Vladimir Zapletin

Last month, AZZ, Inc. (NYSE:AZZ) reported Q2’23 earnings results that missed Wall Street expectations. The miss sent the company’s stock tumbling nearly 23% on the release. Despite the miss, the quarter was by and large a success. Demand for the company’s value-added services remains intact and the company made solid progress towards its debt reduction goals. The stock has since recovered all that it lost from the post-earnings sell-off but continues to trade well below its intrinsic value. Therefore, AZZ maintains its Strong Buy rating with a $68/sh price target.

Q2’23 Results

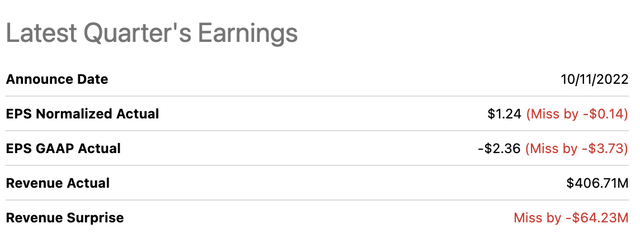

AZZ reported revenue of $406.7m in the quarter, which was $64.2m less than estimated by the Wall Street 2 analysts covering the firm. Adjusted earnings also missed by 14¢:

The top and bottom line miss was unsurprising given the transformative M&A transactions taking place in the quarter. Q2 incorporated the first full quarter results of AZZ’s Precoat Metals acquisition in addition to an accounting reclassification of AZZ’s Infrastructure Solutions (“AIS”) to discontinued operations due as part of its planned divestiture. These two transactions made it extremely difficult to forecast the P/L.

Setting aside the market’s knee-jerk reaction, demand for AZZ’s services remains robust and margins are strong. Metal Coatings saw sales grow 28% y/y to $165.8m, with organic demand up ~22% y/y. Operating margin for the segment remained historically high at 27.1%. Precoat also reported a strong quarter with sales of $240.8m and a 15% operating margin; although no baseline was presented for comparison.

Based on Q2 results, the anticipated benefits expected to result from the dual transactions appear intact. One of the primary drivers behind the Precoat Metal acquisition and AIS divestiture is to deliver shareholders a higher margin business going forward. Historically, AZZ carried an adj. EBITDA margin of ~15%. Through these two transactions, AZZ forecasts a go-forward EBITDA margin closer to 20%. Q2 results confirm this expectation. Metal Coatings and Precoat Metals combined for a 25% EBITDA margin. Although margins will decrease in the coming quarters due to seasonality and ongoing labor constraints, it is reasonable to assume AZZ will maintain higher margins into the future.

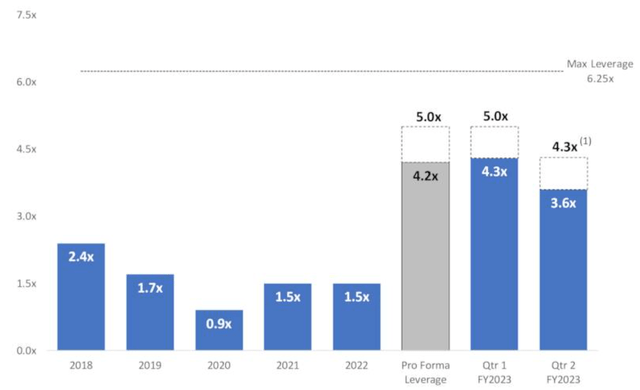

Debt Reduction

In the quarter, AZZ demonstrated its commitment to deleverage the company’s balance sheet after its Precoat Metals acquisition. In Q1’23, AZZ’s debt jumped from $226m to $1,594m primarily from the $1,300m cost of the acquisition. In taking on the debt to fund the transaction, management stated its intention in the quarters to follow, it would focus on reducing debt to achieve a leverage ratio between 2.5x to 3x. In Q2, the company reduced its leverage ratio from 4.3x down to 3.6x:

AZZ Q2’23 Earnings Presentation

The reduction was mostly driven by from conversion of a $240m note into preferred shares, however, $116m came from cash the company’s cash reserves. At quarter-end, AZZ had $1,237m debt outstanding. As the company further reduces debt, the benefits from which will inevitably inure to the value of AZZ’s equity owners.

One additional point to mention is that AZZ smartly entered into a fixed-rate swap on $550m of its term loan. The Fed has not indicated a slowdown in rate hikes in the immediate term, making the swap a good maneuver to hedge borrowing costs in the near term.

Conclusion

Despite AZZ’s share price volatility, the company remains on track to deliver sustainable sales and higher margins into the future. Therefore, the company’s Strong Buy is reiterated with a price target of $68/sh.

Be the first to comment