Justin Sullivan

Investment Thesis: With churn rates having decreased and overall revenue increasing, the stock could be trading at a significant discount at this point.

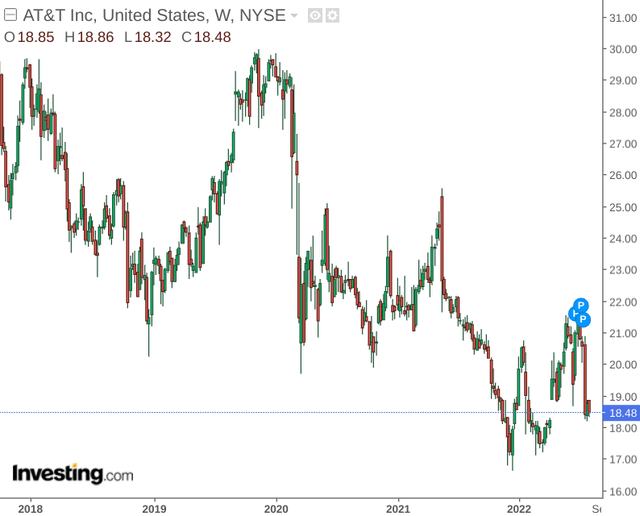

Over the past five years, investors have been largely bearish on AT&T (NYSE:T), with the stock having seen a significant decline:

investing.com

The purpose of this article is to investigate whether there is an increasing disconnect between price and the company’s overall performance, and whether we could expect to see a longer-term rebound in upside.

Performance

One of the most important metrics for a telecommunications company is churn – i.e. the rate at which the company sees customers ceasing to do business with them.

To get a broader overview of churn performance for AT&T, I decided to average quarterly churn data for both AT&T and competitor Verizon (VZ), in order to determine whether this metric has been improving (decreasing) over time, and where AT&T stands on this metric relative to its largest competitor. The specific churn rates used were postpaid phone churn for AT&T and wireless retail postpaid phones for Verizon.

The original quarterly data and SQL calculations can be found here.

Here are the average yearly churn rates for AT&T and Verizon (with 2022 averaging two quarters of data):

AT&T Average Churn By Year

| Year | Churn Rate (%) |

| 2018 | 0.90 |

| 2019 | 0.95 |

| 2020 | 0.79 |

| 2021 | 0.76 |

| 2022 | 0.77 |

Source: Average churn rate calculated by author using SQL.

Verizon Average Churn By Year

| Year | Churn Rate (%) |

| 2018 | 0.76 |

| 2019 | 0.79 |

| 2020 | 0.67 |

| 2021 | 0.72 |

| 2022 | 0.76 |

Source: Average churn rate calculated by author using SQL.

When looking at the above churn rates, we can see that while that of AT&T was higher than that of Verizon in 2018 – churn rates for the former have decreased significantly over the past five years.

This is an encouraging sign as it indicates that less customers are choosing to leave AT&T, and the company is also better able to compete with Verizon in terms of customer retention.

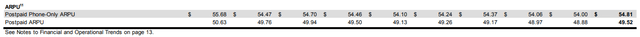

That said, when looking at ARPU (or average revenue per user) – we see that this has remained more or less consistent over the past two years, with the company reporting Postpaid Phone-Only ARPU of $54.47 in June 2020 and $54.81 in June 2022.

AT&T: 2nd Quarter Earnings 2022

Although revenue has remained constant, I take the view that lower churn provides significant opportunity for the company to grow its customer base and revenue overall – with postpaid subscribers up by over 10% from June 2020 to June 2022.

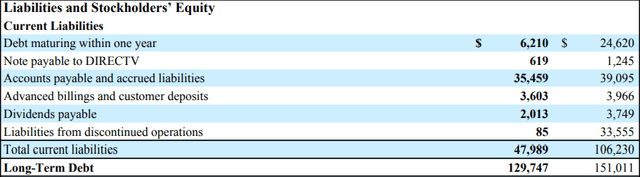

From a financial standpoint, we can see that the company’s long-term debt has decreased by 14% from the last quarter, which is encouraging.

AT&T: 2nd Quarter Earnings 2022

However, when looking at the company’s quick ratio (cash less inventories all over current liabilities), we can see that this ratio has dropped sharply from December – indicating that AT&T has less cash available to meet its short-term liabilities.

| December 2021 | June 2022 | |

| Cash and cash equivalents | 19223 | 4018 |

| Inventories | 3325 | 3241 |

| Total current liabilities | 106230 | 47989 |

| Quick ratio | 14.97% | 1.62% |

Source: Figures sourced from AT&T 2nd Quarter Earnings 2022. Quick ratio calculated by author.

Looking Forward

With AT&T having significantly reduced churn rates and showing a reduction in long-term debt, investors have nonetheless seemed coy of this stock.

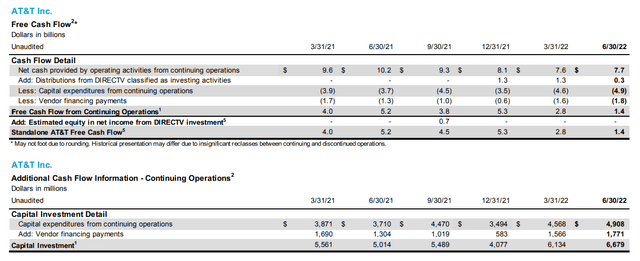

As referenced by another contributor on Seeking Alpha, the decline in share price means that AT&T has had to use a high dividend yield as a way of enticing investors. Free cash flow has seen a significant decline over the past two quarters in part due to higher capital expenditure:

AT&T: 2nd Quarter Earnings 2022

We have also seen that the company’s quick ratio has shown a significant drop. As such, investors have come to largely prioritise income over growth in AT&T, and negative cash growth is concerning for this reason – as it raises speculation that the company might need to cut its dividend in order to continue reinvesting in the business. The company already cut the dividend in half following the spin-off of WarnerMedia.

With that being said, AT&T’s current dividend yield is still high at 6.05% as compared to Verizon’s yield of 5.65% at the time of writing. Moreover, the market came to recognize that the continually high dividend levels that AT&T was previously paying to shareholders was ultimately unsustainable without significant cash flow growth to back it up. This is likely one of the reasons why we have seen the stock decline up until now.

I see the risk of further cuts to the dividend as low for as long as the company can demonstrate longer-term revenue growth and a reduction in churn – which has been the case for AT&T. Standalone operating revenues are up by over 9% since June 2020, from $27.19 billion to $29.64 billion in June 2022.

Going forward, one of the main risks for AT&T at this time is inflation. With the company recording a greater frequency of late bill payments – this could affect cash flow in the short to medium-term. Additionally, while we have seen churn rates decrease – price increases could mean that customers might choose to reduce spending or increasingly compare carrier plans and potentially switch in order to ensure the best deal.

With that being said, this risk is not unique to AT&T – Verizon and other competitors also face the same macroeconomic headwinds. As such, I do not see a particularly high risk of an increase in churn – though investors will likely pay significant attention to this metric going forward.

Conclusion

In my opinion, AT&T could be trading at a significant discount at this point. The market seems to have focused excessively on income growth, while ignoring the growth in revenue and the reduction in churn that AT&T has managed to achieve over the longer-term.

For these reasons, I remain long AT&T.

Be the first to comment