Sundry Photography/iStock Editorial via Getty Images

Price Action Thesis

This is a detailed and timely price action analysis follow-up to our post-earnings article on Enphase Energy, Inc. (NASDAQ:ENPH) in May. Given the bull trap that formed last week, we now have a robust price action structure to discuss our perspective and help investors visualize our analysis more clearly. Moreover, given the bull trap, we are increasingly convinced that ENPH stock’s colossal run could end once the market decides to digest those massive 2020-21 gains.

Therefore, investors still sitting on those tremendous gains should consider paring down their positions by layering out. Don’t hold on to the bag when the dominoes start to fall.

Accordingly, we reiterate our Sell rating on ENPH stock.

Don’t Ignore The Double Top Bull Trap

There are two types of price action structures that we have the utmost respect for. The double top bull trap (only seen in an uptrend) and the double bottom bear trap (only seen in a downtrend).

Why? Because these are highly effective, potential trend reversal signals that could set the stage for a sustained reversal in a stock’s trend. Therefore, we pay close attention to such price action structures, given the prevailing investors’ sentiments in the market preceding these traps.

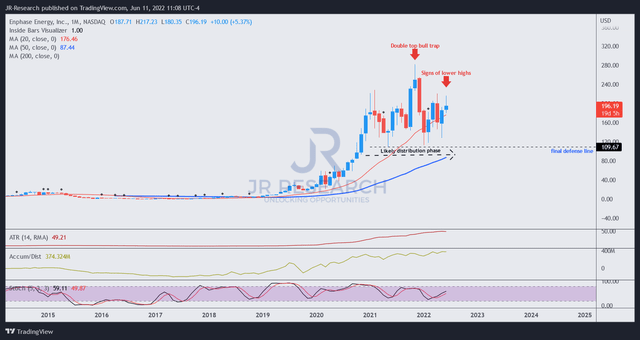

ENPH price chart (monthly) (TradingView)

The double-top bull trap for ENPH stock occurred in November 2021 (see monthly chart above). Note that ENPH stock was in an uptrend preceding the formation of the trap. Therefore, how were investors’ sentiments preceding the trap? You probably guessed it. It’s likely extremely bullish, as the market drew in buyers rapidly, as seen in the price bars before the bull trap formed. That’s why it’s called a bull trap. Don’t believe double top bull traps need to be respected? Check out our articles on Moderna (MRNA), Costco (COST), and Plug Power (PLUG).

After a double top bull trap is formed, investors should use the price action signal to get out because it could portend a sustained reversal of its trend. The challenge is that the market could continue to distribute before forcing a steep sell-off subsequently. Unfortunately, the duration of the distribution phase is the one that’s hard to predict.

We believe that ENPH stock is currently in such a distribution phase. Also, note that ENPH stock has failed to break to a higher high in a sustained fashion, akin to a slow accumulation phase. Instead, every subsequent recovery to its near-term resistance after its double top bull trap has been a series of bull traps. Therefore, that’s ominous.

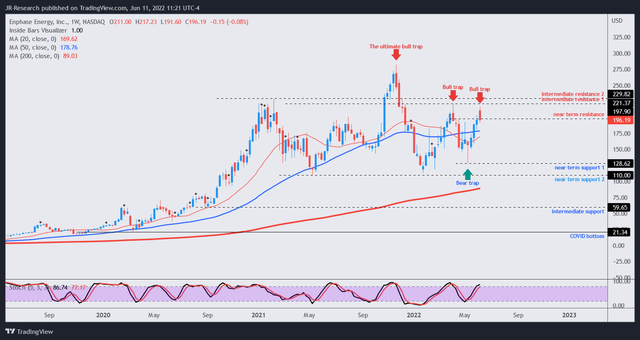

ENPH price chart (weekly) (TradingView)

As seen in our weekly chart above, ENPH stock formed a couple of bull traps in April and June after its February double top. The price action also occurred close to its near-term resistance.

Therefore, we believe it’s increasingly likely that ENPH stock is facing massive resistance at the current level and should represent the top of its current distribution range.

The bear trap reversal price action in May is valid. However, the price action structure has already been resolved through its bull trap in June, as seen above. Furthermore, initial bear traps after double top bull traps are usually unreliable. Therefore, investors watching for potential bear traps should consider a further re-test of its near-term support before adding exposure.

However, since our thesis is for the double top price action to play out, we don’t think the near-term support would hold. Instead, we see a further decline toward the gap between its near-term and intermediate support. If the extent of the decline reaches its intermediate support, that would mean a potential retracement of close to 70% from June 10th’s close. If a double bottom bear trap forms at that level, we consider it attractive.

Is ENPH Stock A Buy, Sell, Or Hold?

If you have ENPH stock, we urge you to start layering out. Use the current bull trap to cut exposure. Please don’t wait till it falls back to its support zone.

If you don’t have any ENPH stock, we implore you to wait for a resolution of its double top bull trap and its accompanying distribution phase. Be patient with adding ENPH stock. Let the dominoes fall first.

Accordingly, we reiterate our Sell rating on ENPH stock.

Be the first to comment