Andrii Yalanskyi

Rumble plans to close the SPAC deal with CF Acquisition Corp. VI (NASDAQ:NASDAQ:CFVI) next week via a shareholder vote. The proclaimed neutral video platform competing with YouTube, owned by Alphabet (GOOG, GOOGL), remains a work in progress. My investment thesis is Neutral on the stock until the SPAC deal closes and the financials are more visible with a likely discount to occur typical of most SPACs.

Deal Closure

In December 2021, Rumble announced a definitive business combination agreement with CF Acquisition Corp. VI. Shareholders must approve the deal on a vote scheduled to close on September 15.

SPACs have recently faced a difficult period of getting retail shareholders to vote. Digital World (DWAC) has failed to obtain the necessary shareholder approval to extend the deal to acquire Trump Media & Technology Group. The retail investors are effectively cutting the share price in half with shareholders set for the $10 payout on the $20 stock.

With CF Acquisition trading at $12, investors shouldn’t vote to redeem shares considering the redemption only offers a $10 cash return. The closing of the SPAC deal offers Rumble ~$400 million in net cash to invest in the future via $300 million held in the Trust Account and $100 million via the Pipe. As with most SPACs, a big key is raising funds at the $10 level from the SPAC and the PIPE deal versus ones with high redemption levels ending up have to raise funds at lower stock prices.

The stock will have 261 million diluted shares plus the warrants, and earn-out shares. The fully diluted share count could end up higher based on warrants exercisable at $11.50 per share and earn-out shares not redeemable until at least $15.00.

Missing Financials

A big key to where the stock trades following the approval of the SPAC deal are the actual financials. Rumble is still in the startup phase and the public market isn’t very forgiving of money losing stocks right now.

The online video service reported August monthly active users (MAUs) jumped to 78 million in August. The key US & Canada number was 63 million for 103% YoY growth with huge growth from the younger Gen Z age group.

The Q2’22 MAUs were only 44 million. Users uploaded 8,948 video hours per day, representing 283% growth and Rumble only reported 36 million MAUs for Q3’21 when the SPAC was announced. The online video platform clearly doesn’t have any issues with growing the base of content creators and users.

Rumble continues growth mode, but the stock market has to understand that only a couple of weeks ago the company launched their Rumble Ads platform. The platform will take years to fully monetize users similar to other social media platforms where ARPUs in the $1 range are still common.

The new subscription platform business is promising, but Locals only created $7.5 million in transactions during Q2’22. Locals provides a unique platform allowing creators to sell access to movies and other content on an individual basis.

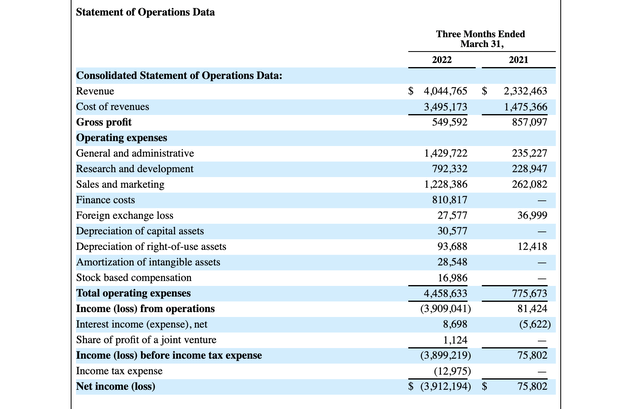

Rumble hasn’t reported Q2’22 financials. The company reported Q1 revenues of only $4.0 million with a minimal gross profit of $0.5 million.

Building out these platforms come at high costs and investors are likely to have sticker shock when seeing the limited revenue growth in relation to users and expenses. If anything, the higher MAUs boost costs and the company isn’t fully monetizing these users.

In the private market, VC investors would fully fund these losses realizing the surging user base could turn into a very profitable business in a few years. In the public market, investors aren’t so long term thinking without direct access to the management team and more updated financials.

The stock is likely to struggle with revenues sitting far below $50 million and the stock market cap at $3.1 billion. The valuation just won’t attract investors with the additional risk of whether Rumble will raise enough cash, as $400 million is pocket change in the social media and online video sector.

Takeaway

The key investor takeaway is that once the dust settles, the stock could become very appealing at lower prices with what could turn into a very valuable user base. Rumble just isn’t ready for prime time yet and updated financials could shock public investors with the meager numbers and likely mounting losses.

Be the first to comment