William_Potter/iStock via Getty Images

Thesis

Consumer Portfolio Services (NASDAQ:CPSS) had strong sales growth (above 30%) in the latest quarter, as well as cost improvements (lower provision for credit losses plus lower staff costs as a % of sales), but unfortunately, this does not mean potential upside given that the company, on a P/B basis, is fair valued, in line with peers, and therefore we recommend holding until we see some material changes.

Intro

CPSS is a specialty finance company based in Las Vegas and founded in 1991. The company is active in the purchase and service of auto-related contracts from auto dealers (new and used vehicles). The contracts are retail automobile instalment sale contracts. Borrowers tend to be sub-prime.

Despite being volatile over the year (and experiencing a great summer) the share price has performed well and is up almost 3%, significantly better than the overall market.

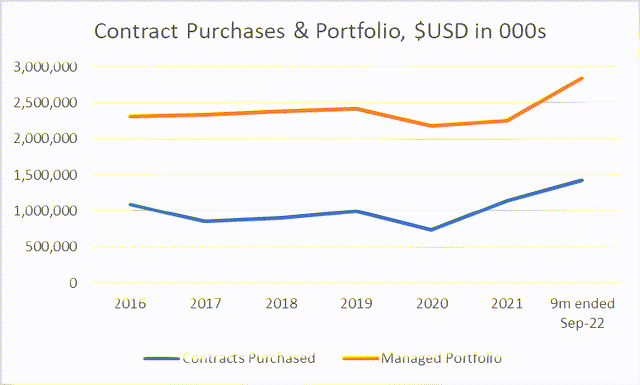

From the company’s founding to today, CPSS has originated almost $20bn of auto contracts, as well as acquired over $800m of auto contracts via M&A through the years. The company has recently upped their contract purchasing volumes and subsequently, the managed portfolio is illustrated below. The numbers are for the set period.

Financial Analysis

The company generates revenue by originating the receivable on the contracts as well as generating servicing fees on active accounts in the portfolio.

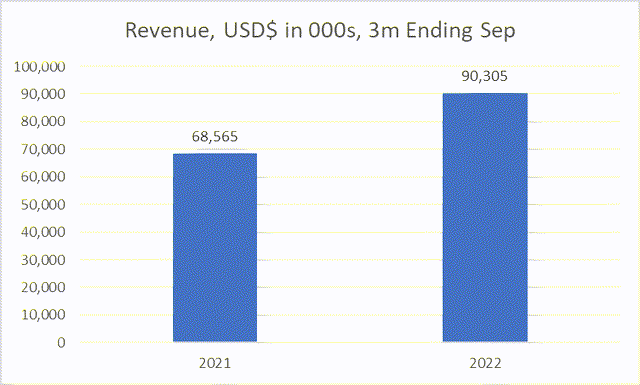

Revenues during the three months ended Sep 30, 2022, were around $90m, increasing by over 30% compared to the same period a year prior, increasing by just over $20m. The revenue growth was driven by an increase in interest income from the increase in the outstanding balance of finance receivables. Furthermore, markups on these receivables also contributed to the revenue growth (for example, an $8.2 million markup was recorded during the period).

The company also made $2.3m in other income which is made up of origination and servicing fees, which is up almost 50% compared to last year, but this remains a fraction of total revenues.

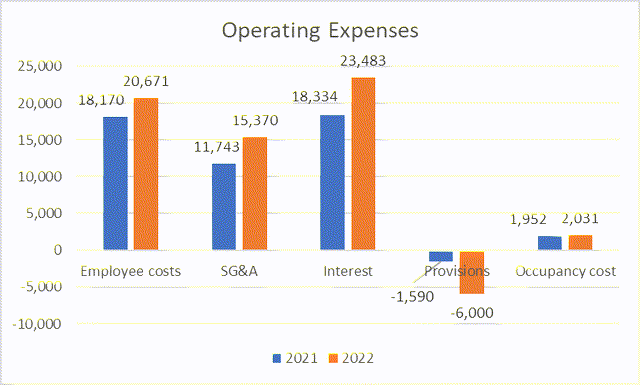

In terms of expenses, operating expenses are largely made up of interest expenses, provisions, staff costs, and SG&A.

The largest cost growth increase was in SG&A, which grew from around $12m in 2021 to just above $15m in the period for 2022, growing 31%. However, this is the same growth as sales given that SG&A expenses are driven by applications and the processing and servicing of the auto contracts. Therefore, SG&A as a % of revenue remains stable at 17% for both periods.

However, while employee costs are also driven by typical operational items such as processing and servicing costs, they grew by less than revenue, only growing by around 14% reaching $20.6m in 2022. Therefore, as a % of sales, employee costs actually reduced from 27% as a % of sales in 2021 to 23% today, despite the increase in staff numbers from 751 in 2021 to 792 in 2022.

Interest expense grew by almost 30% during the period, reaching around $23.5m, 26% of sales. These costs are significantly affected by the volume of the auto contracts purchases, hence the (in-line) increase, but the costs remain stable.

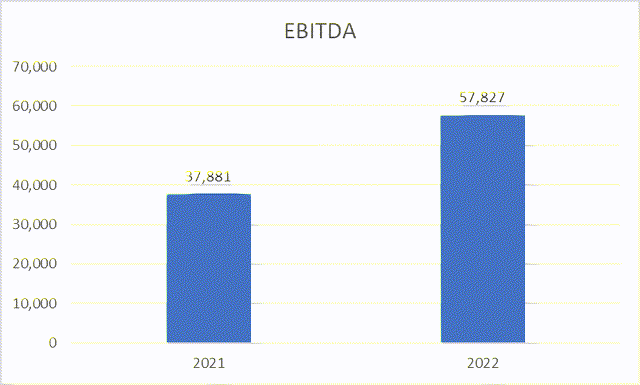

As revenue increased for the period and growth remains robust, and costs were either stable or improving, this has led to an improvement in the bottom line.

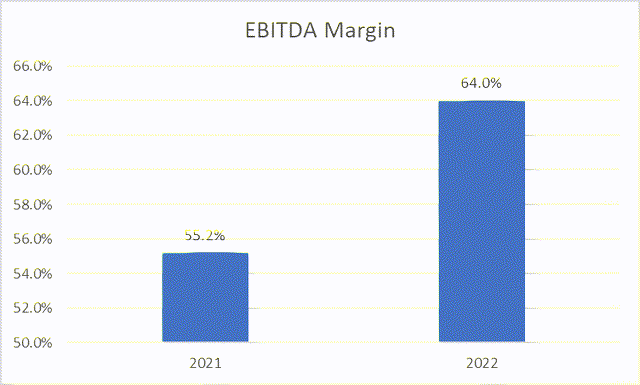

Along with the growth stated above, coupled with an improvement in provision for credit as well, EBITDA grew by a massive 50%, from around $38m EBITDA for the 3-month period in September 2021, to almost $58m for the period today, leading to a growth in the EBITDA margin by almost 10 whole points, from 55% in 2021 to 64% in 2022.

Valuation

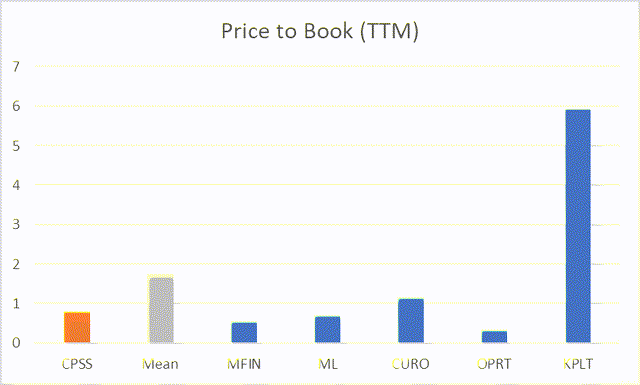

If we collate a set of peers in the same industry with similar market caps, we could potentially see if CPSS is undervalued, overvalued, or even fair-valued.

On a P/B basis, we can see that CPSS looks undervalued compared to peers by a substantial amount, with a potential upside of around 100%.

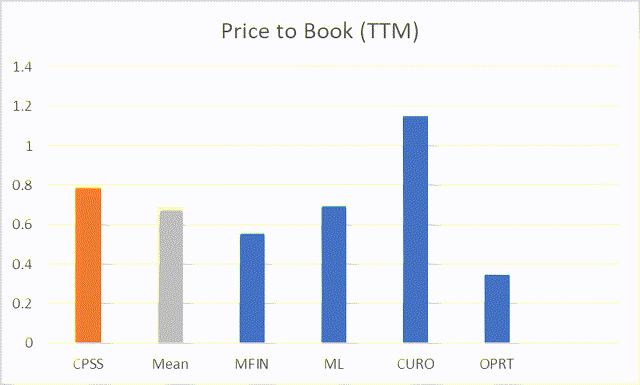

However, this looks to be potentially skewed by the outlier here from Katapult Holdings (KPLT). If we remove this figure from the analysis, then the picture looks more normalized and CPSS looks to be more in line with peers in regard to a P/B valuation.

Therefore, while CPSS have successfully grown both the top line and bottom line over the past year, the share price does not seem to be undervalued, is in line with peers, and therefore does not have any upside from current prices, nor a significant amount of downside. We could see the stock continue as usual over the next 12 months or so.

Risks

- One risk to this thesis would be if the improvement in provision for credit losses is reduced. Over $7m of the growth in profit in the period was driven by provisions alone, and therefore if provisions were added back (given the rough economic climate right now with inflationary pressures), then the picture as positive. On the other hand, even if we exclude provisions, EBITDA still grew, and the margin remains high.

- If revenue growth were to taper or slow down, we would typically see this as a risk. But this is only a risk if certain operating expenses, such as staff costs and SG&A, remain elevated. However, given that these costs are driven by company performance (i.e. driven by sales), we do not see this happening.

Conclusion

Overall, CPSS has had very strong growth in revenue this period compared to the same period last year (over 30% growth) and has improved its cost structure where provision for credit losses has decreased and staff costs as a % of sales have also declined. Despite these improvements, however, CPSS is not undervalued compared to peers and is in fact fairly valued, as the P/B valuation is in line with competitors. Therefore, we recommend holding until we see further material changes in the company and signs of outperformance (or underperformance).

Be the first to comment