Cindy Ord/Getty Images Entertainment

It’s fascinating how much can change over the course of a year or so. While some companies in some industries may exhibit slow rates of change, that’s not true of all companies or of all industries. A great example of this can be seen by looking at The Boston Beer Company (NYSE:SAM), a producer of alcoholic beverages such as Samuel Adams, Angry Orchard, and Twisted Tea. Despite finishing off its 2021 fiscal year with strong revenue growth compared to the year prior, financial performance in 2022 has been quite disappointing. Add on top of this how expensive shares currently are, and it’s likely that investors could find far better prospects elsewhere, leading me to rate the business a ‘sell’ at this point in time. Of course, this picture could change when management reports financial results covering the third quarter of the company’s 2022 fiscal year. Bottom line results are forecasted to be far better than what they were the same time last year, while the same can also be said of top line results. But unless the company posts figures that significantly exceeded expectations and/or unless management unveils something truly unexpected, I feel quite comfortable in this bearish position.

The picture has changed

Back in March of last year, I wrote an article that took a rather neutral stance on Boston Beer Company. In that article, I found myself impressed by the strong financial growth that the company had achieved over the prior few years, including throughout the COVID-19 pandemic. I found the company to be fundamentally attractive and the risk to shareholders being quite limited. Having said that, the stock was trading at rather lofty levels, leading me to rate the firm a ‘hold’. When I rate a company a ‘hold’, I am indicating my belief that the stock of that firm should more or less match the market for the foreseeable future. Since then, this call has proven to be abysmal. While the S&P 500 is down by 7.6%, shares of Boston Beer Company have dropped by 66.2%.

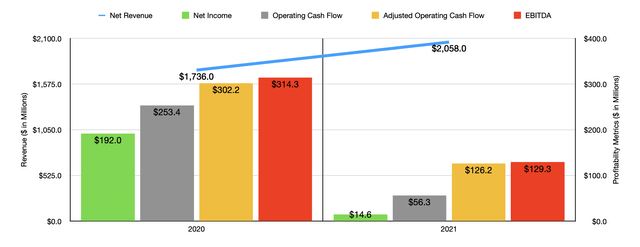

Before we dig into results covering the current fiscal year, we should first highlight how the company ended its 2021 fiscal year. After all, when I last wrote about the firm, we only had data covering through the 2020 fiscal year. In 2021, sales came in just under $2.20 billion. This compared favorably to the $1.85 billion reported for the 2020 fiscal year. Actual net revenue, which takes out excise taxes, rose from $1.74 billion to $2.06 billion. A key driver behind this improvement was a rise in the number of barrels of alcohol sold from 7.37 million to 8.50 million. In addition to that, however, the company also saw net revenue per barrel climb from $235.67 to $241.97. Profitability, however, has been a bit more complicated. For instance, net income at the company actually fell from $192 million to $14.6 million, driven by the company’s gross profit margin plunging from 46.9% to 38.8% in response to higher freight charges, higher material costs, and more. Operating cash flow went from $253.4 million to $56.3 million, while the adjusted figure, which ignores working capital adjustments, shrink from $302.2 million to $126.2 million. Meanwhile, EBITDA for the company also declined, dropping from $314.3 million to $129.3 million.

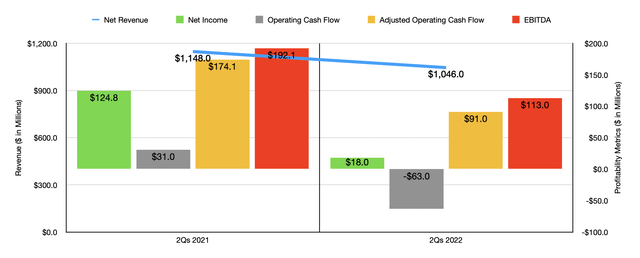

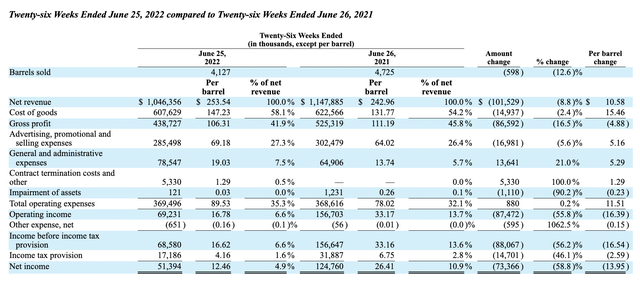

If the company had experienced margin contraction in 2021 and that’s it, the picture might not have been so bad. Unfortunately, the situation has worsened since then. We are also seeing revenue contract. In the first half of the 2022 fiscal year, for instance, the company saw revenue drop from $1.22 billion to $1.11 billion dollars, while the net revenue figure declined from $1.15 billion to $1.05 billion. Even though net revenue per barrel increased from $242.96 to $253.54, the number of barrels sold dropped from 4.73 million to 4.13 million. This decline, management said, of 12.6% was driven by weak sales from distributors as demand for its offerings just declined.

This decrease in revenue brought with it a decline in profitability as well. Net income fell from $124.8 million in the first half of 2021 to $51.4 million the same time this year. Operating cash flow did improve, jumping from $31 million to $121.5 million. But if we adjust for changes in working capital, it would have fallen from $174.1 million to $105.7 million. And over that same window of time, we also saw a drop in EBITDA, with the metric tanking from $192.1 million to $114.6 million.

Of course, this picture could always change when management reports financial results covering the third quarter of the firm’s 2022 fiscal year. At present, analysts are anticipating net revenue of $569.2 million. This would represent a slight improvement over the $561.6 million reported the same time last year. Earnings per share, meanwhile, are expected to be $3.24. That would compare favorably to the $4.76 loss achieved the same quarter last year. In dollar terms, the company is expected to generate net income of roughly $40 million, up from the $58.4 million loss achieved in the third quarter of 2021.

Expected improvements in the third quarter notwithstanding, the picture for the 2022 fiscal year as a whole is looking rather bleak. No guidance was given when it came to revenue. But management does expect earnings per share to be between $6 and $11. In addition to being such a wide range as to be virtually worthless, this guidance is also a significant reduction compared to the prior expected range of between $11 and $16. Even if we rely on this, it would imply net income for the year of $104.9 million. When it comes to other profitability metrics, annualizing results achieved in the first half of the year would yield adjusted operating cash flow of $76.6 million and EBITDA of $77.1 million.

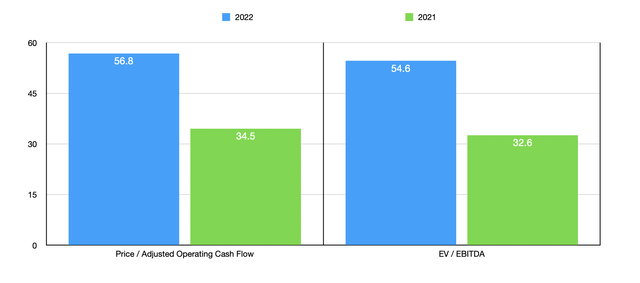

Based on these figures, the company would be trading at a forward price to adjusted operating cash flow multiple of 56.8 and at a forward EV to EBITDA multiple of 54.6. These numbers stack up poorly against the 34.5 and 32.6 readings that we get, respectively, when using data from the 2021 fiscal year. Using that 2021 data, I then compared the company to five similar firms. On a price to operating cash flow basis, these firms ranged from a low of 6.4 to a high of 31.4. In this case, Boston Beer Company was the most expensive of the group. And using the EV to EBITDA approach, the range was between 7.4 and 58.4. In this scenario, four of the five companies are cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Boston Beer Company | 34.5 | 32.6 |

| Molson Coors Beverage Company (TAP) | 6.4 | 7.4 |

| Ambev S.A. (ABEV) | 10.4 | 11.3 |

| Constellation Brands (STZ) | 16.8 | 58.4 |

| The Duckhorn Portfolio (NAPA) | 31.4 | 25.4 |

| MGP Ingredients (MGPI) | 20.2 | 14.4 |

Takeaway

All the data shown right now suggests to me that Boston Beer Company is not having a particularly pleasant time. It does seem as though analysts are somewhat hopeful for the third quarter earnings release. And it is entirely possible that the picture could change around at that time. By considering the totality of the picture, with weak demand and low margins, I do think that the company is a worthy ‘sell’ prospect at this time. This is especially true when looking at how pricey the stock is on both an absolute basis and relative to similar firms.

Be the first to comment