manassanant pamai/iStock via Getty Images

The Federal Reserve is expected to raise interest rates today and another 75-basis point hike is widely expected. What’s less clear is how long and how fast the central bank tightens policy. No one knows the answer at this point, not even the Fed and so the path ahead is arguably the main known risk factor for the markets. In turn, pondering where the terminal rate lies is the burning question for investors and analysts trying to forecast economic activity.

Although predicting when and where the Fed will cease and desist in tightening the screws, there are some obvious indicators to monitor that will likely offer early clues that the tide is turning. The analysis starts with the inflation trend.

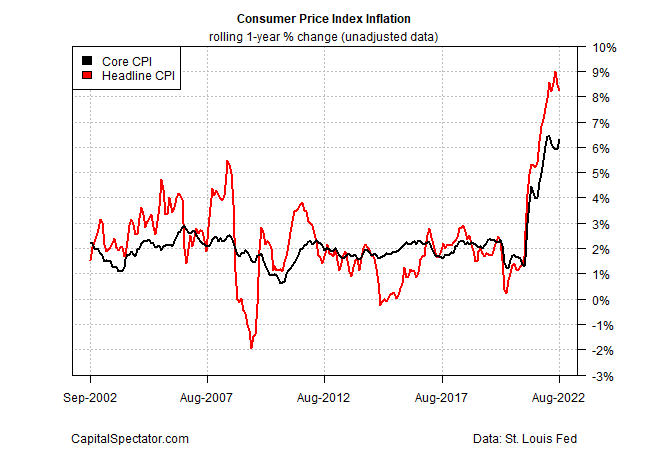

Consumer price inflation remains far above the Fed’s 2% target, although there are hints that maybe, possibly, pricing pressure has peaked. But even if that’s true, it will likely take several months at the least of decelerating inflation prints to convince the central bank that it can ease up on policy tightening. As the chart below suggests, however, that point doesn’t look imminent, based on CPI data through August. Perhaps the upcoming September report will bring more encouraging news… or not.

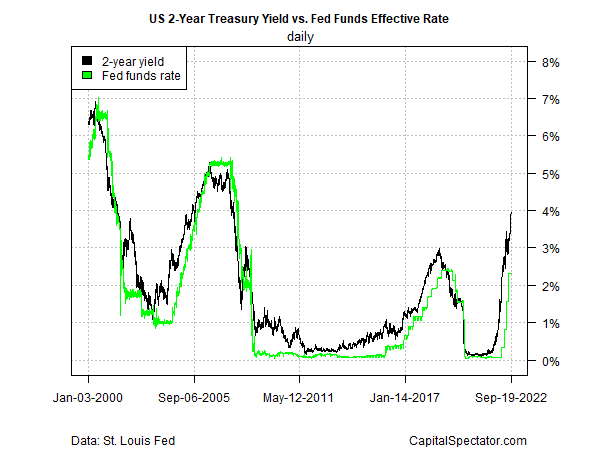

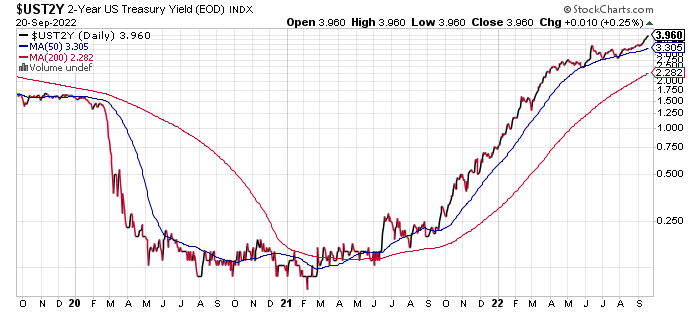

The 2-year Treasury yield is considered a more timely profile for monitoring where the Fed funds target rate is headed. Widely viewed as the most policy-sensitive maturity on the yield curve, the 2-year rate was an early predictor of tighter policy when it began trending higher in the second half of 2021. The ongoing rise of the 2-year yield, and its substantial, positive spread over the Fed funds rate, suggests that the end of rate hikes isn’t on the immediate horizon.

As a number of analysts point out, the Fed has a history of hiking until the Fed funds rate rise over inflation. On that basis, there’s still a long way to go before the current 2.25%-to-2.50% target range (set to rise after today’s announcement) approaches core CPI, much less headline CPI.

It’s reasonable to assume that inflation will ease in the months ahead, making the Fed’s job easier. Economic growth is decelerating and the potential for a recession in the near term is more than trivial – macro changes that will probably take some of the wind out of inflation’s sails.

Paul Ashworth, chief North America economist at Capital Economics, sees potential on that front. “If we’re right that inflation will fall back soon, officials will quickly pivot to much smaller hikes,” he predicts. “The continued drop in gasoline prices and easing food inflation will weigh on headline CPI over the next month or two.”

A number of models are employed to predict the terminal rate for Fed funds. The so-called Secured Overnight Financing Rate estimate, for example, is currently pricing in a terminal rate in the 4%-to-4.5% range. Let’s see if today’s economic forecasts from the Fed, along with Fed Chairman Jerome Powell’s press conference, change the calculus.

Meanwhile, keep your eye on the 2-year yield, which looks set to reach 4% in the days ahead. Until this key rate begins to stabilize, its effective forecast is that the odds remain low for a Fed pivot on rate hikes. The key question: Will the 2-year yield continue rising above widespread expectations that the terminal rate is in the 4.0%-to-4.5% range?

At this point, it’s anyone’s guess. What we do know: the central bank is increasingly committed to taming inflation.

“The Fed has finally realized the seriousness of the inflation problem and has pivoted to messaging a positive real policy rate for an extended period of time,” advises John Ryding, chief economic advisor at Brean Capital.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment