anatoliy_gleb/iStock via Getty Images

Introduction

Huntsman Corporation (NYSE:HUN) is a chemical company that mainly specializes in the production of polyurethane. Like all chemical companies, the shares have been penalized on the stock market because profits have been adjusted downwards due to higher energy prices in Europe.

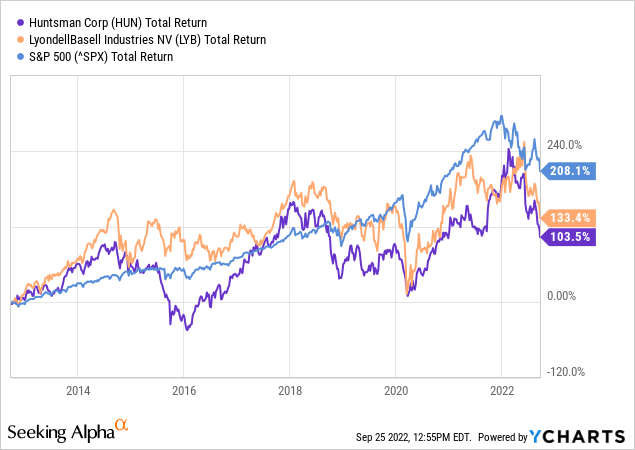

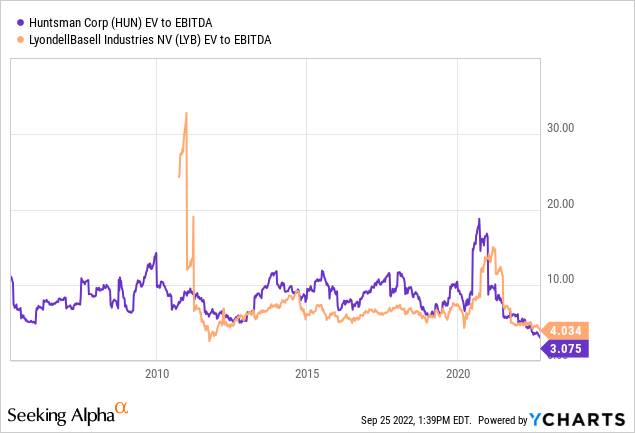

Like Huntsman, LyondellBasell (LYB) produces polyurethane, among other things, and the share prices of both companies are almost in line. Huntsman’s 10-year total return is somewhat lower than LyondellBasell’s. And what we can clearly see from the chart below is that both chemical companies offer good buying opportunities when trading low.

Both Huntsman and LyondellBasell stocks appear to be trading low, but I have the stocks on hold as there are no growth catalysts. Huntsman’s management is a good capital allocator, but the higher energy costs in Europe, the lower demand, and the COVID lockdowns in China are reasons to hold back with purchases. When there is a positive outlook, I will consider a position in Huntsman.

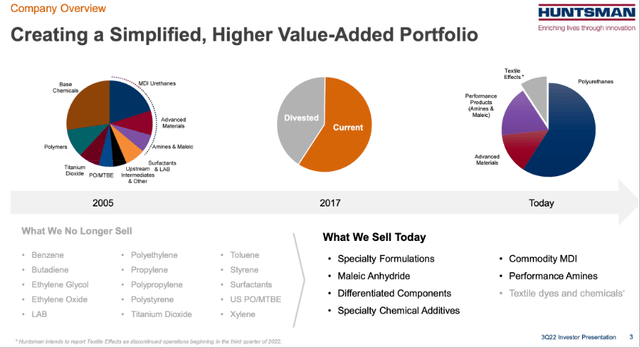

Company Overview

Huntsman mainly specializes in the production of polyurethane. Polyurethane is mainly used as an energy-saving insulation material, lightweight and performance material in the automotive industry, comfort foam for bedding and furniture. It is also used as an elastomer in shoes by companies such as Nike (NKE).

Company overview (2Q22 Investor Presentation)

The Polyurethane market is expected to grow 3.6% from 2022 to 2030. Main growth catalysts are the sustainability of homes and buildings, and the growth in demand for cars.

Quarterly Earnings Were Disappointing

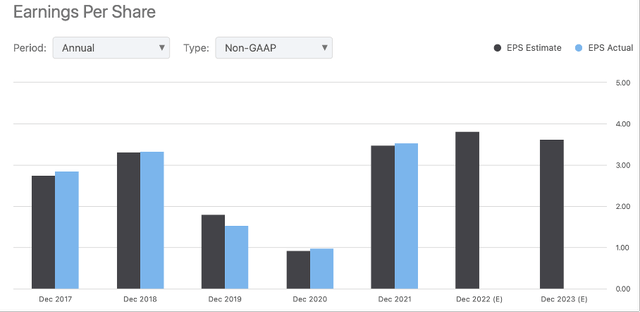

Huntsman has remained profitable in recent years, even during the coronavirus crisis. According to the SA HUN Ticker Page, 11 analysts have revised earnings forecasts downward and expect earnings per share growth after 2024.

Analysts have lowered their earnings forecast after Huntsman released their quarterly update. Huntsman lowers their third quarter EBITDA outlook to $260 – $280 from $310 – $355 excluding EBITDA effects from the sale of Textile Effects division. This is due to higher energy costs in Europe, lower demand for Polyurethanes and Performance Products, and COVID lockdowns in China. Management explains that the United States is their resilient market, but they are experiencing headwinds as residential housing has slowed down.

As a result, Huntsman is further optimizing their costs and expected an annualized run rate of $170M by year-end. They evaluate further cost reduction and import products from their facilities from the United States into Europe.

Selling Textile Effects Business Group For A Great Price

Huntsman has agreed to sell its Textile Effects Business Group to Archroma for $718M. This division had annual revenues of $772M and an adjusted EBITDA of $94M for the past 12 months ending June 30.

The Textile Effects business is an international player in the production of textile dyes and textile chemicals to improve textile colors and improve fabric performance. In 2021, this business segment accounted for about 10% of revenue, and the adjusted EBITDA margin was 7%.

|

2021 |

Revenue |

Adjusted EBITDA |

EBITDA-margin |

|

Polyurethane |

$3,584 |

$472 |

13% |

|

Performance Products |

$1,023 |

$164 |

16% |

|

Advanced Materials |

$839 |

$130 |

15% |

|

Textile Effects |

$597 |

$42 |

7% |

It is a strategic move by Huntsman to separate the Textile Effects business segment from their core businesses, as the adjusted EBITDA margin of their other segments is more than twice as high. This benefits Huntsman’s profitability.

The Textile Effects business segment is dependent on the textile market, which is often volatile in times of economic recession. Sales from this segment decreased by 22% year-on-year in 2020 during the corona pandemic. Adjusted EBITDA fell by 50%, the strongest decline of any of Huntsman’s business segments.

Huntsman’s management is a good capital allocator to sell their least profitable and volatile business segment at a price higher than the price Huntsman is currently quoted in the market. Huntsman’s EV/EBITDA ratio is 3.1 and the Textile Effects business is being sold at an EV/EBITDA ratio of 8.2. A good deal.

Dividends And Share Repurchases

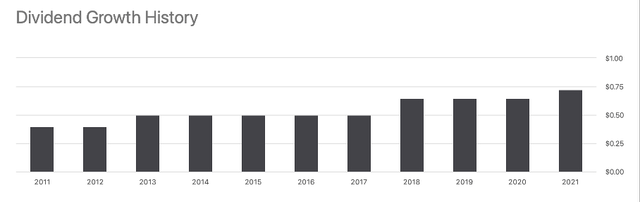

Huntsman’s dividend has grown an average of 6.2% over the past 10 years, with a dividend yield of 3.6%.

Dividend growth history (SA HUN Ticker Page)

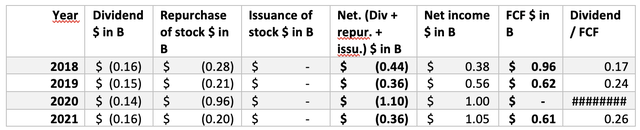

The dividend yield is well backed by their free cash flows and net income. Their dividend payout/FCF 0.26 over 2021 and 0.65 over 2019.

Management buys back Huntsman’s own shares, reducing the number of shares outstanding and increasing the dividend per share. Over 2021, the buyback yield was a solid 4.1% and the stock rose through February 2022.

Cash flow highlights (SEC filings and author’s own calculations)

The share repurchase program continued into 2022 and this year management has repurchased $500 million worth of shares, more than in previous years. However, the share price has fallen since.

Nearly 90% of the outstanding shares are held by institutional investors, only 4% by the public. If institutional investors reduce their position in Huntsman, this has major consequences for the share price. It is important to follow the institutional investors closely. Morningstar has a listing of Huntsman’s ownership.

Valuation Metrics Show Huntsman Is Attractively Valued

Huntsman has historically been valued very low by EV/EBITDA metrics. Based on this metric, Huntsman is rated more attractively than LyondellBasell, which I wrote an article about earlier. The chemical sector is experiencing problems due to high gas prices and a shortage due to Russia no longer supplying gas.

JPMorgan downgrades Huntsman because its dividend yield is lower than Dow and LyondellBasell. Huntsman dividend payout ratio is on the low side (2021 dividend payments/FCF = 26%), so I don’t see this as a worthy argument as they can easily increase their dividend.

Huntsman is feeling pressure on profit margins due to high energy costs in Europe, and reduced demand in their business segments, and COVID-related lockdowns. Therefore, I believe the stock will continue to be under pressure, and consider a position when earnings expectations are positive.

Currently, I think LyondellBasell is a better choice to invest in. Their PO/TBA project will deliver significant cost savings for the production of polyurethane and clean-burning oxyfuels. I see this as a growth catalyst. Both stocks are attractively valued, but I am more positive about LyondellBasell. The market can undervalue or overvalue stocks for long, the former is true for both chemical companies. When there are growth catalysts in sight, I expect the stock to rise sharply. Huntsman is a stock to watch closely.

Conclusion

Polyurethane is a material that can be found everywhere, as an energy-saving insulation material, lightweight and performance material in the automotive industry, as comfort foam for bedding and furniture, but also as an elastomer in shoes such as Nikes. Taking energy-saving measures, together with making houses and buildings more sustainable, is a hot topic. The polyurethane market is expected to grow by 3.6% between 2022 and 2030.

Due to high energy costs in Europe, lower demand and the COVID lockdowns in China, Huntsman is reducing its EBITDA outlook for the third quarter. Huntsman further optimizes their costs and imports products into Europe from production facilities in the US. Huntsman’s management is a good capital allocator as they have sold their least profitable and volatile Textile Effects business at a relatively high price (EV/EBITDA of 8.2), while Huntsman is currently trading at an EV/EBITDA of only 3.1.

Management is shareholder friendly by paying out dividends and buying back shares. The dividend has increased by an average of 6.2% per year over the past 10 years. The dividend yield is currently 3.6% and the 2021 buyback yield was 4.1%. This year, Huntsman is repurchasing a larger dollar value of shares than was the case in 2021.

Huntsman is trading at an attractive stock valuation, but I don’t see any growth catalysts for the foreseeable future. Shares can be traded at a low valuation for a long time, and that is why I am keeping the stock on hold. When there are growth catalysts, the share can rise sharply.

Be the first to comment