Ruslan Lytvyn/iStock via Getty Images

Co-produced with Treading Softly

Growing up we had a saying:

Wake up and smell the coffee

Some others had a similar version for the coffee-adverse individuals of “wake up and smell the roses/flowers”. It all meant the same thing. It’s time to get real and face reality. You can’t live in lala land forever and expect your problems to resolve themselves.

Well, good for you, I have an alternative solution!

You can just run away from them!

Just kidding. Terrible solution.

Sometimes being an adult means waking up and addressing your problems head-on in the cold stark light of reality.

So when it comes to investing, it means you also need to keep a realistic mindset on your investments and evaluate them realistically in the light of your investment goals and priorities.

Joe-blow Total Return Investor may try to rain on your parade with their sparsely explained logic and clever wit. Yet their goals of rapid trading and options gumption may have zero in common with your goals. Don’t let them lull you to sleep and make you miss the whole reason for your investments.

Today, we want to look at two cashflow-focused investments. We bought them for the free cash flow they produce and share with shareholders. We need to evaluate if we think cash flow is sufficient to cover their dividends, whether management is actively trying to resolve any potential issues, and if the dividend is going to continue or grow from growing or sustained cash flow.

Don’t let others chloroform you with their wit, it’s time to wake up and smell the cash flow.

Let’s dive in.

Pick #1: AT&T – Yield 6.0%

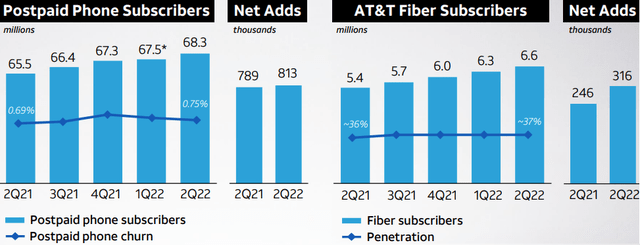

AT&T (T) reported earnings that beat expectations. Adjusted EPS came in at $0.65, beating expectations. Revenues were higher than most analysts expected. Most importantly, AT&T had the best quarter for subscriber growth that it has experienced in 10 years. (Source: AT&T Q2 Earnings)

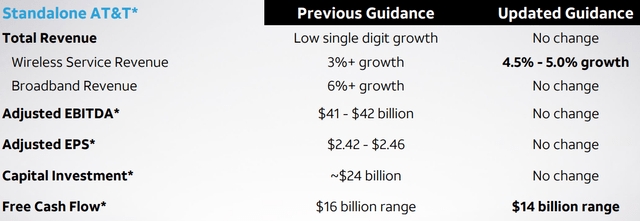

When you compare to Verizon’s (VZ) results, AT&T knocked it out of the park in their wireless segment. Where VZ expects near zero growth for the year, AT&T maintained overall guidance and increased guidance for wireless growth.

So why is the market upset? Free cash flow guidance was cut from $16 to $14 billion, from a lot to still a lot. AT&T is a free cash flow beast, which is its main attraction because FCF (Free Cash Flow) is what funds the dividend. The dividend is roughly $7.9 billion/year, so at $14 billion, the payout ratio is 56%.

The telecom industry isn’t particularly exciting, it is a low-growth sector. Low single-digit growth is what you can expect. The appeal is entirely in the cash flow, which is capable of supporting a generous dividend and has minimal volatility. Cell phones have become a modern-day essential, and people will go through extraordinary measures to maintain their phone service.

The market is right, when FCF comes in lower than expected, it is a concern. It is something we should look at. Let’s turn to the earnings call for an explanation:

I’d also like to touch on free cash flow directly. While free cash did come in lower than we expected this quarter, there were several notable factors that drove this. The first is the timing of higher success-based investments on the back of our robust customer growth. Additionally, we front-end loaded our capital investment plans in order to kick-start our growth initiatives. We expect these plans to seasonally moderate through the course of the year, as we achieve our $24 billion in capital investment plan. And I’m pleased we’ve been able to effectively manage our supply chain and front-end load some of our work this year.

In addition to these investment-driven impacts, we’re seeing some longer collection cycles and inflationary costs that we’ve not been successful in fully offsetting. These cash flow impacts, along with expectations for a more tempered economic climate in the latter half of the year, have led us to adjust our cash flow expectations for the full year, even with our expected material improvements over the next 2 quarters.

Remember, FCF is after capital expenditures. So when you spend more money upfront, that reduces FCF for the quarter. Such timing issues aren’t really a concern to us. The cap-ex will be spent sooner or later, so it will come out of FCF sooner or later.

Two main factors that have negatively impacted AT&T’s FCF are a bit more noteworthy.

First is inflation, AT&T estimates costs will be approximately $1 billion higher than anticipated. AT&T has been responding by increasing prices but has not yet fully offset the rising costs. Telecom is a huge market, but it is also a competitive one. AT&T has to be careful about increasing prices because if they move them up too quickly, customers will simply move over to the competition. So it isn’t completely unexpected or unreasonable for the expense side to go up more quickly than the revenue side when inflation is moving quickly as it has over the past year. As inflation slows down, we can expect that our cell phone bills will be going up, and revenues for AT&T will catch up. This is a reality that is hardly unique to telecom, as most businesses cannot immediately pass along inflation to consumers. However, in the long run, those costs will be passed along. This might be a headwind for T, but it is a headwind that won’t last forever. Over the next year, pricing will go up even as expenses stabilize.

The second is collections being slower. This impacts the financials by forcing AT&T to have higher levels of working capital. On average, customers are taking an extra two days to pay their bills. This is a direct impact of how inflation is hitting consumers. As consumers find their budgets getting tighter, they become more likely to wait until the last minute to pay. This is a trend that has been seen in prior economic slowdowns. On the extreme side, consumers might decide not to pay at all, which is then lost revenue. Most of the time, consumers might be late, but they tend to pay before their phones are shut off. Historically, consumers paying late is far more common than not paying at all. This goes back to the idea that their phone bill is a priority to consumers, and shutting off phone service is a disaster for the modern consumer.

At the end of the day, the telecom business has very reliable cash flows, even through recessions. AT&T’s FCF will be slightly lower than initially guided for this year, but it is still very high and easily covers the dividend. Business is growing, revenues are up, and their subscriber base is growing faster than expected, and that will eventually translate into higher FCF. We view the downgrade in guidance as being due to temporary factors that will work out in time, and therefore, the recent dip is an opportunity to add.

Pick #2: OXLC – Yield 13.8%

It has been a tough year for debt investments, while they defied gravity for a while, Oxford Lane Capital (OXLC) is no exception. As the price investors are willing to pay for debt fell, OXLC fell with it.

OXLC invests in the equity tranches of collateralized loan obligations, or CLOs. CLOs buy up “leveraged loans” using a combination of debt and equity. The manager then manages this portfolio of loans in an effort to maximize the return for the equity tranches because that is how the manager is paid.

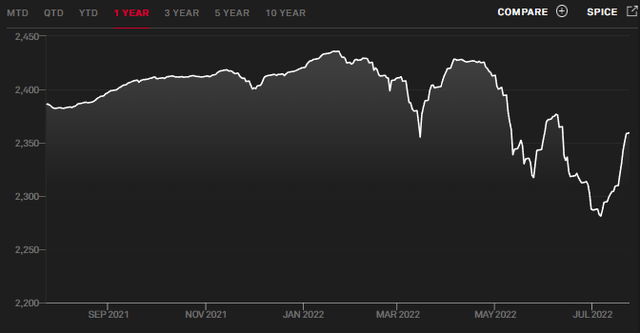

The price of leveraged loans has an impact on CLO valuations because it is the collateral that the CLO owns. If we look at the S&P/LSTA Leveraged Loan 100 Index we can see that prices crashed in June. (Source: SP Global)

Well, the price of virtually everything crashed in June. They also started to recover quite quickly in July. While still down year-to-date, leveraged loans are in the midst of a solid rebound. Similarly, OXLC has started a rebound, up about 12% off of July lows but still has a long way to go to prior highs. Will it get there?

First, let’s understand OXLC’s business model. OXLC is not in the business of flipping positions. By this, we mean that OXLC pursues a predominantly “buy and hold” strategy. While it might occasionally sell a position to reinvest elsewhere, materially all of OXLC’s earnings come from distributions from their CLO equity positions.

I often talk about how I’m not concerned about the price of a particular security because I don’t intend on selling it, and OXLC is similar as their positions are loans. Loans have a maturity date, and the borrowers will either pay it or file bankruptcy. While the price of loans might bounce around like a superball at a kid’s birthday party, at the end of the day, none of that movement matters. The only thing that matters to OXLC is whether the borrower repays as agreed.

The funny thing about corporations, most of them pay their bills. Default expectations remain very low and are expected to remain below 3% for 2023, and we would need to see a huge increase in defaults to get to the originally forecasted 2% for 2022. Year-to-date, CLOs have seen two defaults, and over the past 12 months, there have been 5 defaults. For all practical purposes, defaults have been non-existent.

Ironically, we can thank COVID for these incredibly low default rates. Businesses responded to COVID by shoring up their balance sheets. They retained cash, cut back on expansion, and refinanced their fixed-rate debt at historically low-interest rates. Defaults will remain low because frankly there is little for most companies to default on. Defaults don’t typically occur over interest payments; they occur when large loans mature and the borrower is unable to refinance. Most corporations don’t have any material loan maturities until 2024 or later because if they were capable of refinancing, they did refinance. The companies that couldn’t refinance long-term in the very borrower-friendly environment of 2021 are the ones at risk of defaulting.

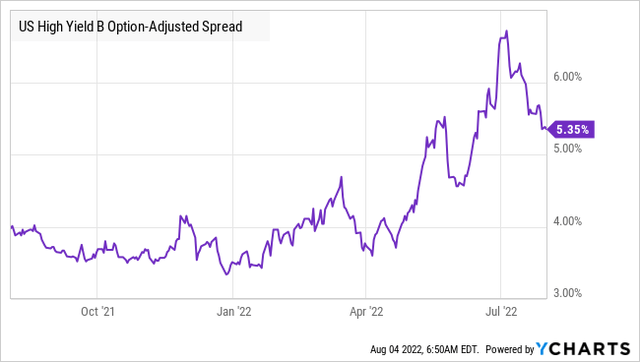

Loan prices weren’t falling because investors feared some huge spike in defaults, they fell because credit spreads widened. This is the spread that investors are demanding from borrowers above Treasury Rates.

The market is pricing in future rate hikes, and the widening spreads impact all debt. Higher spreads mean lower prices for existing loans. After all, if you can invest in a new loan that is +5.35% over Treasuries, would you pay the same price for a loan that is only yielding +4.00% over Treasuries? Of course not. You would only buy a lower-yielding older loan at a discount to par.

For CLOs, things get a bit more complex because the production of new CLOs dried up in June and is likely to remain minimal. New CLOs aren’t being made, and CLO equity positions aren’t being sold. Investors who have them aren’t willing to let them go.

We expect that OXLC will struggle to find opportunities for new investments from June forward. At least until the credit markets stabilize and there is clarity about when the Fed will stop hiking.

This is good and bad news. The good news is that OXLC has been investing hand over fist. Reinvesting excess cash flow and issuing new equity rapidly to buy as much as possible.

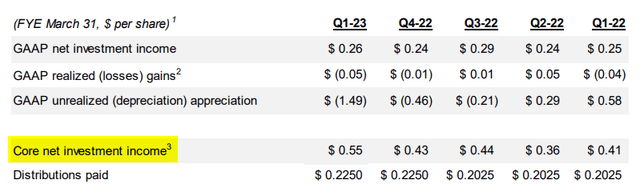

At the end of last quarter, OXLC has over $450 million, nearly 1/3rd of its total investments, that were new and had not yet made a distribution. This started paying by the end of June and is what drove a nearly 28% increase in core net investment income in a single quarter. (Source: Investor Presentation June 30)

Prior earnings growth was somewhat offset by OXLC continuing to issue new shares. So while gross earnings went up, earnings per share were depressed by the share count rising. With fewer buying opportunities, we can expect growth in share count to slow down considerably, allowing earnings per share to rise.

With fewer investment opportunities, OXLC will take its foot off the gas and retain more cash flow. Cash flow will eventually need to be dispersed to shareholders through higher dividends. OXLC has had the foot on the gas pedal, expanding rapidly. Now conditions are turning, and it is time to start realizing the benefits of that growth and collecting income.

Dreamstime

Conclusion

AT&T and OXLC are both cashflow-focused investments.

AT&T produces a massive amount of free cash flow and is actively working to ensure that cash flow is maintained or grows into the future. Economic headwinds are causing them to take action. They’re not sleeping at the wheel, hoping to see improvements.

OXLC saw a massive cash flow increase last quarter, which is recurring cash flow. It is now covering its dividend with Core NII by over 240%! This will drive dividend growth next year with the possibility of a special dividend at the end of this year.

As income investors, we want a clear path from the investments’ incoming cash flow to cash pouring into our accounts. T and OXLC are investments with which we can see that cash flowing through the companies and into our pockets.

What do you do with that cash? Whatever you want! That’s the ultimate level of flexibility. Got a hankering for snickers? Go get it! Want a new set of golf clubs? Do it! Want Trix? Sorry, they’re only for kids.

Retirement should be a time when you can do what you want. Money shouldn’t be a constraint on your options. Income investing can help make that happen for you today.

Be the first to comment