Jose Luis Pelaez Inc/DigitalVision via Getty Images

There are a lot of sayings about cake, like exhibit A: Have your cake and eat it too.

Or exhibit B: Let them eat cake.

Or exhibit C: Like a fat kid likes cake.

And then there’s this one: a piece of cake, which – truth be told – doesn’t do cake justice. Sure, eating a cake is exceptionally easy. Far too easy, if you ask me and many others.

But in order to enjoy that goodness, someone first has to make it. And that’s more complicated.

I’ve personally never made a cake before, choosing to rely on other people’s talents instead. So I had to look up how to do it.

When I did, one of the first results was for a “Simple Scratch Cake” on AllRecipes.com. That seemed like a good enough link to go with, and so I did.

The creation in question says it requires 10 minutes prep and 25 minutes cooking, and serves eight. This from adding:

- 4 cups of all-purpose flour

- 2 teaspoons of baking soda

- 4 eggs

- 2 cups of white sugar

- 1 (14 ounce) can have sweetened condensed milk

- 2 cups of sour cream

- 2 tablespoons of vinegar.

My first reaction to those last two ingredients was an immediate and uncontrollable grimace. But, again, I’m not a baker. So I went on to check out the comments, one of which assured, “Don’t let the sour cream or vinegar scare you.”

In fact, none of the reviews that I looked over were negative about those ingredients. Just a whole lot of other things…

Might Want to Add Some Time to That Cakewalk

As it turns out, there were two five-star ratings, two four-star, three three-star, one two-star, and five one-star. Out of those, one of the best began this way:

“OMG! Best cake ever! I made it into cupcakes, and the family devoured them in minutes – without frosting! Excellent taste and consistency. A new family favorite. Not overly sweet either – despite the amount of “sweet” stuff.”

And here’s one of the worst:

“This cake took 50 minutes in a 13×9 pan and cake had a high dome, was very crusty and tough. I bake and decorate a lot of cakes and am always looking for a new cake recipe. This cake was a waste of expensive ingredients. It was a bland and tough cake. I hate to give bad reviews, but I was VERY DISAPPOINTED. I salvaged my efforts and ingredients by cutting off the hard edges, cutting up the cake, sprinkling on some triple sec, and layering with pudding to make a palatable dessert.”

Come on, Karen (her real listed name). Tell me how you really feel.

She wasn’t the only one who mentioned it taking longer than expected, though. Even one of the five-star reviews said the same thing.

And again, that’s for something with “Simple” in its title. Imagine how long a non-simple cake would take?

So what? You might be asking. Just go to the store and buy a boxed kit. It just takes an egg or two, some oil, and voila! You’re done.

Sure. True. But is it going to taste as good? (The answer might be “yes” if we’re comparing it to the cake recipe above.)

The thing is there’s always a tradeoff to consider between taking the easy way out and going the long way.

Always, always, always.

REITs: A Key Ingredient To My Portfolio

In the case of cakes, the easy way out might be worth it if you’re craving something sweet stat.

Buy the store-bought box or a store-bought cake altogether. Though, the latter will cost you a decent bit, I’m sure.

But when it comes to portfolios, I strongly advise reconsidering shortcuts. Do you really want to spend extra time on something that isn’t going to sit right with you?

To quote Elon Musk,

“If you’re trying to create a company, it’s like baking a cake. You have to have all the ingredients in the right proportion.”

And nobody else is going to do that for you. Not without a hefty price.

The same can be said about a winning portfolio. It might not be “a piece of cake” that way, but it can provide extremely satisfying – and sustainable – results.

In my well-researched and tested-out book, that means adding a significantly sized scoop of real estate investment trusts (REITs) to your portfolio mix. As I wrote earlier this month in “Protect Your Nest Egg With These Inflation-Resistant REITs”:

“Simply put, REITs tend to outperform during periods of rising and unexpected inflation. This contrasts with other stocks’ and bonds’ modest or negative inflation sensitivity.

“The economic drivers are often tied to inflationary trends, resulting in outsized returns when inflation exceeds expectations.”

That’s why, as I published the prior week, “I’ve Lived Through 8 Recessions, and I’m Not Worried About the Next One.”

You can say the same thing… possibly with the REITs reviewed below.

2 REITs That Offer Lots Of Icing On The Cake

Medical Properties Trust (MPW) is a healthcare REIT that’s one of the world’s largest non-governmental owners of hospital properties. The company owns 440 properties with roughly 46,000 beds leased out to 53 different operators within 10 different countries.

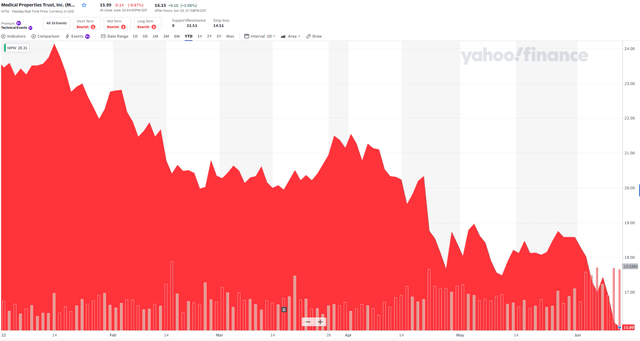

As seen below, shares have fallen off by over 32% year-to-date. This makes it more difficult to utilize its equity currency, with an AFFO yield now at 8.8%

On MPW’s recent earnings call, the management team made it clear that it was slowing down growth due to its cost of capital and acquire a portion of the $4 billion to $5 billion worth of opportunities it intended to pursue. Analyst growth estimates (AFFO per share) for 2022 have also declined by around 3% – from 9% to 6%.

To help finance the original expectation, MPW would have to sell assets and various joint ventures.

Admittedly, the “pure play” hospital landlord has a good history of using JVs. It recently sold a 50% stake in a $1.7 billion Steward portfolio to Macquarie Asset Management.

Also, on the earnings call, MPW took time to defend claims regarding straight-line rent write-offs and coverage ratio comparisons. As for the latter, detailed tenant disclosure is important for investors.

So this should be very helpful for analysts and investors – especially given how most of them are citing some signs of improvement. Here are its top five report operator coverages:

- Steward’s was 2.8x

- Median was 1.9x

- Prime was 5.2x

- Priory was 1.8x

- Springstone was 1.5x.

Also, CEO Edward Aldag explained on the Q1 call:

“First, let me point out as I have numerous times, EBITDARM [earnings before interest, depreciation, amortization, rent, and management fees] in these calculations come straight from property level GAAP [generally accepted accounted practices] basis financial reports we received from our tenants, which include their annual audited financials at year-end.

“Except an extremely rare or unusual circumstances such as the Covid grants for 2020 and 2021, and some minor immaterial prior period updates, no adjustments have been made to these numbers.

“These EBITDARM numbers are trailing 12 months for the period ending 12/31/21. We use earnings before interest, depreciation, amortization, rent and management fees and the actual cash rent amounts owed to MPT.”

Here’s more:

“There have been a couple of recent reports from third parties outside of the company that have tried to use CMS cost report NOI [net operating income] numbers to show profit margins and equate that to a lease coverage comparison. CMS uses different definitions and allows different deductions for items such as depreciation, amortization, interest and other items than what is required in GAAP financial statements.

“Furthermore, they include all rental and lease payments and interest payments among other items. Therefore, when quoting the profit margins, one must keep in mind that all MPT rent and other rent and interest has already been accounted for in those numbers. By definition, the CMS cost reports could actually show a negative profit margin and all of the rent and interest being paid at the same time.”

This comment is specifically related to a short report where the analyst used CMS reported NOI numbers to back into lease coverage comparisons.

However, Aldag says CMS uses different definitions to calculate such ratios compared to GAAP requirements. As such, the CMS cost reports imply negative profit margins for all operators – which is negated by the EBITDARM coverage ratios.

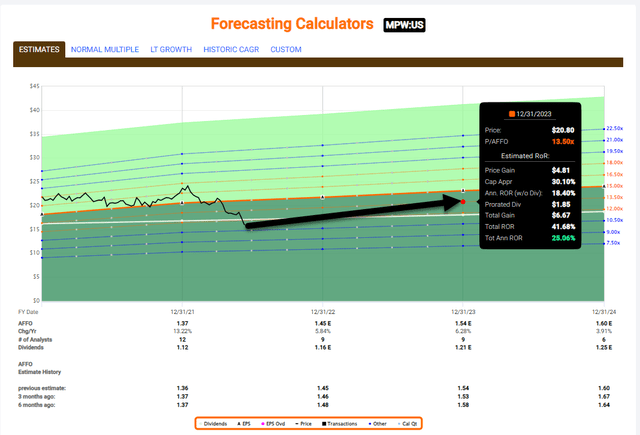

Given the selloff last week (shares declined by another 5.9%), MPW has become much cheaper, with a share price of $15.99 and P/AFFO of 11.4x. MPW has historically traded at around 14.x (over 5 years) and 17.6x just a few months ago.

On May 26th, MPW declared its quarterly dividend of $.29 per share, that translates into a dividend yield of 7.3%. The payout ratio (based on AFFO) is 86.3%. Our conservative total return forecast for MPW is 25% over the next 12 months, and our most bullish estimate (over 12 months) is 35%.

Given the recent history for MPW, we see more dividend growth ahead, albeit modest growth until the company’s cost of capital improves. MPW remains a strong buy.

This week I met with STORE Capital’s (STOR) management team at REITWeek including CEO, Mary Fedewa.

This was my first in person meeting with her since she became the CEO of the net lease REIT that owns a well-diversified portfolio that consists of investments in 2,866 property locations in a wide variety of industries within the service, retail and manufacturing sectors.

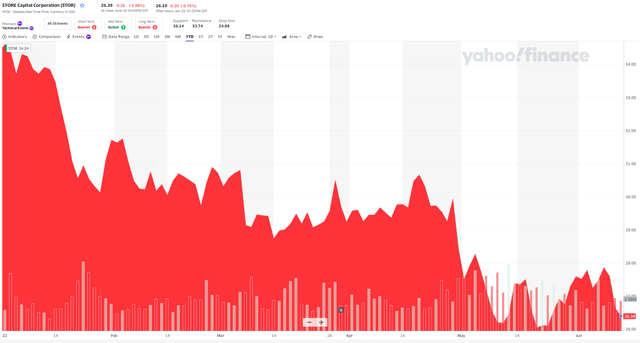

As seen below, shares have fallen by over 23% year-to-date.

Fedewa has been the CEO for around a year now, and she has a few new associates including CFO, Sherry Rexroad, and Chairman, Tawn Kelley.

Although STOR’s price has been beaten down, Fedewa, appears to be navigating just fine as she announced on the recent earnings call that STOR “acquired $513 million in profit center real estate, the highest first quarter volume in STORE’s history. These acquisitions were at an initial cap rate of 7.1% with weighted average annual lease escalations of 1.8%.”

One of the things that attracts me to the net lease sector is the high fragmentation, and Fedewa pointed out that the “total addressable market is estimated to be nearly $4 trillion and over 2 million properties”.

Within that total addressable market, STOR is “focused on an estimated 200,000 companies that are in vital, sustainable and growing industries.”

STOR’s balance sheet is in great shape to seize opportunities as the company has ample access to capital, including $39 million in cash, approximately $370 million available under the ATM program and borrowing capacity available under the revolving credit facility.

In order to help fund acquisitions, STOR issued 5.5M shares ($166.2M/$30.41 per share) on its ATM. Previously announced, STOR issued $600M of floating rate debt ($400M of 5-year and $200M of 7-year), which was swapped to a weighted average interest rate of 3.68%. At 3/31, adjusted debt/EBITDAre was 5.8x (vs. 5.8x at 12/31).

STOR also increased its 2022 acquisition volume, net of anticipated sales, to $1.3 billion to $1.5 billion, and maintained cap rate guidance of 7.0% to 7.2%.

Historically, STOR boots its dividend in the fall, and we suspect that the company will continue to reward shareholders with another juicy increase.

Last year it bumped the divvy by 6.9%, and given the Q1-22 results, we suspect to see something with at least a 5% handle (increase). STOR has always maintained a lower payout ratio (sub 80%) which provides a nice margin of safety. Also, the annual dividend increase streak is now 7 years.

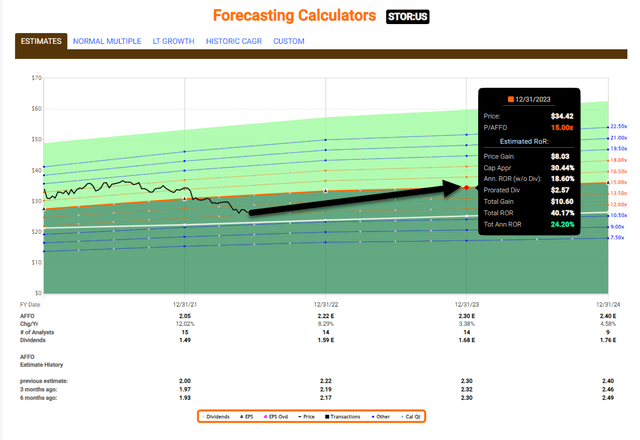

As seen below, STOR is cheap, based upon the P/AFFO multiple of 12.4x. Keep in mind, STOR trades at around 16.3x historically and shares are now trading at the pre-Buffet-bump level, Berkshire (BRK.A) (BRK.B) bought STOR initially when shares traded at around 13.5x.

Note: Berkshire Hathaway has reduced holdings in STOR to ~14.8M shares from 24.4M.

Analysts forecast STOR to grow by 8% in 2022 and our conservative total return forecast for STOR is 20% over the next 12 months and our most bullish estimate (over 12 months) is 30%. The current dividend yield is 5.8% and iREIT maintains a strong buy.

In Closing…

MPW and STOR are both Strong Buys, and we believe that patient investors will be rewarded by hanging onto shares.

Our job at iREIT on Alpha is to carefully evaluate the most attractive REITs to own, and we utilize traditional fundamental analysis research to select the highest quality names that are trading at the widest margin of safety.

In this environment, there are plenty of sweet REIT opportunities, and I believe that you “can have your cake and eat it too”. I thought this quote by the legendary investor, Benjamin Graham, sums up this article nicely,

“The intelligent investor realizes that stocks become more risky, not less, as their prices rise—and less risky, not more, as their prices fall. The intelligent investor dreads a bull market, since it makes stocks more costly to buy. And conversely (so long as you keep enough cash on hand to meet your spending needs), you should welcome a bear market, since it puts stocks back on sale.”

Who wants a slice of REIT cake?

Be the first to comment