JHVEPhoto

Marriott Vacations Worldwide (NYSE:VAC) is one of the world’s premier timeshare companies. Along with Travel + Leisure (TNL) and Diamond Resorts, they stand at the summit of the industry. It came into existence when it became somewhat trendy for the large hoteliers to divest ownership by spinning out their vacation ownership segments to unlock shareholder value. These tend to be relatively undercovered companies and for that reason they often offer superior repurchase and dividend agreements due to the relatively low multiples. As a stock, Marriott Vacations tends to lead sector recoveries, which is what makes it a potentially high-value opportunity. Due to concerns about an economic slowdown brought about in large part by fed tightening, hospitality and timeshare stocks have once again seen precipitous falls. This is on the back a recovery in the sector following the massive sell off due to the COVID-19 pandemic. Today we’ll take a look at what investors can expect from the company on the cusp of what could be a global economic slowdown.

Company Profile

I like to think of Marriott Vacations as a Mercedes-Benz of the timeshare industry. They may not have the same sales volumes as Toyota, but they cater to more affluent clientele and enjoy all the benefits associated with that. The company offers more than 120 resorts and has roughly 700,000 owner families, making it a leader in the high-end timeshare segment. It also has the exchange and third-party management segments, which contribute roughly 20% of Adjusted EBITDA. Its exchange network interval international has more than 1.6 million members and offers access to an impressive 3,200 exchange resorts in more than 90 countries and territories, making it one of the largest exchange networks in the industry.

Their vacation ownership segment accounts for approximately 90% of total revenue. This is driven primarily by the sales of vacation ownership products and financing agreements, but also encompasses management and rental fees. The reminding 10% is made up of the exchange and third-party management agreements.

Marriott Vacations

The exchange networks earn revenue by allowing members to trade their ownership in the Marriott vacation network with owners who have access to properties outside of the network or vacation club. It is important to note that this is often not a direct trade. The exchange network provides an estimate of the value of the property and allows owners to access other properties for a proportional length of time. So the company acts like a broker of sorts and earns a fee for facilitating the change. There are also usually membership fees.

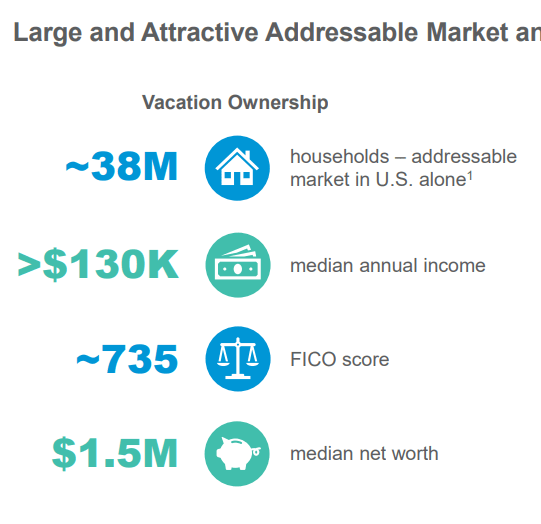

Timeshares are generally considered to be a luxury purchase, but as we touched on before, Marriott Vacations tends to focus on the high end of the industry. Their owners have a median annual income of $130,000, a median net worth of $1.5 million, and an average FICO score of roughly 735. The company identifies its addressable market in the US alone as 38 million households.

Marriott Vacations

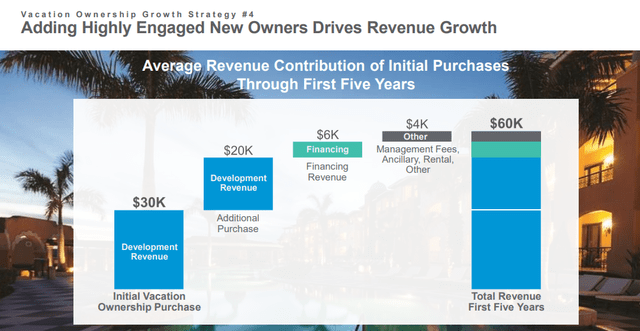

By doing this, the company helps protect itself in an economic downturn as high earners tend to have more of a financial cushion to deal with a temporary slowdown in wages which would, of course, soften the rate of defaults in high levels of unemployment or a financial crisis for example. This allows the company to focus on pushing its relatively new vacation club model. In 2011 Marriott VO products were primarily deeded week-based offerings. For those of us who are unfamiliar, deeded products primarily involve a commitment to a specific location and are sometimes referred to as your “grandma and grandpa’s” timeshares. These products initially were very popular because they allowed owners to control the cost of their vacations in the future and step away from the inflation associated with hotels, apart from the occasional maintenance adjustment. The offerings of today are primarily points based. Instead of buying ownership in a specific location, owners purchase a portion of a vacation ownership trust that allows them to freely or cheaply move across multiple properties without having to go through an exchange network. This is much more cost-effective and easier to sell to younger customers, who are not necessarily interested in visiting one location for the remainder of their lives. This model has also become popular with the timeshare companies as it allows them to distance themselves from the construction of the properties, and due to the high revenue per square unit they can offer to developers, they are able to sign advantageous sales agreements to incorporate properties into their networks. The company earns roughly $60,000 on average on initial purchases through the first five years. Roughly half of this comes from the initial vacation ownership purchase, but perhaps more crucially is the additional $20,000 that comes from an additional purchase through the period. This suggests that owners are happy with their purchases, which is a great sign for future business prospects. Unhappy customers never come back to buy more. Interestingly, the company also earns an average of $6,000 in the first five years in financing revenue, which is normally a tightly kept secret.

Marriott Vacations

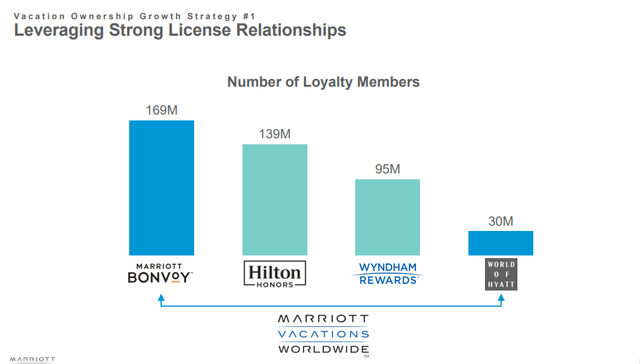

Marriott’s strong presence in the member loyalty space continues as it still is the industry leader with an eye-watering 169 million loyalty members. This is a great metric to key in on. These loyalty membership programs are awesome, but they offer great insight into brand strength and consumer preferences. We can see that Marriott is still identified as one of the world’s premier brands.

Marriott Vacations

Recent Earnings Report

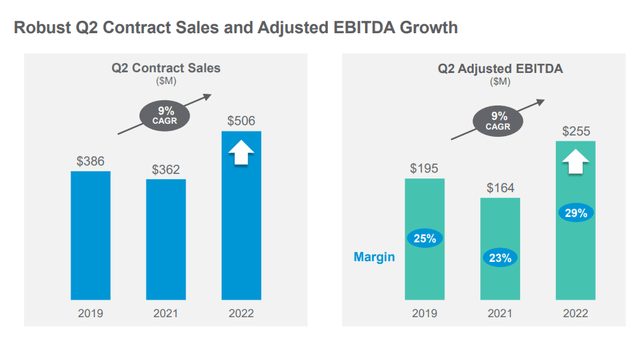

In the recent Q2 earnings report, the company had a strong performance. They generated an impressive $506 million in contract sales for the quarter, which is more than a 40% increase over the prior year. It is important to note that revenue for the last two years was impacted by the COVID-19 pandemic, but nevertheless, the recent performance represents a 9% compounded annual growth rate in contract sales and EBITDA.

Marriot Vacations

Their Adjusted EBITDA grew 55% due in large part to strong performance in the rental segment. Perhaps most importantly was the average occupancies exceeding 90%. Timeshare companies derive much of their revenue from vacation ownership sales to in-house residents. In fact, for Marriott Vacations, roughly 85% of vacation ownership sales happened to in-house guests. The company’s membership interval international service saw revenue grow 21% year over year. This was driven in part by affiliations with Disney and Welk resorts. These partnerships were formed fairly recently, and it’s great to see that the companies already reaping the rewards of this agreement.

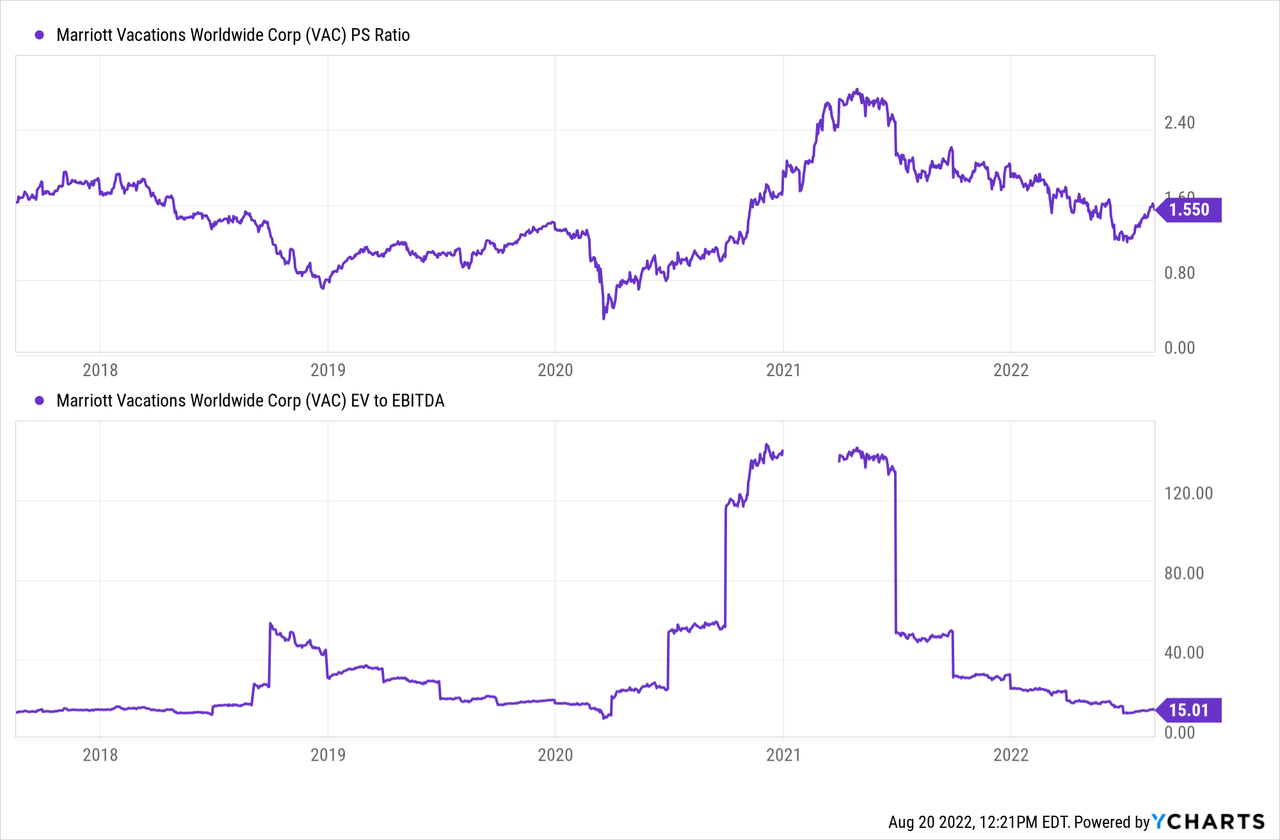

Valuation And Forward-Looking Commentary

The recent relief rally following the widespread sell-off has greatly lifted Marriott Vacations. We can that the stock isn’t exactly a bargain, and we are still in the middle of a tightening cycle from the Federal Reserve. This is a cyclical stock, so ideally, we would like a better starting point considering the short-term risks.

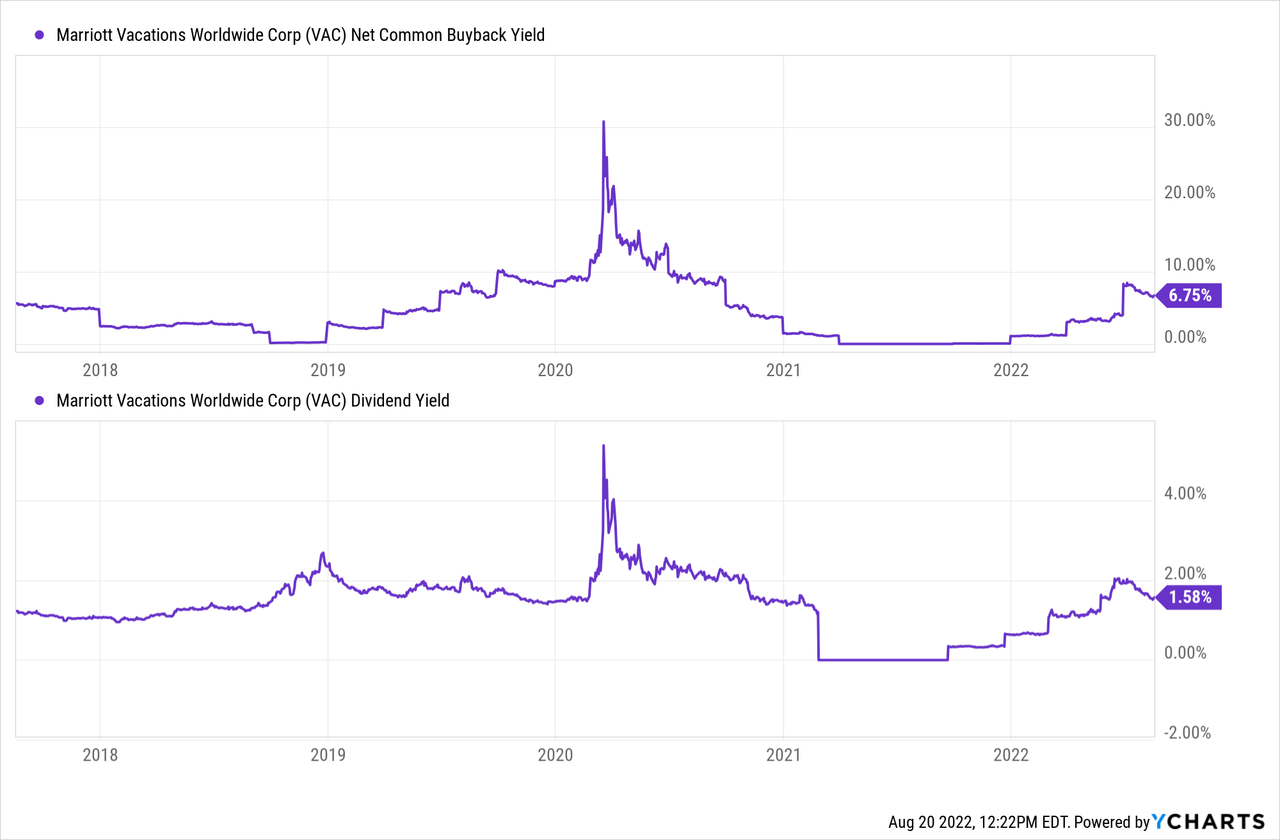

The company has been focusing on buybacks more than dividends lately, which is acceptable considering where the stock is. Investors still get paid a 1.58% dividend while they wait for their trades to pan out, which is always welcome.

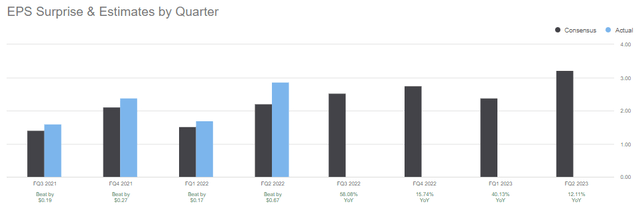

The company also does a great job delivering to earnings expectations. They have beat for all of the last four quarters, and the winter months are historically strong periods for timeshare vacation ownership sales.

Seeking Alpha

The Takeaway

I believe the price investors are paying here is a bit high for the short-term risks on the horizon, but long term, we should see robust upside from these levels. It is definitely not the best starting point, and we may very well see lower prices in the short term, but you should care more about where the stock will be five years from now versus where it will be five months from now, then you might have a pretty good opportunity here. I rate Marriott Vacations a buy at this level.

Be the first to comment