Editor’s note: Seeking Alpha is proud to welcome Enrique Boente as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Summary

It seems workers are wary of marrying with a company for life and instead are seeking changes and new challenges. As of January 2020, the median number of years that wage and salary workers had been with their current employer was just 4.1 years.

The success of the streaming video and music platforms is based on allowing users to decide what to see or what to listen and when to do it. Similarly, the work industry is experiencing a significant transformation thanks to the rise of the “Gig Economy” or “Freelance Economy.” On one side, people increasingly want to have the opportunity to decide when, where and how to work, and on the other side, companies are looking for flexibility, light capital models and an on-demand workforce. As a result, and accelerated by the COVID-19 pandemic, freelancing is challenging the traditional concept of a full-time job.

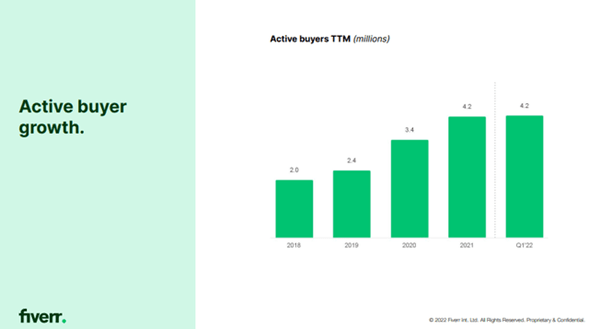

Based on this secular trend, Fiverr International Ltd (NYSE:FVRR) presents an opportunity for investors. Fiverr is an online marketplace offering on-demand freelance services to individuals and businesses. Founded in 2010, it has been exponentially growing thanks to the rise in the gig economy. Currently, Fiverr, with its more than 4 million active users and +$1b GMV, is seen as having a lot of potential to become a key player in the future as it is the first in the queue and it has, already, a considerable network of early-adapters loyal buyers and sellers.

Throughout this investment thesis we would like to help the reader understand the secular trend backing the long-term growth of the industry, Fiverr’s historical performance and its long-term strategy, and why do we think Fiverr is a good opportunity by translating our expectations into numbers and by carrying out what we believe is a reasonable intrinsic valuation of Fiverr.

Gig Economy – As the main driver

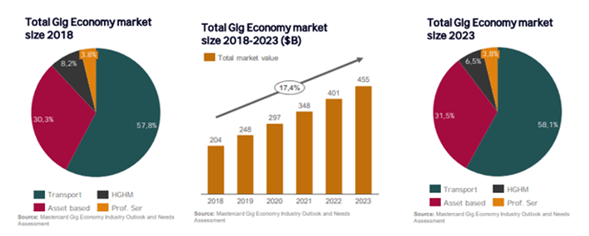

The Gig economy is projected to growth at a double-digit annual rate, with drivers from both the supply and demand side gig platforms continuously expanding geographically and offering new services to consumers. In 2018, according to the report release by Mastercard in May19, the market size was estimated to amount to $204b globally and it was expected to growth at least at a 17.4% CARG until FY23E.

“Mastercard Gig Economy Industry Outlook and Needs Assessment” report

Currently, the Gig Economy in itself can be divided into four different sectors.

- Transportation-based services: including platforms as UBER, Lyft, Grab, etc. (57.8% of the total Gig economy in 2018).

- Asset-sharing services: major players include Airbnb, Tripadvisor rentals, etc. (30.% of the total Gig economy in 2018).

- Handmade Goods, Household and Miscellaneous Services: mostly comprised by niche platforms focused on on-demand services like TaskRabbit or Etsy among others. (8.2% in 2018).

- Professional services: companies like Fiverr or Upwork will belong to this sector. (3.8% in 2018).

As it can be observed, transportation-based and asset-sharing services are the current leaders as they were the forerunners of the industry. Nevertheless, other verticals as professional services should catch-up over time.

Fiverr’s TAM and industry outlook

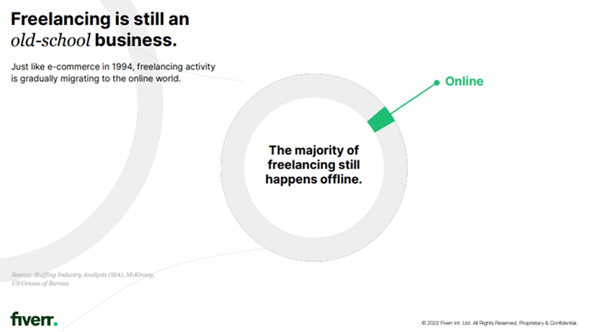

The penetration of the freelance model is rising at an exponential rate year by year. According to Fiverr and supported by other relevant industry reports, the freelance economy represents a large market opportunity with still very low online penetration. Just in the US, according to the latest US Census Bureau Nonemployer Statistics data, the estimated US total freelance income amounted to $815b out of which $115b includes professions subject to be penetrated by Fiverr and other freelancing platforms.

Company website

What is Fiverr?

Business model

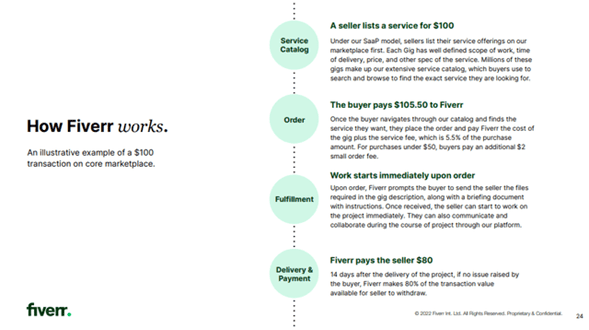

Fiverr is an online marketplace where people and businesses buy freelance services, similarly to the way people buy physical goods on an e-commerce marketplace. The company aims to provide an “on-demand, e-commerce-like experience that makes working with freelancers as easy as buying something on Amazon”.

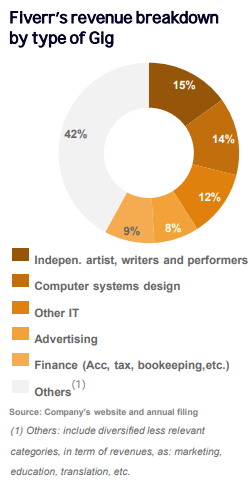

Customers can easily find and purchase services, such as logo design, video creation and editing, website development and blow writing, voice-overs, and translation, with prices ranging from $5 to thousands of dollars.

Company website and annual filing

Where does Fiverr’s revenue come from?

Fiverr generates revenue primarily through fees based on the value of the transacted service. When an order is placed, buyers pay Fiverr the Gig (service) price plus a 5.5% service fee; upon successful completion of an order, Fiverr makes 80% of the Gig price available to the seller of the Gig while retaining the 20% as a selling fee. Although Fiverr’s current take rate starts from 25.5% (5.5% from the buyer and 20% from the seller), the actual take rate reported in 1Q22A amounted to 29.6%, thanks to additional revenues streams.

Company website

How things have been going so far and what is next?

As one could expect, Fiverr meets the profile of a high growth company with double digit revenue growth rates but still negative margins.

Over the historical period (FY17A-FY21A) Fiverr’s total turnover increase by 5.7x (54.6% CAGR) mainly driven by:

- An increase in the number of active buyers from #1.8m to #4.2m (23.9% CAGR).

Company website

- An increase in the average spend per buyer from $119 to $242 (19.4% CAGR).

- An increase in take rate from 24.47% in FY17A to 29.17% in FY21A (4.5% CAGR).

In terms of margins, although still negative, top-line growth has been translated into an operating leverage expecting to breakeven in the short-medium term.

- Gross margin improved from 74% in FY17A to 82.6% in FY21A.

- EBITDA margin also improved in terms of revenue from -c.35.4% in FY17A to -10.9% in FY21A.

In the long-term, as stated by management, Fiverr’s strategy involves going upmarket into more business-oriented service buyers and expanding its geographical presence.

Fiverr’s is currently involved in a transition process through which, once it has developed a loyal and consolidated based of freelancers (assets) interacting with a large number of SME and individuals, its main focus will be going after bigger companies, representing an attractive opportunity in terms of volume and recurrence.

Who are Fiverr’s main competitors?

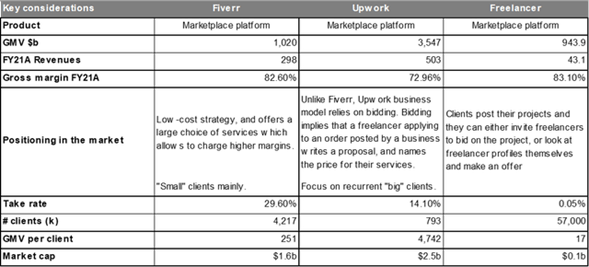

Fiverr faces competition from a number of online and offline platforms and services that offer freelancing services. Nevertheless, its more comparable competitors are other online freelancer platforms, such as Upwork (UPWK) or Freelancer.com.

Company filings and own analysis

As shown in the table above, Fiverr differentiates against its peers mainly through its business model and its customer base.

Business model: Fiverr uses a “clients come” instead of “go to clients” strategy, which means that in case of Fiverr freelancers offer and quote their services for potential buyers. Both Upwork and Freelancer work mainly the other way around, with freelancers applying to projects posted by clients.

Customer base: In the case of Fiverr it is mainly comprised of individuals and SME customers while Upwork, which could be considered its main competitor, is focused on recurrent “big” enterprises. Nevertheless, as previously explained, Fiverr is currently targeting this market segment.

Fiverr’s intrinsic value

Now that we understand Fiverr and its potential, how much is it worth?

Industry growth prospects

First of all, in order to get an estimate of Fiverr’s current intrinsic value there are a few key points which every investor should reassess: (1) current market size and future market growth and (2) Fiverr’s current and long-term market share.

Current market size and future market growth

For the purpose of estimate the current market size and its future growth rate, we can refer to Mastercard’s (research estimates of the total global Gross Volume (GV) generated by the Gig Economy and, specifically, the GV generated by the professional services sector as our starting point. We believe this is a good estimate of the current market size. However, in order to incorporate the effect we consider COVID-19 has had on the market, we have slightly changed the given assumption by bringing forward estimated figures by half a year. The result is:

- a current GV equal to c.$14.5b in FY21E (vs $13.5b as per the Mastercard report) for the professional services sector and,

- an estimated 12% growth rate from FY21A to FY26E. Thereafter, we assume a linear decreasing annual growth rate up to 3.0% (FY30E-FY31E) approximating the current risk-free rate.

We consider this figure to be reasonable given Fiverr’s own estimations of the TAM of just the US to be c. $115B, which implies that the current market would still have a huge penetration potential (at least 7.9x our estimated current market size).

Fiverr’s current and long-term market share

Based on the previous point, we get that Fiverr’s current market share would be around c. 7% (Fiverr’s GMV of $1b in FY21A). Going forward, our assumption is that Fiverr should be able to increase its share over time based, in part, on a strong networking effect, which we consider its main competitive advantage. Consequently, we estimate Fiverr’s market share will be able to reach c.10% in FY26E and c.15% in FY31E.

The result from the previous market growth and share estimations is that Fiverr’s GMV (the total value of transactions ordered through the platform) grows at a c.20% CAGR from FY21A to FY26E. Although this rate is higher than the estimated growth rate of the industry (c.12%), it is explained by the increase in Fiverr’s market share resulting from a progressive market concentration.

Translating our Fiverr’s business expectations into numbers

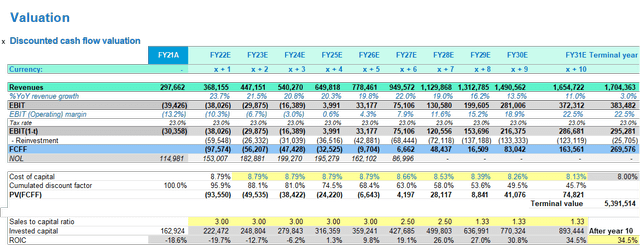

Revenues: Fiverr’s revenues will be driven by the Fiverr’s GMV and its projected take rate.

Over the historical period, the company’s revenues increased at 54.6% CAGR (FY17A-FY21A). Looking forward, we assume Fiverr’s revenues will increase at a c. 21% CAGR from FY21A to FY26E based on a 20% CAGR of its GMV, as explained before, and enhanced by the increase in its take-rate from 29.2% to 30.1%.

In the long term, we estimate revenues in FY31E will amount to $1.7b (5.6x FY21A revenues) with a GMV of $5.3b equivalent to 40% of ETSY’s GMS ($13.5b) and 6% of UBER’s GMV (c. $90b) in FY21A.

We feel comfortable with the estimation and even believe it might be conservative with upside risk arising from:

- a better than predicted market growth or market concentration,

- unexploited international markets (70% of revenues from English speaking countries) as Fiverr’s platform became available in additional languages as recently as FY20.

- a better-than-expected execution of the going up-market strategy (large-enterprises)

Fiverr’s long-term sustainable operating margins: As explained before, top-line growth has been translated into an operating leverage. However, reported EBITDA margin is still negative.

For our valuation purpose, our assumption is that Fiverr’s target operating margin should reach 22.5% by year 10 (FY31E). Although this might appear too aggressive, we believe it is feasible looking at other similar marketplace operating margins as eBay or Etsy (c. 22% in FY21A) as well as Facebook (41% and 38% in FY19A and FY20A). Regarding this point, it must be considered that Fiverr is still a high-growth company with high levels of reinvestment.

Assessing Fiverr’s capital efficiency, cost of capital and failure probabilities

Sales to capital ratio: Fiverr, similar to other marketplaces, has a capital-light business model with no significant working capital needs and no need of high-value physical assets. Nevertheless, to support our narrative in which considerable levels of growth are projected, we consider absolutely necessary to keep high levels of reinvestment at least for the initial years. These investments will consist mainly of product development as well as punctual acquisitions. Therefore, for our valuation purposes, our assumption is that Fiverr will maintain its current sales to capital ratio over the next five years, and then it will move towards the average ratio of the following industries (internet software (1.26), system & application software (0.98) and retail online (1.76)).

Cost of capital: We estimate the cost of capital to be 8.05% based on a current D/E ratio of 0.31, a cost of equity of 9.96% and cost of debt of 4.03%. In the long-term the weighted average cost of capital will approach to that of typical mature companies (risk free rate + equity risk premium).

Failure of risk: Given the early stage of the company, the regulatory issues that we believe that it would have to face, as well as the power of other technology giants to become a great threat, we have assumed a 10% chance of failure with no proceeds if the company fails.

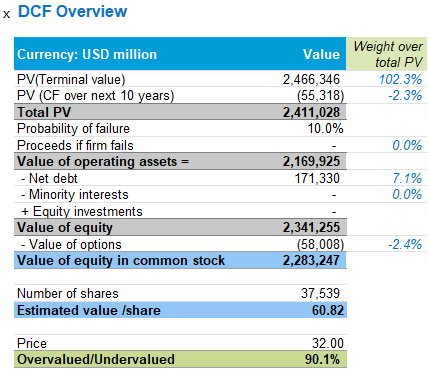

Fiverr’s target price

All the above, leads us to value the stock at $60USD and therefore to consider it undervalued. We believe that, even taking a very conservative approach as we did, the pressure that the stock has suffered is excessive and now there is a very good opportunity for very long-term investors who want to play the digitalization of the freelance economy.

Company Filings and own analysis Company Filings and own analysis

Final conclusion

Our valuation is based on a narrative in which we consider Fiverr to be an early-stage high-growth company with an innovative and disruptive business model. The timing is right for Fiverr to continue to expand and become a key player within the Gig Economy, which we consider to have worldwide relevance.

Notwithstanding, the reason we believe to be behind the tremendous free fall in Fiverr’s stock during the last 12 months (> -85%) is the result of a bubble burst. Although Fiverr’s history sounds very compelling, one must be aware of the uncertainty and challenges ahead. For example, sooner or later, just like any other company in the gig industry, Fiverr could face legal and regulatory problems (think Uber (UBER) and Airbnb (ABNB)), and competition will inevitably intensify as it is currently happening in the rail-hailing and food-delivery industries. Therefore, an above $300 per share valuation of Fiverr (Feb-Mar21) implied an extremely optimistic scenario indefensible by actual figures and realistic projections. Beyond the impact that the rise in interest rates has had on valuations, what we mean by indefensible is that the only price that justified a valuation like that (i.e. 57x sales) is not only assuming the best-case scenario but also discounting it with 100% certainty and, as we all can recognize, there is nothing ever certain in life.

That’s why, now that expectations have come back to earth, there could be reasons solid enough to support the view that today’s conditions could represent an unique opportunity for Fiverr.

We could very likely be wrong in our assumptions in terms of timing because growth rates will not present a linear trend but rather a discontinued line with accelerations/decelerations in between, but ultimately the idea we want to communicate is that in the long-term growth will arrive, margins will improve and Fiverr will create value.

Be the first to comment