porcorex/iStock via Getty Images

Financial stocks were supposed to be a winning segment this year due to higher interest rates. However, uncertainty around the health of the economy has driven the valuations of many large bank stocks back down.

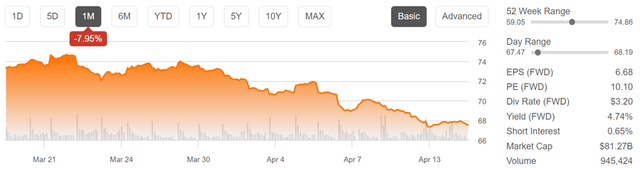

This brings me to the Canadian banking giant, Bank of Nova Scotia (NYSE:BNS), otherwise known as Scotiabank. As shown below, Scotiabank has followed a somewhat steady downward trajectory over the past month, falling by 8% over this timeframe.

This article highlights why this creates an attractive entry point for BNS, so let’s get started.

BNS: This High-Yielder Is Getting Interesting

Scotiabank was founded in the 19th century and is one of the oldest banks in the world. It’s also one of the Big Five banks in Canada and has a market capitalization of $81 billion. The bank has over 25 million customers, $1.2 trillion in assets, and a strong presence in both North America as well as key emerging markets.

Notably, BNS has paid an uninterrupted dividend since 1940, during which it was cut at the request of the Canadian government during World War II. At present, Scotiabank currently offers a yield of nearly 5%. This is well above the average dividend yield for the S&P 500, which is currently sitting at just 1.3%. It’s also well protected by a reasonably low 45% payout ratio, and was raised by 11% in November from C$0.90 to C$1.00.

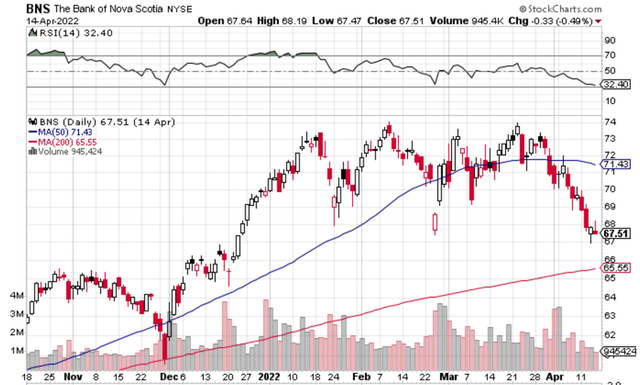

Meanwhile, recent volatility has driven Scotiabank’s stock price down by a meaningful amount. As shown below, the stock price now sits below its 200-day moving average of $71.43, and carries and RSI score of 32, indicating that it’s approaching oversold territory.

BNS Stock Technicals (StockCharts)

BNS is also performing well, with adjusted net income growing by 14% YoY to $2.15 per share during Q1 of 2022 (ended January 31st). Scotiabank also remains well capitalized, with a Common Equity Tier 1 capital ratio of 12.0%, sitting above the 8% minimum requirement. The strong bottom line results were driven by strong loan growth, increased customer activity, favorable credit quality, and cost efficiencies.

The international banking segment also saw double-digit earnings growth, driven by strong mortgages and commercial loan growth. Moreover, BNS is seeing robust growth in its Wealth Management unit, with AUM increasing by 11% YoY in the latest quarter. Also encouraging, Scotiabank was recently named Bank of the Year in Canada by The Banker magazine, and this reflects positively on the management team.

Looking forward, the recent pivot on interest rates by the U.S. Federal Reserve may prove to be a headwind for the economy, especially if they are too aggressive in raising rates. This could negatively impact American banks as well as their Canadian counterparts.

While this is a potential negative for BNS, I do see reasons to be optimistic based on what the bank is doing on things within its control. For one thing, BNS is seeing strong momentum in its Canadian Wealth unit, and it recently launched a partnership with SigFig, an enterprise financial technology firm, to support a digital advice platform.

Digital adoption has also improved, with active mobile users increasing by 13% and the percentage of self-serve transactions increasing to 91%, resulting in operating efficiencies for the bank. Management also highlighted future prospects for its investment bank, Roynat, in the tech-space, as noted during last month’s financial services conference:

We’ve been investing heavily in all the tech hubs that you see in the top 10 Tier 1 cities. In Canada, Roynat is a brand that’s been very active in that regard. It’s a great fee business that goes along with that, as well as transportation. I hope the permanent shift towards climate change being now much more appreciated, I think it’s going to create a whole series of technologies related to transportation. And we’ll be a big participant there, just as we have been this past year.

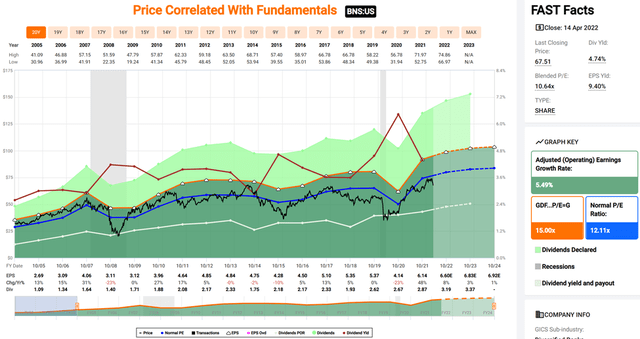

I see value in BNS at the current price of $67.51 with a forward PE of 10.1, sitting below its long-term normal PE of 12.1. Sell side analysts have a consensus Buy rating with an average price target of $73.69. This translates to a potential one-year 14% total return including dividends.

Investor Takeaway

Scotiabank remains a strong and well-capitalized bank, with a diversified business mix and good growth prospects. It’s seeing strong operating fundamentals, and is making meaningful progress towards digital banking, which improves its operating leverage. While no one can tell where the stock might bottom, the recent weakness in the stock price provides an attractive entry point for long-term investors.

Be the first to comment