primeimages/iStock via Getty Images

Originally posted on October 9, 2022

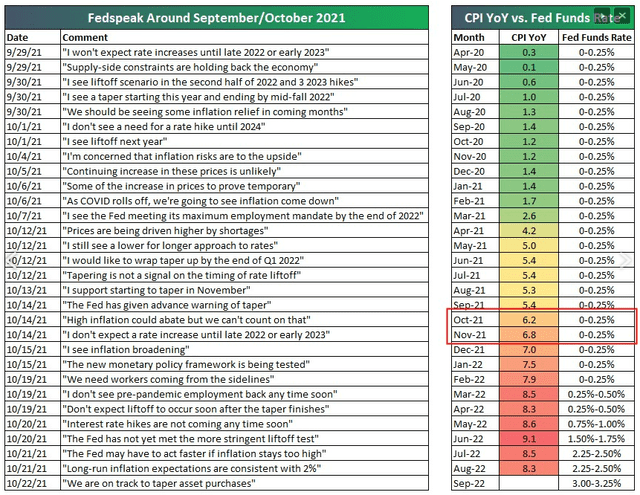

It’s been said that Goldman Sachs had a 5,100 S&P 500 target for year-end 2022 and thought the fed funds rate would be at 1% by the same deadline. This might explain why Goldman held those targets. There was a rash of articles and CNBC comments lambasting the Fed and Powell that started about 3 weeks ago.

This is a Bespoke table cut-and-pasted from the October 6 “Chart of the Day”.

The Fed fiddled while the US capital markets burned.

This should infuriate most investors, but that is wasted energy. My guess is they could be late in reducing the fed funds rate when the time comes too.

This blog thought the June ’22 lows would hold, but that doesn’t appear to be the case. Next major support for the S&P 500 is 3,550 or the 50-month moving average.

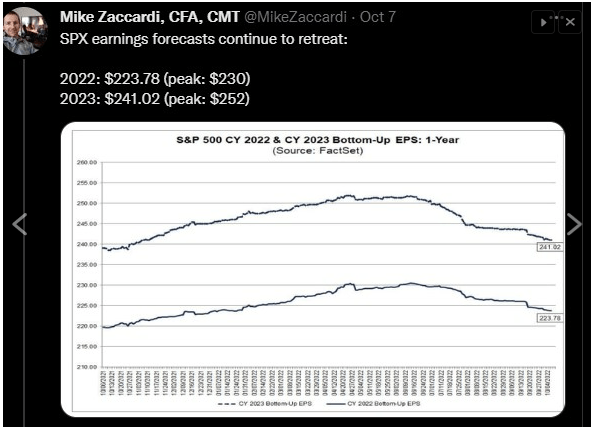

This is a great chart from Mike Zaccardi posted to Twitter (@MikeZaccardi); I’ve tried to describe this in the weekly S&P 500 earnings update.

What’s interesting is the current EPS estimates vs the “peak” 2022 EPS is down about 3% and 2023 EPS estimate has slid about 4%. That’s still not very severe.

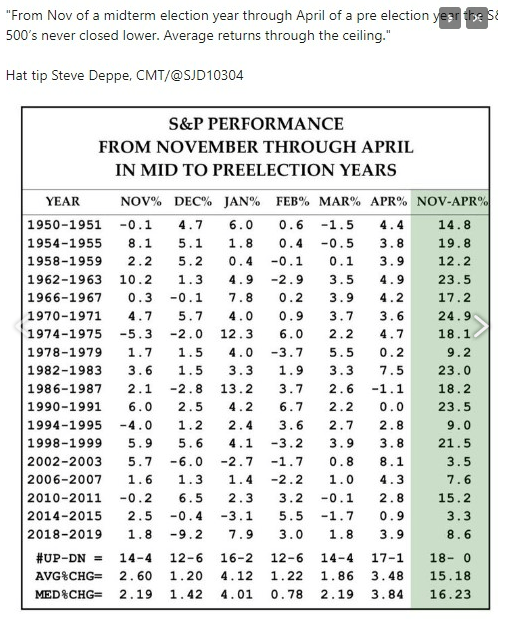

This is a LinkedIn post from Gary Morrow on the “midterm election year” effect. Note the Nov – April return profile.

The midterm elections are a month from yesterday and will take place November 8, 2022.

From J.P. Morgan’s Guide to the Market as of 9/30/22

If you are wondering which sectors might be impacted by the strong dollar, here’s each sector of the S&P 500 and its percentage of non-US sales:

- Energy: 39%

- Materials: 56%

- Financials: 22%

- Industrials: 32%

- Cons Discretionary: 34%

- Technology: 58% (!)

- Comm Services: 42%

- Real Estate: 16%

- Health Care: 37%

- Cons Staples: 44%

- Ute’s: 2%

- S&P 500: 40%

Financials, Utilities and Real Estate are the lowest percentage of non-US sales. That could help financials this week as they report Q3 ’22 earnings.

The bond market is closed Monday, October 10th, 2022.

That’s about it for the long weekend.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment