BernardaSv

Article Thesis

Microsoft (NASDAQ:MSFT) is a very high-quality company with growth tailwinds that seems poised for compelling total returns in the long run from the current level. And yet, famous short seller Hedgeye recently recommended Microsoft as a compelling short idea. I do not believe that MSFT is a great short pick at current valuations, as I will lay out in this article, and I do believe that shorting Microsoft could be a money-losing idea. Both from a valuation perspective and from a business-quality perspective, there are way better short ideas available for those that are interested in shorting individual stocks.

One Of The Highest-Quality Companies In The World

I do believe that Microsoft can be described as a company of excellent quality. This belief is based on several factors. The first one is Microsoft’s excellent balance sheet. As one of just two companies in the world, it holds an AAA credit rating, the other one being Johnson & Johnson (JNJ). In other words, rating agencies believe that a Microsoft default is less likely than a US government default, showcasing the exceptionally low financial risks for Microsoft.

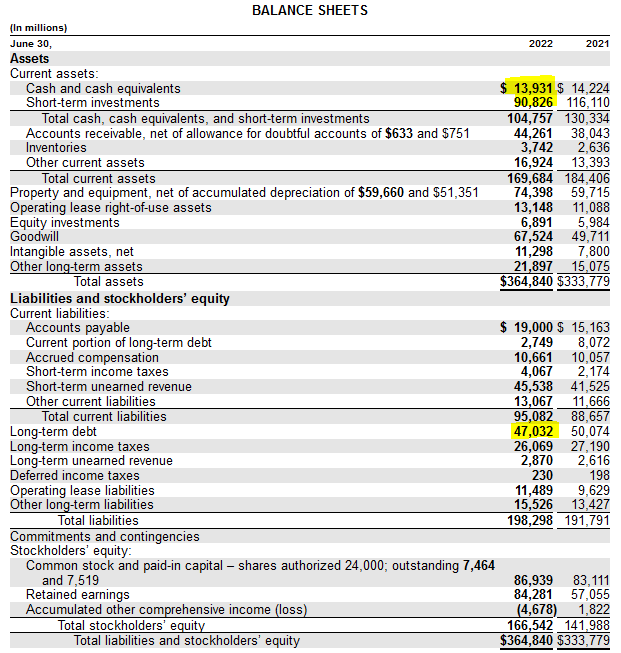

Microsoft 10-K

The company holds a net cash position of $58 billion, as we can see in the above excerpt from Microsoft’s most recent 10-K. That is equal to about 4% of the company’s current market capitalization, which is a much stronger cash balance compared to what most other companies operate with.

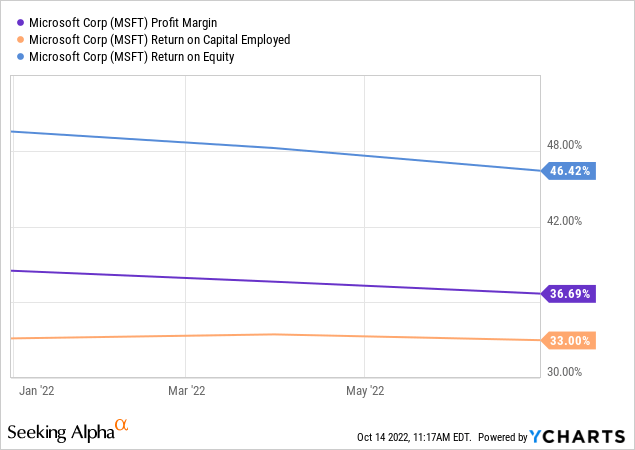

Microsoft has many other strengths on top of that, however. Its returns on capital and margins are excellent, for example:

Microsoft’s net profit margin stands at a very high level of 37%, which has several advantages. First, it means that Microsoft will earn a large amount of money on incremental sales, meaning that business growth is highly profitable for investors over time. On top of that, the very high profit margin protects Microsoft from downturns. If inflation (e.g., for employee compensation) were to hurt Microsoft’s profit margins by a couple hundred of base points, the company could easily stomach that. A company operating with low profit margins would see its net profits get devastated in the same scenario.

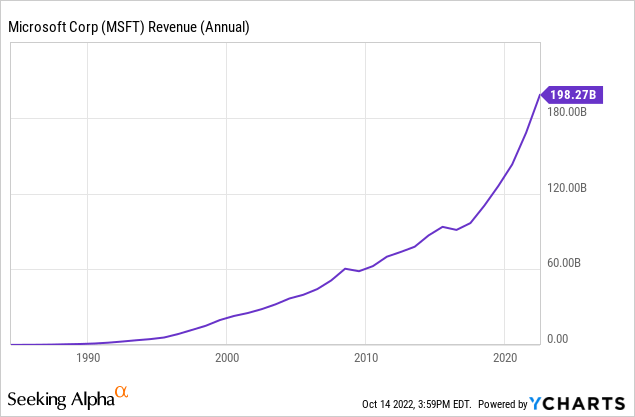

Microsoft’s quality is also showcased by its recession resilience. Many of the company’s products are essential for business and how we live our lives, such as the Windows operating system and the Microsoft Office suite. Not surprisingly, MSFT has seen its revenue remain very resilient versus past crises:

Since the company went public around 40 years ago, there was barely any revenue decline. During the Great Recession and in 2016 revenues dropped marginally, but that was by far not enough to threaten the company’s profitability meaningfully. The company thus also didn’t have to cut its dividend in those times, although it should be noted that its dividend yield is rather low, making MSFT far from a great income pick. Still, the resilience versus recessions and other types of macro issues such as the pandemic is great for long-term holders, especially for those that are looking for a sleep-well-at-night pick.

Last but not least, Microsoft also has strong management in place. Its current CEO Satya Nadella has guided the company very well for years and has identified clear growth trends such as mobile and cloud computing.

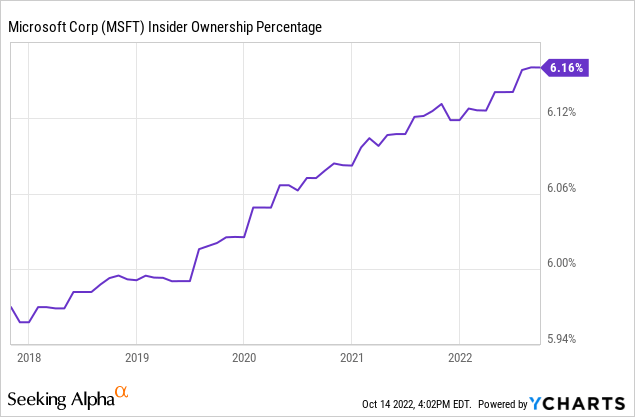

Insiders own a little more than 6% of the company, and that amount has been growing over the years. That amounts to around $100 billion that insiders have invested in the company, leading to strong alignment with other shareholders — there’s thus little risk that the company’s executives will pursue strategies that will not create value for the company’s owners.

Microsoft thus is a company of great quality, but there are two other reasons on top of that why I believe that shorting MSFT is far from a great idea here.

Microsoft Has A Compelling Growth Outlook

First, the company should experience considerable business growth and even stronger earnings per share growth over the coming years. As we have seen earlier, recessions have barely any impact on Microsoft, thus the current economic downturn does not seem like a reason to worry too much. In the long run, several macro trends are poised to lead to significant revenue gains for the company. With Azure, Microsoft is one of the leading cloud computing companies in the world. The cloud computing market is forecasted to grow at an annual rate of 16% between 2022 and 2028 according to this study. As one of the leading players in this space, Microsoft should get a sizeable portion of the to-be-created market opportunity.

Its legacy businesses Windows and Office will be growing less, but will deliver some growth nevertheless. Price increases and some additions of new customers, e.g., due to digitalization in developing countries, should allow for a meaningful growth rate, even though double-digit revenue gains are unlikely in those segments in the long run. Microsoft’s gaming business is not overly large yet, relative to the company’s size overall, but keeps growing, and its pending acquisition of Activision Blizzard (ATVI) should accelerate Microsoft’s growth potential in that space further, due to MSFT getting access to strong IP and ATVI’s talent.

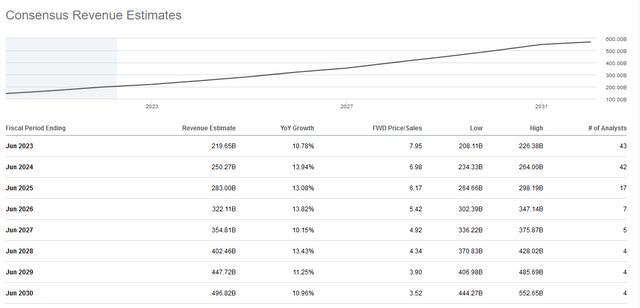

Between these growth drivers, Microsoft is forecasted to see its revenue grow by double-digits every year through 2030:

Seeking Alpha

Of course, forecasting revenues 5 or 8 years from now comes with considerable uncertainties. So let’s assume that actual growth will be just half as high as expected, even though Microsoft has a history of outperforming expectations — it has beaten revenue estimates in 9 out of the last 10 quarters. If revenue growth is just half as high as expected, that would pencil out to an annual growth rate of around 6%. That would still be far from bad. Earnings per share growth should be higher, due to the impact of share repurchases. With Microsoft trading at a low 20s earnings multiple today, it can repurchase shares at a pretty meaningful pace.

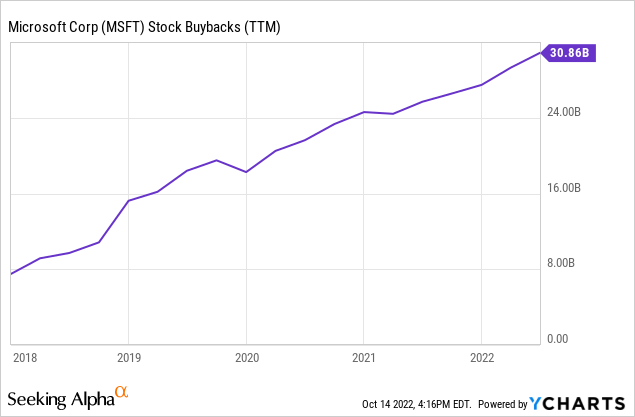

Buybacks have totaled $31 billion over the last year, equal to around 2% of the company’s market capitalization. The buyback amount has been steadily growing, however, which is why I believe that future buybacks will be higher. But even with 2% of its shares being bought back per year, Microsoft’s earnings per share would likely grow at a pace of 8% in the 6% revenue growth scenario.

Thus, when we expect that MSFT will massively underperform expectations and grow just half as much as forecasted, even though MSFT has a history of performing better than expected, Microsoft still should deliver a high-single-digit earnings per share growth rate. Shorting unprofitable companies, or those with declining profits, seems like a better idea to me compared to shorting highly profitable companies with good earnings growth outlooks that can buy back shares at a hefty pace.

Microsoft: Valuation Is Undemanding

Last but not least, there’s a final reason why I believe that Microsoft is far from a great short today. In fact, I believe that MSFT is suitable for a long investment at current prices.

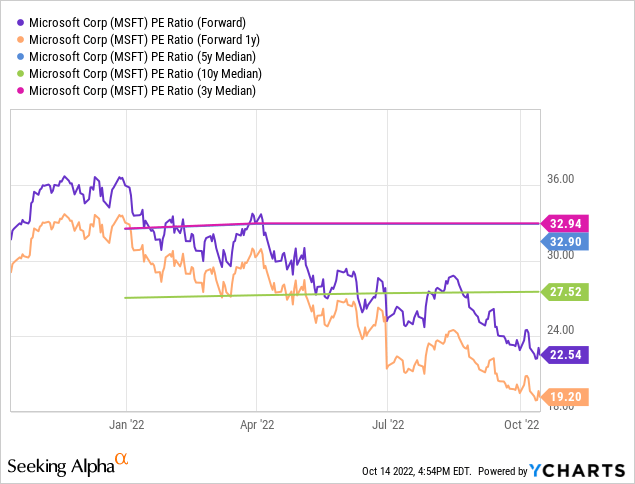

The company’s valuation was pretty high a year ago, but has come down to a very reasonable level in the recent past:

At current prices, Microsoft trades for a low-20s earnings multiple, while next year’s earnings multiple is even lower, at just 19. That is, I believe, an inexpensive valuation for a company of great quality that has a compelling growth outlook. Also, very telling, it represents a clear discount compared to how Microsoft was valued over the last three and five years. In fact, its valuation could expand by close to 50% for the company to trade in line with the averages over the last 3 and 5 years. The 10-year median earnings multiple is lower, but still around 20% higher than the company’s current valuation. This suggests that right now is a relatively opportune time to add shares of Microsoft. At the same time, with MSFT trading below the historic valuation norm today, it looks like a rather bad time to enter a short position. Microsoft was trading at a historically high earnings multiple of 36 at the beginning of the year — it would have been a much better short back then. But shares have dropped more than 30% since then, and now they don’t look like a good short at all, I believe.

Takeaway

Microsoft is a great company with a compelling long-term growth outlook. At the same time, its current valuation is below the historically normal range today. I thus believe that right now is a bad time to enter a short position in Microsoft stock, especially as it has proven to be very resilient versus recessions in the past.

Of course, every stock could decline during an ongoing market downturn. But if one wants to speculate on that, shorting the indices could be a better idea. Alternatively, shorting non-profitable or highly leveraged companies could be a solid way to play an ongoing market downturn. But shorting one of the highest-quality companies in the world while it is trading at a clear discount compared to how it used to be valued does not seem like a good strategy to me — it could lose short sellers a lot of money.

Be the first to comment