How will Gladstone Land cope with tougher drought conditions? appledesign

Introduction

Since my initiation piece in January we had several sets of results and management commentary. Back then I laid out my reasons why I am selling my Gladstone Land (NASDAQ:LAND) shares. It was basically a valuation call which led to a changed risk profile.

That said, I stayed fundamentally positive on the company and was looking forward to eventually get back in. Recent sets of results and management commentary however made me more cautious as I perceive several worrying trends. I believe the western drought situation has become worse than management originally expected. I think this could lead to a stagnating NAV/share development. With P/NAV still very high and more recently fees taking up ever more of the cashflow I am staying on the sidelines and currently prefer Farmland Partners (FPI) as an alternative option to invest in farmland. Please find my detailed views on FPI here and on the benefits of holding farmland in a diversified portfolio here.

I will now lay out the reasons for my more cautious fundamental stance on LAND in the following paragraphs. My main reference materials will be the 2021 annual results plus conference call, Q1/22 report plus conference call, management update from June 2022 as well as the recent Q2/22 report plus conference call.

First Half 2022 key takeaways

I feel that since my initial piece on LAND there have been several worrying trends that have continued throughout the period. I will concentrate on the three that concern me the most.

1. Drought and water supply

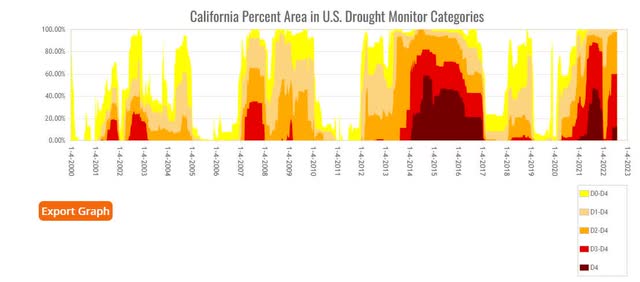

California has been plagued by drought for some time. But it seems that the more normal conditions get shorter and shorter and droughts get more severe and longer. This is especially worrisome for permanent plantings like nut trees or orchards as those can generally cope well with shorter periods of drought but might struggle in more drawn out droughts.

California drought time series (Drought monitor https://droughtmonitor.unl.edu/DmData/TimeSeries.aspx)

Unfortunately, LAND is highly exposed to California as the state makes up 2/3 of LAND’s lease income.

None of this is really new. Gladstone Land has always stressed the importance of water and the fact that nearly all of their farms have their own access to water. Many of them have more than one source of water supply and most of them in California have access to ground water. They have even been buying individual water rights and by year end 2021 they had $34m worth in banked water on their balance sheet. At page 78 of their 2021 annual report, they commented as follows:

In addition, in light of the ongoing drought taking place in the western U.S., all of our farms in the region have independent (and, in most cases, multiple) sources of water, in addition to rainfall, and have not been materially impacted by the current drought conditions.

What worries me is that I feel that their language has become more cautious on the subject as the drought carries on. During their Q3/21 conference call they stated:

…And most of them rely on groundwater as their main source of the irrigation. For these properties, we’re seeing a typical seasonal dropping of the water table levels, and we haven’t had any of course that had gone dry. And all of our farms currently have pumping capacity cover their crop needs.

Q4/21 painted a similar picture:

Almost all of our farms out west have wells on the site, and most of them rely on groundwater as their main source of irrigated water. For these properties, we are seeing the typical seasonal dropping of the water levels, but not enough to make us upset.

However, in their management update from June 13th it reads:

Western Drought: California (and the Western U.S. in general) continues to struggle with a multi-year drought, as snowpack levels, year-to-date precipitation, and reservoir levels are all below historical averages at most locations throughout the state.

Unfortunately, we have gone from a “typical seasonal dropping” to many indicators being “below historical averages.” And yes, groundwater is not directly comparable to reservoir levels and rainfall but their statements nevertheless seem to become overall more cautious as the drought continues. Because the language on how their farms are impacted has also changed over time. In Q1/22 we got:

However, all the properties continue to be in a position where our farmers currently have enough water to complete certainly the crop for this year, and I think we’ll be fine in the years going forward.

Yes, I checked that he really said “years” as transcripts can occasionally a bit sloppy (at about 09:45 into the call if you want to listen into it, after that it seems a bit cut off). In their management update from June, they already sounded a bit more cautious:

We will continue to monitor the drought situation in the west, but at this time, we believe all of our farms have sufficient water to complete the current and next year’s crop cycle.

And now finally in their Q2/22 conference call not even two months after their June update:

All of our properties in California continue in the position where the farmer has enough water to complete the current crop year. And, of course, we never know what next year is going to look like, but water remains a premium at west.

Therefore, we have gone from “I think we’ll be fine in the years going forward” to “we never know what next year is going to look like”. Maybe I am overreacting and read too much into it, but I admit this worries me quite a bit. And not because of any short term impact. You have insurance and also the market reacts to poorer harvests by higher prices for the produce which might even mean higher participation rents. What I am concerned about is, what it might mean for the value of the farms in the medium to long term, especially if it turns out to be a trend of worsening droughts rather than a typical cyclical pattern.

As of June 30th, Gladstone Land had $339m of permanent plantings on their balance sheet. Those are plantings like nut trees or fruit orchards. And I wonder how they might be impacted by multiyear drought conditions. In their annual report 2021 they state:

Permanent crops generally involve more risk than annual row crops because permanent crops require more time and capital to plant. As a result, permanent crops are generally more expensive to replace and occasionally more susceptible to disease and poor weather. If a farmer loses a permanent crop to any natural disaster, such as drought, flooding, fire, or disease, there would generally be significant time and capital needed to return the land to production because a tree or vine may take years to grow before bearing fruit.

I do believe there is a risk of them having to take impairments on their permanent plantings if the drought continues unabated. During the Q1 conference call they even relate a story where this has happened to one of their competitors:

Now you can’t do that much with trees, for example, trees got to be healthy and the problem with trees, of course, as you’re growing the tree, which is growing the nuts that we want off the tree and some of the others are in similar positions. So, you can skip for a while, but if you skip too many times, the tree gets weak and doesn’t produce as much. One of the — our old competitors who had a lot — I mean, a lot of pistachio trees actually shut down, I think it was 15,000 acres because they just couldn’t get enough water under normal circumstances, and the trees were old anyway.

2. NAV progression stalling

The drought situation is part of what one has to deal with when investing in farmland. I would be fine with that risk if I had the feeling it was already priced in.

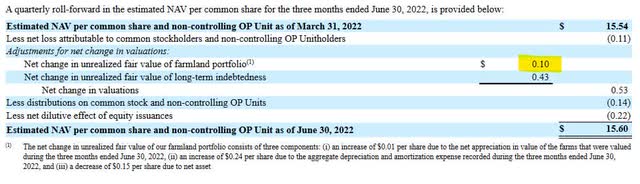

NAV progression stalling in Q2 (LAND 10-Q for Q2/22)

As we can see LAND still trades at a high premium (over 60%) to their NAV. Progression in NAV from their land appreciation has been slowing and is only $0.10 per share for the quarter vs. $0.48 in Q1. They claim their appraisal values lag the underlying market movement but this is not exactly confidence inspiring in a generally very strong agricultural market.

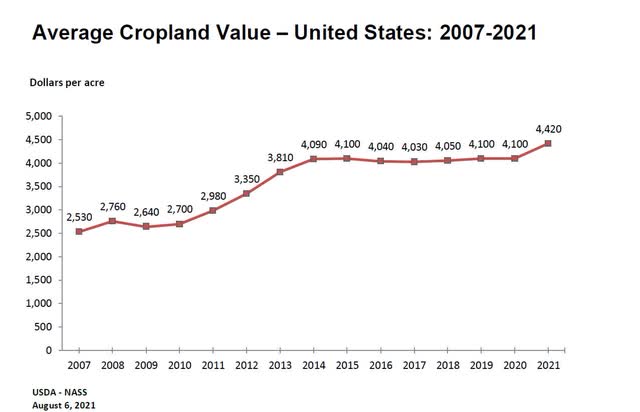

Cropland value development (USDA Survey August 2021)

As one can see in the graph above US farmland has gone nowhere since 2014 and only last year started picking up. Therefore, one can reasonably expect farmland to catch up to other asset values that have increased strongly during that timeframe especially now that we are seeing a very strong agricultural pricing environment. You can find a more detailed article about the benefits of investing in farmland here.

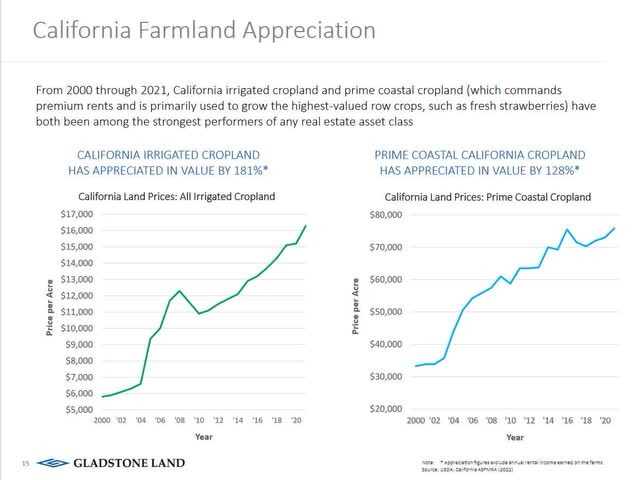

However, as always the devil is in the detail. California has performed exceptionally well during the past years.

California farmland appreciation (Gladstone Land investor presentation May 2022)

Therefore, unlike other farmland in the US, California is rather at risk of seeing a setback or at least not show big improvements should the current difficult weather conditions continue. The farms LAND revalued in Q1 in California only showed a 5.4% increase in value over last year in a generally strong market and remember at that time their commentary was more positive.

As I wrote in my initiation piece the main driver of their NAV/share gains in recent times was issuing shares at a premium to NAV. This can lead to a positive feedback loop that I described there in more detail. Now it seems like this loop has been broken. The premium is shrinking and underlying land price developments are more mute. One should not read too much into one quarter but the high premium already prices in a continued strong positive development in NAV/share leading to an unfavourable risk/reward.

3. Fees increasing strongly

Returns from investing in farmland comes from both land price appreciation and rental income. LAND has focused on specialty farms that produce higher cash yields than the row crop farms that FPI focuses on. LAND targets cash yields around 6% vs. FPI hoping to get around 4%. Now, part of this is some risk premium as specialty products with permanent plantings are less flexible but it also incorporates future cash outlays to replace permanent plantings that unfortunately aren’t permanent but rather have an economic life of 15-25 years.

Still, Gladstone Land has managed to produce a decent cash flow from which they pay their dividend. But in the first six months of this year fees that LAND pays to Gladstone for management and related services have increased strongly.

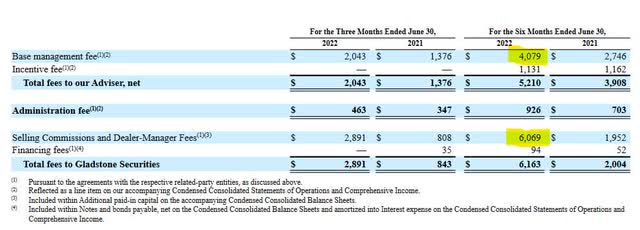

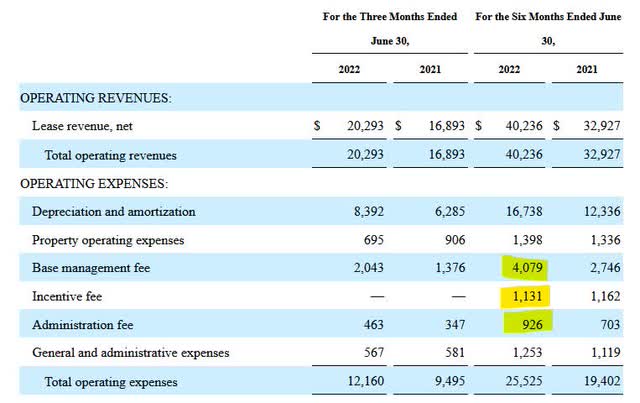

Fees paid by LAND to Gladstone (10-Q for Q2/22)

Base management fees increased by 50% and selling commissions and dealer-manager fees even tripled. Overall fees totalled nearly $12.3m for H1 2022 vs. $6.6m in H1 2021. This compares to only $40.2m of lease revenue. This means over 30% of lease revenue gets paid to Gladstone (up from 20% in H1 2021). But only half of that is visible in the income statement as the selling commissions and dealer-manager fees get booked directly to the balance sheet.

Income statement H1-22 (10-Q for Q2/22)

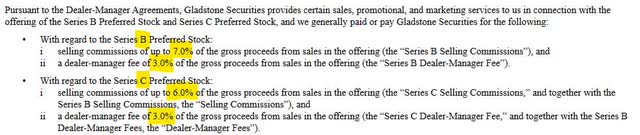

What are those selling commissions and dealer-manager fees? Essentially this is what Gladstone Security charges LAND for selling their preference shares. Currently, if LAND sells $10m worth of Series C preferred stock they pay $900,000 in fees to Gladstone Securities and only get $9.1m in proceeds.

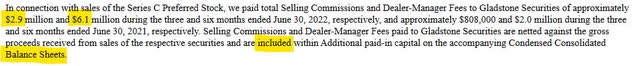

Fees to Gladstone Securities (LAND annual report 2021) Fees paid in H1 2022 booked directly to balance sheet (10-Q for Q2/22)

As one can see these fees have more than tripled in the first six months of the year. This is an exclusive agreement with Gladstone Securities so there is no shopping around for best terms. My understanding is that this is close to the maximum that they can charge but then it has been approved by the board of directors including the independent ones. Gladstone Securities won’t necessarily keep all of the proceeds but pass parts of them on to non-affiliated broker-dealers and wholesalers. This is from their half year report:

Gladstone Securities may, in its sole discretion, remit all or a portion of the Selling Commissions and also reallow all or a portion of the Dealer-Manager Fees to participating broker-dealers and wholesalers in support of the offerings. The terms of the Dealer-Manager Agreement were approved by our board of directors, including its independent directors.

Now, if you want to sell securities you will have to pay fees, right? But just how sensible is this right now? Let’s hear management about this on their conference calls. During their Q1/22 conference call they got asked about that high cost of capital preferred stock sales and answered this:

My CFO will tell me over and over again, we’re paying too much for our money by using it. But think about this for a minute, Craig. As you probably know, when you’re raising money through people who are selling preferred stock, it’s a daily thing for them and you can’t turn it on and off very easily. The good news is they can usually sell during really difficult times.

…

But I do like to know that during a difficult period of time that they’ll keep selling. And it’s a very nice product. A lot of people are buying it. But since it’s not traded, it makes it much more difficult to sell. So, these people are good salespeople and have done a good job for us. So, we’ll just keep it open for a while. And if for some reason, we don’t need it anymore, we’ll have to turn it off, but I really don’t want to do that. We’ve got a great sales team that’s doing a good job of selling that in the marketplace. So yes, I hear you loud and clear.

Basically, they admit that it is a very high cost of capital instrument but they simply keep it going to keep the salespeople happy. During the Q2/22 conference call they made the following statement:

Our issues is that our preferred stock and our borrowings have both become expensive for current farmland prices and rents. We have lines of credit. We’re not using them. We’ve left them all follow and just no reason for us to draw down money and put it to work if we can’t put it to work of some spread from what we’re paying to the money that’s coming in. We’re currently discussing internally a strategy for better managing our cost of capital. And if we make some big changes, we’ll be back to you on that.

This was within the prepared remarks and not in response to a question. Therefore, the good news is that it seems they are aware of how uneconomical their selling of prefs is right now. The bad news is that they did it anyways, raised about $70m in Series C preferred stock and it cost shareholders a lot of money. I sincerely hope they will cut down on their preferred share selling activity going forward.

Summary

My stance on LAND has become more cautious since the start of the year. My impression is that the drought situation has worsened more than management expected. I, therefore, see risk of the NAV/shares progression stalling and the premium to NAV at which the shares sell further contracting. Strongly increasing fee levels do not help and I currently prefer FPI over LAND (although FPI is much more exposed to rising rates – pick your poison). That said, if management can reduce the level of fees and we see the environmental risk being priced into the shares I might get interested again. But right now, it is too early for me to get back in.

Be the first to comment