Sundry Photography

An approach I like to follow during tough market environments is to monitor stocks that are showing relative strength compared to major indexes, which can be a symptom of both resilience of the stock as well as a high-quality business underneath. I believe Arista Networks, Inc. (NYSE:ANET) can be included in this group. The supplier of datacenter hardware infrastructure saw its share price decline year-to-date 22.6%, on par with the S&P 500 (down 23%) but much better than Nasdaq 100 (down 31.3%). It also maintained a premium valuation compared to peers, which spells confidence by the market in management’s ability to weather the storm.

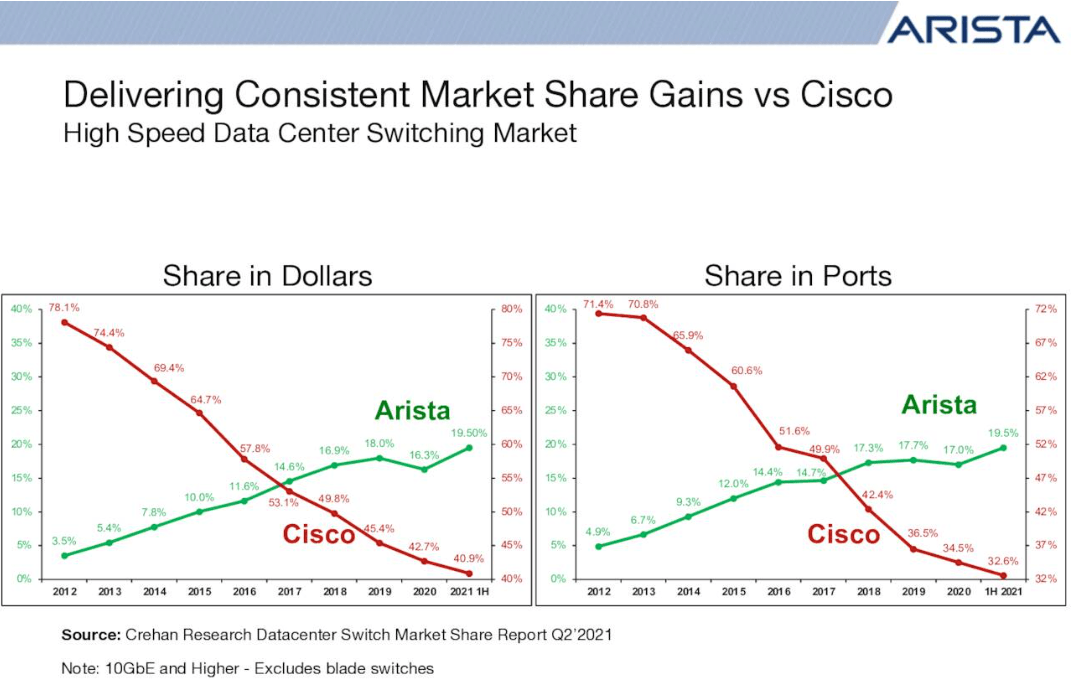

Over the years, Arista has definitely earned such confidence thanks to incredible performance. After entering the public market in 2014, the company’s stock rose almost 700%, which is an incredible accomplishment. What is even more intriguing is the company’s future: Arista has managed to build an impressive business which seems to consistently take market share from the incumbent Cisco Systems (CSCO) and competitors such as Juniper Networks (JNPR) while maintaining sky high margins and consistent profitability. I think the business can continue to perform over the years as it is better equipped than competitors to fulfil customers’ demand for programmable, modular hardware in the ever-so-complicated world of cloud datacenters.

The growth is far from over

Arista primarily competes in the datacenter market for 10 Gigabit Ethernet and above, and is successfully riding a generational tailwind in the widespread adoption of cloud computing by all kinds of firms all over the world. This monumental shift from in-house datacenters to the cloud has seen the emergence of mega winners such as Amazon Web Services, Microsoft Azure, Google Cloud and the likes. From the suppliers’ point of view, this also meant that the traditional legacy IT providers of which Cisco has been a generational champion have seen tremendous pressure over the past few years from newcomers such as Arista.

Arista Networks Annual Report 2021

The main difference between a traditional datacenter and what Arista defines as “Cloud Networks” is that the traffic generated by the latter results in orders of magnitude higher network bandwidth, while the applications installed on the cloud servers also needs to be accessed from anywhere, by any type of devices (computers, IoT devices, smartphones etc.). Legacy infrastructure also generally runs with proprietary protocols that are hard to integrate with third-party applications typical of the new cloud world and tend to force customers to be locked-in with a specific vendor. Arista’s solution is an operating system called EOS which was designed to be programmable and modular from the get go. This allowed the company to increasingly adapt their software (and hardware) to the ever-changing needs of their customers.

Arista Networks Annual Report 2021

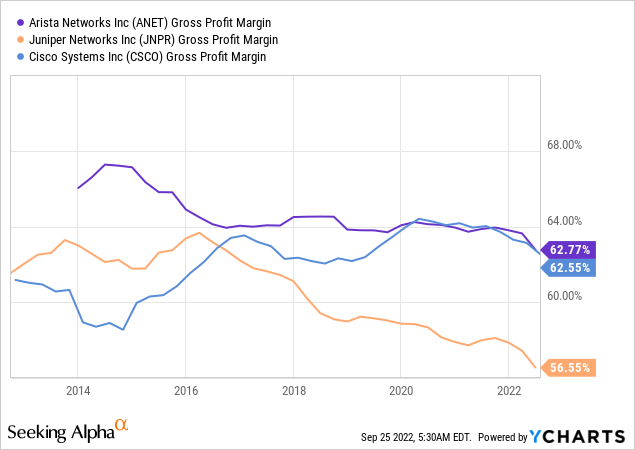

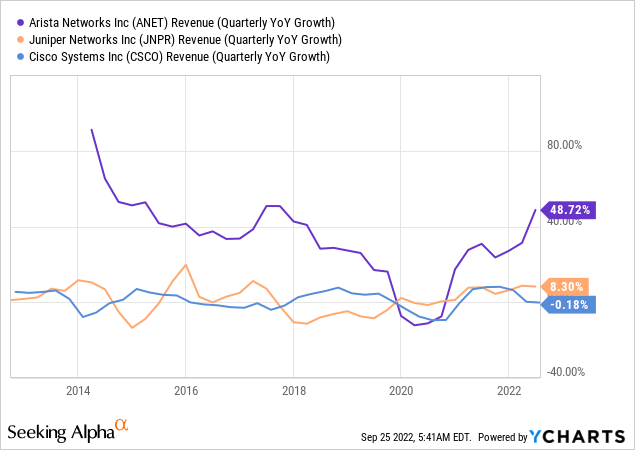

The company released its latest earnings report on Aug 1st, and the results were nothing but stellar. The company saw its revenue rise 48.5% YoY and 20% sequentially to $1.05 billion, while Non-GAAP EPS of $1.08 easily beat Wall Street consensus by $0.16. The company, like everybody else, is navigating a complicated global environment which indeed took a toll on the company’s gross margin: GAAP gross margin came in at 61.2% for the quarter, down from 63.1% in the first quarter and from 64.2% in the same period last year. Nevertheless, management kept a close eye on operating expenses and GAAP operating margin actually expanded to 34.4% from 31% for the same quarter a year ago, a good sign that CEO Jayshree Ullal and her team are able to cautiously lower spending during uncertain times.

The metrics show how the company has carved out for itself a growing leadership position thanks to very impressive margins. Albeit partially eroding, Arista has always boasted the highest gross margins compared to competitors currently matched by Cisco.

YCharts

The evident difference between the three companies, however, is that Arista is still in growth mode, as shown on the revenue growth side.

YCharts

Customer concentration and macro environment pose some risks

It is important to note that Arista is operating in a naturally cyclical market. Due to its relatively small size, the company has achieved constant high growth that managed effectively to masquerade a seasonality that is intrinsic to the datacenter infrastructure market. Now that the company is entering a more mature phase of its journey (Arista has recently reached the milestone of $1 billion in quarterly revenue) this issue might at times be more apparent. For example, in Q3 2019 Arista warned that one of its main customer was pausing its IT spending quite suddenly for internal reasons not connected to Arista itself, and that it would affect the company’s growth prospects in the near term. The stock tanked over 25% that day, and the company indeed posted few disappointing quarterly results in a row for the first time, spooking some investors into thinking that its growth story was over. The company, however, kept insisting that it was a temporary issue and that a new spending cycle from its cloud titan customers would eventually begin. Time proved management right as ANET during 2021 and beyond resumed its blistering growth as the company’s main customers restarted their IT spending cycle.

Any investor in the company should be well aware that the same will inevitably happen again and the stock price might therefore take a beating. The concentration risk was also highlighted by the company in the last Annual Report issued in February this year: for the year ended on 31 December 2021, there was one customer who represented 15% of total revenue; for the same year, there were also three customers who represented 37%, 13% and 12% of total accounts receivable. It is entirely possible that one of these customers could at some point pause their spending and this will generate temporary material headwinds for the company in terms of a slowdown and potential negative revenue growth.

Moreover, despite excellent recent results there is still material risk in the current economic macro conditions. In the last earnings call management has highlighted how in the first half of 2020 the business has achieved around 40% of revenue growth amid a very complicated supply chain environment due to the COVID pandemic. Inflation and higher costs took a dent on gross margins but at the same time the company navigated optimally the difficult quarter and even managed to expand operating margin YoY.

During the call, management was asked to give more color regarding the next quarter, as their original guidance for FY2022 was for 30% YoY growth, but given that the company already had achieved 40% growth in the first half that could mean a strong declaration in the near future. Management response:

We certainly feel good that the demand and our commitment and execution has gone well, well, well north of the 30% we guided in November last year, but one quarter at a time is still our philosophy.

So, the management still sees wild uncertainties and does not feel comfortable in making adjustments to full year guidance. However, based on what they can see until now, the company seems well poised for beating the 30% full year revenue growth previously guided.

Valuations and key takeaway

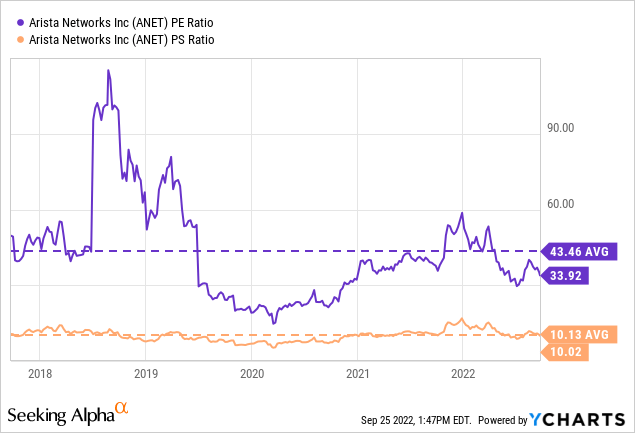

Data compiled by Seeking Alpha shows how Arista is currently trading clearly at a premium valuation. The stock is valued now at Non-GAAP Forward P/E of 27 and Forward P/S of 8.23. As shown before, this is hard to compare to competitors such as Cisco or Juniper Networks as both companies have a much different growth profile. Therefore, what I generally prefer to do is compare a stock valuation to its historical average. Both current P/E and P/S are now running below the historical average over the past 5 years.

YCharts

Although this does not indicate an immediate discount, it does prove how the market has generally agreed to assign ANET with a premium valuation over the long term. Naturally things could fluctuate over the short term especially due to high customer concentration, but assuming that the company will maintain its leading technological edge it is entirely possible that it will keep growing market share at the expense of legacy providers while also innovating and expanding its TAM.

Furthermore, I built a quick discounted cash flow (“DCF”) model for a 10% annual discounted rate. ANET in the past 5 full years (2017-2021) has grown free cash flow on a CAGR of 11.4%. By projecting into the next 5 years, a more conservative 10% growth and the following 5 years 8% growth, with a terminal value for P/FCF of 30 (below the historical average of 34 in the past 5 years), the model returns a valuation of $33 billion, in line with the current market cap.

The current price I believe is a decent entry point for long-term investors. If for whatever reason the stock price should drop in the near future while the thesis is still on track, that would be the time to accumulate more.

Be the first to comment