marchmeena29

Originations for Ladder Capital Corporation (NYSE:LADR) remained strong in the second quarter, and the mortgage trust once again covered its dividend with distributable earnings.

Ladder Capital benefited from strong commercial real estate market conditions and robust demand for new originations.

The stock is an appealing addition to an income-focused investment portfolio because its 7.6% yield is covered by distributable earnings and it continues to trade at a small discount to book value.

Strong Portfolio, Strong Originations

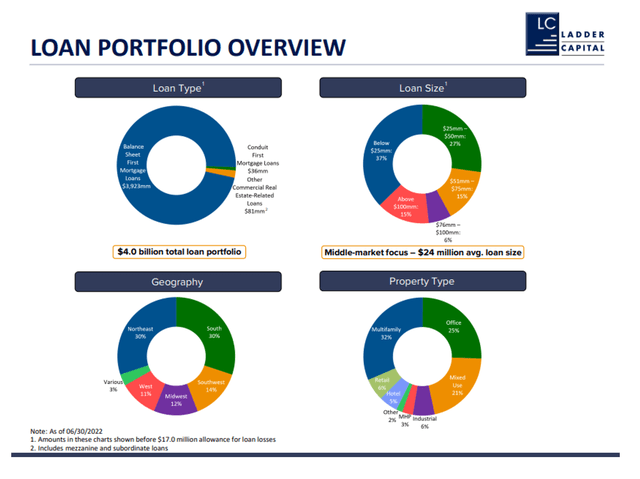

Ladder Capital’s commercial loan portfolio is concentrated in multi-family properties and offices, which account for 32% and 25% of the trust’s total property investments, respectively.

As of June 30, 2022, multi-family and office properties accounted for 57% of Ladder Capital’s property exposure, with the remaining 43% allocated to mixed-use, hotels, retail, industrial, and manufactured housing properties.

At the end of 2Q-22, Ladder Capital’s balance sheet first mortgage portfolio was valued at $4.0 billion, up from $3.9 billion the previous quarter. The value of Ladder Capital’s loan portfolio increased due to new originations.

In 2022, Ladder Capital’s originations are still going strong. Ladder Capital originated $371 million in new loans in 2Q-22, after originating $732 million in new first mortgage loans in 1Q-22.

Ladder Capital has originated an additional $38 million in new loans in 3Q-22. The demand for new loan originations indicates that the commercial real estate market is in good shape.

Loan Portfolio Overview (Ladder Capital Corp)

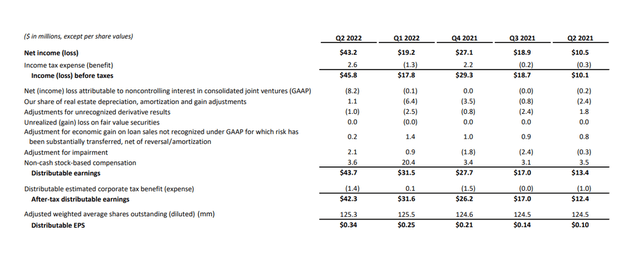

Ladder Capital’s earnings have recovered as a result of the real estate market’s recovery following Covid-19. In 2Q-22, the trust’s loan assets generated $0.34 per share in distributable earnings, a 240% increase YoY. Ladder Capital’s distributable EPS increased for the fourth quarter in a row in the second quarter.

Distributable Earnings (Ladder Capital Corp)

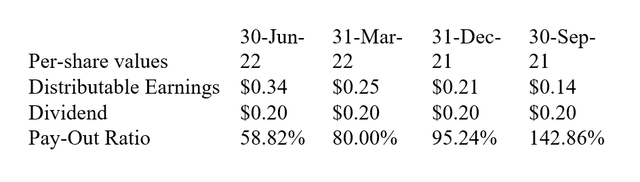

Ladder Capital’s 2Q-22 distributable EPS of $0.34 per share compares to a dividend payout of $0.20 per share. The dividend has since been increased by 10% to $0.22 per share. In the previous twelve months, the trust earned $0.94 per share in distributable income while paying out $0.80 per share, for a pay-out ratio of 85%.

Pay-Out Ratio (Author Created Table Using Trust Information)

A Key Feature For Ladder Capital’s Earnings Growth: Exposure To Floating Rate Loans

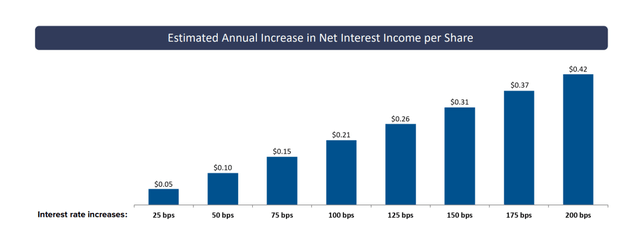

Ladder Capital’s loan portfolio is made up of 90% floating rate loans, which will generate higher interest income if the central bank continues to raise rates.

The central bank has already delivered two consecutive 75-basis-point rate hikes in June and July, and additional hikes are expected to boost Ladder Capital’s net interest income. A 100-basis-point increase in interest rates is expected to result in $0.21 per share in additional annual income, according to Ladder Capital’s interest rate sensitivity table.

Interest Rate Increases (Ladder Capital Corp)

Still Trading At A Discount

Ladder Capital not only offers a 7.6% yield that is fully covered by distributable earnings, but its stock is also trading at a discount to book value.

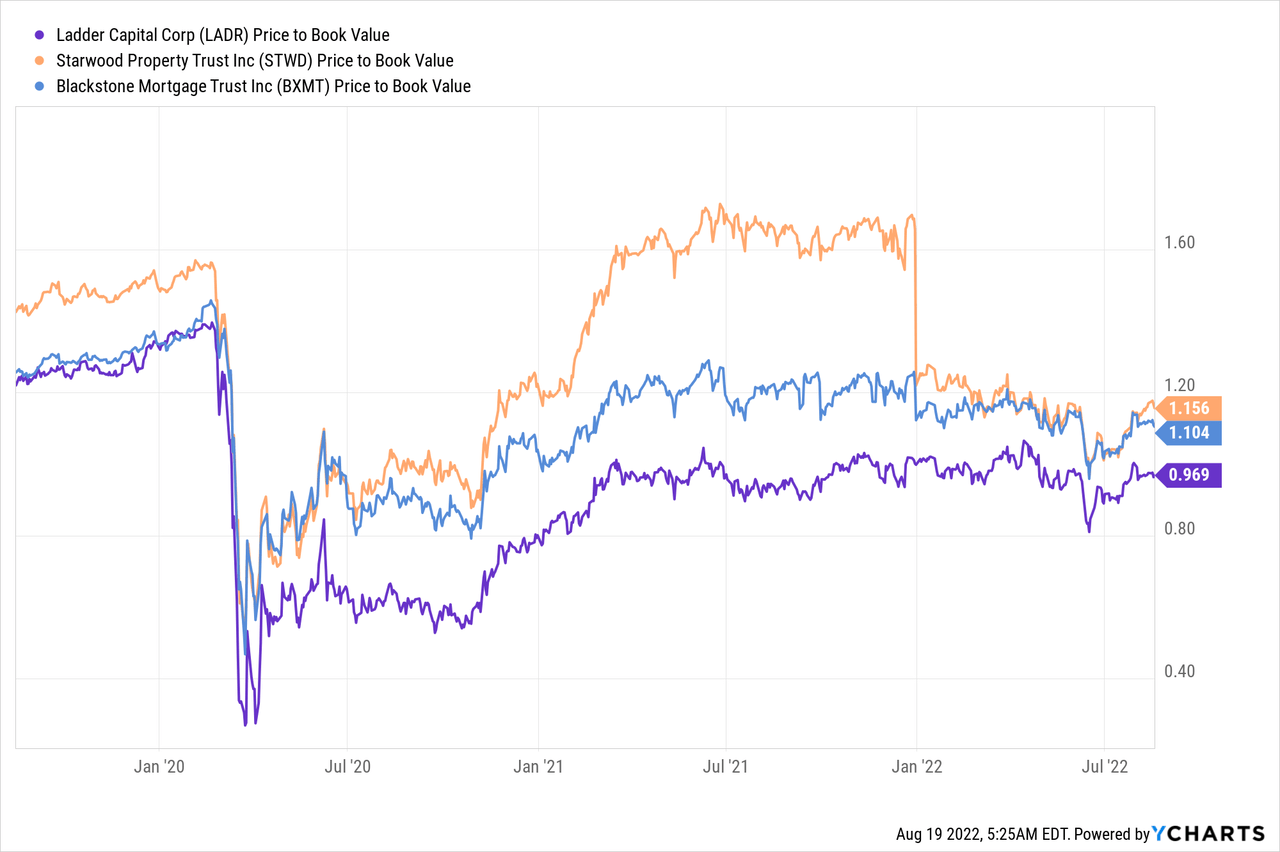

The current price-to-book ratio is 0.96x, which indicates a 4% discount to book value. Ladder Capital’s peers, Starwood Property Trust (STWD) and Blackstone Mortgage Trust (BXMT), both trade at a premium to book value, and I believe Ladder Capital, given its strong origination position and well-performing portfolio, could as well.

Why Ladder Capital Could See A Lower Stock Price

The success of Ladder Capital as a mortgage origination platform is linked to the state of the commercial real estate market in the United States. If commercial real estate investors reduce their investments in the commercial property market and vacancies begin to rise, origination demand will likely slow.

Because Ladder Capital has a sizable allocation of loans to the cyclical office sector, a downturn in the office real estate market could have an impact on the trust’s origination volume and distributable earnings growth.

My Conclusion

Ladder Capital is currently in good shape and performing well. Originations were not as strong in the second quarter as they were in the first, but a cyclical decline in originations is not yet an issue.

Furthermore, Ladder Capital’s dividend is still being covered by distributable earnings, and the stock is trading at a discount to book value.

With a 7.6% covered dividend yield and solid fundamentals, Ladder Capital’s stock is a good buy in my opinion for income-focused investors.

Be the first to comment