Md Saiful Islam Khan

Investing in early-stage biotechs is always risky and almost never easy, and that has certainly been true for Aptose Biosciences (NASDAQ:APTO). Investors have had to deal with unexpected issues tied to its former lead drug luxeptinib and a slow build of positive clinical data for its new lead drug tuspetinib (formerly HM43239, or “239”), and all this while the biotech market has been under pressure.

Heading toward the American Society of Hematology (or ASH) meeting in mid-December, Aptose has been building up its clinical dataset for tuspetinib, and so far this looks like a promising drug worth more than the sub-$70M market capitalization of Aptose as of this writing. Of course, there is still a lot that has to be proven in the clinic, but investors looking for a high-risk play on difficult-to-treat leukemia subtypes should take a closer look.

Enough Cash To Get Into Registration Studies

One of the key issues with small biotechs is liquidity, and Aptose exited the last quarter with just over $55 million in cash. Management continues to believe that this will be sufficient to get the company into 2024, at which point the company should have multiple Phase II studies underway.

Thinking about this more practically, the company will likely not need to test their assumptions for that cash runway. According to the most recent updates from the company, there will be data available in June 2023 from the upcoming expansion trials. If those data are positive (ideally unequivocally and meaningfully so), the shares should trade up, and I would expect the company to use that as an opportunity to raise cash.

Calculating exactly what Aptose will need isn’t so straightforward at this point. Those upcoming expansion studies are meant to inform future trial design, including the number of Phase II studies and the possibility of accelerated approvals, and the number of patients in each study. Still, looking at past studies like VIALE-A (run by AbbVie (ABBV) and Roche (OTCQX:RHHBY) for Venclexta, I believe $10M to $15M for Phase II studies and $20M to $25M for Phase III studies are at least reasonable ballpark estimates, and management has discussed the possibility of three single-agent registrational studies and two randomized combo studies for tuspetinib.

Likewise, there is still the ongoing development of luxeptinib to consider. Management doesn’t have to go all the way back to square one with its new formulation of the drug (“G3”), but it still remains to be seen what clinical activity this new version will produce, and with that the future clinical development plans/needs in terms of cash. Nevertheless, I’m assuming around $10M in Phase I spending, with Phase II and Phase III study costs likely to be similar to what I referenced above.

Tuspetinib Looks Promising, But Again, It’s Still Early

Management didn’t have much to say with third quarter earnings in regard to tuspetinib, other than to note the end of the dose escalation and exploration phase and the progression to dose expansion studies. Management was quite bullish talking about this initial phase of development, calling it a “very successful” Phase I trial and stating that it had delivered “everything we had hoped”.

Management subsequently issued a press release highlighting an abstract for the upcoming ASH meeting that goes over the performance of tuspetinib in these first 60 patients. As is typical, the cut-off for abstract submissions means that there’s nothing in the available abstract that management hasn’t already discussed, and investors will have to wait for an expanded up-to-date presentation at the meeting to get the latest efficacy and safety data.

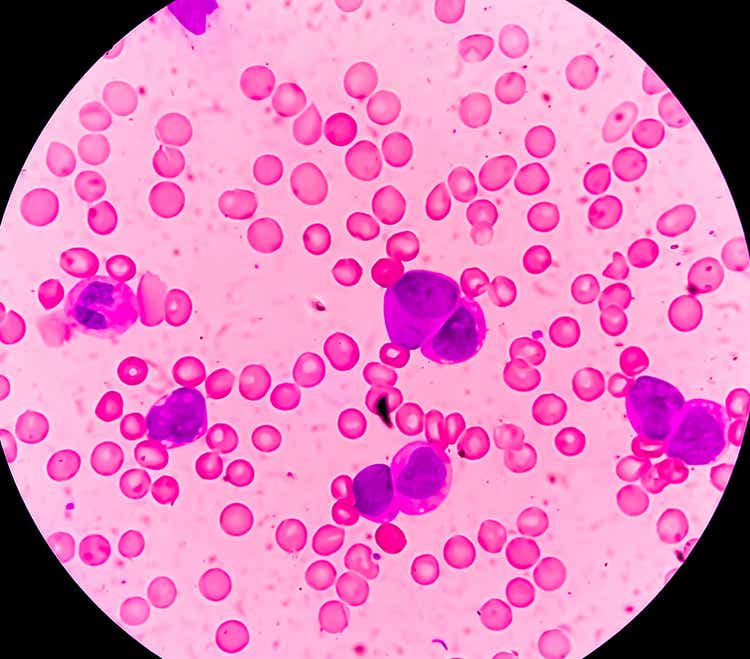

While the numbers are very small, I can appreciate the sense of optimism here. The safety data have been clean thus far, and in patients with FLT3 mutations and prior FLT3 inhibitor therapy, the drug showed a composite complete remission (or CRc) of just under 29%, while patients with a TP53 mutation or NPM1 mutation showed a 25% and 14% CRc, respectively. Comparing across studies is difficult and can be very misleading, but if you look at the results seen in early studies of Venclexta and Astellas‘ (OTCPK:ALPMY) Xospata, these results are worth further exploration.

Now the company is moving forward with a single-agent expansion study that will target patients with FLT3 mutations that have relapsed (or not responded) after treatment with an FLT3-inhibitor, as well as patients with TP53 mutations. The company will also be launching an “all-comers” r/r AML study testing a lower dose of tuspetinib (80 mg versus a 120 mg dose in the single-agent study) in combination with Venclexta.

Depending upon how these studies go, accelerated approvals as a single agent in certain underserved segments (particularly FLT3 mutation after FLT3-inhibitor therapy) could be a possibility. While the patient populations will be relatively small (around 7,000 for r/r FLT3+ in the U.S., EU, and Japan combined), that’s still a $1B-plus revenue opportunity based on current AML therapy prices (to say nothing of the possibility of getting better pricing due to more limited options/worse outcomes for these patients).

Can Luxeptinib Rally Back?

Luxeptinib was previously the lead drug for Aptose, but despite promising in vitro studies that suggested compelling and differentiated potential, the drug has yet to live up to that potential in the clinic. Bioavailability has turned out to be a significant issue, and management will explore Phase I testing with a new formulation that appears to achieve 18x improvement in bioavailability.

The company has modified its Phase I a/b study protocol to allow for continuous dosing (every 12 hours), and dosing with the new G3 formulation could begin in the fourth quarter. If the initial dosing goes well (there are no safety issues and there are sufficient levels of the drug in the patients to drive clinical responses), broader early-stage testing could begin in 2023, but the drug is now basically about two years behind tuspetinib.

The Outlook

Leukemia and B-cell malignancies are unfortunately still significant opportunities. Not only is an aging population leading to more diagnoses, but while there have been significant improvements in treatment, not all patients achieve a durable response and/or can tolerate the newest drugs. That leaves many thousands of potential patients for Aptose’s lead drugs, and these are patients with few other options and poor prognoses.

While I think words like “promising” are fair to use with tuspetinib, the reality of drug development is that it’s a difficult process with far more failures than successes. Only about 5% of oncology drugs that go into Phase I go on to approval and commercialization, and few companies waste their resources trialing drugs they don’t believe in – in other words, most of the 95% that fail were thought promising enough to go into the clinic.

I believe both tuspetinib and luxeptinib could be billion-dollar drugs if the clinical data are positive. It will take time to find out, though, and the odds are still not in the companies’ favor. Thus, while 10% odds of approval do support a $4-plus fair value today, I don’t want to mislead any readers about the long odds in play here.

The Bottom Line

As a microcap biotech with two Phase I assets, Aptose is hardly what investors really want in a biotech stock today. I do think the tuspetinib data are more positive than the market capitalization reflects, though, and if the company’s update at ASH is positive, I see a better path for the stocks. Again, while I think there is a significant upside here on positive clinical outcomes, this is an exceptionally risky stock today, and if the drugs work, investors will have many chances to buy in the future.

Be the first to comment