Dmytro Aksonov/E+ via Getty Images

Three weeks ago, I cautioned that the S&P 500’s stellar performance off its June low would instigate warnings from Fed officials about tighter monetary policy conditions in an effort to suppress speculation and slow the market’s advance. We had that in spades leading up to Chairman Powell’s gut punch in Jackson Hole where he asserted that it might take a “growth recession” to bring the rate of inflation back to 2%. The term describes a slowdown in the rate of economic growth that is more severe than a soft landing, which results in a meaningful rise in unemployment. The danger is that it runs perilously close to a full blown recession. Therefore, the pullback we have had over the past three weeks was expected, as the market was extremely overbought and due for a pause to refresh. Yet bears contend that the Fed is now looking to be far more restrictive than it was a few weeks ago, which I still think is more bark than bite.

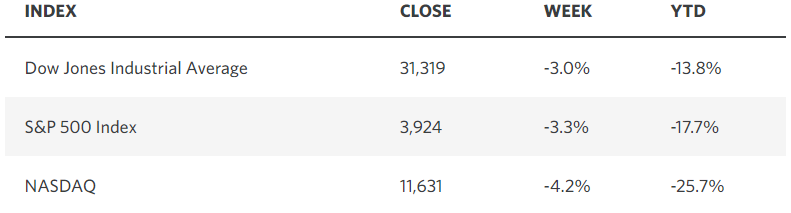

Edward Jones

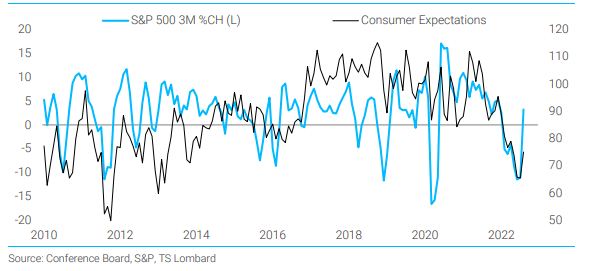

The Fed does not have a lot of control in the short term over the global inflationary forces that have driven up prices over the past 18 months, but it can have immediate and significant sway over financial asset prices, which is what it is now targeting to accelerate the decline in inflation. I think it is trying to reverse, to a relatively modest degree, the wealth effect it worked so hard to create for a decade after the Great Recession. It is now leaning towards a negative wealth effect. Despite the top 10% of households owning nearly 90% of stock market wealth, more than half have some exposure to the market, which is why consumer sentiment runs so closely in line with its performance. I don’t think the Fed is targeting new lows for the stock market anymore than it wants to see a recession, but it is clearly discouraging a return to the old highs before its inflation target is reached. For these reasons, I think we are mired in a wide trading range between the June low and the January high until recession fears recede and the inflationary horizon improves more.

Bloomberg

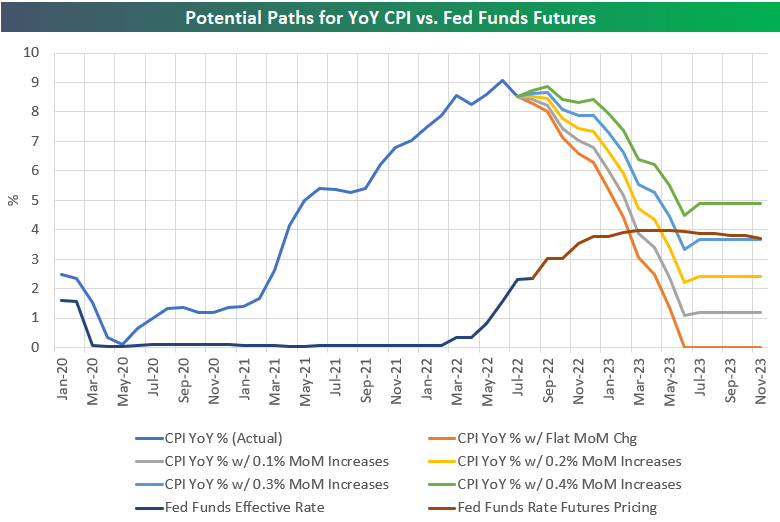

The chart below from Bespoke is an excellent pictorial of the macroeconomic forces that will rule markets over the coming months. It shows how the Fed must throw its pass in front of the receiver in order to score a proverbial touchdown, which is a soft landing for the economy. The football in this case is the benchmark short-term interest rate it controls. The consensus now expects the Fed funds rate to rise to 4% at some point next year and stay there through 2023. I think that would be a pass thrown too far and too soon. It should stop at 3% in November and monitor the incoming data, which should show a more rapid decline in inflation than the consensus now expects. We have yet to see the impact of the rate hikes implemented to date, as they work with a lag.

The receiver in this case is the rate of inflation, which has an inverse relationship with the rise in interest rates. As the Fed tightens monetary policy through rate increases, we should see inflation fall, as depicted below, based on various monthly increases in the Consumer Price Index ranging from 0 to 0.04%. If the Fed overthrows its policy rate and tightens too much, it will miss its target of 2-3%, resulting in a recession with deflationary impacts. If it underthrows and does not raise enough, the rate of inflation will remain well above its target of 2-3%. I say 2-3% because I think the Fed is looking to target a range just above 2%, as it was doing before the pandemic.

Bespoke

If the monthly rate of increase in the Consumer Price Index averages 0.2% moving forward, we will see the year-over-year rate fall to 2.2% by next June. A 0.3% monthly increase would result in a year-over-year rate of 3.3% by next June. I think this is a realistic range, provided the Fed times and sizes its remaining rate increases effectively.

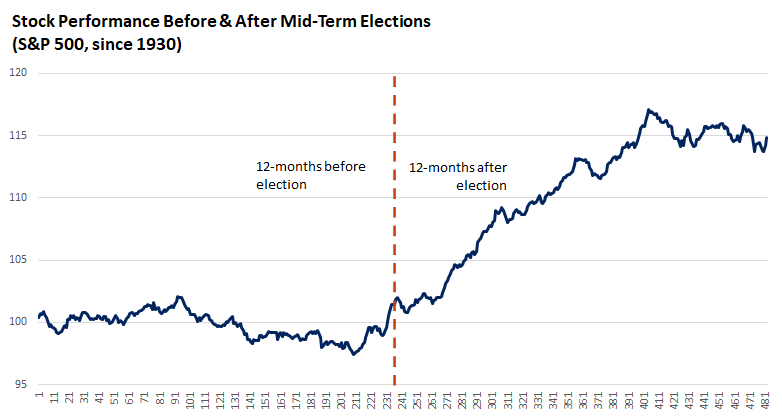

The next two months leading up to the mid-term elections on November 8 are likely to be volatile, but the historical precedent for market performance afterwards is positive. The S&P 500 has returned 15% on average over the 12 months that follow the midterms, regardless of who wins. I expect the next four CPI readings between now and year end to show a well-established downtrend in the rate of inflation. That should allow the Fed to pause hiking rates before the end of the year at what I expect to be within a range of 3.00-3.50%.

Edward Jones

Obviously, there are a lot of other factors influencing this situation, but I still see very good odds that the Fed can complete this pass and score a touchdown for investors in the form of a soft landing that allows the expansion to continue and give birth to a new bull market in 2023.

Economic Data

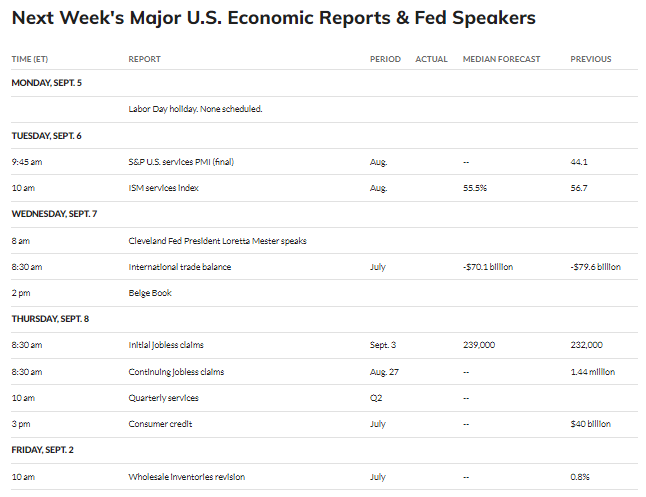

Extremely slow holiday week coming up with the only noteworthy data release being Tuesday’s ISM services index for August, which will give us a read on the rate of growth in the economy for the third quarter.

MarketWatch

Technical Picture

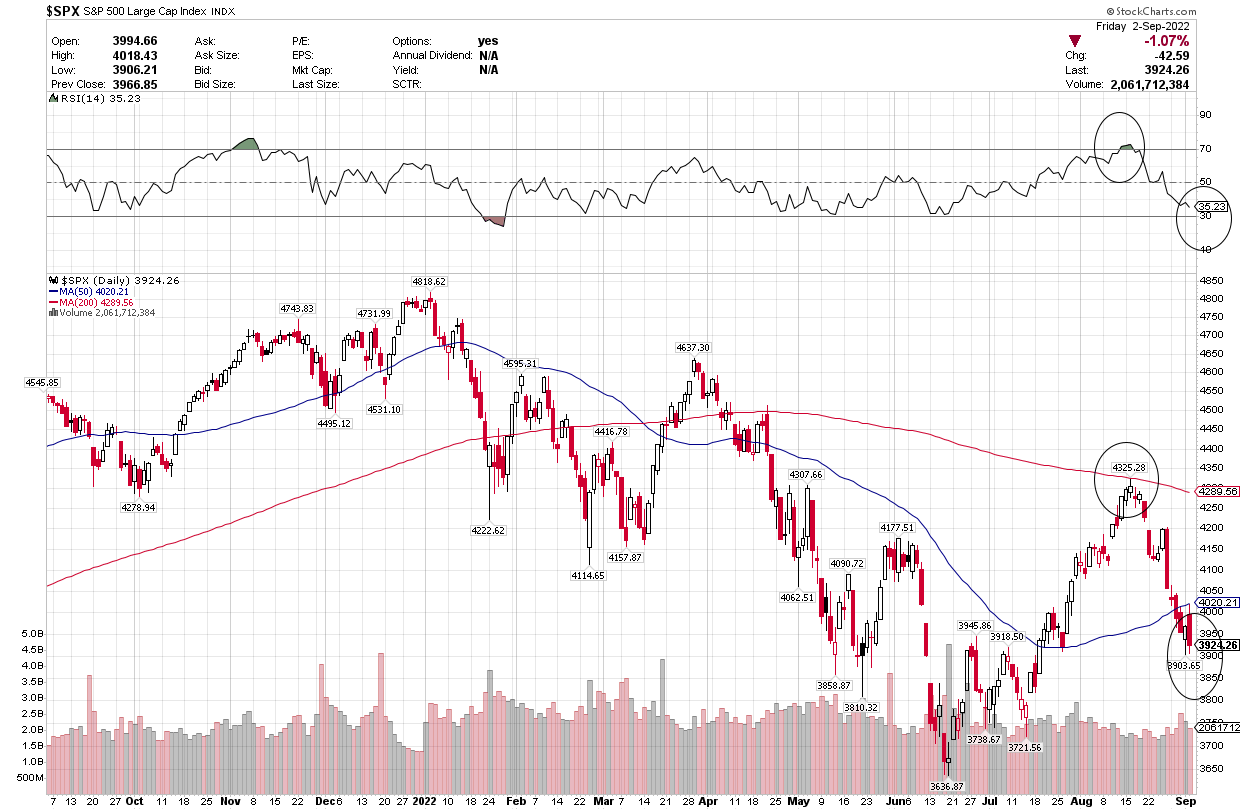

Three weeks ago I discussed the likelihood of a pullback as we bumped up against overhead resistance at the 200-day moving average and the Relative Strength Index climbed above 70 (top of chart). We are nearing the exact opposite situation with the index approaching deeply oversold territory, as the Relative Strength Index nears 30. I expect to see some churning at these levels, but we need to see the dollar’s rise stall, and both short- (2-year) and long-term interest rates (10-year) level off.

Stockcharts

Be the first to comment