B4LLS

In the corporate world that currently values speed and efficiency, many have struggled to find a balance between both, let alone come up with innovative solutions to improve their workflow. In recent years, we have seen an influx of project management [PM] software in the market that serves as a platform for the facilitation of collaboration among employees. Many of these have been successful to be taken public, while the others in the private markets have a post-money valuation in the tens of billions. In this article, we will attempt to present monday.com (NASDAQ:MNDY) to growth investors looking to purchase an enterprise with great amounts of cash reserves, despite aggressively investing in producing greater features for its customers and penetrating different markets. Not only is the application versatile enough for its price compared to its peers, but it also remains attractive for the long run considering its performance YTD.

Value Proposition

Gone were the days of updating spreadsheets, lines of post-its, and participating in long weekly update meetings. With project management software, managers are now able to better juggle their employees, freeing up more time for their own tasks and enabling the team to achieve goals in the most time and cost-efficient manner. Large corporations are more fixated on spending money to improve business efficiency and could choose to build out their own proprietary project management system or even lease it from some project management software company. Compared to small and medium businesses (SMBs), these corporations are able to get bulk discounts for the number of employees they have. This is where monday.com is able to cater to the needs of a spectrum of businesses.

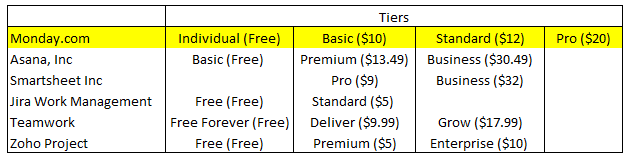

Pricing for Project Management Software for Monthly Subscription (Respective Companies’ Webpage) User Limits for Respective Packages (Respective Companies’ Webpage)

With Work OS as its main selling point, MNDY provides one of the cheapest and most flexible prices when it comes to its packages, enabling SMBs to stretch their every last dollar and focusing equally on its larger customers with more employees. This partially increases the switching cost for businesses as they continue to scale up and require more users since MNDY’s packages are rather competitively priced with its peers.

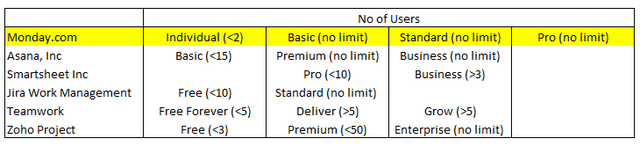

MNDY Features (Q2 2022 Earnings Presentation)

Another thing that drastically increases the switching cost for businesses is the features provided by the respective PM software. The company has come a long way since 2018, from just one board and a few columns and functions to a seamless and comprehensive solution to improve workflow. Its no-code and low-code capabilities enable any user to customise their experience to their own preference, developing routines that would be difficult to switch out of for cheaper and better alternatives.

Features-wise, MNDY provides a Time Tracking Column that enables users to keep track of the time spent on tasks and a longer activity log than Smartsheet, which leans more towards a spreadsheet and lacks an integrated time-tracking function. This is extremely important for the transparency of the team and their leaders to track progress and be accountable and punctual for their deliverables. Comparing the two biggest names in PM, MNDY has fewer integrations compared to its pricier alternative, Asana. However, it provides a greater number of templates (200+ compared to 50+), enables collaborative document editing, and controls email directly on its platform.

As such, MNDY remains well-positioned in the PM software industry compared to its peers.

Industry Analysis

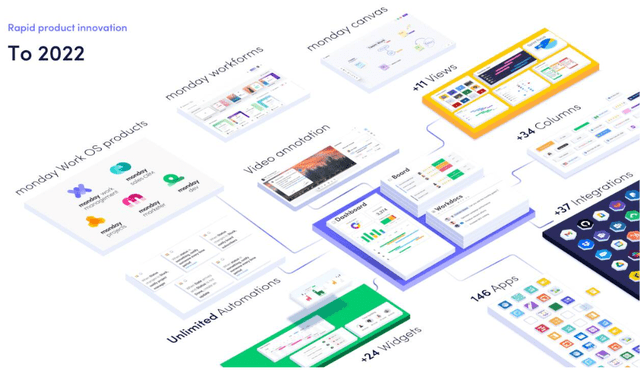

Stock Price of MNDY and its Peers (Seeking Alpha)

It is rather apparent that there is a weakness in the software-as-a-service (SaaS) industry and it affects PM software to a large extent. We saw greater retrenchment figures coming from the tech industry this year, which is still currently ongoing despite lower unemployment data in the US as a whole. PM software customers are largely from the tech industry and by reducing overall headcount, the y-o-y user growth rate for PM software could be taking a beating for 2022, causing analysts to lower their price targets for PM software stocks in general.

That said, we focus on the greatest detractor with a strong market positioning in the industry. This would provide investors with the greatest upside after this period of persistent headwinds from macroeconomic conditions and challenges faced by the industry.

Valuation

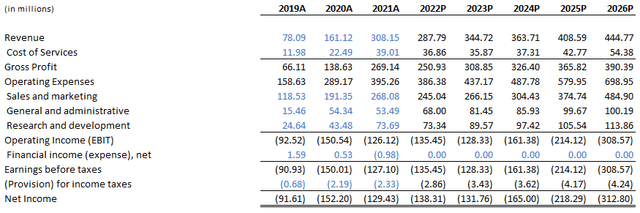

Income Statement with Projections (Author’s Spreadsheet)

Since the company was taken public slightly more than a year ago, we have to work with the limited data that the company provides through its F-1 and 20-F filings. The company generates most of its revenue from its flagship platform, Work OS, for which we projected its growth through the number of paying customers and average revenue per paying customer. We think that MNDY could continue growing its customer base by low double-digits as its rapid product innovation from 2018 has cemented its market positioning relative to its peers, providing that edge to continue attracting newer customers. However, our projection of average revenue per user takes into account the current macroeconomic trends, such as tech layoffs in 2022 and tapered the figure down accordingly.

For cost drivers, the management did not provide a detailed breakdown, and thus we modelled the company’s cost of service relying on our projected addition of customers and number of employees. These two proxies generally affect most of the drivers for MNDY’s cost of service, such as merchant and credit card processing fees, hosting fees, salaries, and related expenses. It is important to note that in our assumption, we projected a dip in the number of employees in 2022 to match the current tech layoff trend, and gradually pick up in hiring at double-digit growth rates by 2026.

No of Employees Projection (Author’s Spreadsheet)

For operating expenses, we projected research & development and general & administrative cost as per the management’s forecast to increase in absolute dollar amounts but remain at least at the same level as a percentage of the company’s total revenue. We are more focused on the projection of sales and marketing expenses, which are the most significant component of MNDY’s operating expenses. Consisting of marketing & advertising expenses and commission paid to MNDY’s partners, we assumed a sharp decline in the former in 2022, before increasing sharply in the year following and gradually tapering it down. For the latter, we looked at the number of partners ever since its rapid product innovation and forecasted a declining growth rate as MNDY begins to be more established.

No of Partners Projections (Author’s Spreadsheet)

Lastly, we assumed a net zero in financial income/expense, taking into account the complexity of estimating its components (eg: exchange rate income/expense, interest income on deposits). We also assumed that the company would not be drawing down on its $80 million credit facility, thus incurring 0.2% per annum on unutilized amounts eligible for drawdown with rather insignificant impacts.

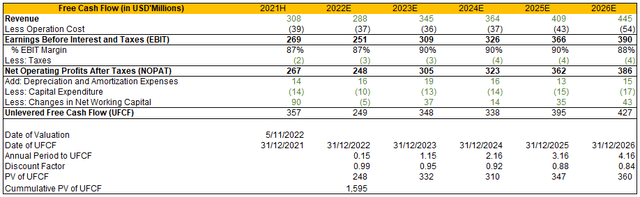

Unlevered FCF Projections (Author’s Spreadsheet)

We conducted a discounted cash flow analysis to determine the present value of MNDY’s future cash flows. For this company, we chose to not add back stock-based compensation as SBC expense is part of the cost of service and the other parts of operating expenses. This is to account for the significant dilution of existing shareholders from what we observed since its public offering.

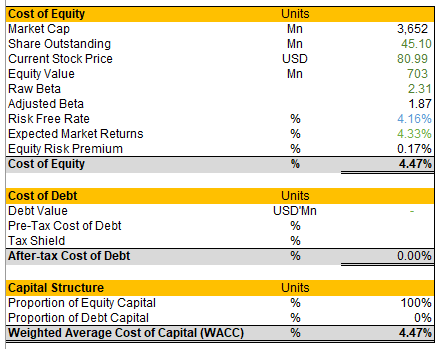

Capital Structure of MNDY (Author’s Spreadsheet)

For the capital structure of MNDY, this section is probably the most volatile projection that we come up with, primarily due to the zero cost of debt at the moment and pegging expected market returns to that of the US 5Y Treasury Note.

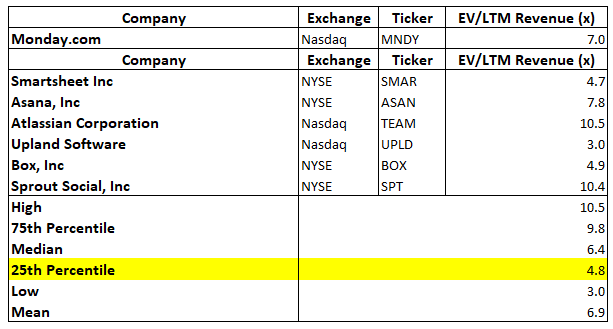

Peer Comps for MNDY (Capital IQ )

We decided to utilise an exit multiple method for our discounted cash flow model, simply because the company is still relatively nascent in the public markets and its EBITDA is currently and projected to be negative. As such, we chose to use the 25th percentile for our EV/LTM Revenue multiple to be conservative in times of industry weakness that could affect revenues and considering the rapid growth of the company 5 years from now.

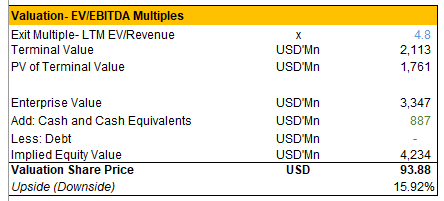

Implied Equity Valuation for MNDY (Author’s Spreadsheet)

As such, we derived an implied valuation of a 15.92% upside from the current price as of writing this article.

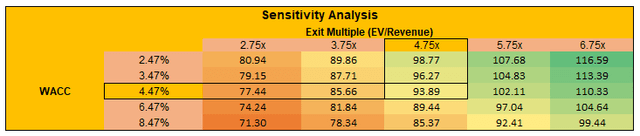

Sensitivity Analysis of Exit Multiple Method (Author’s Spreadsheet)

To mitigate the risk of underestimating MNDY’s WACC and exit multiple, the stock still has greater room to fall and lesser upsides, considering the full range of exit multiples if WACC increases.

Conclusion

In all, the company’s revenue generation compared to the utilisation of its cash reserves remains upbeat till the latest earnings report. We think that the company’s competitive advantage of being a more versatile platform at a competitive price could continue to benefit MNDY in terms of revenue generation. Some key concerns that we think could affect our projections are persistent cash burn through sales & marketing and research & development. Both are necessary to ensure MNDY continues to grow its business, which could be disastrous if such expenses generate lesser returns in terms of revenue. Another concern would be with the company’s stock-based compensation packages, as the drastic dilution of existing shareholders’ value has to be compensated with even greater growth of the company’s business in order for the stock price to not experience massive declines.

We would recommend monitoring if industry weakness continues to persist past 2023 and consider opening a small position on further declines in the stock price. It is imperative to note that the dilution of existing shareholders has been massive and could be likely to continue for the foreseeable future, which could cause further declines in MNDY’s stock price.

Be the first to comment