bymuratdeniz

In previous articles, I mentioned that I have been looking to sell puts to generate income from short-term trades. It’s not something I would recommend for investors unfamiliar with options, but selling puts is a great way to collect options premium, especially if you are fine owning shares of a company at the strike price. Today’s article will be on Laredo Petroleum, Inc. (NYSE:LPI), a company I recently started looking into after a Thanksgiving recommendation from a family member.

Investment Thesis

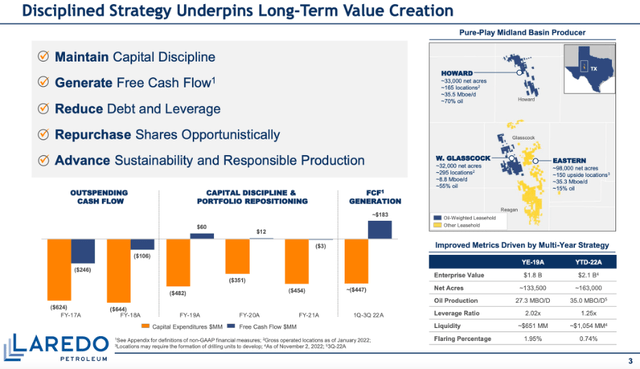

Laredo Petroleum is a small cap E&P company with a checkered past. The company focuses on the Midland Basin in Texas and has posted impressive results so far in 2022. In the past, investors have seen issues with an overleveraged balance sheet and the company’s hedging. However, the company has been reducing debt quickly this year and buying back stock as well. The company earned over $20 for Q3 and $30 for the first nine months of 2022 (keep in mind this is a $55 stock today), and I think multiple expansion is inevitable if the company keeps minting cash anywhere near the current rate. I chose to sell a put instead of buying shares, but the risk/reward is skewed to the upside for anyone who is long Laredo Petroleum.

10-Q

Laredo is an energy company focused on the Midland Basin in Texas. While they have had missteps in their past, with too much debt and a reverse stock split in 2020, things are looking up for the company. 2022 has been a good year so far for the company, and they have been focused on cash flow while reducing debt and buying back stock. The company also recently announced a planned name change to Vital Energy, which will go into effect in early January. The new ticker will be VTLE.

Laredo Overview (laredopetro.com)

The way my uncle described it is that Laredo shot themselves in the foot with their hedges in the past and that is part of why the stock is so cheap. I would recommend reading Long Player’s recent articles on Laredo where he discusses the hedging in more detail (here and here). One of the things he touches on is the expectation that management will reduce their hedging program as the debt levels continue to decrease, which will be a huge boost for cash flow if oil prices surge.

Focusing in on the financials shows considerable improvement in 2022. The most important thing on Laredo’s balance sheet is the debt level. The debt does carry a relatively high interest rate (ranging from 7.75% to 10.125% depending on the issue), but they have been reducing debt at an impressive clip, and the nearest maturity is in 2025. At the end of Q3, the company had reduced debt by approximately $250M when compared to year end 2021 levels. After the end of the quarter, they repurchased another $61M of debt through early November.

I’m expecting they will continue to reduce the debt rapidly, and they have plenty of liquidity as well. Between the cash and credit facility, the company had total liquidity of $1.1B as of November 2. Turning to the income statement shows a dirt-cheap valuation. The company earned over $20 per share for Q3 alone and has already earned $30 for the first nine months of 2022. In my opinion, if cash flow and earnings stay strong and the company continues to reduce the debt level, it’s only a matter of time before we see multiple expansion.

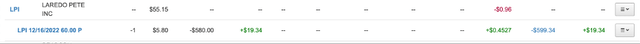

Selling Puts

As I mentioned earlier, selling puts isn’t a strategy for everyone. However, since I’m fine owning Laredo at $60 a share, I view it as a win-win situation. Heads, I collect the $600 in options premium if shares rally over $60 in the next week and half. Tails, I buy 100 shares at the $60 strike price, which is fine by me when you consider that Laredo earned over $20 per share in Q3 alone. One of the things that makes selling puts more attractive (and difficult in some respects) is the volatility of the underlying stock. Laredo has bounced all over the place (shares are down 15% in the last week), but that means the options premium is much higher than a low volatility stock would be. What can be difficult is that a large decline in share price could make selling puts less attractive than just buying shares.

LPI Put (Author’s Schwab Account)

For example, if you sold a put a month ago at a $65 strike while shares were trading around $70, you would have collected less in options premium but still be forced to buy shares at the higher price. While I have experimented with options to some degree, I don’t consider myself an expert, and I would not recommend this strategy unless you are willing to buy shares at the strike price. If the shares are assigned, you can turn around and start selling covered calls, another lower-risk options strategy.

Buybacks

One of the things that investors will benefit from is continued use of Laredo’s share repurchase program. It was a $200M program authorized in May and expiring in May 2024. In Q3, the company repurchased approximately 245k shares for approximately $17.5M. Since the end of the quarter, they bought back another 112k shares for $7.5M (through November 2). Over time, I think the buyback will have a meaningful impact on shares outstanding as well as earnings per share. As the debt levels come down, management will also have more flexibility to plow cash flow into more buybacks.

Conclusion

The leverage has been a problem in the past for Laredo, but that gives investors the opportunity to participate in the upside as the company deleverages. If the debt reduction continues at a similar pace, it’s only a matter of time before we see meaningful multiple expansion. I think the year-end earnings will continue the pattern of debt reduction, and I think it is possible that we could see a nice bump in share buybacks, especially with the recent share price decline.

I chose to sell a put instead of buying shares, but I still think the risk/reward is very much skewed to the upside for investors in the common stock. Laredo Petroleum doesn’t have a spotless track record with its hedging or the reverse stock split in 2020, but that gives investors a chance to buy the company at a dirt-cheap valuation. Throw in a sizable buyback program that will likely increase as the balance sheet improves, and investors in Laredo Petroleum have plenty of reasons to be bullish.

Be the first to comment