Douglas Rissing

There was a lot of new information being released this past week and there was a fair amount of volatility taking place in the financial markets, but, if you look at the balance sheet of the Federal Reserve, very little took place last week.

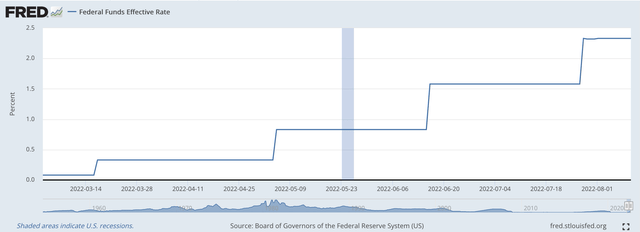

The effective Federal Funds rate remained constant during the week at 2.33 percent.

Effective Federal Funds Rate (Federal Reserve)

This is the chart that captures all the Fed’s rate changes this year beginning on March 16, 2022.

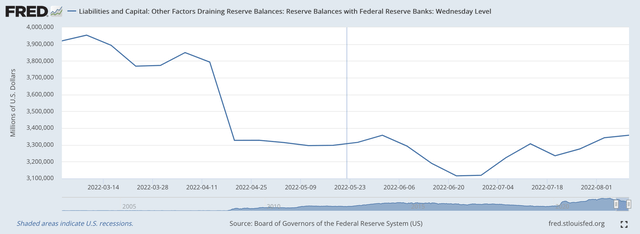

For the time being, the Federal Reserve seems to be happy with the level of “excess reserves” in the banking system. The proxy for “excess reserves” is the line item on the Federal Reserve balance sheet titled, “Reserve Balances with Federal Reserve Banks.”

Reserve Balances have remained roughly constant since the middle of April.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Thus, the Fed has been able to raise and then maintain the new levels of its policy rate of interest without having to “tighten up” on commercial bank “excess reserves” for about three and one-half months.

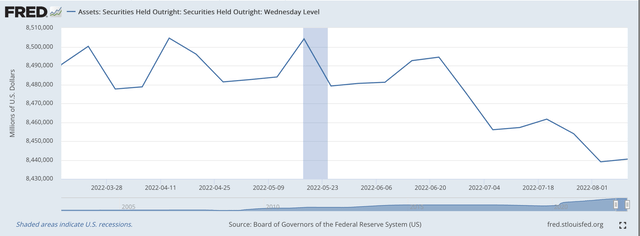

Reduction of the Securities Portfolio

The Federal Reserve did not reduce its securities portfolio this past banking week, but it has reduced its securities portfolio by $54.0 billion since the banking week ending on June 22, 2022.

Here we see that Securities Held Outright reached its highest level in the middle of May, and has declined since then.

Securities Held Outright (Federal Reserve)

So, the Fed moves on its way, but not too aggressively.

Fed Signals

The only immediate response from any Federal Reserve official came from Mary Daly, President of the San Francisco branch of the Fed.

Ms. Daly stated that in her opinion, the Fed still needed to keep on track at the September meeting of the Fed’s Federal Open Market Committee (FOMC) and continue to raise the policy rate of interest.

She even suggested that the Fed might continue to raise the policy rate by 75 basis points, just to make sure that investors understood that the Fed was going to keep up pressure on interest rates.

Furthermore, the Fed has only just started to reduce the size of its securities portfolio, and it would need to maintain the effort to get the portfolio back into a range that was more consistent with where the Fed’s balance sheet needed to be.

The original plan of the Fed was to reduce its securities portfolio by around $2.0 trillion. And, the reduction effort would go into 2024.

In terms of reducing the portfolio, the Fed has a very long way to go.

Financial Markets

Investors seem to be taking a different view of where the Federal Reserve is going.

The Standard & Poor’s 500 Stock Index closed the past week at 4,207.

This was up from a close at 4,145 the week before.

And, this was up from a close at 3,921 on July 26, the week that the Fed last raised its policy rate of interest.

And, this was up from a close at 3,667 on June 16 in the week the Fed made its first 75 basis point increase of the year.

The NASDAQ has risen from 10,646 on June 16 to 12,780 this past Thursday.

The Dow Jones Industrial Index has risen from 29,927 on June 16 to 33,337 on August 11.

Over the past twelve years or so, stock prices have moved very closely with the monetary stance of the Federal Reserve System. Many, many historical highs were attained during this time period as the Federal Reserve continued to stimulate the stock market…and the economy.

Now the Fed is threatening a substantial tightening of monetary policy to combat the inflation that now exists in the economy, but, investors are not following the Fed’s actions or what Fed officials are saying.

Or. are these investors following the “actions” of the Federal Reserve?

Yes, the Fed is raising its policy rate of interest.

Yes, the Fed has reduced its securities portfolio. That is, it has shrunk the securities portfolio, which totals $8.5 trillion, by about $55.0 billion.

But, in terms of the liquidity in the commercial banking system, the money markets seem to be very plush with funds and the Fed does not seem to be removing much liquidity from the banking system.

That is, it appears as if the Fed has injected very little pain into the banking system at this stage.

Part of this problem is that the commercial banking system now has well over $3.7 trillion on deposit at the Federal Reserve. This is the residual of the Fed’s largess over the past two years.

Could it be that investors see a situation in which the Fed will inject very little pain into the banking system as it moves to raise its policy rate and as it moves to reduce the size of its securities portfolio?

In other words, investors see that there is more than enough money in the financial system to weather the small amount of “tightening” the Fed is now imposing.

Talk about excess cash, yesterday I wrote about the fact that venture capital firms, worldwide, have cash balances amounting to $539 billion on their balance sheets at the end of July 2022.

This seems to be true of many other corporate situations.

Maybe the investors, themselves, have lots and lots of cash on their balance sheets and realize that the little bit the Fed is doing right now to “tighten” monetary policy is really not sufficient to keep the stock markets down for a sustained period of time.

That is, the Fed is going to have to do a lot more if they are to really control inflation.

But, these investors see the Federal Government trying to “Reduce Inflation” in their latest thrust into the realm of economic policy, but see that the program produces inflationary stimulus for the first five years or so of the effort, with the efforts to “reduce inflation” only coming on later in the program.

Investors don’t really seem to be too bothered by the government’s effort to bring inflation under control.

Maybe we need to listen to the markets and not to the policymakers.

Be the first to comment