NaokiKim

Water is, undeniably, one of the most important resources on the planet. Although 70% of the planet is covered by it, most of it is not potable and that which is often can be polluted. Regardless of the type of water or the quality of it, there is a significant amount of demand that needs to be met in order for such a large global population to not only exist, but to thrive. One company that’s dedicated to helping meet this need is Mueller Water Products (NYSE:MWA). In recent years, management has done a good job growing the company’s top line and, for the most part, its cash flows. Shares of the company are also reasonably priced from a cash flow perspective, both on an absolute basis and relative to similar players. I would make the case that there are definitely better opportunities out there right now. But for investors who like this space, I can understand why a purchase of the stock might be made.

Going with the flow

According to the management team at Mueller Water Products, the company operates as a manufacturer and marketer of products and services that are used in the transmission, distribution, and measurement of water throughout North America. Its customers largely consist of municipalities, as well as players in both the residential and non-residential construction industries. To truly understand the firm, however, we should break it up into the two key operating segments that the company has.

The first of the company’s two segments is referred to as Infrastructure. Through this unit, the company produces valves for water and gas systems, including iron gate, butterfly, tapping, check, knife, plug, and a variety of other valves. It also produces wet-barrel fire hydrants. But the company does not play is just a marginal operator in these areas. Management claims that they have one of the largest installed bases of iron gate valves and fire hydrants in the country, with these products being used in the largest 100 metropolitan areas of the US. This unit is also responsible for the production of service brass products, pipe repair products like clamps and couplings that are used to repair leaks, and more. This segment largely does focus on the water space, its offerings can also be applied to natural gas utilities. Last year, this segment was responsible for 92% of the firm’s revenue and more than all of its profits.

The next, far smaller, segment, is referred to as Technologies. Through this unit, the company provides residential and commercial water metering, water leak detection and pipe condition assessment products, and related systems and services. As was the case with the Infrastructure segment, Technologies generates most of its revenue from municipalities. But it also generates sales from waterworks distributors. Other products that it sells include water leak detection and pipe condition assessment products and services. One acquisition that the company made in 2021, of a firm called i2O, also involves the sale of pressure management intelligent water Network Solutions and software.

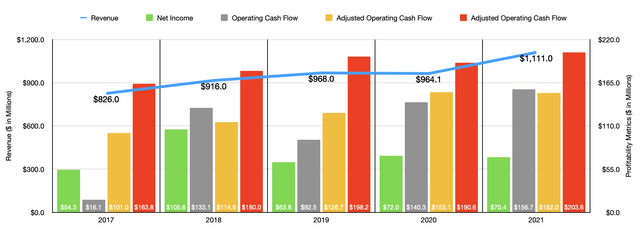

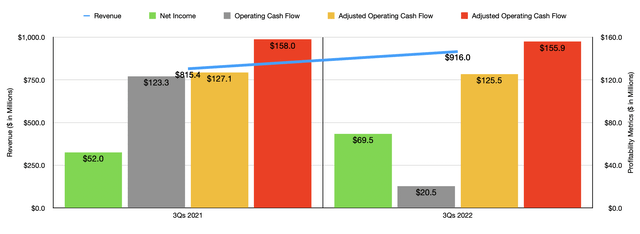

Over the past five years, the management team at Mueller Water Products has done a good job growing the company’s top line. Sales have increased from $826 million in 2017 to $1.11 billion in 2021. The most significant growth came from 2020 to 2021, with revenue jumping by 15.2% thanks to higher shipment volume across most of its product lines, as well as higher pricing. The growth associated with the Infrastructure came in at 15.7%, aided by the aforementioned factors as well as by a $6 million gain associated with the elimination of a one-month reporting lag for one of its subsidiaries. when it comes to the 2022 fiscal year, sales for the company have continued to rise nicely, with revenue in the first nine months of the year climbing from $815.4 million in 2021 to $916 million this year. This 12.3% increase came about largely because of higher pricing and increased shipment volumes. However, just as was the case when it came to annual data from 2021, we don’t know how much of the rise can be attributed to one cause versus the other.

The bottom line for the company has been somewhat mixed but generally positive in recent years. Net income, for instance, has shown no real trend. Last year, it did come in at $70.4 million. That’s down slightly from the $72 million experienced in 2020 but was up from the $63.8 million reported for the 2019 fiscal year. More consistent has been operating cash flow. This metric rose from $16.1 million in 2017 to $133.1 million in 2018. It subsequently fell to $92.5 million in 2019 before climbing consistently year after year to hit $156.7 million in 2021. An even more consistent trend can be seen when adjusting for changes in working capital. In this scenario, cash flow has risen from $101 million in 2017 to $152 million in 2021. A general trend can also be seen by looking at EBITDA, which rose from $163.8 million in 2017 to $203.6 million last year.

As the charts throughout this article illustrate, profitability so far for 2022 has been mixed. Net income has risen from $52 million to $69.5 million. However, operating cash flow has declined from $123.3 million to $20.5 million. On an adjusted basis, it would have fallen from $127.1 million to $125.5 million. Meanwhile, EBITDA also declined slightly, dropping from $158.8 million to $155.9 million. Management has attributed some of this pain to a decrease in gross margin from 33.4% in the first three quarters of 2021 to 30.4% the same time this year. That, in turn, can be chalked up to higher inflationary pressures, labor challenges, supply disruptions, and a rise in its warranty obligations.

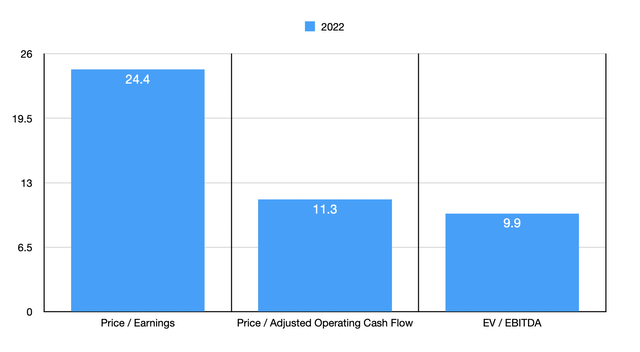

When it comes to the 2022 fiscal year as a whole, management does expect revenue to continue climbing, with sales coming in between 11% and 12% above what the company generated last year. At the midpoint, that would translate to revenue of $1.24 billion. Despite this increase, margin pressures should result in EBITDA remaining virtually flat. It wouldn’t be a stretch to think that net income and adjusted operating cash flow would also come in roughly flat year over year. This makes our analysis fairly easy though. The price-to-earnings multiple of the company, based on my estimate, should come in at 24.4. The price to adjusted operating cash flow multiple should be 11.3, while the EV to EBITDA multiple should come in at 9.9. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 12.4 to a high of 88.1. And on an EV to EBITDA basis, the range is between 6.6 and 13.8. In both cases, three of the five companies were cheaper than our prospect. Meanwhile, using the price to operating cash flow approach, the range of the four companies with a positive multiple was between 6.2 and 16.3. In this scenario, only one of the companies was cheaper than Mueller Water Products.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Mueller Water Products | 24.4 | 11.3 | 9.9 |

| Helios Technologies (HLIO) | 15.3 | 16.3 | 9.7 |

| EnPro Industries (NPO) | 22.0 | 12.3 | 9.7 |

| Kennametal (KMT) | 12.4 | 6.2 | 6.6 |

| Hillman Solutions Corp (HLMN) | 77.1 | N/A | 12.4 |

| Barnes Group (B) | 88.1 | 12.7 | 13.8 |

Takeaway

What data we have today suggests to me that, while Mueller Water Products is experiencing some margin-related pressure because of current economic conditions, the overall picture for the company is positive. Sales continue to climb and at least profits are not dropping. Although shares are pricey from an earnings perspective, they are cheaper from a cash flow perspective and aren’t unreasonably priced compared to similar businesses. This suggests to me that there are likely better prospects on the market to be considered. However, I do think the company is cheap enough and important enough to warrant a soft ‘buy’ rating at this time.

Be the first to comment