Ralph Orlowski

In my last article, I claimed that you won’t regret investing in Henkel AG (OTCPK:HENKY). Now – about five months later – it is probably too early to determine if that statement is correct as I want to invest for the long run and not just for 5 months. But when looking at the stock price in Euro (and that is the currency Henkel is trading for), the stock actually increased from about €59 on April 7, 2022, to €61 at the point of writing. And considering the mediocre performance of the stock market on both sides of the Atlantic, Henkel was actually one of the better performing assets.

In my opinion, Henkel is well-supported around €60, but I don’t want to rule out the possibility of lower stock prices for Henkel. Especially if Germany should face an energy crisis in the next few months (probably combined with a recession as well as potential financial crisis), we most likely will see lower stock prices for most equities – including Henkel. In the following article we are looking at Henkel again – especially on aspects like energy-dependence and a potential recession.

Half-year Results

We start by look at the half year results for fiscal 2022 and Henkel reported solid top line growth. Sales increased from €9,926 million in the first half of fiscal 2021 to €10,913 million in H1/22 – an increase of 9.9% year-over-year. But while the top line could increase, operating profit declined 47.2% from €1,296 million in H1/21 to €684 million in H1/22. And earnings per share declined even 52.3% year-over-year from €2.18 in first half last year to only €1.04 in the first half of 2022.

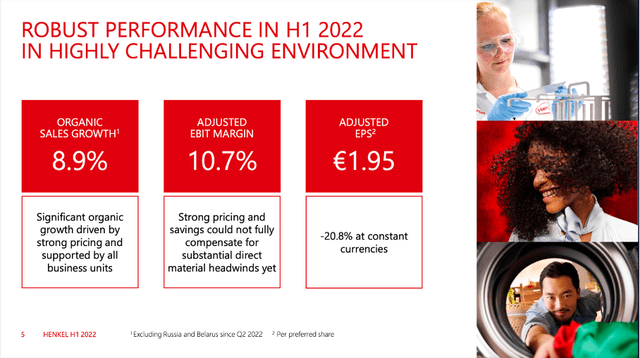

Henkel H1/22 Presentation

When looking at some additional metrics, organic sales could increase 8.9% year-over-year – mostly driven by 10.2% higher prices (and slightly offset by 1.3% lower volume). When looking at adjusted earnings per share, we also see a decline but not as steep: Adjusted EPS declined from €2.40 in H1/21 to €1.95 in H1/22 – a decline of 18.8%.

Henkel H1/22 Presentation

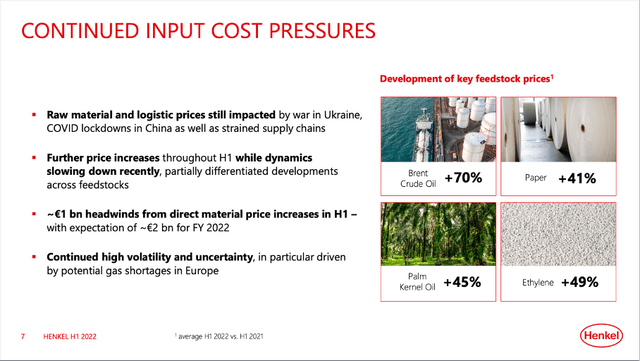

When looking for reasons of these mediocre results, we mostly must mention the continued cost pressures and increasing cost of sales. Raw material and logistic prices are still impacted by different factors (war in Ukraine or lockdowns in China) and prices for crude brent oil for example increased 70% (at the time of the presentation), paper increased 41% or Ethylene increased 49%. In total, cost of sales increased 19.7% year-over-year for Henkel and could therefore not be offset by the 10% top line increase.

Additionally, one-time expenses – which are mainly attributable to non-cash charges related to assets held-for-sale, especially concerning the Russia business activities – were $281 million and lowered the company’s EBIT. After management seemed to refuse to exit Russia for several weeks after Putin invaded Ukraine, Henkel also decided to exit business activities in Russia and Belarus in April 2022.

Henkel H1/22 Presentation

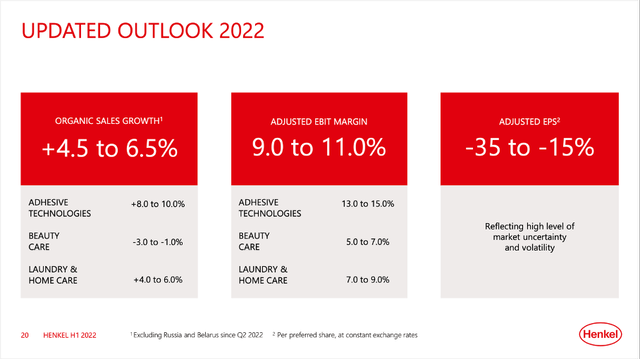

When looking at the company’s guidance for fiscal 2022, management is expecting organic sales to increase between 4.5% and 6.5% but adjusted EBIT margin will only be between 9.0% and 11.0% and this is also resulting in adjusted earnings per share declining between 15% and 35% compared to fiscal 2021.

German Energy Crisis?

When talking about Germany and German businesses, some questions seem to be particularly important these days: Will there be enough gas and oil during the winter? Will energy-intensive companies face problems? I still think that Germany will manage to come through the next winter without lights going out or manufacturing having to shut down, but we can’t ignore the high risks Germany is facing right now. When reading the news, it sounds comforting that gas storage in Germany is filled about 87% (which is above the average of 2011-2019) and the government seems optimistic to reach its goal of 95% filled gas tanks at the beginning of November.

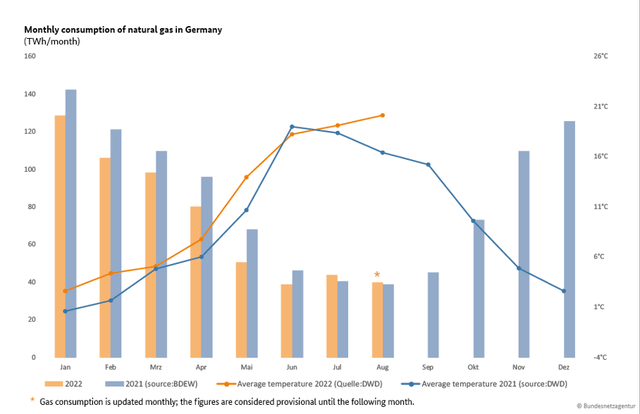

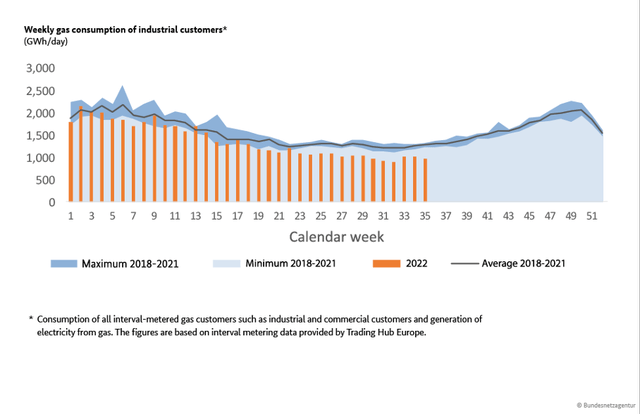

Bundesnetzagentur

Between January 2022 and July 2022, Germany could lower its gas consumption about 15% compared to the same timeframe in 2021. But of course, (private) gas consumption is connected to weather conditions, and this summer was one of the hottest summers ever in Germany making it rather easy to lower energy consumption.

We don’t know what the winter will bring and in a cold winter, Germany could face problems rather quick as filled gas storages are giving us a false sense of security. Germany has a storage capacity for 256 terawatt hours of gas, which will be enough for two or three months during the winter. In previous years about 55% of Germany’s gas supply stemmed from Russia implicating that about 45% of gas supply stemmed from other countries – mainly the Netherlands, Belgium, and Norway.

Bundesnetzagentur

However, it seems like a good sign that weekly gas consumption of industrial consumers is below the maximum and average of the last four years. These are probably “real” savings and not just effects on lower consumption due to a hot summer.

And Henkel also managed to reduce its energy consumption during the last decade. While Henkel used about 3,000 megawatt hours in 2010 it could reduce its consumption to about 1,600 megawatt hours annually right now. Nevertheless, Henkel is using a lot of energy and if Germany should run into troubles during the next winter, Henkel might be affected as well.

Recession

But Germany is not just facing the risk of an energy crisis. Germany and many other countries around the world are facing the risk of a steep recession and the energy crisis will contribute to this recession (especially in many European countries). And it makes sense to ask the question how resilient Henkel would be in case of a recession as it does not make much sense to invest in a cyclical business right before the economy is about to enter a recession.

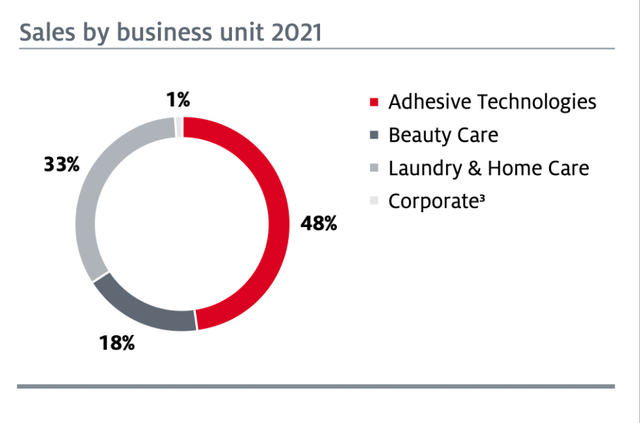

In case of Henkel, we must look at the business segments as the three business segments will be affected by a potential recession rather different. When looking at the adhesive technology segment, we see strong growth rates right now, but a business segment that might also be rather vulnerable in case of a recession. When talking about industries like “Automotive & Metals” or “Electronics & Industrial” we have sub-segments which are rather cyclical, and which might be affected by a recession. And it seems likely that demand will decline for several quarters and the “Adhesive Technologies” segment might be less recession-resilient than the other two segments. And this could be problematic as Henkel generated 48% of its sales from the” Adhesive Technologies” segment.

Henkel Annual Report 2021

When talking about “Beauty Care” as well as “Laundry & Home Care” we have two segments that will most likely see stable product demand even in economic downturns. Products like laundry detergents or hair care products are also purchased during a recession. It might happen that some customers will switch to cheaper competitors or not buy branded products anymore. However, psychological switching costs are rather high – one must switch to the product of a competitor without knowing if it is the same quality only to save a few cents.

Although the adhesive technologies segment might not be so resilient in case of a recession, we can assume Henkel to perform quite well, and revenue might be more or less stable in case of a recession.

Balance Sheet

When a company is facing challenging times, it is especially important to look at the balance sheet. In order to weather these storms, it is helpful for a business to have not too much debt on the balance sheet. On June 30, 2022, Henkel had €1,243 million in short-term borrowings and €1,680 million in long-term borrowings and when comparing the total debt of €2,953 million to the total equity of €20,338 million we get a debt-equity ratio of 0.15, which is no reason for concern. We can also compare the total debt to the operating income Henkel generated in fiscal 2021 – €2,113 million in operating profit (EBIT) – and it would take about 1.4 years to repay the outstanding debt.

And when looking at the development over the last year, Henkel could increase total assets from €30,759 million on June 30, 2022, to €33,966 million on June 30, 2022. And total equity also increased from €18,475 million on year ago to €20,338 million on June 30, 2022. All in all, Henkel has a solid balance sheet and neither an energy crisis nor a recession should get Henkel in trouble.

Intrinsic Value Calculation

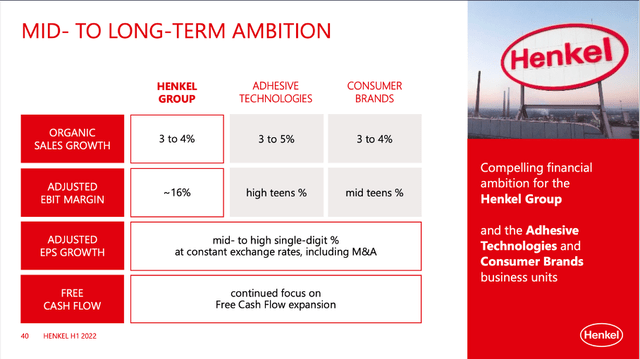

Despite all the challenges Henkel is facing, management is staying optimistic and holding on to its mid- to long-term ambitions of 3% to 4% organic sales growth as well as mid- to high single-digit adjusted EPS growth. And if we take these assumptions, Henkel would be clearly undervalued.

Henkel H1/22 Presentation

Right now, we should be a bit cautious if Henkel can actually achieve higher growth rates in the years to come. Henkel is struggling for several years now and when looking at the recent past, high growth rates and huge optimism does not seem justified. However, when only assuming 3% growth for the years to come, we get an intrinsic value of €65.83 for Henkel (I assumed €2 billion in free cash flow as basis, which might be a realistic amount). And when assuming 4% growth we get an intrinsic value of €76.80 for Henkel. And while I don’t know if Henkel can fulfill its mid- to long-term financial ambition of mid- to high-single digits growth for earnings per share, 3% to 4% annual growth is definitely achievable for Henkel.

In my last article, I stated that an intrinsic value between €90 and €100 is probably realistic and in the last five months not much has changed and that statement is still true in my opinion. Henkel is struggling and will continue to struggle for several quarters. But over the long run, the performance for the next few quarters won’t matter. And for an intrinsic value around €100, Henkel does not have to grow in the mid-to-high-single digits, but only about 5% annually.

Conclusion

I don’t know if I should recommend buying Henkel right now. On the one side, I see Henkel as undervalued and even when assuming rather low growth rates in the next few years, the stock is trading below its intrinsic value. And long-term, Henkel is a solid business with a business model that is working. On the other hand, we must assume a bear market – which will occur in the coming quarters – will draw many stocks down. And even Henkel, which declined already 50% could fall lower and the current support level around €60 might not hold.

Despite the downside risk in the next few quarters, I would still be rather bullish about Henkel long term but will clearly point out that lower stock prices in the coming months are likely, and investors will probably suffer a loss in the next few quarters when holding on to Henkel. But in a few years from now (and especially in one or two decades), I assume Henkel trading for a much higher price.

Be the first to comment