Chip Somodevilla

Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) has made aggressive investments in energy businesses in recent years. In 2022, he has stepped on the accelerator with his aggressive purchases of Occidental Petroleum (OXY) shares, bringing his stake in the energy exploration and production company to a whopping 20%. On top of that, he now has the necessary regulatory approval to increase his ownership stake to 50%.

For those – like us – who have immense respect for Mr. Buffett’s track record and sit up and notice when he backs up the truck on a sector like he has just done with energy, it is tempting to follow him in buying shares of OXY. However, there are also those who feel like they are paying a premium since the market has already priced in Berkshire’s growing interest in the company, especially when there is so much value to be had in the broader energy sector. Instead, it might simply be tempting to bet on energy in general by purchasing a popular, fairly low cost, and highly liquid ETF like the Energy Select Sector SPDR ETF (NYSEARCA:XLE).

However, as easy and tempting as XLE is, we believe it is not the best bet for income-minded investors, especially in the current environment. In this article, we will share two big reasons why we do not favor XLE as well as where we are investing instead in order to capitalize on the attractive values in the energy sector.

#1. Lack Of Diversification

Over 43% of XLE consists of two companies: Exxon Mobil (XOM) and Chevron (CVX). On top of that, its top 10 holdings comprise 76.3% of the total ETF, with the remaining 14 only making up 23.7% of the ETF. As a result, it really does not offer that much value beyond buying just XOM, CVX and perhaps a couple of other of its top holdings. That way, you can just skip the management fee and actually know fully what you own.

#2. Significant Commodity Price Volatility

A second big reason to avoid XLE is that its holdings are primarily engaged in exploration and production of energy. As a result, they are highly leveraged to the price of energy. While this was great earlier this year when prices were sky-high, the fund lost nearly 7% of its value in a single trading day last Friday as the price of oil cratered.

However, much more important than the volatility of the stock price (after all, as income investors, we are not concerned at all with short-term volatility other than to take advantage of Mr. Market’s occasional generosity by paying too much for one of our holdings or offering us a stock at too cheap of a price to resist) is the fact that these companies’ fundamentals take a big hit when energy prices plunge. As a result, if energy prices plunge dramatically as they did in the wake of the COVID-19 outbreak and energy price war between Russia and Saudi Arabia and/or remain in a rut for an extended period of time, these companies will suffer significantly. The result is that they may have to cease dividend growth or even slash or eliminate their dividend payouts. In a worst-case scenario, some heavily leveraged businesses/higher-cost producers may undergo financial distress and suffer permanent impairments or even bankruptcy.

A classic example of this was Vermilion Energy (VET). It was paying out very attractive dividends and its management doubled and even tripled down on the safety of its payout, but it ultimately had to eliminate its payout entirely in the wake of the COVID-19 outbreak. While it has restored its dividend to some degree, it is now on a quarterly basis instead of a monthly basis as it was previously and is also at a far lower level than it was before COVID-19. It will likely be a long time – if not forever – before the payout is fully restored to its pre-cut level. This is simply an unacceptable outcome for income investors, who rely on sustainable if not growing dividend payouts to build their passive income over time.

Ultimately, if you are going to invest in the energy exploration and production space as an income investor, you must insist on investing only in the highest quality names with stellar balance sheets and proven histories of growing and sustaining their payouts through good times and bad. Again, instead of buying XLE, just buy XOM and/or CVX.

What We Are Buying Instead

However, we believe investors can do even better, especially as we enter increasingly treacherous economic waters. Instead of buying XOM or CVX – which offer good, but not great, dividend yields of ~4% – we believe income investors will do much better in the energy sector by investing in midstream (AMLP) blue chips like Enbridge (ENB) and Enterprise Products Partners (EPD). Both of these businesses have stellar balance sheets and have incredible track records of growing their payouts through good times or bad.

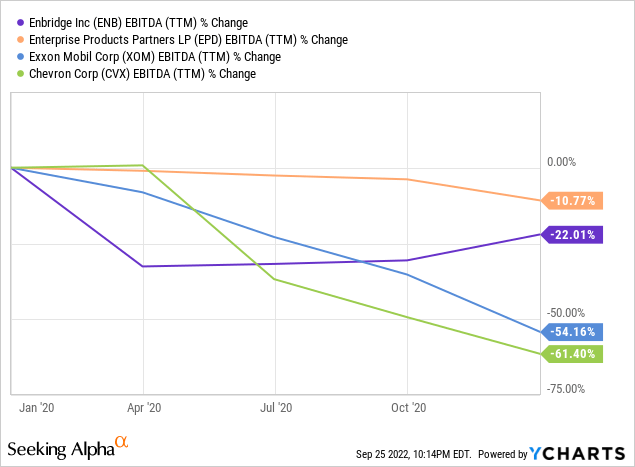

Even better, however, is the fact that both businesses have much more stable business models than XOM and CVX and have proven to weather macroeconomic headwinds better. For example, during the COVID-19 energy crash, EPD and ENB both weathered the crash far better than XOM and CVX did:

On top of the greater defensiveness and cash flow stability, EPD offers an 8.3% forward distribution yield and ENB offers a 7.1% forward dividend yield, giving investors a 75%-100% higher starting income than if they were to invest in XOM or CVX. Moreover, EPD and ENB both are delivering mid-single-digit payout growth per year and are expected to continue doing so moving forward, putting them on a similar payout growth rate trajectory as XOM and CVX.

As a result, income investors are poised to generate vastly superior current income with less downside risk and similar income growth potential with the blue-chip midstream businesses relative to investing in XLE or even XOM and CVX.

Investor Takeaway

Instead of buying XLE in the current environment, we believe income investors are better served by investing in the blue-chip main components of the fund. Better yet, we think investing in blue-chip midstream businesses like EPD and ENB will get them even further.

At High Yield Investor, we have skipped over the E&P portion of the energy sector entirely and instead have purchased investment grade midstream businesses hand-over-fist, with our over 20% allocation to the sector in the Core Portfolio in 2022 helping to drive our significant market outperformance.

Be the first to comment