Paul Morigi/Getty Images Entertainment

Investment Thesis

The Vanguard Financials ETF (NYSEARCA:VFH), a sector that has trailed the S&P 500 over the past five years. So why does Warren Buffett have approximately 1/4 of his stock portfolio invested in the sector? And why is he loading up on Citigroup (C) shares and buying insurance corporations outright? The answer is value.

We believe the Vanguard Financials ETF (VFH) will be the best performing sector of the decade, and return 11% per annum to investors.

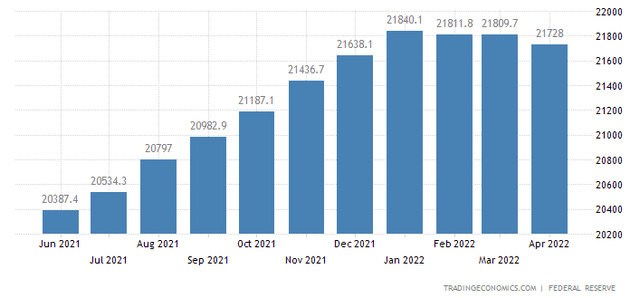

The Shrinking Money Supply

After a steep run-up, the M2 money supply is now declining for the first time since 2018.

U.S. M2 Money Supply (Trading Economics )

The Federal Reserve stopped its bond issuance, causing the money supply to decrease. This is known as quantitative tightening (QT), and it is making the commodity of money more valuable. Interest rates are on the rise.

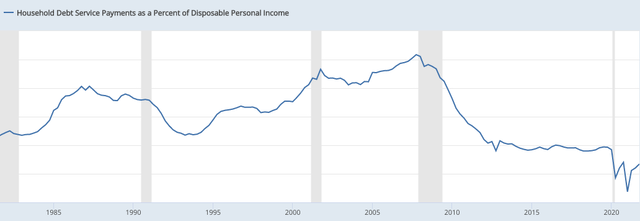

Household And Corporate Finances

Higher interest rates squeezed over-leveraged Americans in 2008, causing a steep recession. However, this time around, Americans have much stronger balance sheets. Overwhelmingly, Americans can service their debts easily using their disposable income. In Q4 of 2021, consumers’ debt payments represented only 9% of their disposable income.

Debt Service Payments as a Percentage of Disposable Income:

Debt Service Payments as Percentage of Disposable Income (FRED Economic Data)

We do not see a wave of defaults coming in the consumer sector. However, there are some over-leveraged sectors in corporate debt, such as the airlines.

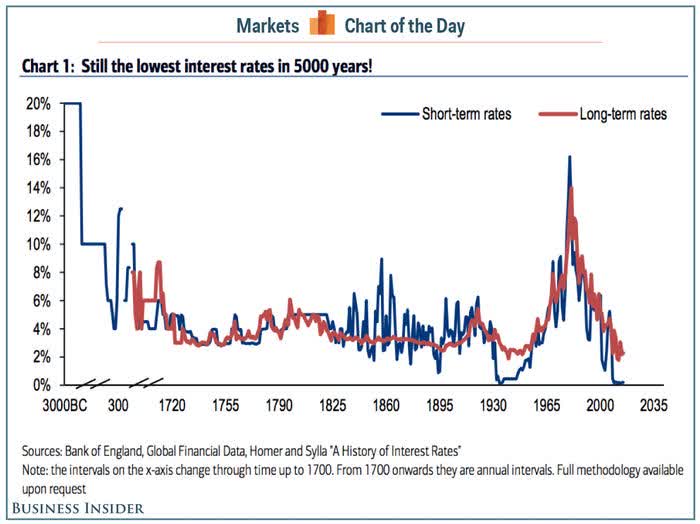

Looking out longer-term, it is likely that interest rates normalize. We are betting on a reversion to the mean. The 5000-year mean for interest rates is 5%.

5000 Years of Interest Rates (Business Insider)

Insurance companies and banks should benefit in a “real return world” where interest rates are higher than inflation, which is normally the case. The past decade has been one of unusually low interest rates. Going forward, we can expect more of American’s income going towards interest payments. Banks are the beneficiaries, and an investment in financials is your hedge.

Largest Holdings

| Holding | Percentage of Fund | P/E | P/B | ROE |

| Berkshire Hathaway (BRK.B) | 9% | 18 | 1.3 | 7% |

|

JPMorgan Chase (JPM) |

8% |

9 | 1.4 | 16% |

| Bank of America (BAC) | 6% | 9 | 1.1 | 12% |

| Wells Fargo (WFC) | 4% | 8 | 1 | 12% |

| S&P Global (SPGI) | 3% | 24 | 3 | 17% |

| American Express (AXP) | 2% | 15 | 5 | 33% |

Source: Image created by author with data from Seeking Alpha and Vanguard

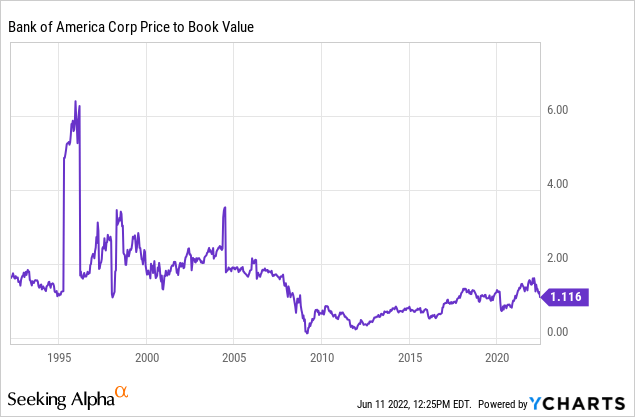

The Vanguard Financials ETF has a diverse blend of assets that can thrive in both a low and high interest environment. Berkshire Hathaway, JPMorgan Chase, and American Express have found ways to make abnormal profits with interest rates near zero. Investment banks and brokerages have also done well in a period of low interest rates and high asset prices. Traditional banks and insurance companies should benefit from interest rates being moderately higher. The price to book of Bank of America was much higher from 1990-2005, during a time when the 10-year treasury yielded 4% to 8%.

We like that the fund excludes Visa (V) and Mastercard (MA), which have stretched valuations. Looking into the future, we believe that some powerful FinTech businesses will also enter the mix.

Valuation

| As of April 30, 2022 |

Financials VFH |

S&P 500 VOO |

| P/E Ratio | 10.3 | 20.3 |

| Price to Book | 1.5 | 3.9 |

| ROE | 12% | 22% |

| Dividend Yield (Trailing) | 2.2% | 1.4% |

Source: Image created by author with data from Vanguard

Future Returns

We believe VFH will return 11% per annum over the next decade, with dividends reinvested.

- The fund has earnings per share of $8.15. Growth should be slightly slower than the S&P 500. The economy has been hot in recent years, and some financials are at a cyclical peak. We estimate 5% earnings growth per annum, resulting in a 2032 EPS of $13.28.

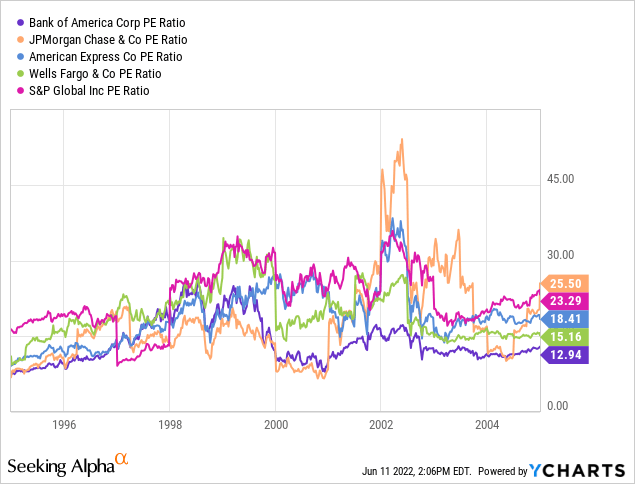

- Financials should get some multiple expansion; they traded at much higher PE ratios in the past. We have applied a terminal multiple of 14, which is appropriate for this level of growth. Our 2032 price target is $186 per share.

PE ratios of core holdings (1995-2005):

The Biggest Risk

A recession in the short-term is not what concerns us as long-term investors; Long periods of stagnation like we have seen in Japan and Europe does. In an environment with over-leveraged consumers, zero interest rates, and stagnant growth, financials struggle to grow. Investors must believe in normalized interest rates and economic growth in the U.S. for this thesis to play out.

Conclusion

Financials are set up to crush the broader market. Against both historical valuations and the S&P 500, financials are cheap. VFH holds a fantastic group of assets that are set to benefit from normalized interest rates and economic growth. The commodity of money is becoming more valuable, and lenders are about to get a bigger piece of the pie. We have a buy rating on VFH, and believe the short-term fear presents a long-term opportunity.

For more on this fund’s largest holdings, check out my articles:

Be the first to comment