Visage/Stockbyte via Getty Images

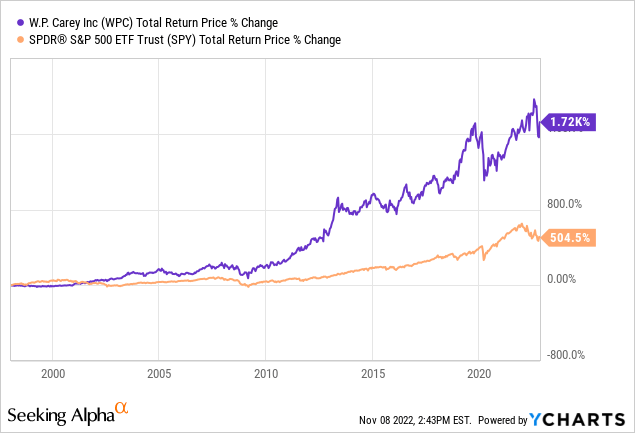

W. P. Carey (NYSE:WPC) is a blue-chip triple net lease REIT that owns a combination of industrial, logistics, essential retail, office, and self storage real estate. It has a phenomenal track record of weathering recessions and consistently growing cash flow and dividends per share, leading to long-term market-beating returns for shareholders:

Given its clear strengths (rock-solid investment grade balance sheet, high quality real estate portfolio that is well-positioned to thrive in a variety of circumstances, and outstanding long-term track record), WPC is one of the safer bets as we head into a widely anticipated economic downturn alongside persistently high inflation. In this article, we will share two important takeaways – one positive and one negative – from the company’s recently released Q3 earnings report and provide our updated outlook for the company.

The Good

While management cited some inorganic growth headwinds on the earnings call as sellers in some segments have proven hesitant to accept higher cap rates, WPC nevertheless raised its 2022 guidance. It raised the midpoint of its expected adjusted FFO per share for 2022 from $5.26 to $5.28 on the strength of inflation-driven same-store rent growth.

While occupancy dipped slightly (20 basis points) during the quarter, it remained very strong at 98.9%. Meanwhile, the acquisition volume momentum remained strong in Q3, coming in at $474.8 million during the quarter and bringing the year-to-date total to $1.3 billion. During Q3, WPC also completed its acquisition of CPA: 18, adding an additional $2.2 billion of assets to the real estate portfolio.

Given that the share price still trades at a meaningful premium to NAV (1.13x) and WPC still has substantial liquidity (including significant recent debt raises at attractive interest rates), it should be able to continue growing inorganically at a pretty brisk pace. When combined with the unique-for-its-industry CPI-linked rent escalators that make up the majority of its rental income, WPC has a pretty exciting growth profile. As management said on the earnings call:

we have the ability to drive higher AFFO growth through our best-in-class contractual same-store rent growth, which reached 3.4% for the third quarter. As current inflation flows through to rents, we expect our contractual same-store rent growth to move even higher in 2023 to between 4% and 4.5% and to continue seeing the benefits into 2024.

Second, we’ve raised well-priced capital and have an exceptionally strong liquidity position. So far in 2022, we’ve raised approximately $1 billion of permanent and long-term capital at attractive prices. We currently have approximately $650 million of untapped equity forwards raised at a stock price averaging in the 80s, and we raised debt capital priced in the mid-3s through our recent private placement Eurobond issuance. Furthermore, our recent upgrade by Moody’s to BAA 1 should enhance pricing on our bonds. And with over $2 billion of total liquidity, we’re confident in our ability to continue investing in appropriately priced opportunities.

Another big positive development for WPC’s growth trajectory is that its acquisition of CPA:18 is actually going better than expected. While we expected that exiting the asset management business (including CPA:18, which was its final large fund) would provide a significant headwind to cash flows per share in the short-term, it actually has not worked out poorly for them at all. As management stated on the earnings call:

we’re benefiting from our recently completed merger with CPA:18, which resulted in better accretion than we initially anticipated, with gains from high-quality real estate AFFO more than offsetting the loss of investment management earnings. CPA:18 net lease assets are well aligned with our existing portfolio, and we expect to realize additional benefits from its sizable operating self-storage portfolio. Given strong self-storage fundamentals, these assets incrementally provide a tailwind to our growth.

The Bad

After Q2, we said that we believed that WPC was still several quarters – if not years – away from meaningful dividend growth acceleration for the following reasons:

- the company’s AFFO per share growth rate has been diluted by substantial equity issuance this year

- rising interest rates are substantially increasing the cost of capital

- WPC still has some upcoming headwinds from leaving the asset management business

- WPC has some major lease expirations coming up

- the stronger U.S. Dollar is weighing on results given that 36% of its portfolio is outside of the United States.

While management commentary on the Q3 earnings call helped to alleviate some of these concerns (such as the asset management business exit), some of them still remain in place.

For example, while WPC is currently not needing to issue new equity given that it still has a significant amount of equity forwards that it can cash in at any time, its cost of capital is still pretty high relative to its cap rates. In Q3, it transacted at an average cap rate 6.4% on external transactions. Meanwhile, when asked about its cost of capital on the earnings call, management said the following:

taking into account the equity forwards that we raised this year or in our ability to issue debt by swapping into euros, maybe factoring in bank debt and some free cash flow that we generate. I mean that could put our cost of capital in the 5s, say.

And on the other hand, if we look at cost of capital exclusively with our current equity trading price and assuming we can only do 10-year bonds through direct issuances either in the U.S. or Europe, and maybe not account for any free cash flow or bank debt, that probably puts our cost of capital clearly in the 6s and higher or lower in the 6s. It’s more dependent on where we’re trading on any given day.

Based on that picture, WPC’s returns on invested capital are clearly getting squeezed to a point where there is not much incremental return being earned on invested capital. If interest rates moves still higher and WPC’s share price does not improve meaningfully, either sellers will have to either start accepting higher cap rates, or WPC will have to pull sharply back on its acquisition pace, which in turn will hurt growth.

Another potential meaningful headwind to cash flow growth – which in turn could prevent them from raising their dividend more aggressively for the foreseeable future – is the fact that the U-Haul assets are still expected to be bought back by the tenant after its lease expires. As long as cap rates remain compressed, U-Haul’s buyback of those properties at an 8-12% cap rate will hurt WPC’s cash flow per share meaningfully. However, if cap rates eventually begin to follow interest rates higher, WPC might be able to reinvest the proceeds in a manner that is not quite so dilutive to earnings after all.

Finally, WPC’s greater than one-third exposure to geographies outside of the United States – primarily in Euro and British Pound geographies – means that when the U.S. dollar is strengthening (as it is now), there is a meaningful headwind to U.S. dollar-denominated cash flows. However, management has implemented a pretty effective hedging technique that it detailed on its earnings call:

regarding currency movements, our dual approach to currency hedging has been remarkably effective in mitigating our risk to the strengthening U.S. dollar: first, overweighting our debt in foreign currencies, primarily the euro, serves as a natural hedge, generating foreign denominated interest expense, which reduces our net cash flow exposure; second, we further reduced the net exposure through low-cost contractual cash flow hedges, typically locking in rates on a laddered approach 4 to 5 years out.

Realized gains on our cash flow hedges totaled $8.7 million for the third quarter and $18 million year-to-date, which appear in the nonoperating income line on our income statement and flow through to our AFFO, materially offsetting the impact of the strengthening dollar. After taking into account hedging, the net impact of foreign currency movements is expected to result in about a 1% decline in our 2022 AFFO per share as compared to our initial guidance at the start of the year. And we would expect our hedging strategy to provide the same level of protection into next year, assuming currency rates remain at or around their current levels.

As a result, while this headwind is still there, a 1% headwind from foreign exchange rates is not too bad at all.

Investor Takeaway

WPC is still in strong growth mode thanks to inflationary tailwinds and a strong acquisition pipeline that is being fueled by WPC’s strong liquidity and access to equity capital at highly accretive prices. This growth momentum should continue moving forward. As the CEO stated:

As current CPI numbers flow through to rents, we expect our same-store growth to move even higher in 2023, and to continue seeing the benefits into 2024

Furthermore, management demonstrated on the earnings call they are working hard to mitigate headwinds to cash flow per share by hedging WPC’s foreign currency exposure, executing above expectations on the CPA:18 asset management exit and property acquisition, raising debt and equity at attractive cost and earning a credit rating upgrade in order to further improve its cost of capital, and patiently scouring the market for higher cap rates on new acquisitions in order to offset WPC’s rising cost of capital.

As a result, we are more bullish than we were previously on WPC’s ability to accelerate dividend growth moving forward. However, we think WPC will still wait at least another quarter or two before accelerating dividend per share growth in a meaningful way as it will likely wait to make sure cap rates are moving higher before doing so. We rate WPC a Buy and continue to view it as an attractive risk-adjusted income investment that also benefits from inflation.

Be the first to comment