Liudmila Chernetska/iStock via Getty Images

Introduction

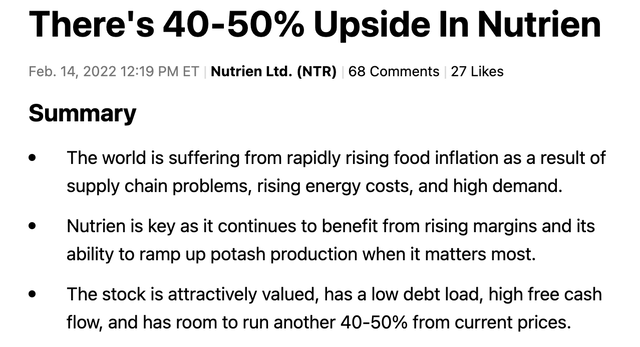

Prior to the war in Ukraine, I wrote the following:

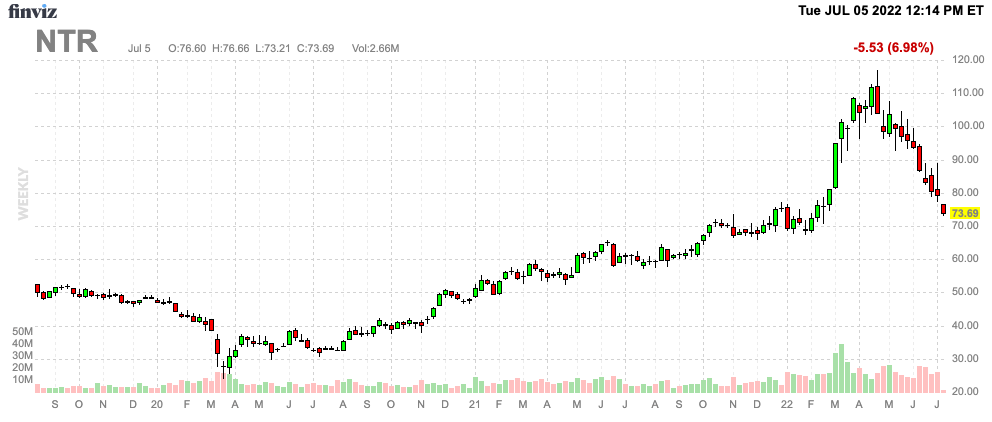

The Russian invasion turbocharged the agricultural bull market. The world’s largest producer of potash, Nutrien Ltd (NYSE:NTR) did accelerate more than 50% in the weeks that followed. Now, it’s less than 2% above these levels after a rather aggressive sell-off in both energy and agriculture has caused prices to drop. While I’m cheering for affordable food and lower global food security risks, I don’t see an end to the bull market. Nutrien remains in a fantastic spot to add another 40-50% to its market cap as agriculture supply remains an issue. Energy prices are likely to bounce back, and European food and chemical companies are in a very bad spot given lower Russian natural gas exports.

In this article, I will guide you through the details and explain why Nutrien remains the place to be.

So, bear with me!

Agriculture & Energy

Agriculture has become such a complex topic that it’s hard to pick the right angle to prevent spending thousands of words on a single (sub) topic.

Agriculture and energy have been the cornerstone of my research since the pandemic of 2020 when I worked with clients on a great commodity comeback after lockdowns had done a number on pretty much all commodities.

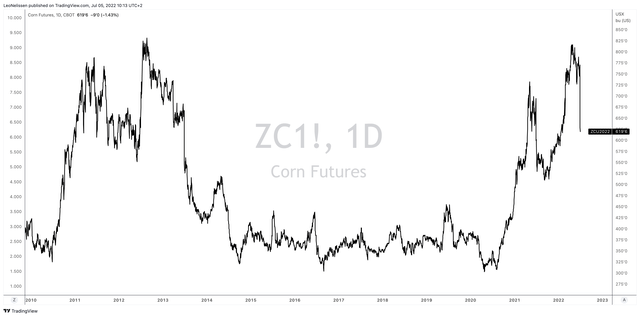

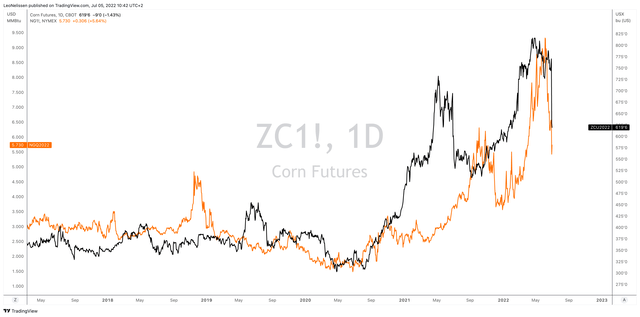

Back in early 2020, corn prices fell to $300 per contract ($3 per bushel).

I usually use corn as a benchmark for agriculture crop prices because it’s the number one crop in terms of planted acreage, it is fertilizer-intensive, and a key component in animal feed, energy (ethanol), chemical production, and others.

Then, the market quickly rebounded as demand came back. Energy prices rose, restaurants reopened, and the Chinese became eager buyers for their stockpiles of pretty much every commodity on the market. Also, the Chinese were rebuilding their hog herds after the African Swine Fever killed millions.

Back then, the bull case was still “fun”. Prices were still affordable, farmers were doing better, and the words “food” and “crisis” weren’t used in the same sentence.

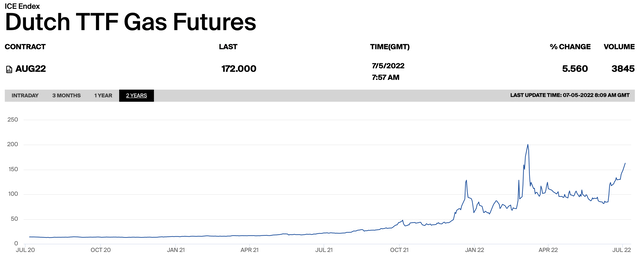

Then, in 2021, things turned sour. The biggest event was the Russian placement of troops on the Ukrainian border and lower gas flows to Europe. It resulted in higher European gas prices and the inability to produce fertilizers (among a wide range of other energy-intensive products).

It was the start of the energy and food crisis we’re in now. Then, the situation got much worse when Russians set foot in Ukraine in February of this year. This devastating war has now caused Ukrainian and Russian food exports to plummet on top of exploding natural gas prices that end the hopes of a quick fertilizer recovery in Europe.

The chart below shows Dutch TTF prices, the benchmark prices for natural gas in Europe. It’s now at EUR 172. That’s almost 9x higher versus pre-crisis levels, to give you an idea of the severity of the crisis.

In the United States, natural gas prices have plummeted. NYMEX Henry Hub futures fell roughly 40% since early June as a result of the Freeport LNG fire that prevents US natural gas from leaving the country to Europe. In other words, it cuts supply expectations in Europe while keeping more natural gas in the United States. In a recent article, I explained why I remain very bullish on natural gas.

With that said, the other day, I tweeted that the only reason why agriculture commodities have sold off is based on lower natural gas prices.

While the chart above shows natural gas compared to corn prices, the chart below compares long-term oil prices and corn futures. In general, crop prices tend to trade close to the production cost of a given crop. Spikes are then caused by supply issues.

CME Group

Not only that, but corn is a feedstock for ethanol production, which is an energy commodity.

And, on top of that, higher energy prices make the production of fertilizer more expensive. The period between 2012 and 2020 was supported by massively accelerating natural gas supply, which provided the US and countries abroad with low-cost input for various industrial processes. It’s one of the reasons why inflation was relatively low.

Now, that’s changing.

Nutrien’s Place In This Mess

The word “mess” in the sentence above describes the general state of agriculture and energy supply. It’s actually good news for Nutrien, the world’s largest potash producer – and third-largest nitrogen fertilizer producer.

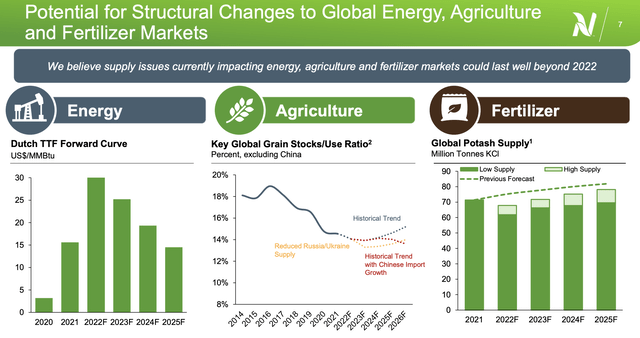

According to the last investor presentation, the company sees prolonged tailwinds:

We believe supply issues currently impacting energy, agriculture and fertilizer markets could last well beyond 2022

Needless to say, I agree with that statement. In the case of Nutrien, management provided us with three charts. The first one shows that European natural gas prices are expected to remain high using Dutch TTF forward curves. In this case, it’s in $ per MMBtu, which is comparable to NYMEX Henry Hub. This is the ICE TTE contract (instead of TTF). The second chart shows the global grain stocks/use ratio. It’s highly likely that inventories remain tight. If it isn’t for the war in Ukraine, inventories will still remain tight because of high Chinese (and emerging market) demand.

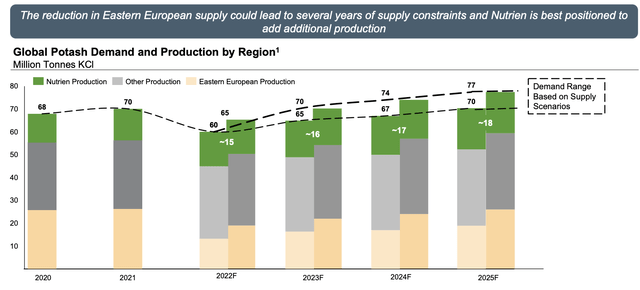

And last but not least, the potash supply is tight. In 2022, supply is actually down versus 2021 in a high-demand environment. If we’re lucky, supply is back above 2021 levels in 2025, which would still be below prior forecasts.

Personally, I believe – but hope I’m wrong – that supply will be closer to the lower bound of the range as I simply don’t see a scenario where the supply comes back due to favorable production circumstances (i.e., energy costs).

Nutrien benefits from way more than just the simple fact that it delivers products that are in short supply. The company has both a reliable supply chain based on 6 mines and access to 4 marine terminals through Canpotex. and room to boost output. Moreover, the company reaches key markets like Brazil, China, India, Indonesia, and Malaysia, which account for 70% of offshore sales.

Nutrien is using its supply chain to boost production. This year, we’re looking at 15 million tonnes of potash. This is 1 million above planned production. Technically speaking, Potash production can be boosted by an additional 2 million tonnes to 18 million annual tonnes. Longer-term, Nutrien can boost output to 23 million tonnes.

The bottom line is that 3 million tonnes can come online between now and the end of 2025. If everything goes right, another 1.3 million tonnes can come online in 2024.

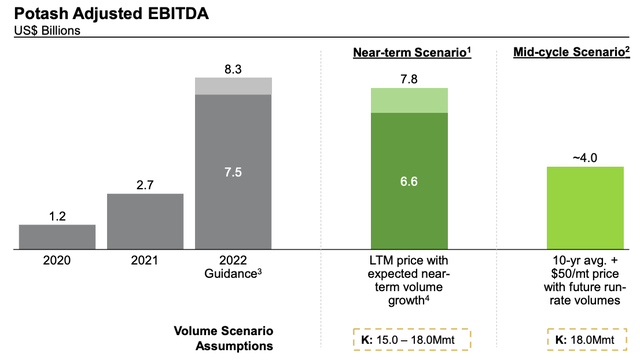

What’s interesting is that not only higher production is expected to lead to higher EBITDA, but also the company’s investments in more efficient production.

When incorporating production growth towards 18 million tonnes, Nutrien is in a good spot to do $7.8 in adjusted potash EBITDA. This is based on elevated potash prices. In a mid-cycle scenario, $4.0 billion in adjusted EBITDA is more likely.

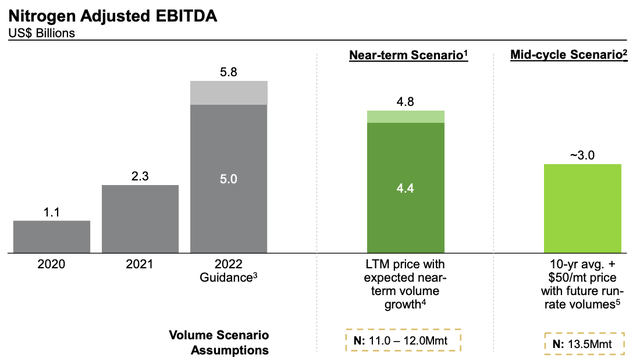

The same is expected in nitrogen. On a 13.5 million tonne basis, a mid-cycle adjusted EBITDA result is likely to be close to $3.0 billion according to the company.

With that said, the bigger picture remains fantastic for NTR.

Valuation

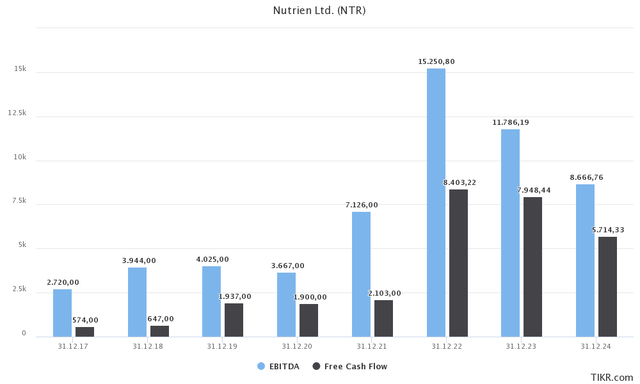

Nutrien is in a fantastic spot to return cash to shareholders. This year, analysts believe that the company can do $8.4 billion in free cash flow. This would translate to an implied free cash flow of 21% using the company’s $40.7 billion market cap. This is based on $1.25 billion in sustaining CapEx as well as $1.4 billion in growth capital to expand operations.

These CapEx numbers allow the company to gradually add 3 million tonnes of additional potash, as well as higher nitrogen output in its Brownfield mine and Geismar (clean ammonia project).

As a result, Nutrien is guiding to $16.5 billion in adjusted EBITDA as of May 2. A near-term scenario based on up to 18 million tonnes of potash and 12 million tonnes of nitrogen could result in $15.2 billion in adjusted EBITDA – that’s what analysts expect as well.

On a mid-cycle scenario based on 13.5 million tonnes of nitrogen (new future capacity), we are looking at $9.2 billion in adjusted EBITDA.

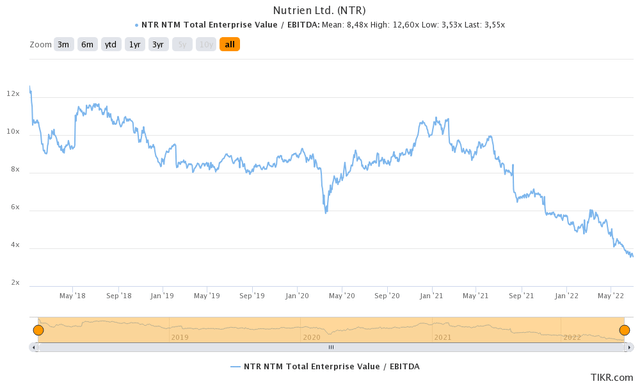

With that said, we’re dealing with a 3.8x EBITDA multiple based on 2023 expected net debt of $4.2 billion, $450 million in pension-related liabilities and minority interest, and $11.8 billion in expected EBITDA.

If I use the $40.7 billion market cap, $4.7 billion in expected 2024 net debt (higher because of new investments), the same $450 million pension-related liabilities and minority interest, and $9.2 billion mid-cycle EBITDA, I get a multiple of 5.0x.

That’s a good valuation.

Note that using mid-cycle EBITDA, the net debt ratio is 0.5x EBITDA, which is extremely healthy.

Using mid-cycle EBITDA, the company should be trading 15-20% higher than current prices. If we assume that the ongoing agriculture supply remains tight driven by high energy costs, I see at least a 40-50% upside over the next 12 months.

However, right now, the market is volatile. NTR is getting punished – just like energy stocks in general. The biggest downside risk is demand risk. Despite weak supply, crushed demand could lower energy and agriculture demand.

I’m eagerly watching this market for opportunities to add to my long-term agricultural investments. After all, the biggest problem is finding an entry.

FINVIZ

I believe that we’re seeing irrational selling at this point. However, it doesn’t mean we’re through. NTR could fall to $60 if energy continues its downtrend based on demand fears.

However, and this is why I like NTR, supply problems haven’t been solved. If anything, temporarily lower energy prices make higher supply even more unlikely. And, the market is completely ignoring the winter risks for the European nat gas supply.

Hence, I stick to my bullish targets but warn everyone reading this that we’re dealing with a load of uncertainty and volatility. If you’re not a trader and usually a conservative long-term investor, NTR may not be the right stock for you. Please keep that in mind.

Takeaway

In this article, I wanted to achieve two things. First, to explain why agriculture remains in a long-term bull market. Production costs and geopolitical uncertainty provide crops with a floor well above prior lows. Moreover, risks are to the upside as we head into a higher demand period with subdued supply.

On top of that, I explained why Nutrien remains one of my favorite investments in the industry. The company has short supply chains, the ability to boost production in a situation of tight supply, and efficient production allowing the company to achieve high mid-cycle EBITDA.

While the market is extremely volatile and hard to time, I believe that NTR is undervalued – even without pricing in any EBITDA growth above expected mid-cycle results.

However, please be aware of NTR’s cyclical behavior. NTR may not be the right investment for you if you like to avoid volatility.

That said, I think the risk/reward for NTR is very good regardless of which angle I approach this Canadian potash giant.

(Dis)agree? Let me know in the comments!

Be the first to comment