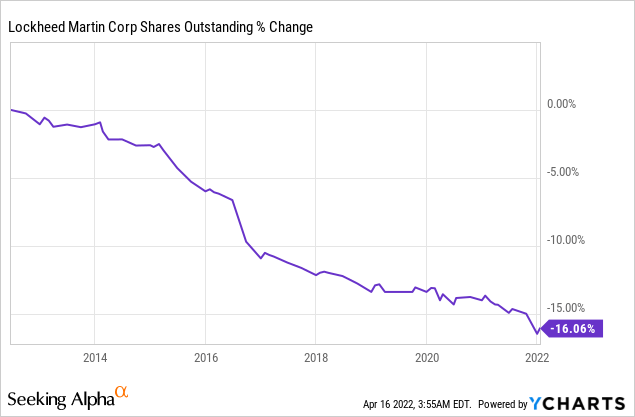

The number of shares outstanding has declined by 16% over the past decade. Lockheed Martin is constantly supplementing its dividend payments with buybacks. Buybacks support the share price, and they support EPS growth. As long as the company can fund organic growth and dividends, I appreciate excess capital allocated for buybacks.

Valuation

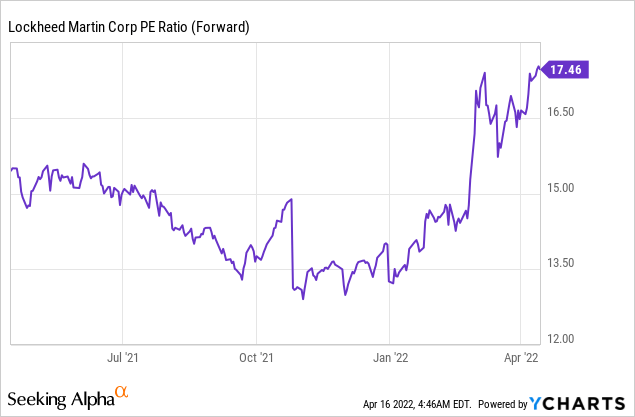

The company’s current P/E (price to earnings) ratio is 17.5 when taking into account the 2022 earnings forecast. The current valuation is the highest valuation over the last twelve months. It doesn’t fit the current forecasted growth rate that stands at 2% annually. However, it does fir the expectations for improved guidance due to higher demand as the geopolitical tensions get higher.

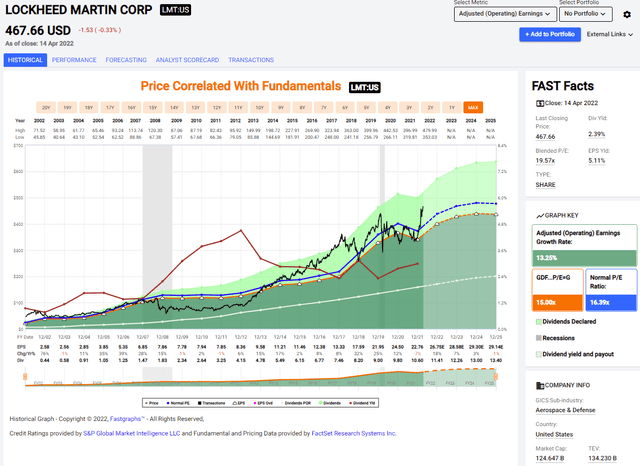

The graph below from Fastgraphs.com shows how the company has deviated from its average valuation in the past several months. On average, over the last two decades, Lockheed Martin traded for 16.4 times earnings. The current valuation is higher even when the forecasted growth rate doesn’t seem to justify a premium. From the graph below, the company seems slightly overvalued.

Fastgraphs

To conclude, Lockheed Martin is a solid company with firm fundamentals. It is constantly growing both sales and EPS to fuel dividend payments and stock buybacks. The company is currently slightly overvalued and it seems like investors expect Lockheed Martin to improve its guidance for the short and medium-term due to the war in Europe.

Opportunities

The first opportunity for Lockheed Martin is increased defense spending by NATO members. Germany has already announced that it plans to spend €100B ($108B) on modernizing its armed forces. Germany already showed interest in Lockheed Martin’s F-35. Germany also intends to increase its annual defense spending and other NATO members will follow increasing the demand for Lockheed Martin’s prominent planes and other products.

The F-35 is not the only product that may see increased demand. For example, one of the most notable weapons given to Ukraine was the Javelin anti-tank missile. The Ukrainians use this missile to make significant damage to Russian armor. It is very plausible that due to its significant success we will see other NATO members, especially in the eastern flank, purchasing more Javelins. Countries like Poland, Lithuania, Latvia, and Estonia all have borders with Russia and may consider rearmament.

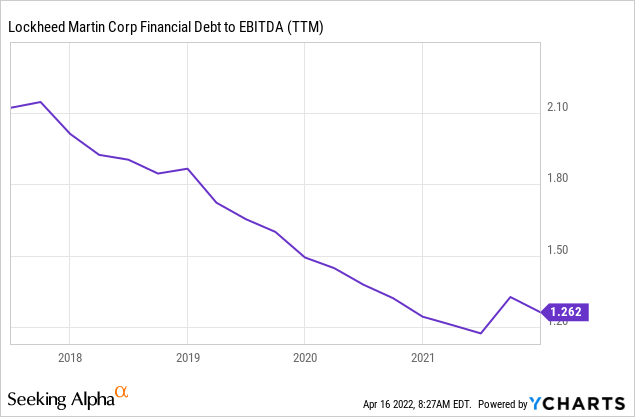

The company is ready for the macro challenges ahead. The company’s balance sheet is in very good shape. The company’s debt to EBITDA has declined by 40% over the last five years and it now stands at 1.2. A flexible balance sheet means fewer interest payments when interest rates climb, it also means that it has more flexibility in dealing with inflation as it can lower prices to compete.

Risks

Lockheed Martin is relying heavily on government spending, and mainly the government spending of the American government. The company has most of its revenues coming from one client, and the rest relies on a small number of other western countries. Relying on a limited number of clients with one being so significant is always a risk.

In addition, the company is active in a competitive realm. The barrier to entry into the defense and aerospace realm is indeed high, but incumbents are competing for contracts. Companies like Raytheon Technologies (RTX) and General Dynamics (GD) are just two examples of prominent competitors that Lockheed is dealing with.

Moreover, the company which should have been poised for growth due to the geopolitical tension may struggle to capitalize on it. The company has lowered its guidance just several months ago. Lockheed Martin is reassessing its five-year plan, and that includes the company’s pipeline. It may be challenging to capitalize on higher demand while reconstructing.

Conclusions

Lockheed Martin is a great company. The company provides products that help keep the world safe, and governments are paying more to maintain the safety of their citizens. The company has several growth prospects, and what I believe to be limited risks. In addition, the company is trading for 17 times 2022 earnings which I believe is a decent valuation.

I believe that Lockheed Martin is trading right now for a decent price. The company may not seem like great growth is expected according to the consensus of analysts. However, I believe that the company will be increasing its guidance despite its short-term challenges. Lockheed Martin will enjoy higher demand for its products due to the higher level of tensions, and investors should consider it in their dividend growth portfolio.

Be the first to comment