CinemaHopeDesign

Even if you know absolutely nothing about gold miners, if you understand the full story of Centerra Gold (NYSE:CGAU), you will see the tremendous value in the stock. The current enterprise value of CGAU is astounding.

Let’s dig into the details…

Enterprise Valuation = $305 Million

Three weeks ago, Centerra Gold settled its dispute with the Kyrgyzstan government over the Kumtor mine. In exchange for giving up its ownership in the mine, CGAU received the ~26% ownership stake in the company held by the Kyrgyz Republic. Centerra promptly canceled those shares and considerably reduced the share count.

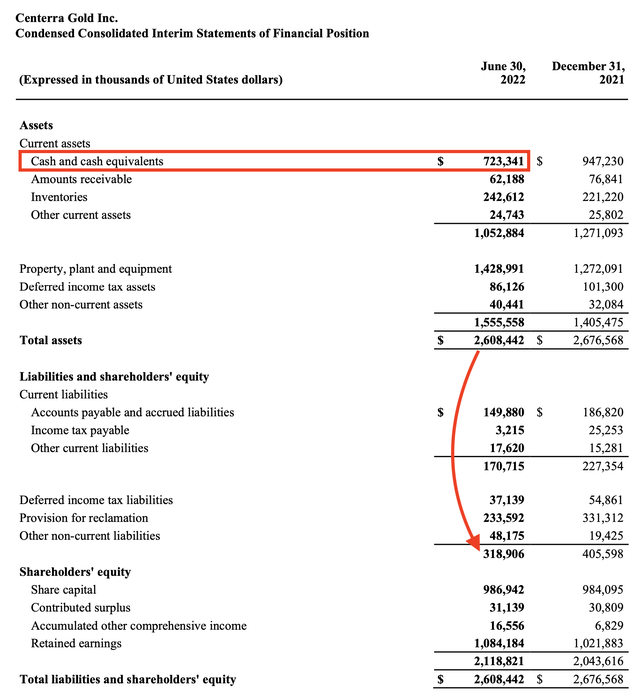

At a current price of US$4.57 and ~220 million shares outstanding, the market cap of CGAU is $1.0 billion.

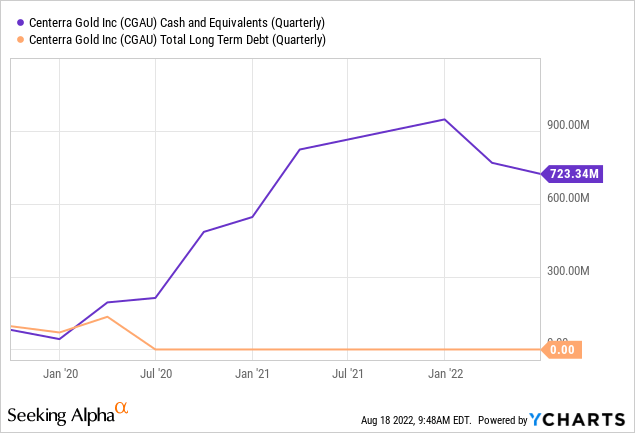

Over the last 2-3 years, the company has marketably increased its cash balance. At the end of Q2 2022, Centerra had $723 million in cash, while debt was $0.

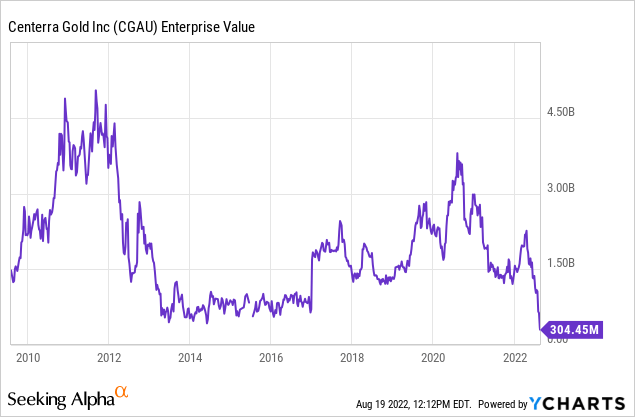

The current EV is just US$305 million, which is the lowest enterprise value that CGAU has traded at in the last 10+ years. The graph also shows the precipitous drop since April 2022, as it was only four months ago that the company had an EV of over $2 billion.

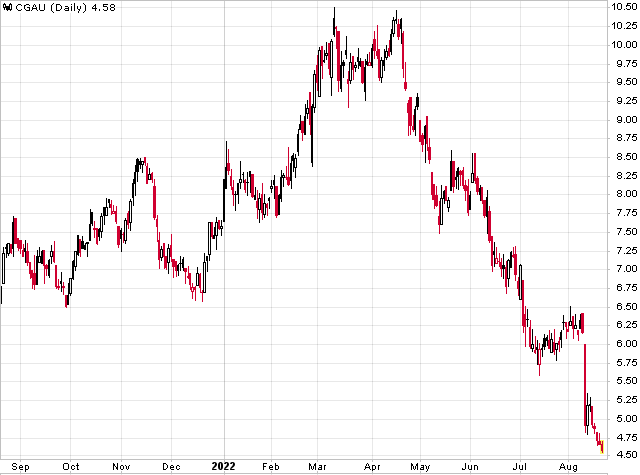

Last week, CGAU fell by over 20% after Q2 financial results were released. The stock was already heavily discounted to fair value, and to have it decline another 20%+ was an extreme overreaction. CGAU has trickled even lower this week as the selling continues.

StockCharts.com

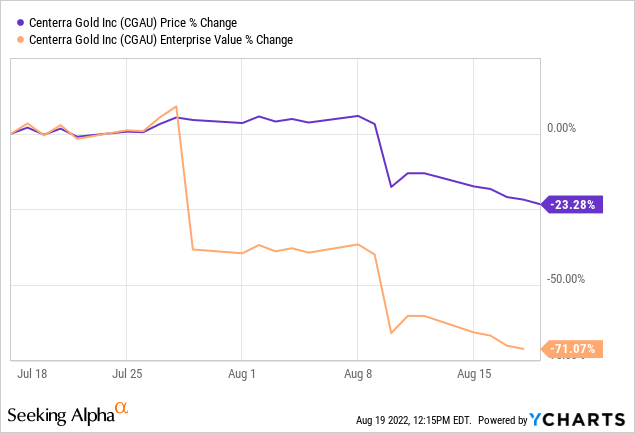

The following graph shows the percentage loss in both the stock and enterprise value in the last month. With the share cancellation, the EV has contracted by 71%, even though the share price has only dropped by just over 23%. I don’t believe investors truly understand what’s occurred with the share count or have a solid grasp of the valuation of the company. If they did, CGAU wouldn’t be trading where it is today.

What Do Shareholders Get For $305 Million?

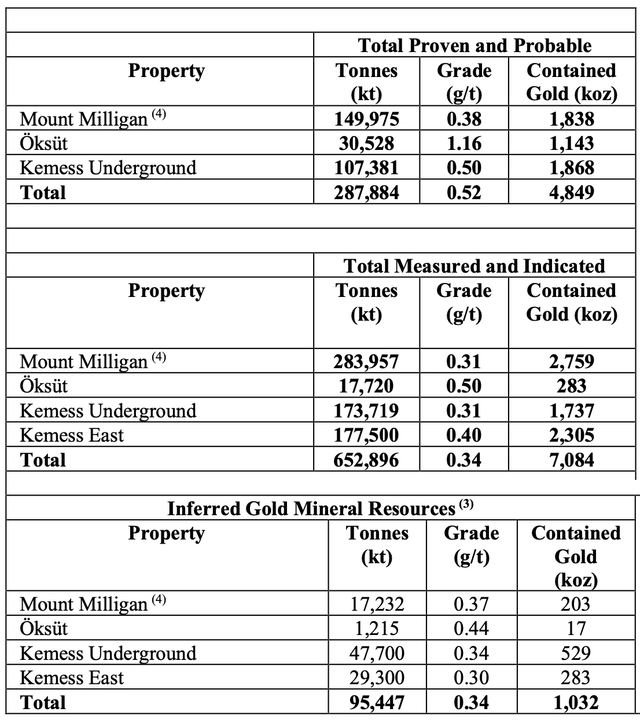

Centerra has two mines in production: Mount Milligan in Canada and Öksüt in Türkiye. Technically, Öksüt isn’t producing gold at the moment, but we will get to that in a bit. Mount Milligan contained 1.8 million ounces of gold and 736 million pounds of copper reserves at the end of 2021. There are an additional 2.8 million ounces of gold at Mount Milligan in the M&I category, along with almost 1 billion pounds of copper. Öksüt contained over 1.1 million ounces of gold reserves at the end of last year. The Kemess property in Canada (a past-producing mine with over C$1 billion of infrastructure, but isn’t in production today) had an estimated gold reserve and resource of almost 7 million ounces plus substantial copper resources. Two studies on Kemess Underground and Kemess East conducted several years ago estimated almost 2.5 million ounces of gold and 1.3 billion pounds of copper production from both mines.

Centerra Gold

Centerra also owns a couple of molybdenum assets, as well as a new gold project called Goldfield (Nevada) that it bought earlier this year for just over US$200 million. Goldfield’s is the next phase of growth for the company.

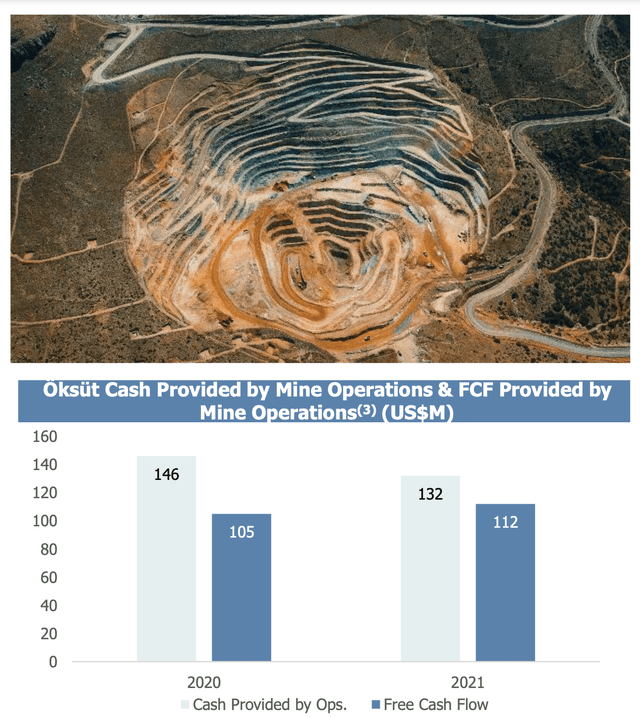

Mount Milligan and Öksüt are two of the lowest-cost gold mines in the world. In 2020 and 2021, Mount Milligan’s AISC on a by-product basis was $552 and $508 per ounce, respectively. While Öksüt’s AISC was $523 and $668 per ounce during those years.

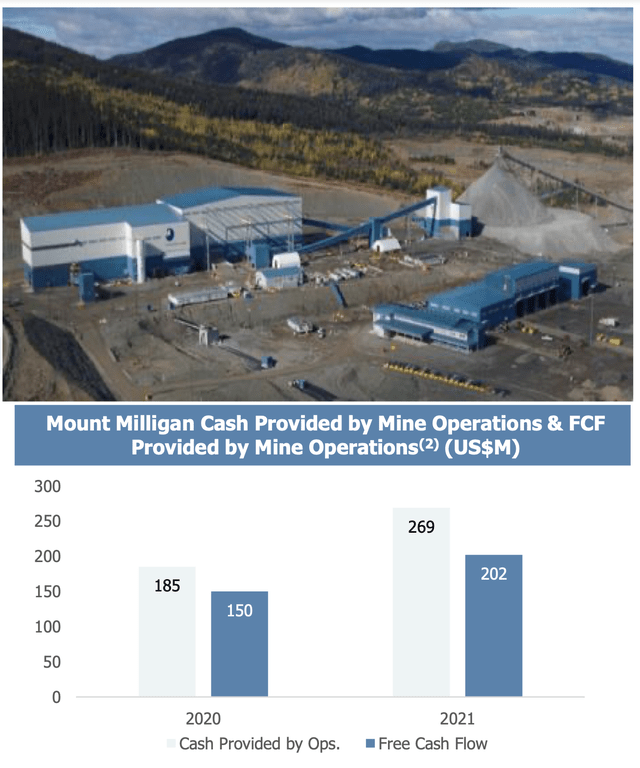

Last year, the duo produced a combined 308,000 ounces of gold and 73 million pounds of copper and generated $314 million of mine-site free cash flow. To put this in perspective, Centerra generated more free cash flow in 2021 from these two assets than its current EV.

Centerra Gold

Centerra Gold

Mount Milligan has 7-year mine life based only on reserves. When copper and gold were at $4.40 per pound and $1,800 per ounce, respectively, earlier this year, I estimated the mine would generate $1.342 billion of total cash flow from 2022-2029, and the NPV (5%) was $1.18 billion. Copper has dropped since then and is trading just below $3.75, but still, even at $3.75 copper and $1,800 gold, the mine would generate over $1 billion of free cash flow.

SomaBull

The NPV (5%) of Öksüt at $1,800 gold is $500-$600 million (depending on the tax rate).

The other assets in the portfolio, including the recently acquired Goldfield project, have a value of at least $400 million at fire-sale prices.

The balance sheet showed $2.6 billion of total assets, including over $1.4 billion of PP&E, with just $319 million of liabilities. These figures support my valuation assumptions. Valuing Mount Milligan, Öksüt, Goldfield, and all of Centerra’s other mines and projects at just $305 million makes zero sense.

Centerra Gold

Why The Shares Have Been Under Pressure Lately

There were several negatives in Centerra’s Q2 2022 report:

- AISC on a by-product basis was $1,659 per ounce last quarter compared to $395 per ounce in Q1.

- The company generated negative free cash flow of $31.2 million in Q2.

- The Öksüt mine’s stacking and leaching operations were suspended “due to the Company’s inability to obtain approval from regulators to use more activated carbon than is currently allowed in the Öksüt Mine’s environmental impact assessment (“EIA”),” and there was also commentary in the press release about how Turkiye’s Ministry of Environment noted a number of deficiencies relating to the Öksüt Mine’s EIA.

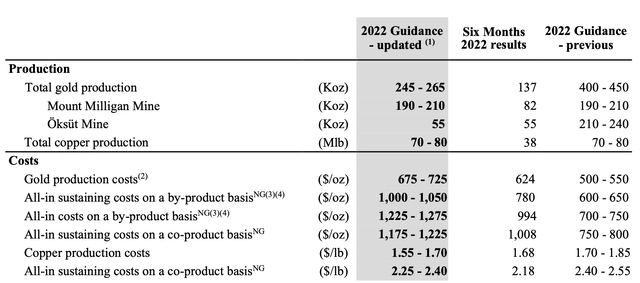

- 2022 production guidance was drastically reduced with no more production expected from Öksüt for the remainder of the year, and AISC guidance was raised due to higher costs at Mount Milligan. 2023 guidance was also withdrawn.

On the surface, the above looks quite negative, but it’s not nearly as disastrous as it seems.

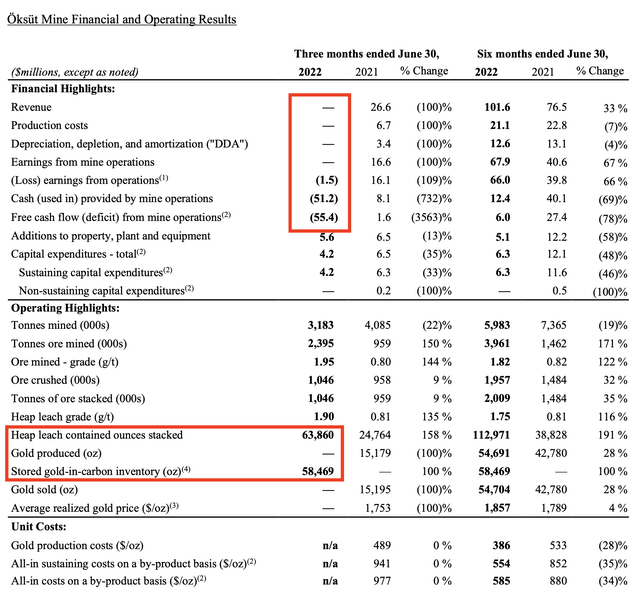

Let’s start with Öksüt. In March, and as previously disclosed by the company, CGAU suspended gold doré bar production at the Öksüt Mine due to mercury detected in the gold room at the ADR plant. The company was still mining, stockpiling, crushing, stacking, and leaching at that point, with the gold-in-carbon ready for processing. Centerra discussed processing the gold-in-carbon inventory at a third-party site if it was economically viable. However, that didn’t occur in Q2. As a result, no revenue or production was recognized last quarter, but there were still losses as the mine had to pay 2021 taxes, there were negative changes in working capital, sustaining capital expenditures, etc. As highlighted below, the operation consumed $55.4 million in Q2 2022. But also notice the contained ounces stacked on the heap leach and the stored gold-in-carbon inventory. There are 58,469 ounces of gold ready to be processed.

Centerra Gold

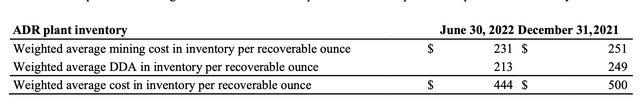

The average mining cost of this inventory is $231 per ounce, or $444 if you include DDA (depreciation, depletion, and amortization). In other words, these ounces will generate over $90 million of free cash flow once they are processed.

Centerra Gold

The good news is the company will only need to spend $5 million for a mercury abatement retrofit at the ADR plant, which will include an upgraded ventilation system with a dedicated heating, ventilation, and air conditioning unit in the gold room area, properly covered equipment that will be vented and off-gases scrubbed, the drying oven will be replaced by a mercury retort system which will allow mercury to be “safely vaporized from the sludge, with the vapor condensed and collected in a fully contained system,” and the furnace off-gas system will also be replaced to “ensure that any remaining mercury is scrubbed from the gas and captured.”

Centerra stated the procurement process for the equipment has been started and is progressing well, and they expect the retrofit to be completed in late 2022.

So what’s the market fretting about?

Assuming the company receives approval, they don’t expect gold pours to restart until 2023. So there won’t be any more production from Öksüt for the rest of the year.

I do want to mention that Centerra did disclose in the MD&A that the “ADR plant is expected to have sufficient production capacity to process up to approximately 35,000 ounces of gold-in-carbon inventory per month.” In other words, they will be able to process the gold-in-carbon quickly once the modifications are complete.

All in all, I don’t believe this is a major issue, and nothing has changed with the mine. Investors seem to think otherwise.

Making matters worse, and likely the main factor weighing on the stock, was the following disclosure by the company:

In May, 2022 the Öksüt Mine was inspected by the Ministry of Environment, Urbanization and Climate Change (the “Ministry of Environment”). The Ministry of Environment informed the site management of a number of deficiencies relating to the Öksüt Mine’s EIA. Since that time, the Company has worked to address the majority of the deficiencies and understood that the permitted production capacity and activated carbon usage at the mine continued to be under review by the Ministry of Environment.

On August 9, 2022, the Company met with the Ministry of Environment which did not approve the Company’s request to use more activated carbon than is permitted in the Öksüt Mine’s EIA. That request became necessary because the Company is unable to operate the gold room at the ADR plant which would allow the Company to recycle activated carbon in the normal course of operations. Consequently, the Öksüt Mine is suspending stacking and leaching of ore on the heap leach pad and the Company is now considering whether to continue mining and crushing activities in the current circumstances.

The Ministry of Environment also noted that while the Öksüt Mine was in compliance with EIA limits in terms of both mining production and crushing capacity, it had stacked more ore tonnes on the heap leach pad than had been permitted in the EIA during the years 2019, 2020 and 2021. The Company is seeking further clarification on the interpretation of these topics from the Ministry of Environment.

Given the position expressed by the Ministry of Environment and the need for further clarity on the Öksüt Mine’s EIA, the Company is in the process of preparing a new EIA which would clarify, among other things, the heap leach stacking capacity of the mine and the amount of activated carbon usage allowed. The Company expects to submit the new proposed EIA application by the end of August and pursue its approval as quickly as possible.

The Company is also in pursuit of other ordinary course permits, including: (i) an enlarged grazing land permit to allow expansion of the existing operation to the currently defined EIA boundary of the Keltepe and Güneytepe pits; and (ii) an extension of the Öksüt Mine’s overall operating license which is scheduled to expire in January 2023.

As noted above, Centerra is involved in several discussions with various Turkish regulatory authorities which, in some cases, concern interrelated issues. While the Company will continue to pursue a new EIA and all required permits, there can be no assurance that the Company will be able to successfully resolve any of the matters discussed above nor can there be any assurance as to the timing of any of the foregoing. The inability to successfully resolve matters could have a material adverse impact and delay on the Company’s mining, stacking, leaching and production activities at the Öksüt Mine, future cash flows, earnings, results of operations and financial condition.

The market is clearly concerned about Centerra having to submit a new EIA and whether it will be approved. The mine’s operating license is scheduled to expire in January 2023 and needs approval as well. These are all “interrelated” issues, and right now, investors are heavily (or completely) discounting the value of Öksüt.

It’s important to note a few things about the situation:

1. Scott Perry, CEO of Centerra, stated in the Q2 conference call that the regulatory agencies recommended Centerra file a new EIA, and regulators have instructed that their preferred approach is for CGAU to remediate the facilities and complete the retrofit of the ADR plant, as they want Centerra to produce doré on site. Perry mentioned on the call that the government believes the solution is to submit a new EIA that will align its operating activities with that EIA.

It doesn’t sound like Turkiye is about to shut down the mine, but there are obviously higher risks until Centerra has all permits and regulatory approvals in place.

2. Also, the company isn’t writing down any of the value of Öksüt and says it doesn’t expect one in the future. While the situation can change, Centerra seems confident that this is only a temporary issue that will be resolved.

3. Finally, if Centerra can process the current gold-in-carbon inventory at a third-party site (maybe as a one-time exception by the government), they can then build up the inventory again without the need for regulatory approval or an amended EIA.

Still, the short-term impact on production is considerable, as guidance for the year has gone from 400,000-450,000 ounces of gold down to 245,000-265,000 ounces because of Öksüt. There was no change in production guidance for Mount Milligan. The company’s AISC for 2022 has increased from $600-$650 per ounce to $1,000-$1,050 per ounce, partly because Centerra will still be recognizing sustaining capital on Öksüt even though there won’t be any production. There were also mark-to-market adjustments on provisionally priced copper contracts at Mount Milligan that impacted AISC by $560 per ounce last quarter due to the plunge in copper and the timing of the contracts, which are negatively impacting full-year guidance. Centerra is now using a copper price of $3.25 per pound for H2 2022, and copper is much higher today, which means that there will be a positive impact (i.e., lower-than-expected AISC) if copper prices remain at these levels.

Centerra Gold

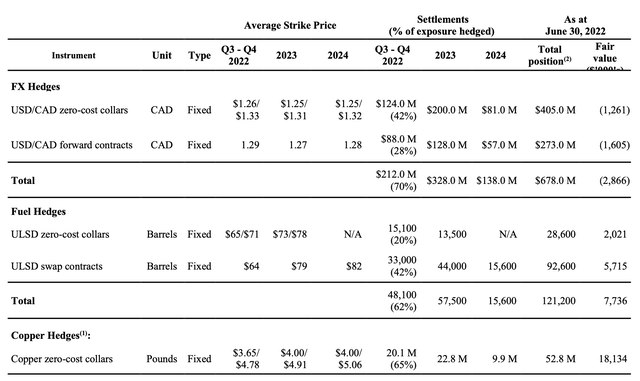

What the market is also ignoring is that Centerra has hedged some of its copper production, so while the price of the metal declined and negatively impacted AISC, the zero-cost collars had a fair value of $18.1 million at the end of last quarter. The company has some copper hedged in 2023 and 2024 as well at a floor price of $4.00 per pound.

Centerra Gold

Summarizing The Situation And Assessing The Actual Risks

1. AISC are temporarily elevated due to mark-to-market adjustments on provisionally priced copper contracts at Mount Milligan, as well as no realized production from Öksüt since Q1, even though sustaining capital and other costs are still being accounted for in the quarterly results. With copper now higher, this will lead to lower than expected AISC if the metal price remains at these levels. If the company decides to suspend mining at Öksüt until the upgrades to the plant are complete, then AISC will drop precipitously as they won’t be recording any costs at Öksüt for the short-term.

2. It’s not 100% certain that Öksüt will receive approval for the amended EIA, but it would be unusual for the government of Turkiye to not grant the permit since they are the ones requesting Centerra submit an amended version and for the company to move forward with the upgrades to the plant. Centerra stated the “preferred approach for the operation from the regulators point of view is for us to remediate our facilities, so that we can continue to produce doré on site.” Why would Turkiye ask Centerra to spend millions on these upgrades and then not approve them? To me, it seems the government simply wants Centerra to have the EIA align with current operational plans, which have changed since the original EIA was approved. The last thing the Ministry of Environment wants is for mines in Turkiye to be exceeding permitted limits or operating outside of the boundaries of their EIA, as this sets a dangerous precedent. I can understand the government’s stance and the requests made. Investors seem to believe there is a high risk that Turkiye will shut the mine down. I don’t believe that’s the likely outcome, at least given what management of Centerra stated in the Q2 press release and conference call.

3. The ~26% reduction in share count seems to be lost on investors.

I believe we are in a situation where investors are selling CGAU at whatever price as they don’t fully understand the value or what’s going on with the operations. This has resulted in Centerra’s stocks trading at one of the most extreme discounts to fair value that I’ve ever seen in this sector for a mid-tier producer. Investors are pricing the shares as if both Öksüt and Mount Milligan are worth nothing at this point.

There are no guarantees with Öksüt, but I believe the odds favor a positive outcome and a resumption of production by early next year. If Centerra can monetize the gold-in-carbon inventory before then, which they are still exploring, that will be an additional ~$90 million of free cash flow. As a side note, Centerra did make a one-time payment of $86 million for the settlement of Kumtor after the close of the second quarter. However, the gold-in-carbon inventory and likely free cash flow from Mount Milligan this quarter more than offset that payment, which is why I feel using the cash balance at the end of Q2 to determine current enterprise value is reasonable.

The main issue for Öksüt is the reserve life is short, and the mine plan calls for mining well above the reserve grade only for another 1.5-2.0 years. Production is at its peak at over 200,000 ounces per year but will drop sharply over the remainder of its mine life once it’s through the high grade. Exploration success is key for Centerra.

The main issue for Mount Milligan is the lack of an updated mine plan. Centerra stated in its latest report that it: “continues to progress its life of mine planning work for the Mount Milligan Mine with a focus on assessing the impact of an extended mine life on capital equipment costs and tailings storage facility expansion requirements.”

Mount Milligan has plenty of ounces to extend the mine-life well past the current 7 years. However, there are some concerns about capital costs and overall project return. Centerra somewhat addressed the topic in the conference call and assuaged some of these concerns as they stated:

What we’re seeing in terms of the unitary cost profile, be it the productivity profile, I think it’s quite similar to what you would have been seen in the prior life of mine profile.

I think when you look at Mount Milligan’s performance over the first half of this year, even 2021, I think you’ve seen a significant improvement in terms of productivities, unitary cost et cetera. Even our recovery efficiencies and I don’t see any reason why that would be dissimilar to what would be in the new life of mine plan as and when we released it.

Still, the company said earlier this year that investors shouldn’t rely on the previous 2023 guidance for Mount Milligan as it’s likely to change, yet we don’t have a new mine plan. As a result, there are uncertainties about the valuation for Mount Milligan, and I do believe that CGAU should be slightly discounted because of the lack of details.

Fair Value In The Current Environment And Catalysts That Will Spark A Reversal

The vast majority of mining stocks are trading well below fair value, so I’m not expecting CGAU to command full price in the current bearish environment. But even if we discount Mount Milligan by 25%, CGAU would need to increase 30% to get in line with the average ~0.5-0.6x NAV of the group.

Once common sense returns to the sector, which could happen at any moment, CGAU should naturally increase to a valuation that is more in line with its peers. But even if the bearishness in the sector continues, positive news on Öksüt in the next six months should spark a reversal. Also, while the Kumtor issue was outstanding, Centerra didn’t want to buy back its stock. Now with the disagreement resolved and the Kyrgyz Republic not a shareholder any more, the company can implement an aggressive buyback. With over $700 million of net cash, they can certainly afford to repurchase 10% of the stock without breaking the bank.

Be the first to comment