onurdongel/iStock via Getty Images

A lot of semiconductor stocks have crashed this year, but companies like NXP Semiconductors (NASDAQ:NXPI) are still seeing strong demand and a lack of supply. The stocks with a lot of automotive exposure are even more appealing due to the restrictions on supplies during covid limiting any pulled forward demand. In addition, NXP Semi. has some acquisition appeal boosting the potential for quick gains and downside protection in this volatile market.

Automotive Leader

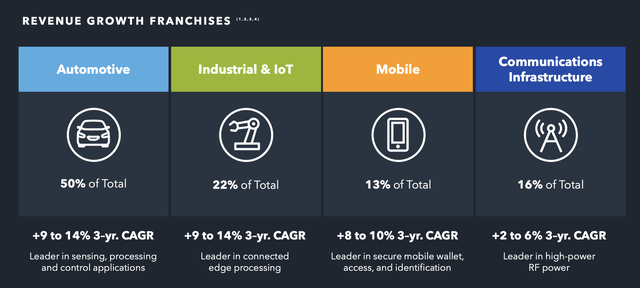

The most interesting part of NXP Semi. is that the automotive business is the driving force of the chip company. The company obtains about 50% of total revenues from the automotive sector with growth rates in the 10% range. The sector is seeing booming demand due to higher technology content in general and especially with modern electric vehicles.

Source: NXP Semi. Investor Day 2021 presentation

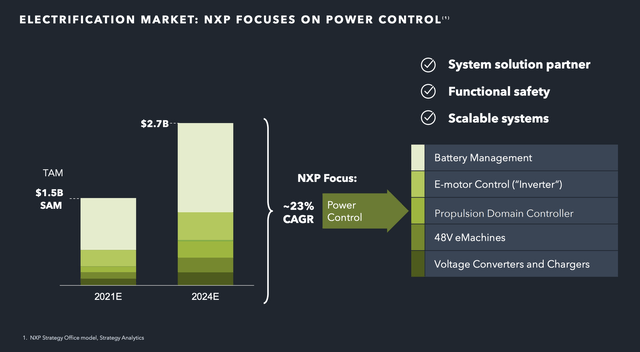

As highlighted at the Investor Day back in November, NXP focused on the power control systems for EVs. The company has technology for the electrification process, battery management system and in-vehicle network sensors.

This market is forecast to nearly double from 2021 to 2024 reaching a total market of $2.7 billion. The EV market will still be in the infancy a few years from now. With EVs having roughly 2x the semiconductor content, this is another strong secular tailwind to growth.

Source: NXP Semi. Investor Day 2021 presentation

While the auto market offers so much promise, the company recently reinforced the incredible demand imbalance in the current market. On the Q1’22 earnings call, CEO Kurt Sievers highlighted these key issues showing how demand still far exceeds supply while other semiconductor companies are running into demand issues:

- The months of supply in the channel was 1.5 months, which is about a month below our long-term target.

- Lead times across the board continue to be extended, with more than 80% of all of our products being quoted at 52 weeks or greater.

- In the U.S., new car inventory at dealers is substantially below historic levels at 27 days versus the historic metric of 64 days.

The company estimates needing an additional $500 million worth of inventory at auto OEMs in order to normalize inventory levels. Management even factors in estimates for potential double and triple orders by customers desperate for additional supplies.

Deal Or No Deal

The rumor this week was that Samsung (OTC:SSNLF) plans to acquire NXP Semi. The stock initially jumped on the news, but the stock ended up fading with the market last week. The stock trades over $60 off the highs from just in January.

As well documented, the auto chip company will be a difficult acquisition target due to regulator issues around the world. QUALCOMM (QCOM) failed to purchase NXP Semi. years ago and a move by a Korean company is likely to raise the alarm bells of European regulators.

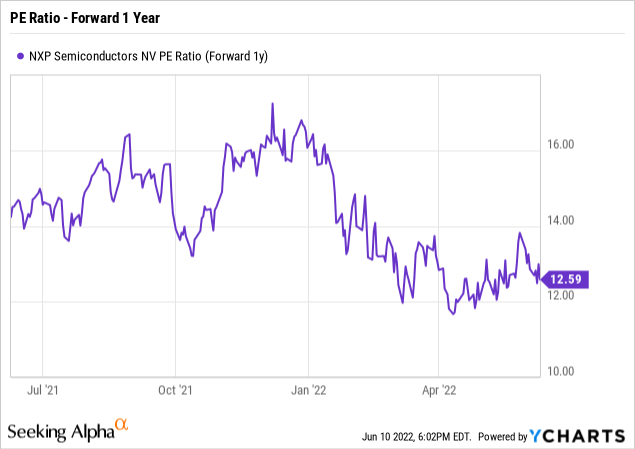

The stock hasn’t collapsed as much as other semi. stocks, but NXP Semi. only trades at 12.6x forward EPS targets. The auto market never boomed during covid, but a recession and higher financing costs could definitely limit some of the production rebounds in 2022.

A deal by Samsung would provide an immediate gain for shareholders, but the stock is so cheap here that an investor doesn’t need or want a lowball bid. Clearly, the Korean chip giant would love to acquire NXP Semi. down here for a relatively low premium. The growth potential in auto is very appealing to every company in the sector.

The stock offers a 1.8% dividend yield and NXP Semi. plans to continue repurchasing cheap shares with all of the cash flow generated each quarter. For Q1’22, the company bought 2.65 million shares for $552 million.

The diluted share count dipped from 283 million shares last year to 265 million for Q1’22. In total, the company reduced the share count by 6.4% in the last quarter. Between the share buybacks and the potential for NXP Semi. being an acquisition target, the stock appears to have downside protection here around $180.

Takeaway

The key investor takeaway is that NXP Semi. is far too cheap here with the company riding the automotive semi. demand higher. The company continues to repurchase tons of shares with the free cash flow being generated from a strong business with growth drivers to power through a recession.

Investors should use the weakness in the semi. sector stocks to buy NXP Semi.

Be the first to comment