Michael Vi

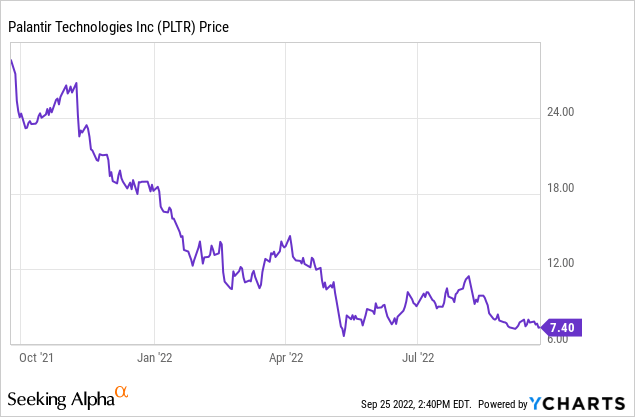

After once trading above 30x forward revenue, Palantir (NYSE:PLTR) has seen their stock tumble over 60% so far this year as investors have rotated out of growth technology stocks and into more defensive positions.

The company continues to perform well operationally, however the fears around a potential global recession, rising interest rates, and PLTR’s revenue growth decelerating have pushed the stock and sentiment lower.

In early August, the company reported an overall good quarter, but lowered growth expectations for the year given some uncertainties around their Government segment, which represent over 50% of total revenue. Given that government budgets and spending can be somewhat erratic, larger deals have been known to slip out of current quarters and the buying decisions of governments can get stuck up in the bureaucratic system.

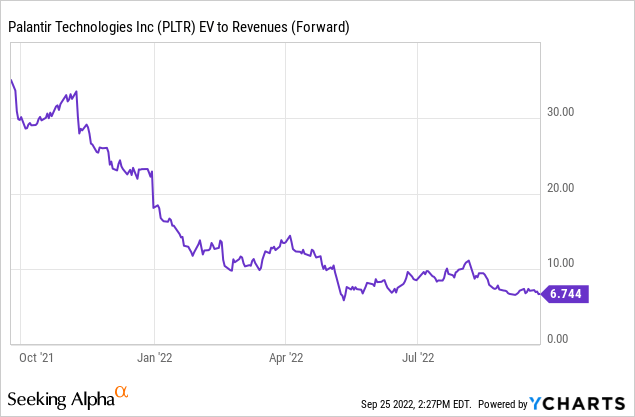

With the stock currently trading at just under 7x forward revenue, valuation has significantly pulled back. However, I believe this pullback has been largely justified by two main factors.

First, the company’s historical valuation had been well above 20x forward revenue for most of their public life and we are not currently in that type of reality any more. Macro conditions have deteriorated and interest rates continue to rise, which ultimately have pushed down valuations across the technology sector.

And second, the company’s revenue growth has continued to decelerate into the low-20’s and their previously stated target of 30%+ revenue growth through 2025 now appears to be highly at risk.

Given the current volatile environment and investors lack of willingness to step in on high-valuation names, I remain on the sidelines for now and will wait for a better entry point. I believe the company could be in for a few volatile quarters, especially as the Government business enters into some growth challenges. And while the Commercial business growth has remained very strong in recent quarters, growth is starting to hit more difficult comparisons, making current growth sustainability more challenging.

Financial Review and Guidance

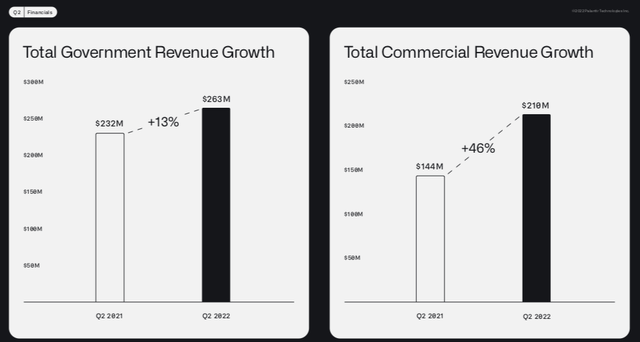

During the company’s most recent quarter, revenue grew 26% yoy to $473 million and while this decelerated from the 31% yoy growth in Q1, revenue during Q2 did still beat consensus expectations for $472 million. Admittedly, the revenue beat was a little disappointing as investors are more accustomed to larger revenue beats.

However, this quarter was a tale of two segments, with the Government segment underperforming and the Commercial segment continuing to grow nicely.

During the quarter, Government revenue only grew 13% yoy to $263 million, which decelerated from the 16% yoy growth seen last quarter and 26% yoy growth in Q4. Management commented on some near-term headwinds to revenue growth, largely due to the push-out in US government deals.

On the other hand, Commercial segment revenue continues to remain strong at 46% yoy to $210 million. Given the stronger growth seen in the Commercial segment, it would not be surprising to see this segment represent the majority of revenue in the coming quarters.

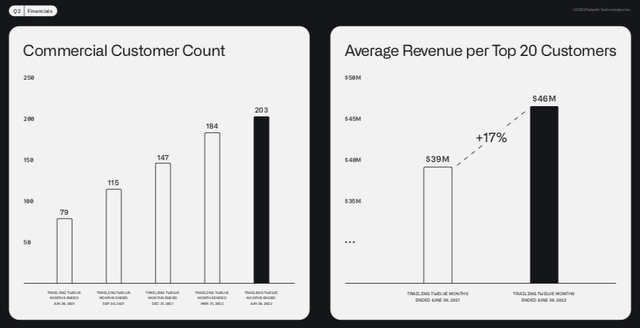

One of the biggest drivers of the company’s recent strong growth has been their ongoing penetration within their existing customer base as they move further into the Commercial segment. While the Government segment tends to have very sticky contracts, Government deals can be pushed out from quarter to quarter as governments tend to operate vastly different than enterprises.

Net dollar retention was 119% during the quarter and total customer count grew 80% yoy. In other words, PLTR is benefitting from both increased penetration in existing customer base as well as ongoing new logo expansion.

This is further seem as the company’s average revenue per top 20 customers grew 17% yoy, which demonstrates that existing customers continue to spend more with Palantir.

One of the more interesting comments made during the quarter was management’s perception of the competitive environment. While it’s natural for companies to see some attrition each quarter, Palantir noted that they have seen customers return to Palantir after leaving for competitor products.

A related development is that we are seeing former customers, including some of the world’s largest transportation, banking, and retail enterprises, return to our platforms in increasing numbers after periods of experimentation with other data integration and analytical platforms and approaches.

These customers are returning because they have tried other options and those options have failed. The product has brought them back.

This also goes to show that Palantir’s product is a true competitive differentiator and the many years of R&D investments have paid off. Yes, I continue to expect some level of attrition from the customer base, but during more challenging economic conditions, companies are going to move towards best in class products.

However, despite the strong underlying trends, especially within the Commercial segment, management lowered their guidance for the full year.

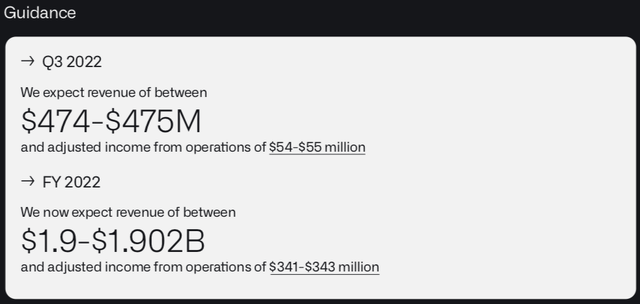

For Q3, the company is expecting revenue of $474-475 million which reflects only 21% yoy growth. While 20%+ growth is still admirable during a challenging macro period, this does reflect ongoing growth deceleration compared to Q2 revenue growth of 26% yoy.

Additionally, full-year revenue guidance was lowered to $1.9-1.902 billion, or 23% yoy growth.

Across government and commercial, the opportunity in front of us is enormous, which makes the revised near-term outlook, all the more disappointing. It doesn’t come close to representing our ambition and the opportunity before us.

While the timing of large contracts in government can be frustrating, the underlying requirements and needs are enduring. It’s worth noting that our revised guidance excludes any new major U.S. government awards.

At the same time, we have seen the opportunity presented by this environment before. As organizations around the world face more pressure and experience more pain, there will be a slowdown in the rate of spending and lengthening of sales cycles, but it will also reveal gaps in enterprises operations. Gaps our software can solve.

In the short term, this means less revenue now. But on longer time horizons, it accelerates our business. The global financial crisis, ISIS attacks in Europe, the COVID pandemic, through each upheaval, we emerged substantially stronger by investing in our customers ahead of revenue and delivering results in days, not months.

To no surprise, management was disappointed with the lowered guidance metrics, however, they remain confident in the long-term growth opportunity. Noting that the government contracts can be a little volatile, the company also commented that the current challenging environment may actually accelerate their business over the long-term as governments look to use big data to make better, more accurate decisions.

However, it is worth noting that the company withdrew their commitment of 30%+ revenue growth until 2025, which I believe adds an additional risk factor over the coming quarters.

Valuation

Valuation continues to be the challenging part for the company. With the stock down almost 40% since the beginning of August and now down 60% so far this year, investors have clearly pivoted away from high-valuation technology companies.

The fear of rising interest rates and the uncertain macro environment has caused many investors to rotate into more defensive positions, which generally do not include technology companies trading at premium valuations.

Currently, valuation is just under 7x forward revenue and while this is significantly down from the company’s >30x forward revenue multiple seen in late 2021, current valuation does remain at a premium.

Admittedly, relative to other fast-growth technology companies, PLTR’s revenue growth of 20%+ and operating margin approaching 20% is a great financial combination to see. And while there are many other stocks trading at higher valuations, I continue to believe that the current macro environment does not lend itself well to high-valuation companies.

Combined with the Government segment facing some headwinds around contract timing and spending slowdown, I believe the company may continue to report decelerating revenue growth over the coming quarters.

The fear around revenue deceleration and a high-multiple stock facing rising interest rates does not sound like a great set-up in the near-term. While I remain bullish around the company’s fundamentals and long-term opportunities, I have moved to the sidelines for now and will wait for a better entry point.

Be the first to comment