Torsten Asmus/iStock via Getty Images

Thesis

State Street Corporation (NYSE:STT) is one of the largest asset managers in the world, primarily known for its low-cost exchange-traded fund (“ETF”) offerings. The company also engages in providing investment servicing and management solutions through a comprehensive suite of products and services. After a few years of mediocre financial performance, STT’s stock has been struggling. In this analysis, I explore the company’s performance, prospects and valuation.

A Rough Year So Far

Considering the growth in passive investing and the asset management industry in general, State Street’s stock performance has been rather disappointing. Over the past five years, STT has recorded a total price return of -26%, during a period where competitors like BlackRock (BLK) have grown their stock price at over +40% and even big banks like JPMorgan Chase & Co. (JPM) have recorded positive +20% overall price returns.

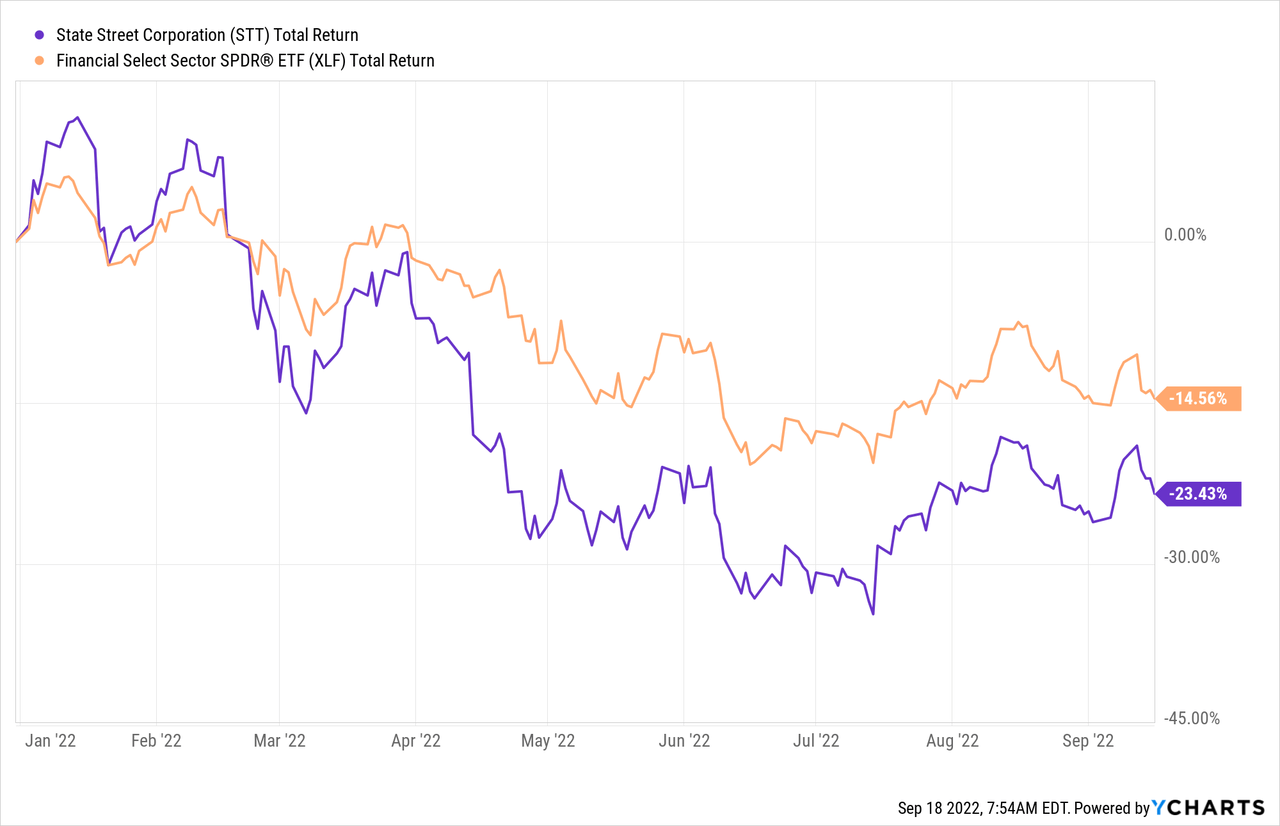

Since the beginning of the year, more struggle has revealed itself for State Street. The stock has significantly underperformed the financial sector, retreating -23% YTD (-14.5% for XLF). Currently, the stock trades -32% from 52-week highs, at $70.10 per share ($25.8B market cap) and pays a 3.25% dividend yield.

Macroeconomic Headwinds

The Investment and Asset Management Industry is cyclical as the volume of inflows, trades, and deals is correlated to economic conditions and interest rates. During economic downturns and times of uncertainty, volume declines. As a result, servicing fees, commissions, and management fees contract. Despite the short-term challenges, according to research by PwC, global Assets Under Management are expected to rise by approximately 6.2% annually, to $145.4T, through 2025. Given the mature nature of the industry, the growth prospects seem decent. Active management is expected to account for 60% of global assets under management (“AUM”), leaving plenty more room for growth to passive investing, though active investments are set to continue to lose market share from passive ones.

Growth drivers include the incorporation of advanced technological solutions, Asia-Pacific markets, contribution-based retirement saving, and others. Mutual funds and ETFs are also forecasted to grow significantly, reaching an industry penetration rate of 42.1%. AUM growth in North America and Europe are expected to slow down a bit, with emerging markets offering the best prospects.

Business & Financial Performance

State Street operates through two lines of business; Investment Servicing offers custodian, clearing and settlement services to institutional clients, while the Investment Management segment provides, through State Street Global Advisors, a broad range of investment management strategies and products including ETFs, mutual funds, active management funds, and more.

State Street seems to have failed to capture the tailwinds in the asset management industry, as the lack of significant revenue growth is in part to blame for poor stock performance. Over the past five years, revenue has grown at a 2.60% CAGR, while annualized net income growth stands at 3.90%.

In July 2022, State Street reported results for the second quarter of the fiscal year. The company recorded a Non-GAAP revenue miss and an EPS beat. Still, decreases YoY in both have investors worried. EPS was down -8% and revenue -3%. Lower equity and fixed income market levels have caused a 6% decrease in fee revenue that has been in part offset by higher FX trading services revenue. On the other hand, higher interest rates have led to a +25% net interest income increase. Total expenses remained flat YoY. AUM has decreased by -11% YoY primarily due to the decreases recorded in equity and fixed income markets.

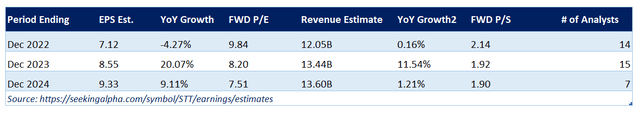

Even though 2022 is expected to result in revenue stagnation and EPS contraction, over the next couple of years analysts expect State Street’s business to grow. Revenue is expected to reach $13.6B in 2024 and EPS $9.33 per share, aided by share repurchases.

Intense Competitive Landscape

The Investment industry is highly competitive and more consolidation is expected moving forward. Currently, State Street sits behind companies like Vanguard and BlackRock, both offering similar if not identical products while displaying greater growth opportunities as the threat of market share loss becomes evident. Especially when considering a wide range of others competitors, including Charles Schwab (SCHW), Invesco (IVZ), Fidelity, and others, all aspiring to expand their products and services. Gaining market share is becoming increasingly hard, and State Street’s growth prospects might suffer as a result.

Attractive Dividend Case

Despite underwhelming financial performance, State Street offers a rather attractive dividend investing case. The current yield of 3.25% beats the sector average of 3.10%, while considered safe, given a Seeking Alpha A- score for safety and consistency. Recently STT increased dividend payment by 10%, following a respectable 5-year 8.5% dividend growth. Dividend growth is expected to continue at similar rates through the foreseeable future, offering dividend growth investors a solid argument for the stock.

The average share count for STT has also been marginally decreasing over the past decade, increasing shareholders’ returns. The inexpensive valuation that State Street has been trading at for a while also favors the company’s strategy to continue buying back cheap shares, in an effort to support the stock price and effectively put its free cash flow to use.

Valuation

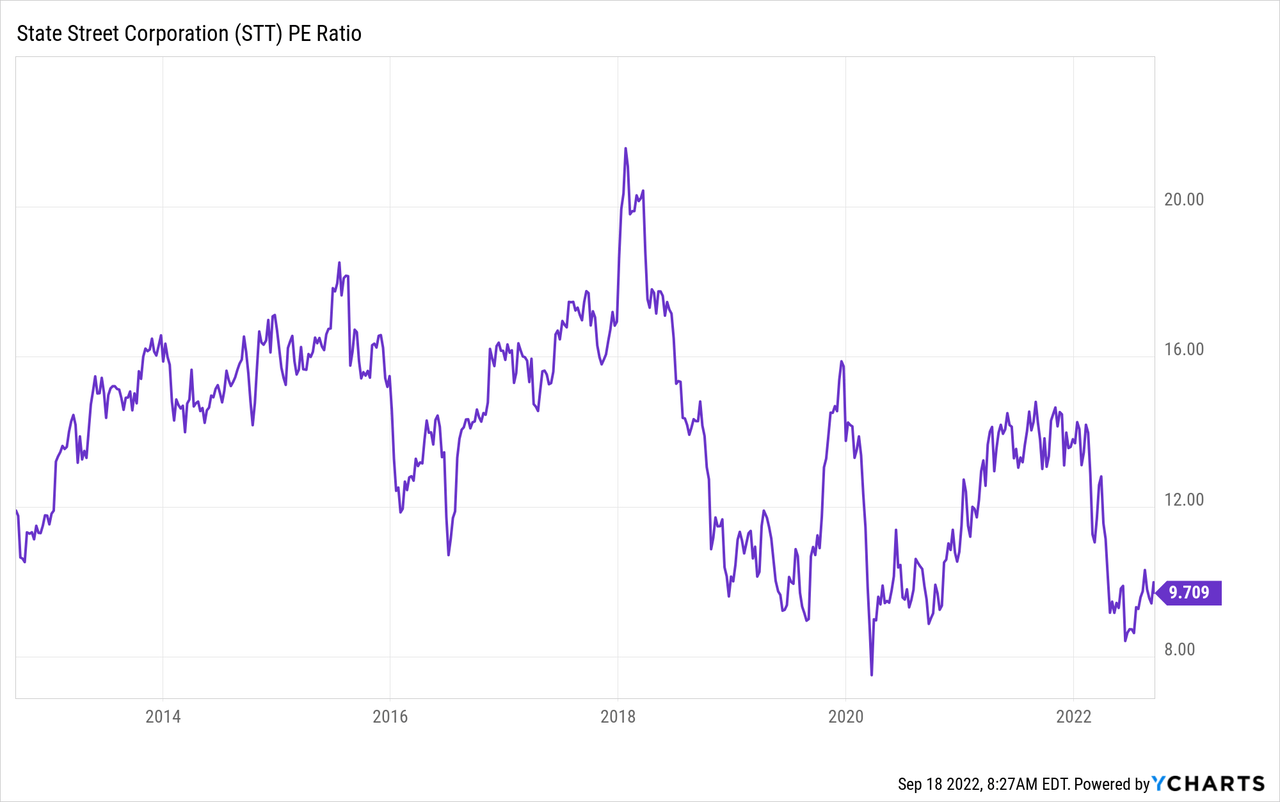

Naturally, the poor stock performance into the first 8 months of the year raises the question of whether STT is inexpensive enough to present a good value opportunity, created by market overreaction. Indeed, State Street trades near its 10-year lows in terms of P/E multiple. The current 9.7x multiple appears very low, considering that the stock traded just shy of an 8.0x multiple in the midst of the Covid-19 pandemic. In fact, the stock traded in 2022 at the lowest P/E in 10 years, with the exception of March 2020. P/B and P/S ratios also stand near 10-year lows.

Final Thoughts

After all things are considered, State Street is likely to continue struggling as long as turmoil persists in the market, and even more so in the case of a broader economic recession that would result in a slowdown of investment activities. Over the long term, however, the outlook is more optimistic. As both passive and active investing are expected to grow, and markets eventually recover, State Street’s business will have the opportunity to persevere. An inexpensive valuation further increases the long-term attractiveness of the stock.

Be the first to comment