dani3315

ETFs come in many different flavors, and the passive managed ones, in my opinion, are better options than actively managed mutual funds. That’s because ETFs don’t face redemption risk in the way that mutual funds do, in which investors sell during down markets, forcing the fund manager to liquidate holdings when they should be doing the exact opposite.

This brings me to the Vanguard Dividend Appreciation ETF (NYSEARCA:VIG), which has a reputation for low fees and a basket of well-respected large cap companies. In this article, I highlight whether if VIG is currently a buy, hold, or sell, so let’s get started.

Why VIG?

Vanguard Dividend Appreciation ETF seeks to track the performance of a basket of very large common stocks that have a record of increasing dividends over time. It attempts to replicate the performance of the Nasdaq US Dividend Achievers Select Index by investing in stocks in that index.

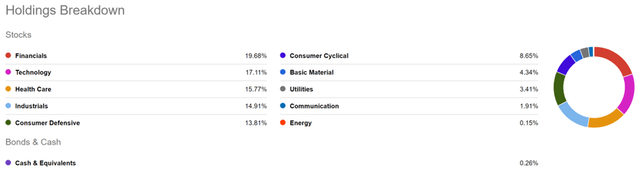

VIG appears to be a rather popular among retail investors and institutions alike was it has total net assets of $63.8 billion. It has 289 stock holdings and is heavily weighted in giant companies with very large market caps, which comprise 93% of the fund’s holdings. Large cap companies make up much of the rest, representing 6% of the portfolio total. As shown below, VIG is diversified by industry, with higher concentrations in financial, technology, healthcare, industrials, and consumer defensive.

VIG Portfolio Mix (Seeking Alpha)

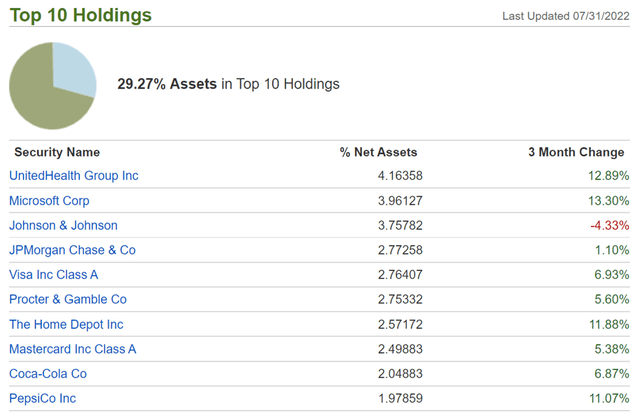

VIG’s top holdings are leaders in their respective industries, including UnitedHealth Group (UNH), Microsoft (MSFT), Johnson & Johnson (JNJ), JPMorgan Chase (JPM) and Visa (V). The top 10 holdings represent 29% of the ETF’s total value. As such, retail investors should bear in mind that like any ETF, the portfolio’s concentration in the top names also means that they have out-sized influence over the ETF’s performance.

VIG Top 10 Holdings (Gen Alpha)

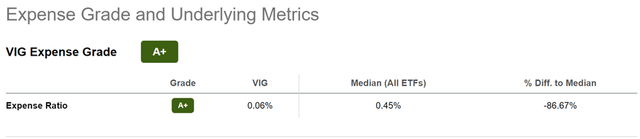

Nonetheless, I see VIG’s low fees as making it an attractive choice compared to peers. As shown below, VIG scores an A+ Expense Grade, with an expense ratio of just 0.06%, sitting well below the 0.45% median for all ETFs.

VIG Expense Grade (Seeking Alpha)

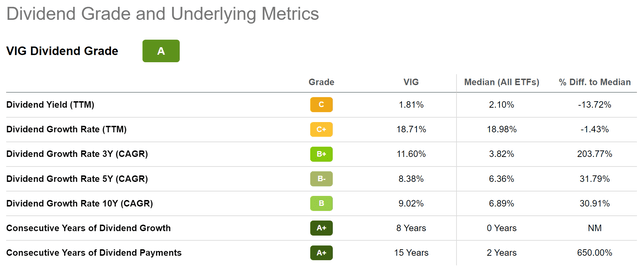

Importantly, VIG’s dividend yield of 1.8% sits above the 1.4% yield of the S&P 500 (SPY). It also comes with a respectable 8.4% 5-year CAGR and scores an A grade compared to other ETFs, as shown below.

VIG Dividend Grade (Seeking Alpha)

Factors that could drive VIG’s stock price down include general economic headwinds such as inflation and higher interest rates. This could impact more economically sensitive industries such as financials, which represent VIG’s largest segment. Moreover, higher interest rates increase the discount rate which investors use to value high growth technology companies, and an economic downturn could have a negative impact to industrials.

However, these factors should just be noises for long-term investors who don’t mind day-to-day ore even month-to-month fluctuations. As shown below, VIG’s total return has closely tracked that of the S&P 500 over the past decade, all while paying its investors a higher dividend yield.

VIG Total Return (Seeking Alpha)

Investor Takeaway

In summary, I believe VIG is a solid hold at current prices. It’s a high quality, low fee ETF that has performed well over the long term while paying investors a solid dividend yield. While there are risks in the near-term such as inflation and higher interest rates, I believe these factors to be transitory and not enough to warrant selling the ETF. For long-term, income-seeking investors, VIG is a great addition to any portfolio. Value investors may want to wait for a sub $150 price, which occurred during the June – July timeframe when the overall market was down.

Be the first to comment