M. Suhail/iStock Editorial via Getty Images

Just over six months ago, I wrote on Wendy’s (NASDAQ:WEN), noting that dips below $21.00 would likely provide buying opportunities, given that the stock would become attractively valued at this level. While the stock rallied nearly 10% off this level in March, it made yet another lower high at $22.70, and it’s been a difficult few months since. This is because, on top of the industry’s traffic declines due to tightened discretionary budgets, Wendy’s has been receiving negative headlines related to a potential E. Coli outbreak.

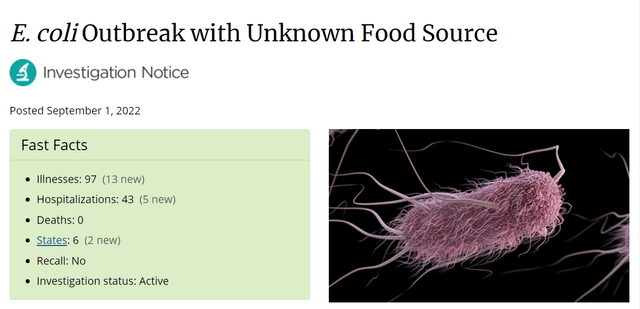

The potential link to Wendy’s was reported in mid August, with romaine lettuce from sandwiches potentially responsible for an outbreak that left dozens sick and hospitalized ten people. The potential Wendy’s linked outbreak was expanded to six states in September, with 97 illnesses and 43 hospitalizations, prompting Wendy’s to remove salad lettuce from some sandwiches and reassuring customers that the lettuce used in salads is different. According to the CDC, 10 affected developed hemolytic uremic syndrome, a condition that damages blood vessels and can cause kidney failure.

Wendy’s Menu (Company Twitter Account)

While 43 hospitalizations may not appear that significant relative to Chipotle’s (CMG) 2015 scare that made 700 sick, it’s likely to hurt WEN’s traffic in Q3, with the potential for much worse trends in states that were affected (Indiana, Michigan, Pennsylvania, Ohio, New York, Kentucky). This is not ideal at a time when industry-wide traffic is attempting a rebound, helped by lower gas prices. Given the potential for an earnings miss on softer H2 results and the stock’s recent support break, I don’t see any way to justify chasing the stock above $20.

Q2 Results

Wendy’s released its Q2 results last month, reporting quarterly system-wide sales of ~$3.42 billion, translating to 5.6% growth, helped by nearly 3% unit growth and better than expected sales performance. From a same-restaurant sales standpoint, Wendy’s reported a growth rate of 3.7% in Q2, which lapped 17.4% growth in the year-ago quarter, translating to a two-year stacked same-restaurant sales growth of 21.2%. The solid performance exceeded the company’s expectations despite a difficult period for the industry, aided by traffic share growth in the US breakfast daypart and menu pricing (8%).

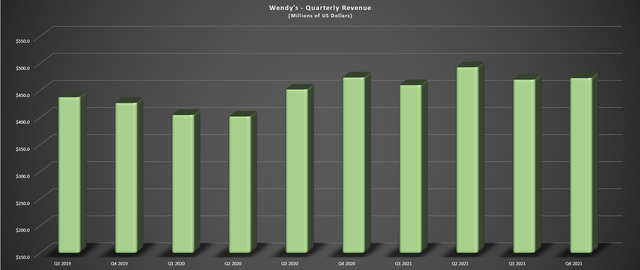

Wendy’s – Quarterly Revenue (Company Filings, Author’s Chart)

Moving over to quarterly revenue, we can see that it was up 9% year-over-year to $537.8 million, which was driven by higher sales at company-owned restaurants with the acquisition of 93 franchised restaurants in Florida and higher royalty and ad fund revenue. Wendy’s noted that it also saw its global digital sales mix come in at 10%, and it has now launched breakfast in Canada, hoping that this will improve profitability in its Canadian restaurant fleet. In the US, its breakfast segment remains strong, and Wendy’s is confident in its goal of $3,000/week in sales, up 10% year-over-year and well above its break-even level of $2,000/week.

Wendy’s Menu Innovation (Company Website)

Unfortunately, although Wendy’s put together solid results during a period of weaker traffic industry-wide (rising gas prices, grocery costs, and mortgage costs), margins did slide sharply year-over-year. This was evidenced by a 580 basis point decline in company-owned restaurant margins year-over-year (14.5% vs. 20.3%). It’s worth noting that these margins were up against tough comps, but they are still down 200 basis points from pre-COVID-19 levels (Q2 2019: 16.5%), despite the benefit of additional pricing, with Wendy’s running at ~8.0% pricing in the quarter.

The company noted that it plans to take additional pricing of 2.0% in Q3 to help combat inflation, with margins pressured by commodity inflation of 19% and labor inflation of 12%. In addition, as we’ve heard from some other brands, there appears to be somewhat of a consensus that turnover rates are improving and inflation may be peaking. This would be good news for the company, which saw a decline in operating profit in the period despite the near double-digit revenue growth. Meanwhile, adjusted earnings per share slid 11% ($0.24 vs. $0.27), impacted by a higher tax rate and higher interest expense.

Overall, this was a solid quarter for Wendy’s, and the company is looking for ways to boost productivity to help claw back lost margins with its recent Global Next Gen design. This will include a delivery pick-up window, dedicated mobile order pick-up, and a galley-style kitchen to increase efficiency, with the kitchen running from the front to the back of the restaurant. According to the company, this will decrease the steps required to complete tasks and allow the crew to slide between positions more easily.

Wendy’s New Restaurant Design (Company News Release)

Given the solid quarter, it’s no surprise that Wendy’s share price rebounded, coupled with the decline in gas prices, which peaked in late June above $5.00/gallon, and improved sentiment for the industry. However, while several other brands might have seen a meaningful improvement in traffic as gas prices took another leg down below $4.00/gallon (easing the pressure on discretionary budgets), it’s possible that Wendy’s might see a negative divergence. This is because Wendy’s has several competitors in the burger category, and value or not, an E. Coli scare might have caused some consumers to take a pass, opting for Burger King (QSR) or McDonald’s (MCD) instead.

A Stunted Traffic Recovery Relative To Peers?

As noted earlier, there were reports of E. Coli potentially linked to Wendy’s romaine sandwich lettuce in mid-August, and the outbreak expanded to six states in September. This led to the CDC providing an Investigation Notice, highlighting that “many sick people reported eating sandwiches with romaine lettuce at Wendy’s restaurants.” The Investigation Notice also stated that six states were believed to be affected, the investigation remained active, and 43 were hospitalized, with 97 total illnesses.

While Wendy’s provided notice on its blog that it was fully cooperating and had removed sandwich lettuce at some restaurants, not everyone reads Wendy’s blog, and even those that did might have preferred to wait a month to ensure everything blew over, similar to the brief Chipotle boycott by some in 2015/2016. In addition, quick service – QSR – eating can often be an impulse decision. Any potential friction (anxiety about a recent E. Coli scare) could lead to some choosing to wait till they get home to eat or simply visiting another QSR brand, with over a dozen other options out there for those craving a burger, and several that also offer value for customers that are looking to spend less than $10.00.

E. Coli Investigation (CDC)

This could be a negative development for Wendy’s at a time when the industry could be seeing an uptick in traffic as gas prices have spent an entire month below $4.00/gallon, increasing consumers’ appetite to dine out. Based on this, I’m less confident in the company’s ability to accelerate system-wide sales in the back half of the year (guidance: FY2022 growth of 6-8%), even with the benefit of a slight increase in pricing. Hence, while many restaurant brands might be able to beat downward-revised earnings estimates, WEN could have difficulty meeting its FY2022 earnings estimates of $0.84 – $0.88, which would require $0.45 in H2 2022 EPS to meet the mid-point.

Earnings Trend

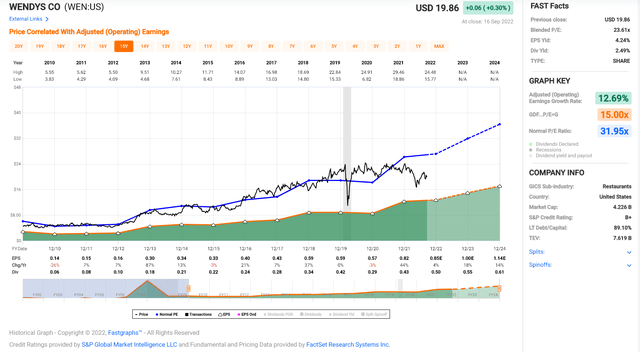

Looking at WEN’s earnings trend below, the company has seen solid annual EPS growth over the past decade, growing annual EPS at a high double-digit compound annual growth rate even with wading through a global pandemic. However, based on more conservative estimates of $0.84, we could see limited growth in FY2022 (2.5% year-over-year), leading to a deceleration in its compound annual EPS growth rate from 16.6% to 14.7% (FY2014-2022).

WEN Earnings Trend (YCharts.com, Author’s Chart)

The good news is that Wendy’s is expected to report record annual EPS growth in FY2023 based on conservative estimates of $0.97, which would translate to a return to double-digit growth year-over-year. However, this would still see its compound annual EPS growth rate sink from ~24% (FY2012-FY2018) to less than 15.0% if it meets these estimates. It’s possible this could lead to some multiple compression vs. the premium multiple the stock has enjoyed over the past decade, especially given the near-unprecedented industry-wide headwinds related to commodity inflation and continued staffing challenges, and elevated turnover for some brands.

Valuation and Technical Picture

Looking at the chart below, we can see that Wendy’s has historically traded at ~32x earnings (15-year average), but this was during a period of accommodative monetary policy, modest wage inflation relative to current levels, and much lower inflation levels in general. This is not the case currently, with a Federal Reserve laser focused on stamping out inflation, multi-decade highs in wholesale food prices, and what appears to be a shift away from the industry with the “Great Resignation.”

Most importantly, though, Wendy’s is now in the spotlight for a negative reason due to a potential linkage to an E. Coli outbreak. These headwinds make it difficult to justify paying a premium valuation for the stock, suggesting that while paying 25x earnings might normally be a buying opportunity, using a more conservative multiple might be necessary to build an adequate margin of safety into the stock. In fact, if we look at Chipotle, the company saw its earnings multiple nearly halved from 51 to less than 28 despite growing its units like a weed (~11% growth) during the period and being one of the industry’s best growth stories.

Wendy’s Historical Earnings Multiple (FASTGraphs.com)

Based on these negative developments (recessionary environment, potential E. Coli linkage), I believe a more appropriate earnings multiple for the stock is 22.4x, a 30% discount from its historical multiple. If we multiply this figure by FY2023 earnings estimates of $0.97, this translates to a fair value of $21.70, translating to a barely 10% upside from current levels. Generally, I prefer a minimum 25% discount to fair value when buying mid-cap stocks, and after applying this discount, this would place WEN’s low-risk buy zone at $16.30 or lower. Let’s take a look at the technical picture:

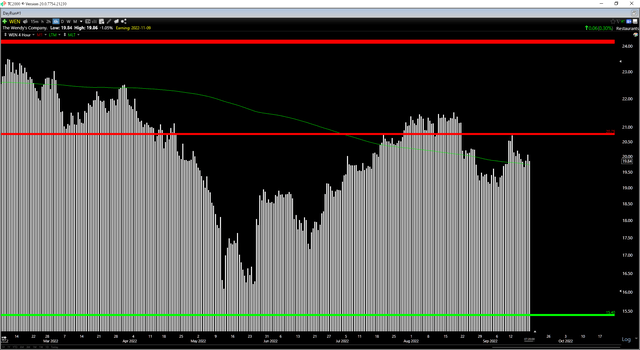

WEN Daily Chart (TC2000.com)

Looking at the chart above, WEN broke below key support at $20.75 earlier this year, a level that has provided strong support since Q2 2020. This was a very negative technical development, given that major support areas often become new resistance once broken, and the next strong support level for the stock doesn’t come in until $15.40. So, despite the sharp decline in the stock from Q1 levels, the reward/risk ratio has deteriorated from a technical standpoint, with $0.90 in potential upside to resistance and $4.45 in potential downside to support.

This doesn’t mean that the stock must decline to $15.40 and undercut its May lows. Still, with the stock wedging into a key resistance after its multi-month rally, the reward/risk is nowhere near favorable. In fact, I generally prefer a minimum of a 5.0 to 1.0 reward/risk ratio to justify entering new positions, and WEN’s current reward/risk ratio comes in at 0.20 to 1.0 from a current share price of $19.85. Therefore, I think there are far more attractive setups elsewhere in the market.

Summary

Wendy’s may have had a decent Q2 report, but its Q3 sales may miss the mark, potentially leading to limited annual EPS growth this year vs. FY2021 levels ($0.82). If the stock were trading at a very attractive valuation, it might suggest that this was priced into the stock. However, with the stock trading at ~24x FY2022 earnings estimates, I don’t see any clear margin of safety here. For investors looking for high-quality businesses trading at a deep discount to fair value, I much prefer Agnico Eagle Mines (AEM), which trades at ~18x earnings with higher operating margins (31% vs. 20%), and a ~4.0% dividend yield.

Be the first to comment