Cecilie_Arcurs

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of the CEF Weekly Roundup on September 21, 2022, with certain numbers updated.

ZTR rights offering results

The results for the rights offering Virtus Total Return Fund Inc. (NYSE: NYSE:ZTR) are in! This was a non-transferable, 1-for-3 rights offering that expired on September 19, 2022. ZTR is a hybrid equity/fixed income fund focused on the utilities/infrastructure sector.

From the press release:

HARTFORD, Conn., Sept. 19, 2022 /PRNewswire/ — Virtus Total Return Fund Inc. (NYSE: ZTR) announced the completion of its non-transferable rights offering that expired on September 16, 2022. In accordance with the Prospectus, the subscription price was determined to be $6.96 per share, which was equal to 95% of the lower of [i] the net asset value per share of the Fund’s common stock at the close of business on September 16, 2022 (the “Pricing Date”), or [ii] the average of the last reported sales price of a share of the Fund’s common stock on the New York Stock Exchange on such date and the four preceding business days. The net asset value per share of the Fund’s common stock on the Pricing Date was $7.88. The average of the last reported sales prices of the Fund’s shares on the Pricing Date and the four preceding business days was $7.33. It is anticipated that confirmations will be issued on or shortly after September 23, 2022. Under the terms of the rights offering, shareholders as of the Record Date were entitled to acquire one share of common stock for each three shares held, up to an aggregate of 16.5 million shares of common stock of the Fund, plus up to an additional 25% if the offering was oversubscribed. Based on preliminary results provided by the Fund’s Subscription Agent, the Fund received requests for approximately 20.3 million shares. The Fund expects to announce the aggregate number of shares subscribed for and the total net proceeds to the Fund on or about September 21, 2022.

A subsequent press release confirmed that all 20.3 million subscription requests would be fulfilled, with a total of $140.6 million of proceeds added to the fund.

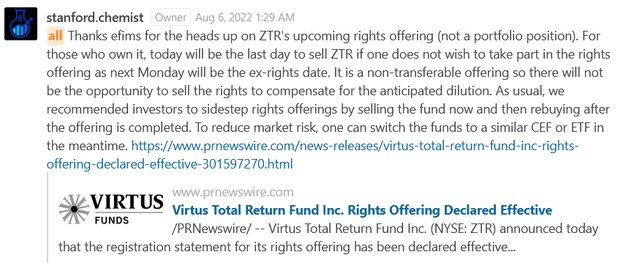

We discussed this when it was announced in a previous CEF Weekly Roundup (public link) and then again last week when it was due to expire in another Roundup.

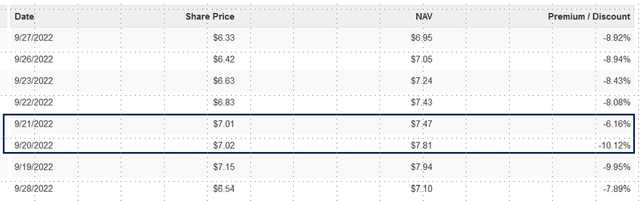

To recap, the subscription price was the lower of 95% of the NAV on the expiry date, or 95% of the average closing market price on the final five days of the offering. Because the fund traded at wider than a -5% discount on expiry date (the discount was -9.14% to be exact), the 95% of the average closing market price was used putting the subscription price at $6.96. This was a discount of -2.8% to the actual closing price on expiry date, or a -11.7% discount to the NAV.

Despite what ended up being only a slim discount to the current market price, the fund still received subscription requests for 20.3 million shares, exceeding the 16.5 million shares available in the primary subscription and nearly hitting the maximum of 20.6 million shares if the oversubscription is fully allocated.

Unfortunately, this also means that the offering is going to be dilutive to the NAV/share of the fund, penalizing the investors who did not subscribe in the rights offering. The NAV/share hit is estimated to be between -3.0% to -3.5% by my rough calculations.

Looking at the NAV history of ZTR, it looks like that the NAV adjustment occurred on September 21, the day that the fund announced the final aggregate amount of shares subscribed in the subsequent press release. On that day the fund’s NAV dropped by -4.35%, on a day that utilities (XLU) declined by -1.37%, so the net NAV decline in the fund was around -3%, consistent with my estimate.

As we discussed last week, our recommendation to sidestep a fund which is undergoing a rights offering was proven to be accurate once again (tax issues not considered).

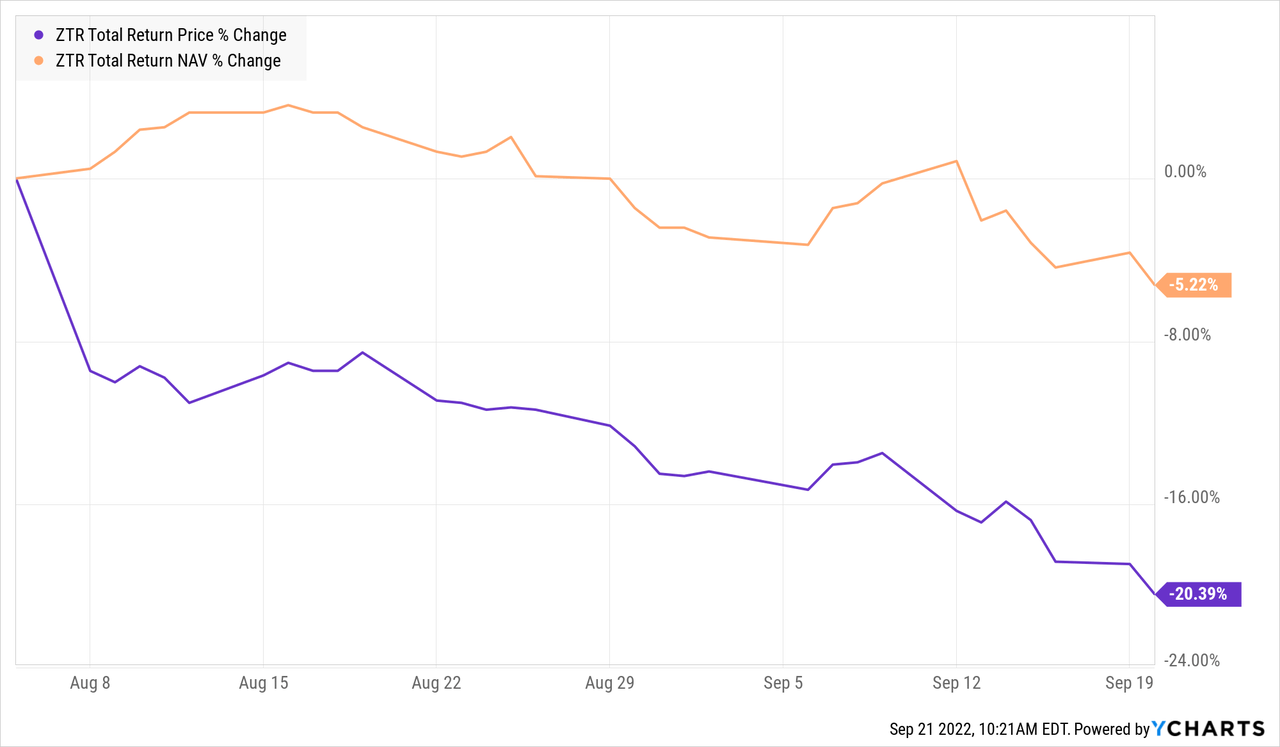

Since the ex-rights date, ZTR’s price has underperformed its NAV by 15 percentage points (!).

YCharts

Going forward

All other things being equal, the dilutive offering will make the distribution less safe due to the approximately -3% hit to NAV/share. However, this is small relative to the effects of the current bear market that we are in, so it’s unlikely to be the deciding factor if the distribution does need to be cut. If the market does not recover, I do expect an eventual cut because paying out a NAV yield of 14.44% (market yield 15.57%) is not sustainable in a bear market when the net income coverage is only 28%.

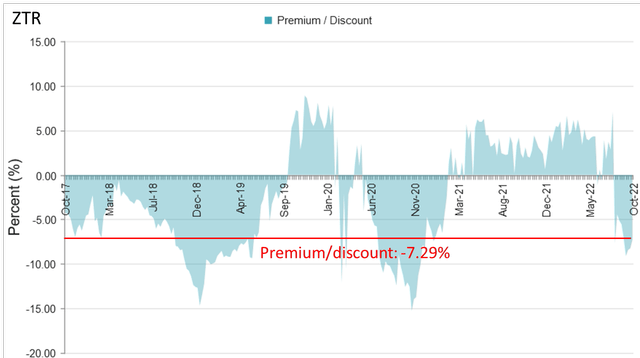

ZTR currently is showing a -7.29% discount (as of October 7, 2022), which is relatively attractive discount compared to its 1, 3 and 5-year average discount values of +1.89%, -0.08%, and -2.40% respectively.

Nick last covered ZTR for our members here: ZTR: Utilities To The Rescue (public link).

Strategy Statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to “double compound“ your income.

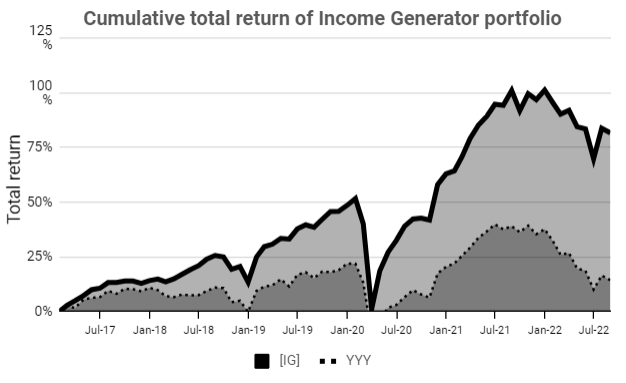

It’s the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Income Lab

Remember, it’s really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

Be the first to comment