ronniechua

According to worldwide news sources, suddenly investors have a new outlook on China. The Politburo and President Xi Jinping just announced new leadership. The group consists of Xi loyalists, casting doubt on the prospects for more pro-market policies. On Monday investors panicked and brought the Hong Kong Hang Seng index down 6%. Even worse, the iShares China Large-Cap ETF (FXI) dropped 10% and the Wisdom Tree China ex-State-Owned Enterprises ETF (NASDAQ:CXSE) was off 9%.

I outlined the case for China equities in my 2020, “Why Investors are Underweight China Equities, But Should Reconsider.” In November 2020 I made the case for investing in CXSE. The fund subsequently soared by 29% until peaking in February 2021. But a lot has changed since my earlier analysis. Mounting woes over the past 18 months have hammered shares, especially those of non-state-owned enterprises. Year-to-date CXSE is down 45%.

But what has really changed and where do we go from here? Is this a buying opportunity or time to abandon the sector, as much of the media is portraying? Here I will take a step back and try to provide a rational and objective view on Chinese equities and CXSE.

The Bear Case for Chinese Equities and CXSE

1. New leadership casts a cloud over the market

At this week’s twice-a-decade party congress, President Xi Jinping’s was reelected for a third term. There was also a wholesale change in the Politburo leadership. The committee is packed with Xi loyalists. Premier Li Keqiang, who called for “all possible means” to spur China’s economy, was left off the list of the party’s Central Committee. The South China Morning Post reported,

Security considerations, especially those related to food, energy and supply chains, will feature more prominently in future economic policy, according to Moody’s Investors Service. This indicates that “the shift towards more state-led economic development, which has become more prominent in recent years, is likely to continue and intensify.”

This will likely fuel more redistributive and profit dampening moves by the government.

2. Zero-Covid policy continues to hamper economic growth

As Covid evolved and the rest of the world adapted to an endemic situation, China continued to adhere to a zero-Covid stance, shutting down major cities and regions at the sign of outbreaks. As a result, economic growth has slowed dramatically. At the recent congress President Xi reiterated China’s zero-Covid stance. Yet only 60% of the country’s elderly are fully vaccinated and China’s healthcare system infrastructure with too few beds is still ill-equipped to handle large outbreaks. This suggests more disruptions and spotty, less predictable growth ahead. This is further exacerbated by the backdrop of a weakening world economy.

3. Prospects for a Continuation of an Unfavorable Regulatory Environment

At the congress, Xi reasserted an emphasis on the “common prosperity” mantra. The change in leadership casts further doubt on regulatory easing in favor of publicly traded companies. While this could bode well for state-owned enterprises, it is a continuing threat to private enterprises, the sole holdings of CXSE. The state could significantly constrain profit in key growth industries including web services and finance. Investors abhor uncertainty and there is a wide range of outcomes from this risk.

4. Property market woes and large debt overhang

China has one of the biggest real estate bubbles in the world. At the end of 2021, the government stepped in to help Evergrande, the real estate developer at the heart of the problem, with $300B in liabilities. However there are systemic problems beyond the company that will likely persist for years. Home prices in China fell for a 13th straight month in September. And enormous accumulated government debt stimulus retards the ability to use debt to stimulate growth going forward. This year’s precipitous yuan currency decline places further pressure to maintain interest rates at current or even higher levels.

5. China geopolitical risk

Russia’s invasion of Ukraine has prompted many comparisons between China and Taiwan. And China’s swift and stern reaction to Pelosi’s visit to Taiwan intensified those concerns. The congress opening speech from Xi Jinping reaffirmed the leadership’s views: it is up to the Chinese people to resolve and China will never renounce the right to use force. But the country will strive for a peaceful resolution.

Ray Dalio, who has personally engaged with Chinese leadership for years and has immersed himself in understanding China has written a lot about U.S. – China dynamics:

Sovereignty, especially as it relates to the Chinese mainland, Taiwan, Hong Kong, and the East and South China Seas, is probably China’s biggest issue. Probably the most dangerous important sovereignty issue that is difficult to imagine the peaceful resolution of is the Taiwan issue.”

And Taiwan is only one dimension of the conflict between the superpowers. There is an ongoing and growing economic, technology and trade war that will likely persist for years.

6. The world’s shift to onshoring

The pandemic, supply chain disruptions and ongoing U.S. – China dynamics continue to fuel the shift to onshoring. Given China’s position as the world’s premier exporter, this will put further downward pressure on the economy. The Biden administration has further escalated the economic and tech cold war by announcing new measures to limit the flow of high-end semiconductors and equipment to China. This comes on the heels of the CHIPS and Science Act in August, designed to spur more domestic investment in semiconductor R&D and production and limiting dependence on China’s technology. The onshoring movement also adds to inflation, hurting not only China, but economies across the world.

7. Risk of delisting China equities from U.S. exchanges

The overhang from this threat has been around for a while but was alleviated in August. The Public Company Accounting Oversight Board announced a framework agreement with two Chinese authorities: The China Securities Regulatory Commission and the Ministry of Finance. The agreement attempts to resolve a dispute relating to the ability to inspect auditors of U.S. listed Chinese companies. Despite the tenuous agreement, worries continue over the bigger picture and the possibility of further regulations from both countries. Policy analyst Paul Leder, former director at the SEC’s Office of International Affairs wrote in Barron’s:

The signing of the agreement does not guarantee that the inspections will proceed without a hitch or that delistings are off the table.”

8. Even Bridgewater Has Sold Major China Equity Positions

Dalio’s Bridgewater, the world’s largest hedge fund and long-time advocate of China investing has sold some of its major positions. According to the Q2 13F filing, the firm sold its entire position in Alibaba, worth over $813M. The firm also sold substantial positions in JD.com, Bilibili, NetEase and Didi Global. However, it increased positions in some well-known Chinese stocks such as Baidu while maintaining a substantial amount in Tencent.

9. Chinese ideology is anathema to some U.S. investors

Besides financial factors, the rise of ESG investing has led many to avoid China out of moral obligation. Some members of Congress are trying to deter U.S. universities’ investments in Chinese companies. It is hard to quantify or predict where sentiment will go, but this is a very real negative factor that likely won’t go away any time soon.

The Bull Case for Chinese Equities and CXSE

1. Size and stature of China

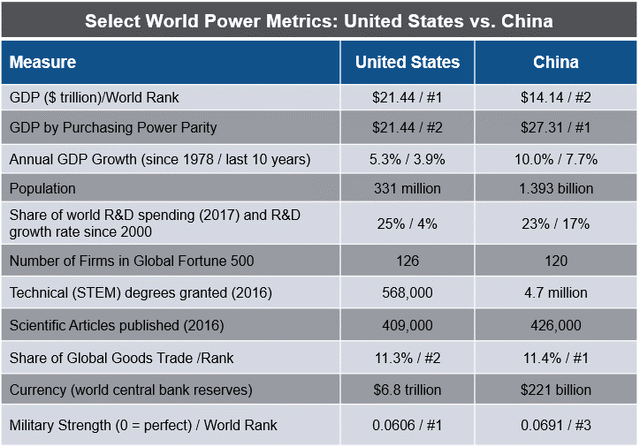

China is a rising world power, on par with the U.S. in terms of purchasing power parity. It ranks first in shares of global goods trade, third in military strength and has 1.39 billion people. The country accounts for 23% of world R&D spending. Yet its stock market doesn’t reflect the country’s stature on the world stage. It accounts for only 5% of the FTSE All-World Index. Even if China remains underweight in major indexes, there is still substantial upside.

Author, Investopedia.com, Macrotrends.net, Nature.com, AIP.org, McKinsey.com, Statistica.com, TheBalance.com, globalfirepower.com, Wikipedia.com

Another example of China’s influence is The Regional Cooperation Economic Partnership (RCEP) trade deal. The pact covers China along with 14 other countries that orbit around China, including Japan and South Korea. Together they account for a third of global GDP and 53% of world exports. The deal helps China as it locks in Asian trade while making U.S. exports to the region less competitive.

2. Solid long-term growth prospects

China is an economic powerhouse. Despite recent woes, it posted Q3 GDP growth of 3.9%, ahead of the expected 3.4% and well ahead of the U.S. The country is home to nine of the world’s top 20 tech firms. Policymakers implemented more than 50 economic support measures since late May, seeking to bolster the economy. Yet The World Bank states, “Over the medium term, China’s economy continues to confront a structural slowdown. Potential growth has been on a declining trend, reflecting adverse demographics, tepid productivity growth and rising constraints to a debt-fueled, investment-driven growth model.”

3. Favorable valuations

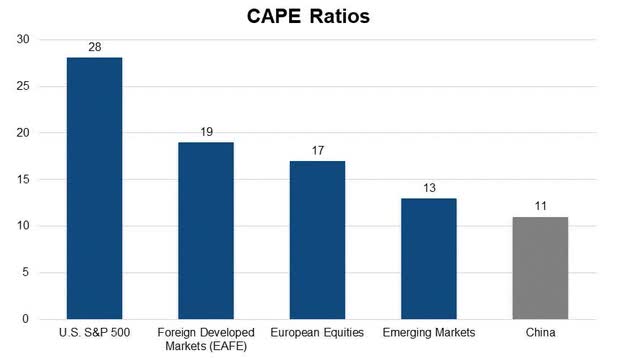

Chinese equities trade at a CAPE ratio of only 11. The iShares China Large Cap ETF trades at only 8.3X trailing earnings. Shares trade at a 60% discount to U.S. equities. The pricier, higher growth CXSE trades for 20X trailing 12-month earnings. It should be noted that these valuations can be rationalized and may persist. The specter of government intervention under the common prosperity goal dampens profitability and growth. This makes them somewhat like U.S. utility companies. However, in the case of CXSE, it has a meager dividend yield of 1.7%.

4. Portfolio diversification benefits

Earlier Bridgewater research showed low China equity correlations relative to a U.S. traditional portfolio. This factor is a plus for U.S. investors, especially when we see an inevitable reversal in the strong dollar trend. And the weak yuan, down 12% versus the dollar this year, helps China’s world trade competitiveness.

5. Don’t fight the Politburo

Much like U.S. investors who “don’t fight the Fed,” there is a case to invest alongside the ruling Politburo. China has a long-term push to spur a baby-boom, improve the lives the middle class, and bolster its international competitive position in 5G, clean energy and semiconductors. This week’s leadership change suggests a new investing landscape. As such, investors comfortable with risk and/or short-term oriented ones (see #7 below) might consider taking a position in CNYA or FXI, which hold state owned enterprises. During Monday’s selloff, CNYA dropped more modestly, 4.8%, compared to CXSE’s 9% drop.

6. The Chinese government wants prosperity too

Many analysts have painted a bleak picture about Chinese leadership, emphasizing how their moves are harming investors. While largely true, the reality is that they are still politicians who want economic prosperity. They want Chinese companies to produce profitable revenue to maximize employment and promote the overall well-being of their people. Indeed, during the February-March stock selloff, government stepped in to reassure markets. They even acknowledged that their crackdowns on internet stocks might have gone too far. Subsequently CXSE went from $34.53 on March 15th to $42.72 on April 4th, a gain of 24%. With this week’s meltdown, it’s possible we could see another move by leadership to soothe markets.

7. Bearish sentiment

With the Hang Seng index down 35% this year on top of last year’s declines, sentiment appears to be near an extreme. Hedge funds that invest in China are showing their biggest net outflows of funds in at least 15 years. Only 9% of respondents to a recent Barron’s Big Money Poll thought the Chinese market would be the best performing major equity market. Media reports following this week’s selloff have predominantly struck a bearish tone. For example, CNBC reported: “U.S. listed Chinese stocks drop 15% after Beijing’s power reshuffle make the market uninvestable.”

Conclusion: Outlook for Chinese Equities and CXSE

Adding it all up, the score is Bears 9, Bulls 7. However, unlike sports, the points aren’t weighted equally. In my view, the actions of the communist leadership, particularly President Xi, carry more weight than any other factor. They can legislate away businesses and implement measures to quash profits. They can also rig or withhold financial reports, making it harder for investors to gauge what is really happening. To wit, Bloomberg reported last night that the historic selloff on Monday wasn’t even mentioned in state-owned newspapers.

Yet, they can also help other companies that support their agenda. All this makes buying Chinese stocks more like sports betting rather than traditional investing. I believe this reality combined with Covid policy and growing geopolitical risk have fundamentally changed the investing landscape in China over the past 18 months.

But the game isn’t over. The other dominating factor which the government does NOT control is worldwide investor sentiment. Right now, it is suggesting we may be near a bottom. Although it could be temporary, I would look for a significant market bounce, with or without moves by the government to calm markets. Speculative investors willing to trade may want to acquire positions, while longer term investors wanting to exit CXSE may be well-served to wait for a bounce before doing so.

Long-term, conservative investors will probably want to avoid China and put their hard-earned money into more solid, predictable asset classes and sectors. I discussed that in my recent series on all-weather retirement portfolios. Stock pickers can also have success by identifying winners aligned with state interests, but that is also fraught with greater uncertainty and risk than investing in free-market regions.

I look forward to your comments.

Be the first to comment