Baris-Ozer/iStock via Getty Images

3M Company (NYSE:MMM) is an anomaly. While conducting research for this article, I saw the company characterized as “an innovative powerhouse” and an “industrial stalwart.” Pundits wax poetic as they describe the firm’s prodigious R&D spend, and the mountain of patents the company has won (118,000 overall, and 9,000 U.S. patents since 2001). Invariably, they point to these and other characteristics of 3M as factors that provide a nearly unassailable competitive advantage.

Of course, the firm’s position as a Dividend King is also frequently cited, along with the jumbo yield the stock is currently sporting. In fact, at least one writer included 3M’s membership among the Dogs of the Dow as a positive.

While novice investors may jump at the opportunity to snare a high yielding stock, a dividend paying 4% or more often prompts market veterans to pause. Too often, a high yield is the result of a declining share price, which in turn is the result of deteriorating fundamentals.

Therein lies 3M’s departure from the norm. Yes, the company is innovative, and it does possess a wide moat; however, the stock has somehow managed to lag the S&P 500, rather badly, I might add, for one, five, and ten year time frames.

One cause of the poor performance is that the number of litigants assailing the firm actually outnumber the number of patents awarded 3M. Add to that a decade of slow growth and a variety of headwinds, and you are left with an investor’s conundrum.

The Positives That Are 3M

There is no doubt, 3M leads many of its rivals in terms of the intellectual property it has amassed. The company maintains this lead in part by devoting nearly 6% of net sales to R&D. This compares favorably with a median R&D spend among the Global Innovation 1000 of 5.5%, as well as the median R&D budget of 2% to 3% for diversified industrial firms. The resulting technological advantage allows 3M to charge a 10%-30% premium for its products while at the same time reducing unit costs.

One mark of the company’s dedication to innovation is that senior engineers employed by 3M are free to devote 15% of their work time to projects and ideas of their choosing. It is reasonable to assume this boosts the company’s research efforts.

According to analysis provided by Morningstar, 3M’s technology and manufacturing scale generates a strong cost advantage over competitors. This results in the company yielding gross margins ten to twelve percent higher than that of rivals. Furthermore, 3M’s production facilities are typically larger, resulting in 40%-45% more productivity than competitors’ smaller plants. The same holds true of the firm’s distribution centers, which are on average 20%-to 25% more efficient than that of most other industrial conglomerates.

Another manifest positive is that MMM is highly diversified. With 55,000 products, and roughly 65% of revenue generated outside the US, the company does not rely on a concentrated core of customers or a narrow market to generate sales.

The Flip Side Of The Coin

Investors familiar with 3M are well aware of the litigation risks associated with an investment in the stock.

Lawsuits related to the company’s production and use of PFAS have been ongoing for years.

PFAS is an acronym for substances used in a variety of 3M products, including non-stick cookware and stain-resistant fabrics. Oftentimes they are referred to as “forever chemicals” as PFAS is known to persist in the environment.

The following list is by no means comprehensive, but it provides readers with an insight as to the potential for these suits to increase in number, and it indicates that 3M may be weighed down by these court proceedings for an extended period.

To date, 3M is a defendant in at least 187 PFAS lawsuits. In 2019, six states filed class actions against the company. By some estimates, 3M could eventually be liable for up to $32 billion in product liability, litigation, and pollution-cleanup expenses associated with PFAS.

Recent court cases include a settlement late last year that resulted in 3M paying $99 million to four litigants in Alabama. In addition, 3M previously spent $100 million on related cleanup efforts, and the company also agreed to spend more due to a consent decree issued by the state of Alabama and EPA.

Early last April, a court in Ohio made way for a PFAS class action lawsuit that includes over seven million people. The court also ruled that citizens from other states may be permitted to join the Ohio class action lawsuit, potentially adding millions more to the pool of litigants.

Add to this a suit by a state agency in California claiming 3M “knowingly” polluted groundwater, and legal action for a similar claim regarding pollution of water sources on a number of US military bases.

The company also has government agencies breathing down its virtual neck. Late last year, environmental regulators in Belgium banned PFAS emissions. This resulted in 3M closing a factory in that country.

Six weeks ago, the Environmental Protection Agency announced it is taking action “to protect communities and the environment from per- and polyfluoroalkyl substances (PFAS) in our nation’s waters.” How this could affect 3M remains to be seen.

The PFAS lawsuits are but one source of litigation against 3M. The company is also embroiled in litigation related to hearing protection products sold to the US military.

From 2003 through 2015, 3M Company sold Combat Arms earplugs to the US military. According to Veterans Affairs, hearing loss and tinnitus are the two most common service-connected disabilities among veterans. In 2017, disability compensation was paid to over 1.16 million veterans for hearing loss, and approximately 1.79 million former military members for tinnitus.

Less than two weeks ago, a U.S. District Judge reduced a $55 million verdict to $21.7 million in a case brought against 3M for faulty Combat Arms earplugs. Along with this verdict, the judge identified an additional 500 similar claims that will move forward.

To date, 3M has lost nine of fifteen similar cases. It is estimated that in the future, the company will face up to 1,500 Combat Arms earplug trials. As the federal court system generally hears about 2,000 civil jury trials each year, the suits involving Combat Arms earplugs may weigh on MMM shares for quite some time.

Moreover, Bloomberg reported the company may eventually be liable for up to $185 billion in damages related to Combat Arms earplugs. You can count me among those who believe 3M will resolve the suits for a fraction of that cost; however, readers should weigh the ramifications of these lawsuits when considering an investment in the company.

Lawsuits have impacted MMM’s bottom line to such an extent that management has changed its reporting approach to exclude litigation costs.

As Bruce just noted, to provide additional clarity on litigation-related costs and our underlying business performance, starting in the first quarter, we are reporting adjusted earnings to exclude significant litigation costs, which was $0.13 in Q1.

Mike Roman, CEO

To understand how costs related to litigation as well as clean up costs weigh on the company’s bottom line, look no further than this excerpt from last month’s earnings call.

Looking specifically at our Q1 2022 performance on slide 4, adjusted earnings were $2.65 per share. This result excludes total special items of $0.39 per share, which is comprised of $0.13 of legal related costs in the quarter, along with a $0.26 charge for PFAS-related remediation in Belgium.

Aside from the headwinds related to litigation, MMM also has a long history of tepid growth.

At first glance, MMM’s 2021 results appear fairly solid. Looking over a three year span, total revenue increased from $32.8 billion in 2018 to $35.4 billion in 2021. This provides a three year compound annual growth rate of 3%.

However, digging a bit deeper we find the firm’s operating margin fell to 20.8% in 2021 from 23.1% in 2018. This means adjusted EPS dropped at an average rate of 1% over that time frame.

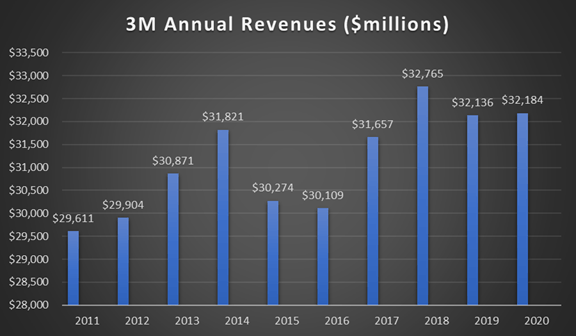

Borrowing a chart from my 3M article of 2021, we see that in the ten years from 2011 through 2020, 3M’s revenues increased by less than 9%.

Author

Studying the above graph, it is apparent that in 2021, MMM recorded its best growth rate in years.

For the coming fiscal year, management guides for 1% to 4% year-over-year sales growth and 2% to 5% organic sales growth. EPS for 2022 is forecast in a range of $10.15 to $10.65 versus EPS of $10.12 in 2021. Operating cash flow is expected to land in a range of $7.3 billion to $7.9 billion compared to $7.5 billion in 2021.

If the company hits management’s forecasts, shareholders will be rewarded with a modicum of growth, albeit following the best year 3M has had in over a decade.

What Should Investors Know About 3M’s Dividend?

MMM is a Dividend King, a member of an elite group of companies in the S&P 500 that have increased their dividend payments for at least 50 years. 3M’s dividend has a yield of 4.33%, a payout ratio a bit below 60%, and a 5 year growth rate of 5.38%.

Investors should consider the dividend safe, as the payout ratio is reasonable, and the company has investment grade credit ratings. However, shareholders were disappointed when the company increased the dividend by a mere $0.01 to $1.49 a share early this year.

MMM Stock Key Metrics

3M currently trades for $137.65 a share. The average 12 month price target of the 15 analysts rating the company is $165.14. The average price target of the 5 analysts that rated the company following the most recent quarterly report is $152.00.

I should add that only one analyst rates the stock as a buy.

MMM has a forward P/E of 13.39x, well below its five year average P/E ratio of 20x. The 5 year PEG ratio is 2.00x, which is also significantly below the companies average PEG ratio of 2.43x.

Is MMM Stock A Buy, Sell, or Hold?

In this article, I outlined how the company constructed a deep moat that serves to distance it from the competition. Added to that is a solid balance sheet and a yield well above 4%. From a historic perspective, with a price-to-earnings ratio below 14x, 3M is a screaming bargain.

However, those positives must be weighed with the stock’s extended history of market underperformance. Moreover, the prospect of lengthy and costly litigation may weigh on the shares for the foreseeable future.

Even though MMM devotes large sums to R&D and has a culture that promotes innovation, the bulk of the company’s products are commodity-like. This leaves 3M without pricing power and has led to stagnant operating margins.

Now consider that management provided commentary that presents a less than sanguine picture for the company’s short term prospects.

Before I wrap up, let me make a few comments regarding the second quarter. First, we are seeing a slow start to sales in April, primarily due to COVID-related impacts in China, along with the geopolitical crisis in the Ukraine. Raw materials and logistics costs are expected to be up, impacting Q2 year-on-year by approximately $225 million. We expect disposable respirator demand to decline both year-on-year and sequentially by approximately $100 million to $200 million.

Monish Patolawala, CFO

I hold a small position with 3M, but it had been a number of months since I had conducted due diligence on my investment. I was unaware that the yield had surpassed 4%, and my initial reaction was to think that I would add shares to take advantage of the downward trend in the stock.

Unfortunately, the company’s stagnant growth, the specter of litigation costs weighing on profits, and the recent miserly dividend increase, which may signal a lack of confidence by management in the firm’s future, give me pause.

Consequently, I rate MMM as a HOLD.

Be the first to comment